Given the holiday on Wednesday, I decided to give you "Diamonds in the Rough" Monday, Tuesday and Thursday with the Recap going out on Friday as always. Tomorrow will be ETF Day.

The mega-caps continue to keep the market elevated leaving the broader market behind. This is part of the reason why my exposure is so low. The rest of the market isn't keeping up with the rising indexes. Caution is warranted.

Today I was surprised to see an artificial intelligence darling hit my PMO Crossover Scan. Super Micro Computer (SMCI) has been in a correction, but now it appears ready to resume its previous rally. They work closely with NVIDIA (NVDA) and on a recent interview with the CEO, he said that they can barely keep up with orders. I'll discuss the pluses on the chart.

I like the other selections just fine, but as noted, I'm keeping my exposure low. However, SMCI is on my radar as a "can't beat 'em, join 'em" trade on AI.

Good Luck & Good Trading,

Erin

Today's "Diamonds in the Rough": CGNX, CRVL, SMCI and TRGP.

Runner-ups: STWD, TSCO, VMC, MLM and CHD.

RECORDING & DOWNLOAD LINK (6/14/2024):

Topic: DecisionPoint Diamond Mine (6/14/2024) LIVE Trading Room

Download & Recording LINK

Passcode: June#14th

REGISTRATION for 6/21/2024:

When: Jun 21, 2024 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (6/21/2024) LIVE Trading Room

Register in advance for this webinar HERE.

After registering, you will receive a confirmation email containing information about joining the webinar.

Here is the latest recording from 6/17. Click HERE to subscribe to the DecisionPoint YouTube Channel to be notified when new content is available.

Welcome to DecisionPoint Diamonds, wherein I highlight ten "Diamonds in the Rough" per week. These are selected from the results of my DecisionPoint Scans which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

"Predefined Scans Triggered" are taken from StockCharts.com using the "Symbol Summary" option instead of a "SharpChart" on the workbench.

Stop levels are all rounded down.

Cognex Corp. (CGNX)

EARNINGS: 08/01/2024 (BMO)

Cognex Corp. engages in the provision of machine vision products and solutions that improve efficiency and quality in a wide range of businesses across attractive industrial end markets. It operates through the following geographical segments: the United States, Europe, Greater China, and Other. The company was founded by Robert J. Shillman, William Silver, and Marilyn Matz on January 7, 1981 and is headquartered in Natick, MA.

Predefined Scans Triggered: None.

CGNX is up +1.37% in after hours trading. It has been on a nice run after bouncing off strong support. Today it formed a bullish engulfing candlestick. I like how it is repairing the damage of the corrective move from May. The PMO has turned back around and the RSI is not overbought. I notice that the OBV is rising to confirm the rally. Stochastics are rising toward 80 and relative strength is improving for the group and the stock. I've set the stop between the 50-day EMA and the 200-day EMA at 7.2% or $43.42.

We have a nice rally out of a prior double bottom formation. Price hasn't quite reached the minimum upside target of that pattern. The weekly RSI is positive and not overbought despite the rally out of the lows of 2024. The weekly PMO has surged above the signal line and the StockCharts Technical Rank (SCTR) is inside the hot zone* above 70. I see great potential for this one should it reach the next level of intermediate-term overhead resistance.

*If a stock is in the "hot zone" above 70, it implies that it is stronger than 70% of its universe (large-, mid-, small-caps and ETFs) primarily in the intermediate to long terms.

CorVel Corp. (CRVL)

EARNINGS: 07/30/2024 (BMO)

CorVel Corp. engages in the provision of services to employers and payors in the risk management and insurance services arenas, including workers' compensation, general liability, auto liability, and hospital bill auditing and payment integrity. It operates through the Patient Management Services and Network Solutions Services segments. The Patient Management Services segment includes claims administration, utilization review, medical case management, and vocational rehabilitation. The Network Solutions Services segment consists of fee schedule auditing, hospital bill auditing, coordination of independent medical examinations, diagnostic imaging review services, and preferred provider referral services. The company was founded by V. Clemons Gordon Sr. in 1987 and is headquartered in Fort Worth, TX.

Predefined Scans Triggered: Bullish MACD Crossovers and Moved Above Ichimoku Cloud.

