Reader requests were light but one thing that I noticed was that Healthcare was well represented. While I'm only presenting two Healthcare stocks, you'll find two more in the "other requests" section.

The market snapped back earlier in the day as we proposed it would in yesterday's DP Alert, but gains couldn't be held. Mega-caps are still struggling to perform. The broader market has stepped in but I don't know that they can continue to keep things elevated if mega-caps continue to slide. Hedges on the Technology side of the market seem wise should mega-caps continue to feel pressure to the downside.

I'd love to get more requests on Thursdays. Feel free to send them in anytime during the week.

Tomorrow is the Diamond Mine trading room so be sure to sign up. The recording links will always be posted below the Diamonds logo.

Good Luck & Good Trading,

Erin

Today's "Diamonds in the Rough": CAH, HCA and REVG.

Other requests: DVA, EXPD and MTD.

Diamond Mine Trading Room:

RECORDING & DOWNLOAD LINK (7/19/2024):

Topic: DecisionPoint Diamond Mine (7/19/2024) LIVE Trading Room

Download & Recording Link HERE

Passcode: July#19th

REGISTRATION for 7/26/2024:

When: July 26, 2024 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine LIVE Trading Room

Register in advance for this webinar HERE

After registering, you will receive a confirmation email containing information about joining the webinar.

Below is the latest free DecisionPoint Trading Room recording from 7/22. You'll find these recordings posted on Mondays to our DP YouTube Channel. Be sure and subscribe HERE.

Welcome to DecisionPoint Diamonds, wherein I highlight ten "Diamonds in the Rough" per week. These are selected from the results of my DecisionPoint Scans which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

"Predefined Scans Triggered" are taken from StockCharts.com using the "Symbol Summary" option instead of a "SharpChart" on the workbench.

Stop levels are all rounded down.

Cardinal Health, Inc. (CAH)

EARNINGS: 2024-08-14 (BMO)

Cardinal Health, Inc. is a healthcare services and products company, which engages in the provision of customized solutions for hospitals, healthcare systems, pharmacies, ambulatory surgery centers, clinical laboratories, and physician offices. It also provides medical products and pharmaceuticals and cost-effective solutions that enhance supply chain efficiency. The firm operates through the Pharmaceutical and Medical segments. The Pharmaceutical segment distributes branded and generic pharmaceutical, specialty pharmaceutical and over-the-counter healthcare and consumer products. The Medical segment manufactures, sources and distributes Cardinal Health branded medical, surgical, and laboratory products. The company was founded by Robert D. Walter in 1979 and is headquartered in Dublin, OH.

Predefined Scans Triggered: Filled Black Candles and Shooting Star.

CAH is down -0.95% in after hours trading. The big double bottom pattern caught my eye on this one. I do note that we had a very bearish candlestick today so we could see a decline tomorrow offering a better entry. This is a reversal candidate which can be a bit dangerous when the market is weakening but I like this one as it offers a lower stop level. The indicators are lined up well too with the RSI just moving into positive territory and the PMO on a new Crossover BUY Signal. Stochastics are nearing territory above 80. Relative strength has really picked up for the group and given CAH is performing in line with the successful group, it is consequently outperforming the SPY. I've set a thin stop at 5.5% or $91.60.

The weekly chart is weak and thus we should keep an eye on this one in the short term. This reversal off support does look encouraging. While the weekly RSI is negative and the weekly PMO is on a SELL Signal, at least we are seeing upside movement by the SCTR. It has a lot of work to do to get back into the hot zone*. Given the low stop, I think upside potential is very good.

*If a stock is in the "hot zone" above 70, it implies that it is stronger than 70% of its universe (large-, mid-, small-caps and ETFs) primarily in the intermediate to long terms.

