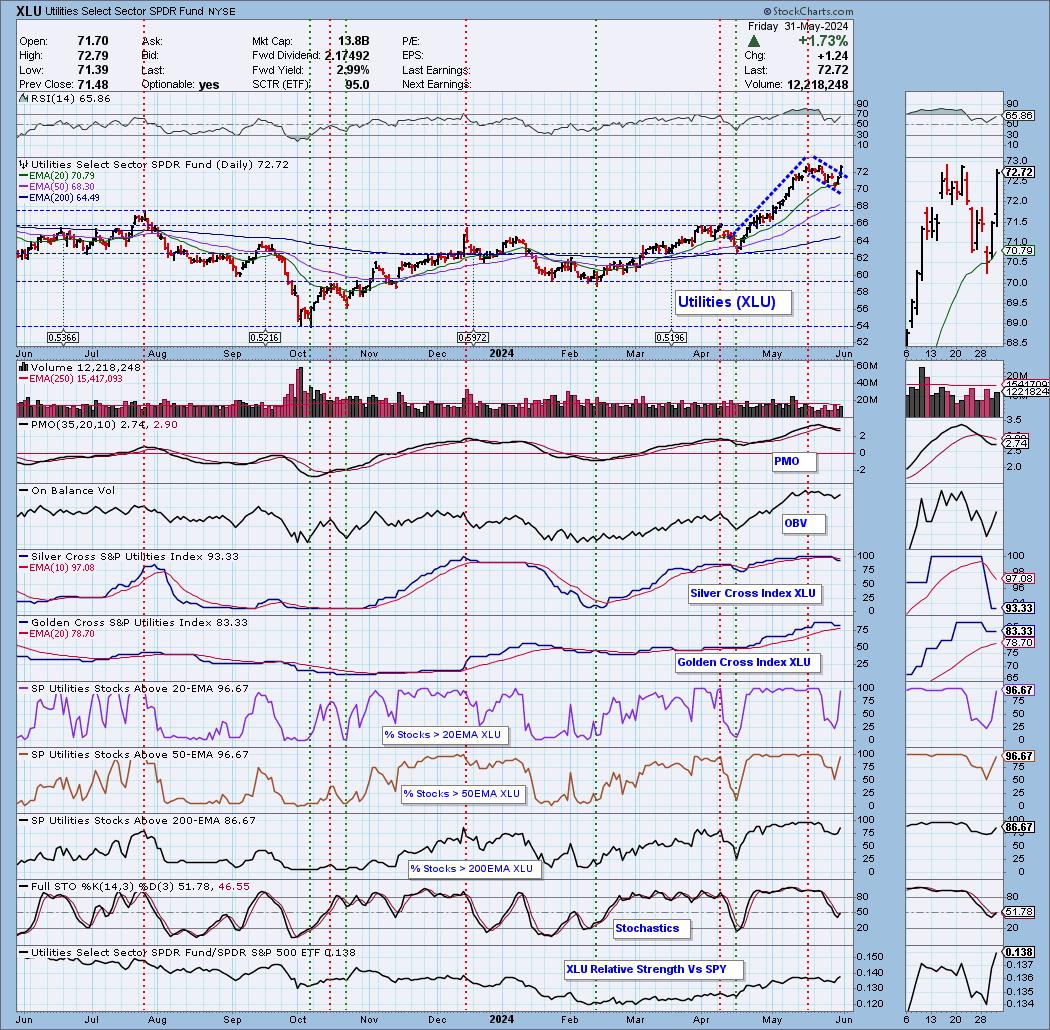

Today saw a remarkable reversal in the market to finish the day, likely short covering. This has ripened the Sector to Watch's chart and turned what was a questionable chart into a somewhat bullish chart. In fact, most of the sectors saw reversals that decelerated PMOs.

It was between Real Estate (XLRE) and Utilities (XLU) this morning. XLRE does have a PMO that has turned up, but XLU has the best participation around. It also sports a bull flag.

