While only a few sent in requests today, it was very easy to make selections from those presented. It is clear that you understand my methodology for selecting "Diamonds in the Rough". I've listed the other requests as well. You probably will want to take a look at them. I didn't find much fault with any of them.

I have requests today from four different sectors so we have good coverage. I am getting worried that this rally is overdone and a pullback, possibly correction could follow, but so far the indicators are positive and not showing many cracks.

This is it before I leave on vacation. It's my first 'real' (non-working) vacation in years. Special thanks to Carl who will be picking up the DP Alert while I'm away. I will be checking email regularly so if any customer service issues need to be addressed, I'll handle it fairly quickly. See you in the Diamond Mine tomorrow!

Good Luck & Good Trading,

Erin

Today's "Diamonds in the Rough": CRM, LTH, MUX and STAA.

Other requests: PFS, SOUN, DSX, DRD, GGB, NVEI, EXPE, EZU, FSLY, MTH, PMT and UWMC.

** JULY VACATION **

I will be in Europe 7/14 - 7/28 so there will not be any Diamonds reports or trading rooms during that time. I will hold an abbreviated Diamond Mine on July 14th, no Recap that day. All subscribers with active subscriptions on 7/28 will be compensated with two weeks added to their renewal date.

RECORDING LINK (7/7/2023):

Topic: DecisionPoint Diamond Mine (7/7/2023) LIVE Trading Room

Passcode: July@7th

REGISTRATION for 7/14/2023:

When: Jul 14, 2023 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (7/14/2023) LIVE Trading Room

Register in advance for this webinar HERE

After registering, you will receive a confirmation email containing information about joining the webinar.

Here is the last recording from 7/10:

Welcome to DecisionPoint Diamonds, wherein I highlight ten "Diamonds in the Rough" per week. These are selected from the results of my DecisionPoint Scans which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

"Predefined Scans Triggered" are taken from StockCharts.com using the "Symbol Summary" option instead of a "SharpChart" on the workbench.

Stop levels are all rounded down.

Salesforce.com, Inc. (CRM)

EARNINGS: 08/23/2023 (AMC)

Salesforce, Inc. engages in the design and development of cloud-based enterprise software for customer relationship management. Its solutions include sales force automation, customer service and support, marketing automation, digital commerce, community management, collaboration, industry-specific solutions, and salesforce platform. The firm also provides guidance, support, training, and advisory services. The company was founded by Marc Russell Benioff and Parker Harris in 1999 and is headquartered in San Francisco, CA.

Predefined Scans Triggered: Improving Chaikin Money Flow, New 52-week Highs, Stocks in a New Uptrend (ADX) and P&F Double Top Breakout.

CRM is down -0.43% in after hours trading. I picked this one not only for the technicals, but also because news was released that they are increasing their presence in the UK. I don't invest on news, but it did sound interesting. Yesterday we saw a tiny breakout, today saw follow-through. The RSI is getting overbought, but the PMO looks great on an oversold BUY signal above the zero line. The OBV made a new high with price. Stochastics are rising strongly above 80. Software has been quite successful in outperforming the broad market. CRM is really increasing outperformance in the near term. The stop is set below the 20-day EMA around 7.8% or $212.40.

The weekly picture is very bullish with the exception of the weekly RSI being overbought. It's not terribly overbought and it can stay there for weeks before it becomes a problem. I really like the weekly PMO Surge above the signal line. The StockCharts Technical Rank (SCTR) is well within the hot zone* above 70. Upside potential is excellent now that we have the breakout.

*If a stock is in the "hot zone" above 70, it implies that it is stronger than 70% of its universe (large-, mid-, small-caps and ETFs) primarily in the intermediate to long terms.

Life Time Group Holdings Inc. (LTH)

EARNINGS: 07/25/2023 (BMO)

Life Time Group Holdings, Inc. operates as a holding company through its subsidiaries operates professional fitness, family recreation and spa centers. It is primarily engaged in designing, building, and operating distinctive and large, multi-use sports and athletic, professional fitness, family recreation and spa centers in a resort-like environment, principally in residential locations of major metropolitan areas in the United States and Canada. The company was founded by Bahram Akradi in 1992 and is headquartered in Chanhassen, MN.