CRVL is unchanged in after hours trading. It is on a strong rally off sturdy support. The RSI has just reached positive territory. The PMO is turning back up and is going in for a Crossover BUY Signal. Stochastics are rising strongly. Relative strength is not good for the industry group, but CRVL is outperforming both the group and consequently the SPY. I like where this one is going. The stop is set beneath support and the 200-day EMA at 7.7% or $230.75.

The weekly RSI is positive, but the weekly PMO is suspect in its decline. It is likely a product of the sharp decline it recently experienced. The SCTR is almost in the hot zone. The next level of resistance is about 13.6% away, but I'd look for a 17% upside target to around $292.50.

Super Micro Computer, Inc (SMCI)

EARNINGS: 08/06/2024 (AMC)

Super Micro Computer, Inc. engages in the distribution and manufacture of information technology solutions and other computer products. Its products include twin solutions, MP servers, GPU and coprocessor, MicroCloud, AMD solutions, power supplies, SuperServer, storage, motherboards, chassis, super workstations, accessories, SuperRack and server management products. The company was founded by Charles Liang, Yih-Shyan Liaw, Sara Liu, and Chiu-Chu Liu Liang in September 1993 and is headquartered in San Jose, CA.

Predefined Scans Triggered: P&F Ascending Triple Top Breakout and P&F Double Top Breakout.

SMCI is down -0.05% in after hours trading. Price poked out of the bullish symmetrical triangle on today's strong rally. The symmetrical triangle is a continuation pattern and since the prior trend was up, we should expect a breakout not a breakdown. The RSI is positive and not overbought. The PMO just triggered a new Crossover BUY Signal. Stochastics are almost above 80. Relative strength tells us this one isn't really holding a leadership role within the group and it hasn't really been outperforming the SPY, but I see this as a turnaround stock or reversal play and so we must sacrifice some relative strength. The stop is set below the 20/50-day EMAs at 7.7% or $819.07.

This looks like a mega flag on the weekly chart that would imply an upside breakout ahead. The weekly RSI is positive and not overbought. The SCTR is at the top of the hot zone. The weekly PMO is still in decline so for now we should keep this one in the short term. If it can recapture its prior all-time high, we could see quite a gain.

Targa Resources Corp. (TRGP)

EARNINGS: 08/01/2024 (BMO)

Targa Resources Corp. provides midstream natural gas and natural gas liquids services. It also provides gathering, storing, and terminaling crude oil, and storing, terminaling, and selling refined petroleum products. It operates through the Gathering and Processing and Logistics and Transportation segments. The Gathering and Processing segment includes assets used in the gathering of natural gas produced from oil and gas wells and processing this raw natural gas into merchantable natural gas by extracting NGLs and removing impurities, and assets used for crude oil gathering and terminaling. The Logistics and Transportation segment focuses on the activities necessary to convert mixed NGLs into NGL products and provides certain value-added services such as the storing, fractionating, terminaling, transporting and marketing of NGLs and NGL products, including services to LPG exporters, and the storing and terminaling of refined petroleum products and crude oil and certain natural gas supply and marketing activities in support of its other businesses. The company was founded in October 2005 and is headquartered in Houston, TX.

Predefined Scans Triggered: Elder Bar Turned Green and P&F Double Top Breakout.

TRGP is up +0.06% in after hours trading. The Energy sector hasn't gotten going yet, but the Crude Oil trade is shaping up. I liked TRGP because it has been rising while the Energy sector in general has been falling. It is bucking the trend so a Crude rally can only help in my opinion. The RSI is positive and not overbought. The PMO has surged above the signal line. Stochastics could be a bit better as they are flat, but they are in positive territory for now. The group has been suffering but TRGP has been a clear leader within the group. It is also seeing a little outperformance against the SPY right now. The stop is set beneath the 50-day EMA at 7% or $113.10.

The main problem is that TRGP is overbought on the weekly chart. It has been far more overbought so it is forgivable right now. The weekly PMO is still rising (I had to double check it with a thumbnail view) and the SCTR is in the hot zone. Consider a 17% upside target to about $142.30.

Don't forget, on Thursdays I look at reader-requested symbols, click HERE to send me an email. I read every email I receive and try to answer them all!