I will say that today's reversal turns our hedges into vulnerable territory. Today's late afternoon rally could bleed into next week and render them useless. Caution is warranted. Read more in the DP Weekly Wrap when its published later.

The Industry Group to Watch came out of XLRE, Industrial & Office REITs. We found some symbols for your review: PDM, DEI, DEA and COLD.

This week's Darling was an inverse ETF or hedge. We saw Emerging Markets continue to slide and not recover so the inverse served us well.

This week's Dud was AdaptHealth (AHCO). The chart went south and I'll list some of what may've gone wrong in its section.

Finally we finished the trading room running a number of scans, including the "Diamond Dog" Scan that picks up shorting opportunities. The longs I found were: TILE, ANIP and VFC. The SHORTS were: AMPH, PPRUY and WNS. I feel less confident about the shorts given today's sharp reversal.

We're back in the free trading room on Monday! See you there!

Good Luck & Good Trading,

Erin

RECORDING & DOWNLOAD LINK (5/31/2024):

Topic: DecisionPoint Diamond Mine (5/31/2024) LIVE Trading Room

Download & Recording Link

Passcode: May#31st

REGISTRATION for 6/7/2024:

When: Jun 7, 2024 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (6/7/2024) LIVE Trading Room

Register in advance for this webinar HERE.

After registering, you will receive a confirmation email containing information about joining the webinar.

Below is the latest free DecisionPoint Trading Room recording from 5/20 (No recording on 5/27). You'll find these recordings posted on Mondays to our DP YouTube Channel. Be sure and subscribe HERE.

