This week could've gone better but ultimately it is the mega-caps that are leading the charge while the smaller-caps try to find their way. Participation has been lacking given we are at new all-time highs. Stock selection should be easy, but it is far from it as we have less than 50% reading above their 20/50-day EMAs. Basically I advise caution. I'll be looking toward extra large cap stocks as they seem to still be holding thrall.

"Diamonds in the Rough" were definitely disappointing this week with bullish indicators turning south and areas of strength turn into areas of weakness.

Real Estate and Technology were prominent this week and both are interest rate sensitive. Today's rebound in yields did not help these areas. Where we are seeing movement is in Communication Services, Healthcare and Consumer Staples. Two of those are defensive areas of the market. More reason to be cautious. I chose Healthcare ultimately but I will say it is vulnerable to setting up a double top. Keep an eye on it next week. If it shows weakness I bet Staples will show strength.

The Industry Group to Watch is Medical Equipment or Devices (IHI). It is currently on our spreadsheet. From this area I found five stocks of interest for you to review: GKOS, BSX, ISRG, SYK and TMO.

We had time to run a few scans at the end of the trading room today and I was able to find three symbols for you: IT, MA and V.

See you in the Monday trading room!

Good Luck & Good Trading,

Erin

RECORDING & DOWNLOAD LINK (6/7/2024):

Topic: DecisionPoint Diamond Mine (6/7/2024) LIVE Trading Room

Download & Recording LINK

Passcode: June#7th

REGISTRATION for 6/14/2024:

When: Jun 14, 2024 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (6/14/2024) LIVE Trading Room

Register in advance for this webinar HERE.

After registering, you will receive a confirmation email containing information about joining the webinar.

Below is the latest free DecisionPoint Trading Room recording from 6/3. You'll find these recordings posted on Mondays to our DP YouTube Channel. Be sure and subscribe HERE.