Current Market Outlook:

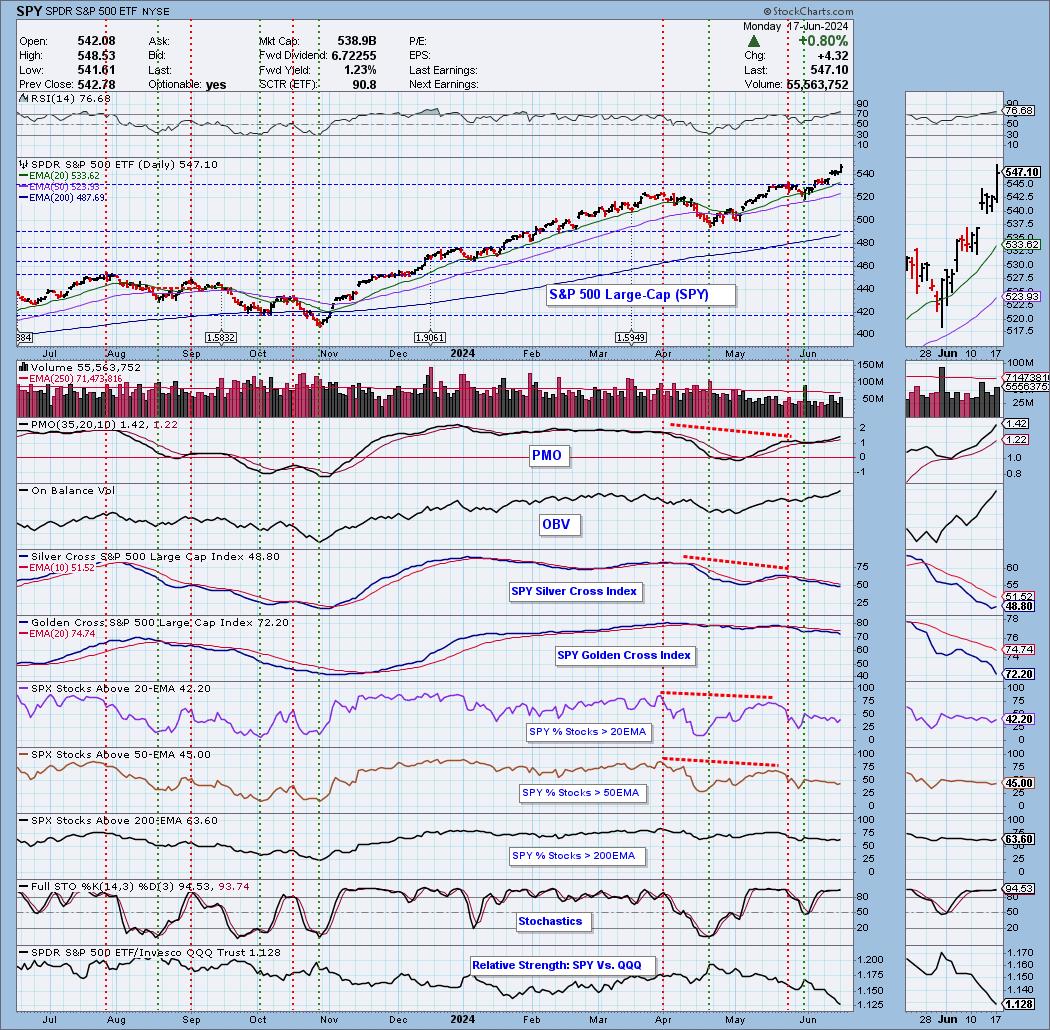

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

Don't forget that as a "Diamonds" member, you have access to our "Under the Hood" curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Full Disclosure: I am 45% long, 0% short. SMCI is on the radar.

I'm required to disclose if I currently own a stock I mention and/or may buy/short it within the next 72 hours.

"Technical Analysis is a windsock, not a crystal ball." - Carl Swenlin

(c) Copyright 2024 DecisionPoint.com

Watch the latest episode of DecisionPoint Trading Room with Carl & Erin Swenlin Mondays on the DecisionPoint YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "Diamonds in the Rough."

Regarding BUY/SELL Signals: The signal status reported herein is based upon mechanical trading model signals and crossovers. They define the implied bias of the price index/stock based upon moving average relationships and momentum, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links:

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com