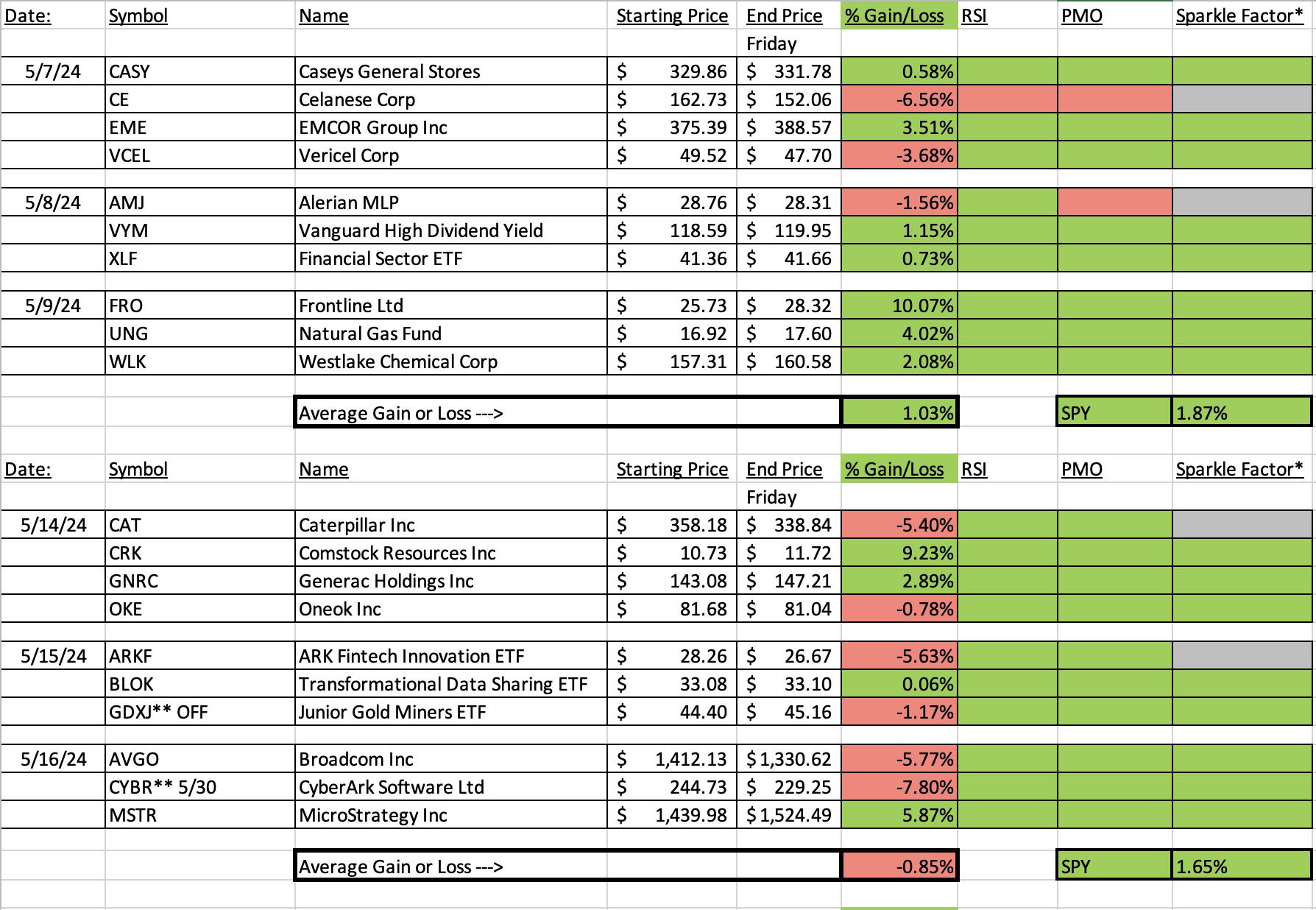

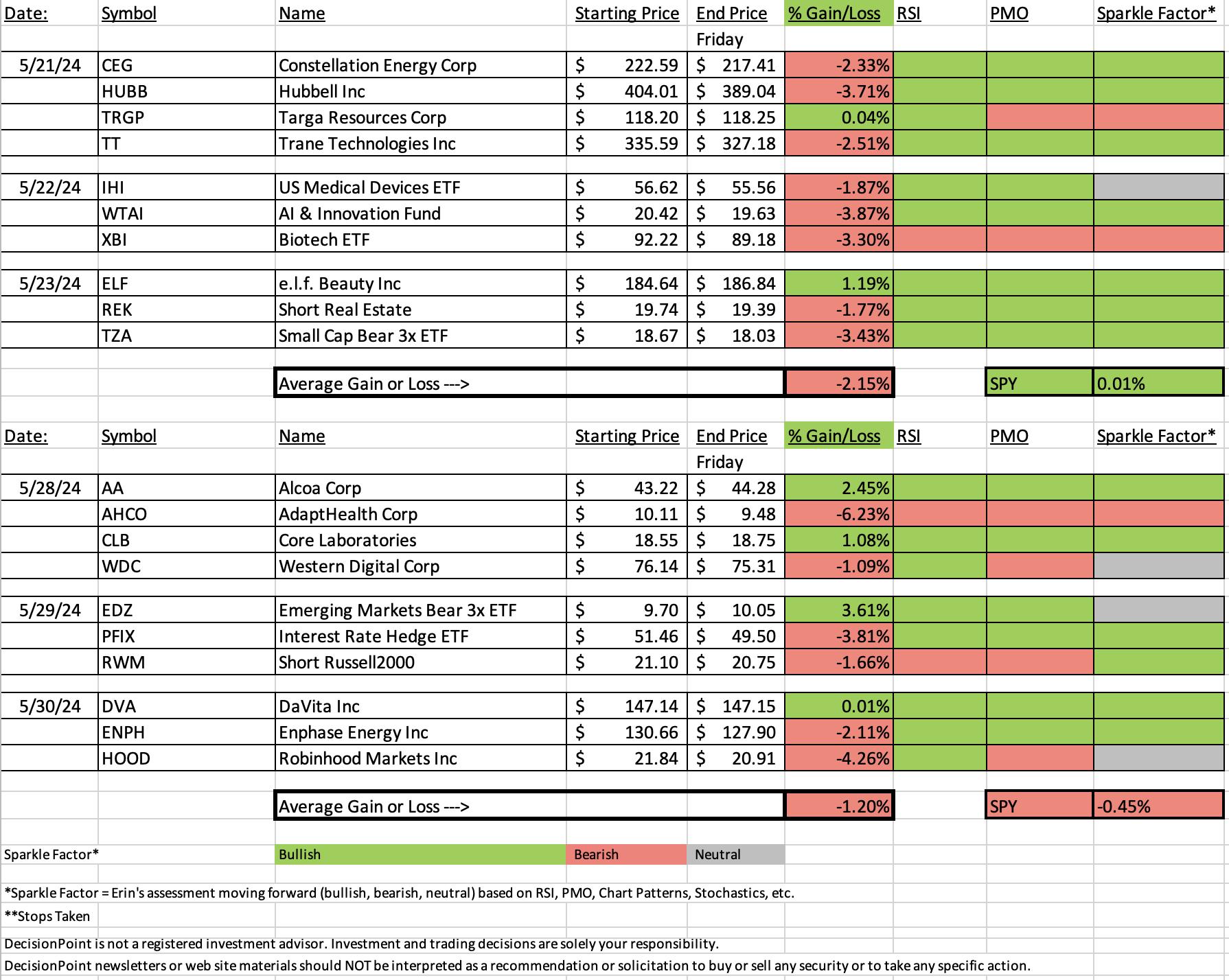

A few items about the spreadsheet: I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

Direxion Daily Emerging Markets Bear 3x Shares (EDZ)

EARNINGS: N/A

EDZ provides 3x inverse exposure to a market-cap-weighted index of companies operating in emerging markets. Click HERE for more information.

Predefined Scans Triggered: P&F Double Bottom Breakdown, P&F Descending Triple Bottom Breakdown, Breakaway Gap Ups, Gap Ups and Runaway Gap Ups.

Below are the commentary & chart from Wednesday, 5/29:

"EDZ is down -0.21% in after hours trading. We have a breakaway gap today that implies more upside to come. It also looks like a "V" Bottom which is also bullish. This pattern suggests we will see a move past the top of the left side of the "V". That's a hefty gain on a leveraged ETF. The RSI just moved into positive territory and the PMO has triggered a Crossover BUY Signal. Stochastics are rising strongly. It is beginning to see a little bit of outperformance. Since this is leveraged, we have to set a very deep stop at 11.9% or $8.54."

Here is today's chart:

This was our winner, but I would beware of it from here on out. As noted in the opening, hedges may not be necessary next week. Today we see a shooting star candlestick which is bearish. I wouldn't be entering this one at this point. While it could still rise, this turnaround today has me rethinking hedging. I've listed the Sparkle Factor as "Neutral". I wouldn't be buying into it but I might consider holding it.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Dud:

AdaptHealth Corp (AHCO)

EARNINGS: 08/06/2024 (BMO)

AdaptHealth Corp. engages in the provision of home healthcare equipment, supplies and related services. It focuses on sleep therapy equipment to individuals suffering from obstructive sleep apnea (OSA), home medical equipment to patients discharged from acute care and other facilities, oxygen and related chronic therapy services in the home, and HME medical devices and supplies on behalf of chronically ill patients with diabetes care, wound care, urological, ostomy, and nutritional supply needs. The company was founded in 2012 and is headquartered in Plymouth Meeting, PA.

Predefined Scans Triggered: Filled Black Candles and P&F High Pole.

Below are the commentary and chart from Tuesday, 5/28:

"AHCO is unchanged in after hours trading. We have a bullish double bottom. It did see a filled black candlestick today which does imply a down day tomorrow. This low-priced and could be considered a 'boom or bust' type stock so it could be a big winner or a big stinker so position size wisely. The RSI is positive and not overbought. The PMO has just had a positive crossover its signal line for a BUY Signal. Stochastics are rising and suggest more follow through ahead. The industry group is sickly and that could put some downside pressure on this one, but so far it hasn't really affected its outperformance against the SPY. I set the stop below the last low at 7% or $9.40."