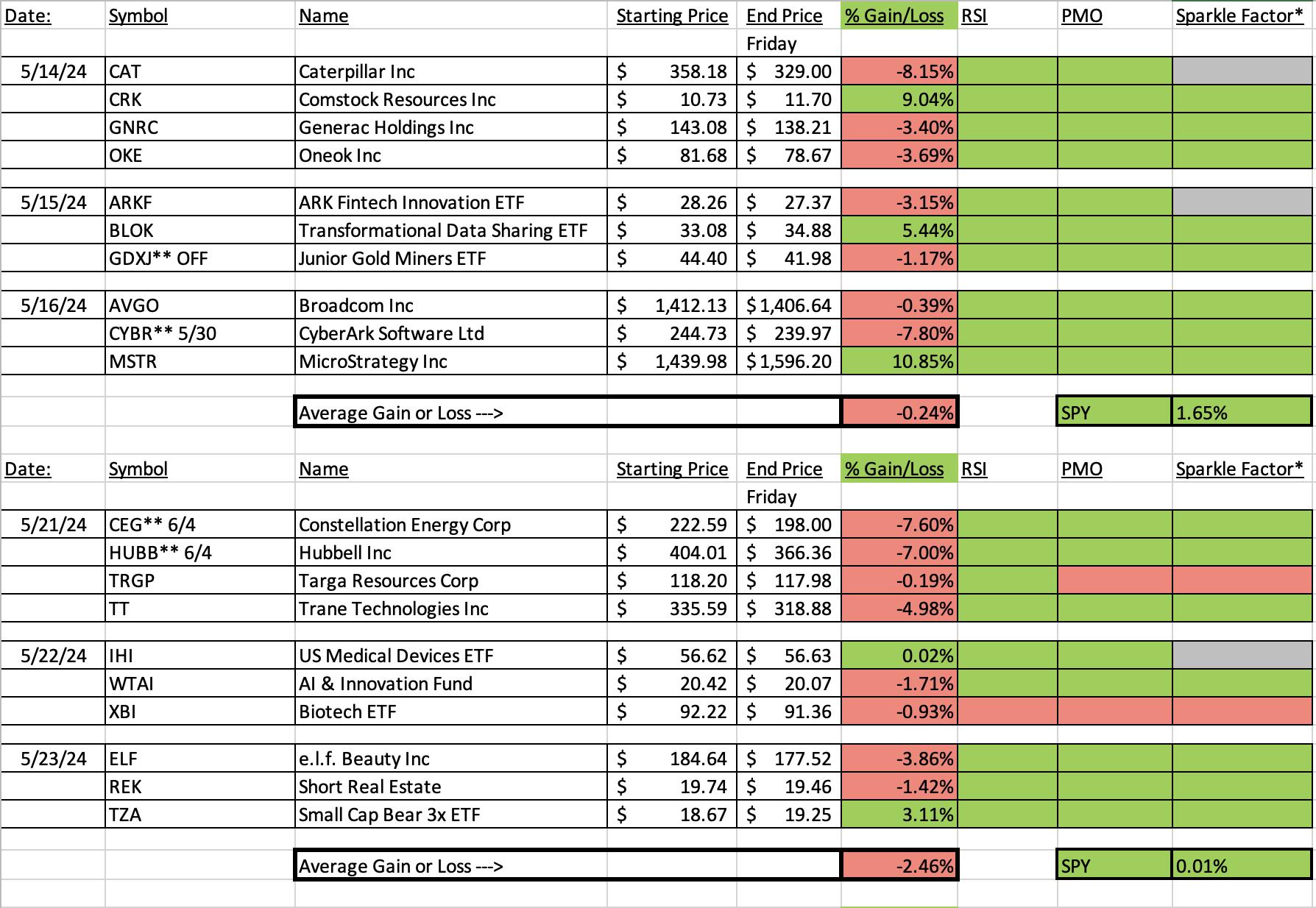

A few items about the spreadsheet: I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

Darling:

Protagonist Therapeutics, Inc. (PTGX)

EARNINGS: 08/01/2024 (AMC)

Protagonist Therapeutics, Inc. a clinical-stage biopharmaceutical company, which engages in discovering and developing peptide-based therapeutic drugs to address unmet medical needs. Its product pipeline includes PTG-300, PTG-200, and PN-943. The company was founded by Mark L. Smythe on August 22, 2006 and is headquartered in Newark, CA.

Predefined Scans Triggered: New 52-week Highs, Hollow Red Candles and P&F Double Top Breakout.

Below are the commentary and chart from Thursday, 6/6:

"PTGX is up +1.41% in after hours trading. I liked today's pause after the big rally yesterday. It sets it up for some follow through. The RSI is getting overbought, but is still safe for now. The PMO is rising after a Crossover BUY Signal above the zero line. Stochastics are rising and are near 80. As noted earlier, the Biotech group is beginning to outperform. PTGX is showing leadership among the group and is also outperforming the market. The stop was set below the prior top at 7.3% or $31.53."

Here is today's chart:

This one saw great follow through on the breakout rally after a mechanical pullback. It looks ready to establish a new trading range above prior resistance. The indicators are still very positive so they also suggest follow through. This one likely worked out as we still had plenty of upside momentum after the strong rally.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Dud:

ARK Genomic Revolution Multi-Sector ETF (ARKG)

EARNINGS: N/A

ARKG is an actively managed fund that targets companies involved in the genomics industry. Click HERE for more information.

Predefined Scans Triggered: Elder Bar Turned Green and Bullish MACD Crossovers.

Below are the commentary and chart from Wednesday, 6/5:

"ARKG is down -0.79% in after hours trading. This is less Technology and more Healthcare, but I couldn't resist the bullish cup with handle pattern that was confirmed with today's stellar rally. The RSI is back in positive territory. I'm noticing an OBV positive divergence with recent price lows that suggests we will see follow through to the upside. The PMO has just triggered a Crossover BUY Signal. Stochastics are rising strongly and this ETF is beginning to show a little outperformance as a bonus. The stop is set below support at 7.8% or $24.41."

Here is today's chart:

This one looked really good coming off this breakout rally. It is healthcare related so we could see a turn around, but I don't think I'd be buying into this decline yet. Look for it to reverse on near-term support. The stop could be triggered before it reverses. What went wrong? I guess the PMO being below the zero line may've contributed. Stochastics are still rising so maybe a reversal is in the cards. I just don't think I'd want the downside risk to get in now.

THIS WEEK's Performance:

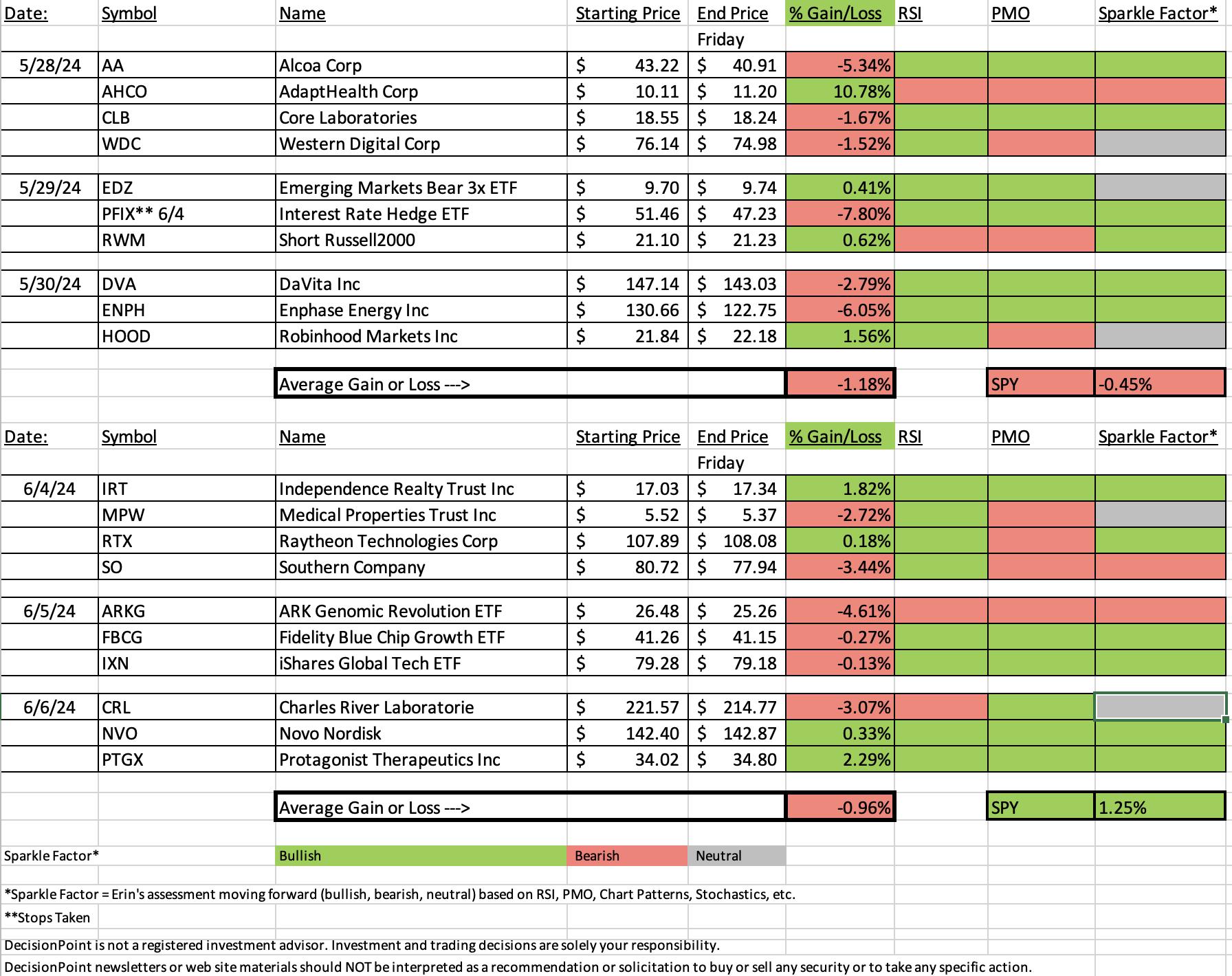

DecisionPoint Market Scoreboard (Mechanical Trend Model Signals):

Friday signal changes are outlined in purple.

Click Here to view Carl's annotated "Under the Hood" ChartList!

Sector to Watch: Healthcare (XLV)

There is an overreaching triple top in effect, but if price can break out here that pattern will bust. We do want to be careful because a concerted decline right now would set up a near-term double top. For now I like what I see under the hood. The RSI is positive and the PMO is rising on a Crossover BUY Signal. The Silver Cross Index could be a problem as we still don't have half the index with a bullish bias, but participation is improving for stocks above their 20/50-day EMAs. Stochastics look excellent and we are seeing a rising trend on relative strength to the SPY. It's not a sure thing, but it does have potential.

Industry Group to Watch: Medical Devices (IHI)

Below is the chart that was presented in DP Diamonds on 5/22. It didn't do much after being selected, but it is starting to make its way higher again. The 20-day EMA is about to cross above the 50-day EMA. The PMO is rising and just now got above the zero line. Stochastics are rising strongly. Relative strength is beginning to turn around. Some symbols to consider from this area of the market: GKOS, BSX, ISRG, SYK and TMO.

Go to our Under the Hood ChartList on DecisionPoint.com to get an in-depth view of all the sectors. On StockCharts.com you can find the Industry Summary.

Good Luck & Good Trading!

- Erin

erin@decisionpoint.com

Full Disclosure: I'm 50% long, 0% short.

Watch the latest episode of the DecisionPoint Trading Room with Carl & Erin Swenlin on Mondays 3:00p EST!

Technical Analysis is a windsock, not a crystal ball. --Carl Swenlin

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

(c) Copyright 2024 DecisionPoint.com