I'm back! The scans weren't particularly productive today and given the market is looking vulnerable, I hesitated to bring two of these stocks to the table. However, I'm going to trust the scans and look for a turnaround.

The two industry groups that were prevalent in all of my scans were Biotechs and Pharmaceuticals. Both are in the Healthcare (XLV) sector obviously and that sector looks far from bullish. Maybe we should start looking for rotation back into that sector given the scan results? I will say that both of those industry groups are far from homogenous so it is certainly possible to find winners in a depressed group or sector. Risk is higher though. Just be sure to set your stops if you dive in.

META came up in my Diamond PMO Scan and I was tempted to include it; however, big names such as these are usually already on subscribers' watch lists. I like to bring you something new, but I'll let you know if one of these big names come up in my scans.

I talked about Coal in yesterday's DP Trading Room so I had to bring you one of my favorite names in Coal.

Good Luck & Good Trading,

Erin

Today's "Diamonds in the Rough": ARCH, CRNX and IDYA.

Runner-ups: JJSF, INTA, LMNR, AKRO, META and WIRE.

RECORDING LINK (7/14/2023):

Topic: DecisionPoint Diamond Mine (7/14/2023) LIVE Trading Room

Passcode: July#14th

REGISTRATION for 8/4/2023:

When: Aug 4, 2023 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (8/4/2023) LIVE Trading Room

Register in advance for this webinar HERE

After registering, you will receive a confirmation email containing information about joining the webinar.

Here is the last recording from 7/31:

Welcome to DecisionPoint Diamonds, wherein I highlight ten "Diamonds in the Rough" per week. These are selected from the results of my DecisionPoint Scans which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

"Predefined Scans Triggered" are taken from StockCharts.com using the "Symbol Summary" option instead of a "SharpChart" on the workbench.

Stop levels are all rounded down.

Arch Coal, Inc. (ARCH)

EARNINGS: 10/26/2023 (BMO)

Arch Resources, Inc. engages in the production and distribution of thermal coal. It operates through the following segments: Powder River Basin, Metallurgical, and Other Thermal. The Powder River Basin segment contains the company's thermal operations in Wyoming. The Metallurgical segment contains metallurgical operations in West Virginia. The Other Thermal segment contains supplementary thermal operations in Colorado, Illinois and the Coal Mac thermal operations in West Virginia. The company was founded in 1969 and is headquartered in St. Louis, MO.

Predefined Scans Triggered: Improving Chaikin Money Flow, P&F Ascending Triple Top Breakout and P&F Double Top Breakout.

ARCH is unchanged in after hours trading. I discussed Coal looking very bullish during yesterday's DecisionPoint Trading Room and tweeted that it was worth a look (@_decisionpoint). There is one problem and that is the group is getting overbought like ARCH which has an RSI reading above 70. However, I expect this group and ARCH to continue higher and possibly challenge the March highs. This rally is being supported by plenty of volume. The PMO isn't overbought yet and is rising strongly. Stochastics are oscillating above 80 which suggests plenty of internal strength. The group is outperforming and ARCH is outperforming the group. It's a leader. I've set the stop below the 200-day EMA at 6.5% or $121.56.

The weekly chart suggests this could be considered an intermediate-term investment. The weekly RSI is now in positive territory and the weekly PMO is nearing a Crossover BUY Signal. Notice the quick rise in the StockCharts Technical Rank (SCTR). It isn't in the hot zone* but it is on its way. Upside potential is over 25% should it challenge 2023 highs.

*If a stock is in the "hot zone" above 70, it implies that it is stronger than 70% of its universe (large-, mid-, small-caps and ETFs) primarily in the intermediate to long terms.

Crinetics Pharmaceuticals, Inc. (CRNX)

EARNINGS: 08/09/2023 (AMC)

Crinetics Pharmaceuticals, Inc. operates as a clinical stage pharmaceutical company focused on the discovery, development, and commercialization of novel therapeutics for rare endocrine diseases and endocrine-related tumors. Its product candidate, CRN00808, is an oral nonpeptide somatostatin agonist for the treatment of acromegaly. The firm is also developing other oral nonpeptide somatostatin agonists for neuroendocrine tumors and hyperinsulinism, as well as an oral nonpeptide ACTH antagonist for the treatment of Cushing's disease. The company was founded by R. Scott Struthers, Yun-Fei Zhu and Stephen F. Betz in 2008 and is headquartered in San Diego, CA.

Predefined Scans Triggered: Elder Bar Turned Green and Bullish MACD Crossovers.

CRNX is down -2.31% in after hours trading. It appears that today's gain may be erased tomorrow if after hours trading is any indication. The set-up is very positive so this may offer a better entry. There is a bullish double-bottom beginning to form and today saw a new PMO Crossover BUY Signal. The RSI just moved into positive territory and Stochastics are rising again. As noted in the opening, the group itself isn't doing very well so this does carry additional risk. CRNX is beginning to show outperformance against the SPY and the group. The stop is set below support at 7.4% or $18.01.

The weekly chart is marginal so I would consider this a short-term trade versus an intermediate-term investment. The weekly PMO is on a SELL Signal, but it does appear to be turning back up. The weekly RSI just moved into positive territory and while the SCTR is not in the hot zone, it is rising.