Here is today's chart:

The stop nearly triggered on this one today. I did mention in the commentary above that this one could turn out to be a stinker. I also pointed it out industry group relative strength was failing. It was a tough day to pick stocks when this is the best you can find in the scan results. We could be setting up a triple bottom pattern so I do think this one is watch list worthy.

THIS WEEK's Performance:

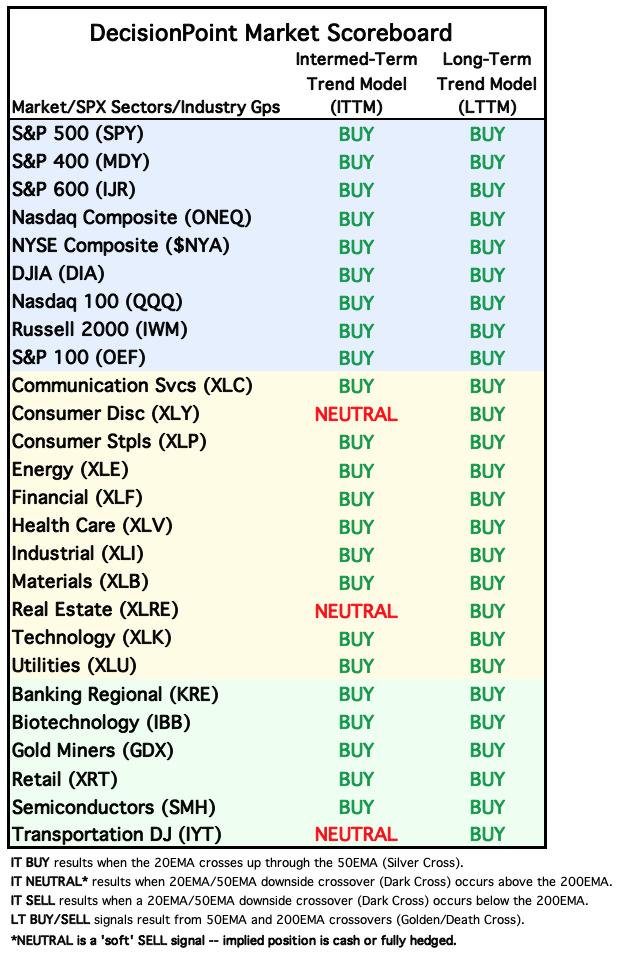

DecisionPoint Market Scoreboard (Mechanical Trend Model Signals):

Friday signal changes are outlined in purple.

Click Here to view Carl's annotated "Under the Hood" ChartList!

Sector to Watch: Utilities (XLU)

The primary reason I picked XLU was because of the bullish flag formation. Today's rally confirmed the pattern. We already had incredibly strong internals that suggest we will see more upside. The PMO is beginning to turn up. It was in decline this morning. Stochastics have also turned back up.

Industry Group to Watch: Industrial & Office REITs ($DJUSIO)

This one caught my eye based on the double bottom chart pattern that is forming. Add to that strong indicators and you should see more upside follow through. The RSI is positive and not at all overbought. The PMO has surged above the signal line and Stochastics are rising strongly. The symbols we found within: PDM, DEI, DEA and COLD.

Go to our Under the Hood ChartList on DecisionPoint.com to get an in-depth view of all the sectors. On StockCharts.com you can find the Industry Summary.

Good Luck & Good Trading!

- Erin

erin@decisionpoint.com

Full Disclosure: I'm 30% long, 5% short.

Watch the latest episode of the DecisionPoint Trading Room with Carl & Erin Swenlin on Mondays 3:00p EST!

Technical Analysis is a windsock, not a crystal ball. --Carl Swenlin

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

(c) Copyright 2024 DecisionPoint.com