HCA Healthcare, Inc. (HCA)

EARNINGS: 2024-10-29 (BMO)

HCA Healthcare, Inc. is a health care services company engaged in operating hospitals, freestanding surgery centers and emergency care facilities, urgent care facilities, walk-in clinics, diagnostic and imaging centers, radiation and oncology therapy centers, comprehensive rehabilitation and physical therapy centers, physician practices, home health, hospice, outpatient physical therapy home and community-based services providers, and various other facilities. The firm operates general and acute care hospitals that offer medical and surgical services, including inpatient care, intensive care, cardiac care, diagnostic, and emergency services, and outpatient services, such as outpatient surgery, laboratory, radiology, respiratory therapy, cardiology, and physical therapy. The company was founded by Dr. Thomas F. Frist, Jr in 1968 and is headquartered in Nashville, TN.

Predefined Scans Triggered: Moved Above Upper Price Channel, P&F Ascending Triple Top Breakout, P&F Double Top Breakout, Moved Above Upper Keltner Channel and New 52-week Highs.

HCA is down -0.03% in after hours trading. I love this breakout to new 52-week highs. The gap up came on earnings so this is great follow through. The one problem is the RSI is on the overbought side, but it can maintain close to the level for some time in a good rally like we saw back in February and March. The PMO is rising strongly above the zero line on a Crossover BUY Signal and Stochastics are rising above 80. Relative strength is excellent with all strength lines rising in concert. I've set the stop near the 50-day EMA at 7.3% or $327.13.

The weekly chart shows us how spectacular this breakout is. The indicators are all bullish. The weekly PMO is not on a BUY Signal yet, but it has bottomed and is close. The weekly RSI tells us that price is not overbought even with a 9.5%+ move this week. The SCTR is comfortably within the hot zone. Consider a 17% upside target to about $412.89.

REV Group, Inc. (REVG)

EARNINGS: 2024-09-09 (BMO)

REV Group, Inc. is a holding company, which engages in the design, manufacture, and distribution of specialty vehicles and related aftermarket parts and services. The company sells its products to municipalities, government agencies, private contractors, and industrial and commercial end users. It operates through the following segments: Fire and Emergency, Commercial, and Recreation. The Fire and Emergency segment offers fire apparatus and ambulance products. The Commercial segment is involved in the production of small Type A school buses, transit buses, terminal trucks, and sweepers under the Collins Bus, ENC, Capacity, and Lay-Mor brands. The Recreation segment covers motorized recreational vehicle and application trailers. The company was founded in August 2010 and is headquartered in Brookfield, WI.

Predefined Scans Triggered: Moved Above Upper Bollinger Band.

REVG is up +0.38% in after hours trading. This one had seen a bearish rounded top, but it came out of it this week and is headed toward a breakout. One thing that caught my eye was the positive OBV divergence. OBV bottoms are rising as price bottoms are falling. That led into this rally and suggests it will be lasting. The RSI is positive and not at all overbought. The PMO is rising on a Crossover BUY Signal above the zero line. Stochastics are above 80. Relative strength is excellent on this rally and the group is really picking up strength as well. The stop is set near the 50-day EMA at 7.9% or $25.23.

This bounce came off support. The stock tends to rally and pull back, rally and pull back. We just finished the pullback so it is time for more rally. The weekly RSI is positive, but is getting overbought. However, given what it has been doing this year, I'm not overly concerned. The weekly PMO is a problem, but it does appear to be decelerating somewhat on this week's strong gain. The SCTR is at the top of the hot zone. Consider a 17% upside target near $32.06.

Don't forget, on Thursdays I look at reader-requested symbols, click HERE to send me an email. I read every email I receive and try to answer them all!