IDEAYA Biosciences, Inc. (IDYA)

EARNINGS: 08/14/2023 (BMO)

IDEAYA Biosciences, Inc. engages in the research and development of oncology-focused precision medicine. The firm focuses on the targeted therapeutics for patients selected using molecular diagnostics. Its product candidate, IDE196, is a protein kinase C inhibitor for genetically-defined cancers having GNAQ or GNA11 gene mutations. The company was founded by Yujiro S. Hata and Jeffrey Hager in June 2015 and is headquartered in South San Francisco, CA.

Predefined Scans Triggered: Bullish MACD Crossovers, P&F High Pole and Parabolic SAR Buy Signals.

IDYA is up 2.01% in after hours trading. CRNX looks pretty good, but I think IDYA looks even better. We have a breakout from a bullish falling wedge, accompanied by a positive OBV divergence. The RSI just moved into positive territory and the PMO is turning back up. Stochastics just moved into positive territory. The group isn't performing well currently, but IDYA is beginning to outperform the group and the market. This is probably my favorite chart of the day. The stop is set below support at 7.8% or $20.66.

For now consider this one a short-term trade. I would like to see a solid breakout from the declining trend. The weekly RSI is positive and rising, but the weekly PMO is configured very bearishly. The SCTR is in the hot zone, so if we do see a consistent rally from here, IDYA could move to an intermediate-term investment.

Don't forget, on Thursdays I look at reader-requested symbols, click HERE to send me an email. I read every email I receive and try to answer them all!

Current Market Outlook:

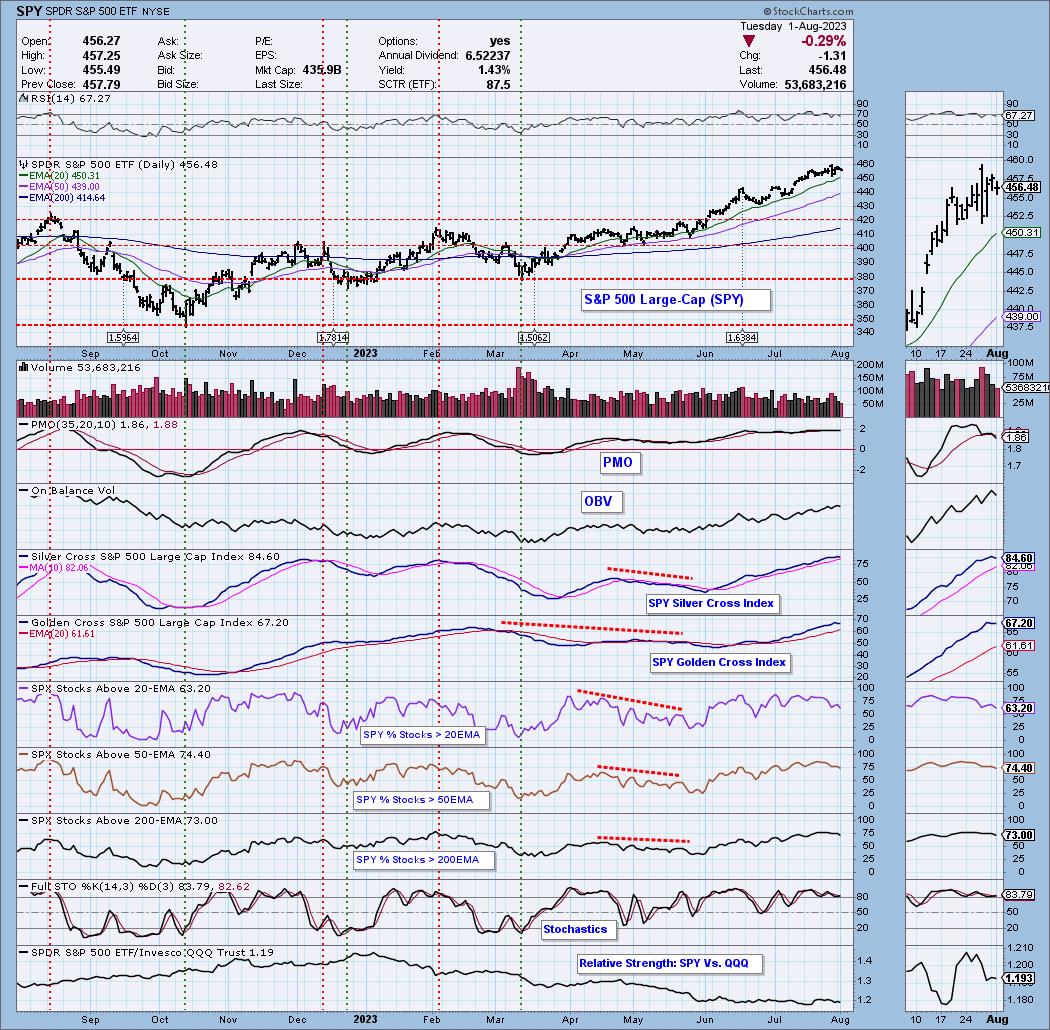

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Full Disclosure: I am 50% long, 0% short.

I'm required to disclose if I currently own a stock I mention and/or may buy/short it within the next 72 hours.

"Technical Analysis is a windsock, not a crystal ball." - Carl Swenlin

(c) Copyright 2023 DecisionPoint.com

Watch the latest episode of DecisionPoint Trading Room with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "Diamonds in the Rough."

Regarding BUY/SELL Signals: The signal status reported herein is based upon mechanical trading model signals and crossovers. They define the implied bias of the price index/stock based upon moving average relationships and momentum, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links:

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com