Current Market Outlook:

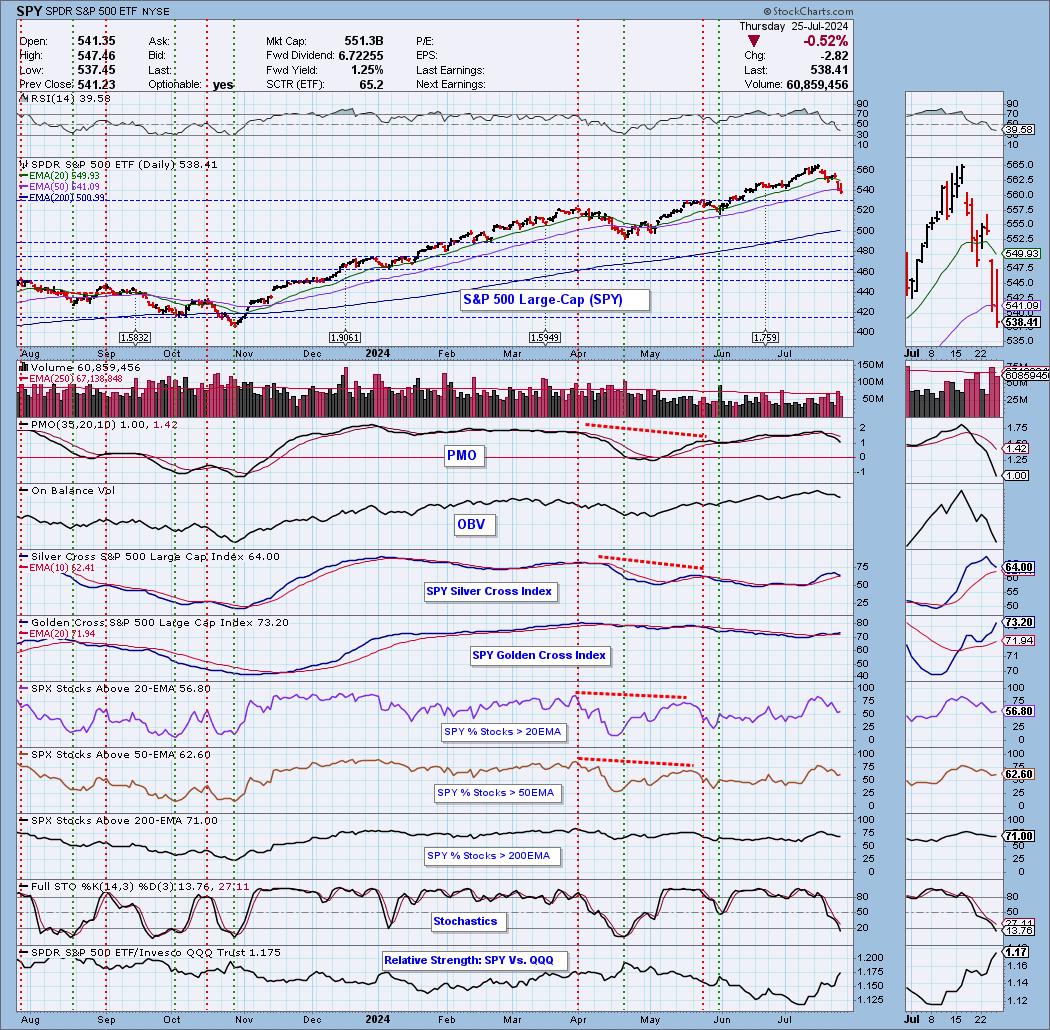

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

Don't forget that as a "Diamonds" member, you have access to our "Under the Hood" curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Full Disclosure: I am 45% long, 3% short.

I'm required to disclose if I currently own a stock I mention and/or may buy/short it within the next 72 hours.

"Technical Analysis is a windsock, not a crystal ball." - Carl Swenlin

(c) Copyright 2024 DecisionPoint.com

Watch the latest episode of DecisionPoint Trading Room with Carl & Erin Swenlin Mondays on the DecisionPoint YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "Diamonds in the Rough."

Regarding BUY/SELL Signals: The signal status reported herein is based upon mechanical trading model signals and crossovers. They define the implied bias of the price index/stock based upon moving average relationships and momentum, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links:

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com