Predefined Scans Triggered: P&F Bear Trap, P&F Double Top Breakout, P&F Triple Top Breakout and P&F Quadruple Top Breakout.

LTH is down -1.70% in after hours trading so new support may not hold on this breakout. Still, the indicators look really good. The RSI is positive and not overbought. We have an oversold PMO Crossover BUY Signal above the zero line. Stochastics are above 80. The group is struggling a bit near-term, but it has held relative strength for some time. LTH is a leader in this group based on increasing relative strength against the group. I've set the stop at 7.5% or $20.16.

Th weekly PMO has whipsawed back into a Crossover BUY Signal. The weekly RSI is positive and best of all, not overbought. The SCTR is well within the hot zone. Since it is close to all-time highs, consider a 16% upside target at $25.28.

McEwen Mining Inc. (MUX)

EARNINGS: 08/09/2023 (AMC)

McEwen Mining, Inc. engages in the the production and exploration of precious and base metals, It operates through the following geographical segments: USA, Canada, Mexico, MSC , and Los Azules. The USA segment includes the Gold Bar mine and exploration properties. The Canada segment consists of the Fox Complex, which includes the Black Fox gold mine, the Froome underground mine development and the Grey Fox and Stock advanced-stage projects, the Stock mill, and other gold exploration properties located in Timmins, Ontario, Canada. The Mexico segment comprises of El Gallo Project and the advanced-stage Fenix Project, located in Sinaloa. The MSC segment focuses in the San Jose mine, located in Argentina. The Los Azules segment operates copper exploration project located in San Juan, Argentina. The company was founded on July 24, 1979 and is headquartered in Toronto, Canada.

Predefined Scans Triggered: None.

MUX is down -1.65% in after hours trading. I definitely like Gold Miners right now, I own GDX. This was an interesting Gold Miner chart. I liked the configuration of the EMAs, mainly the 50-day EMA being above the 200-day EMA (on a "Golden Cross"). Additionally, there is a "Silver Cross" in the works as the 20-day EMA roars up to meet the 50-day EMA. The main problem I see is Miners getting too overbought too fast. For now I'm going with it, but stay true to your stops. Huge rally and big breakout today. The RSI is getting overbought unfortunately, but if this rally can stay hot, the RSI will remain overbought for awhile. The PMO is on a Crossover BUY Signal and should get back above the zero line shortly. I spotted a nice OBV positive divergence moving into this rally so I believe it will stick around (although after hours trading suggests you'll get a decent buy point). Stochastics are above 80 and rising. With the strong rally, setting the stop was a bit tricky. I opted to go with 7.3% or $7.87, but you could go deeper, particularly if you get it on a pullback.

The weekly chart is excellent and really suggests MUX could move much higher. The weekly RSI is positive and rising. The weekly PMO just turned up on this week's stunning rally. The SCTR bolted into the hot zone. The big risk here is that it is low-priced and a dip or problem in Miners will hit this one hard. Be sure and set that stop. Upside potential is plenty but it would be great if it tested the 2023 high.

STAAR Surgical Co. (STAA)

EARNINGS: 08/09/2023 (AMC)

STAAR Surgical Co. engages in the development, manufacture, production, marketing, and sale of implantable lenses for the eye and delivery systems used to deliver the lenses into the eye. It specializes in refractive and cataract solutions. Its products include intraocular lens and implantable collamer lens. The company was founded in 1982 and is headquartered in Lake Forest, CA.

Predefined Scans Triggered: Moved Above Upper Keltner Channel and P&F Double Top Breakout.

STAA is down -0.21% in after hours trading. The rally of the last two days has been great and it is surprising that the RSI isn't overbought already. The PMO surged above its signal line. The OBV is confirming the rally. Stochastics are rising strongly above 80. The group hasn't been performing very well, but over the past month it has ultimately performed as well as the market. STAA is now gaining relative strength against the group and SPY. The stop is set beneath support at 7.6% or $53.70.

The weekly chart needs some improvement, but the weekly PMO did just turn up. The weekly RSI is rising, but isn't positive just yet. The SCTR definitely needs some help. Keep in mind this is a more short-term investment, at least until the long-term declining trend is broken.

Don't forget, on Thursdays I look at reader-requested symbols, click HERE to send me an email. I read every email I receive and try to answer them all!

Current Market Outlook:

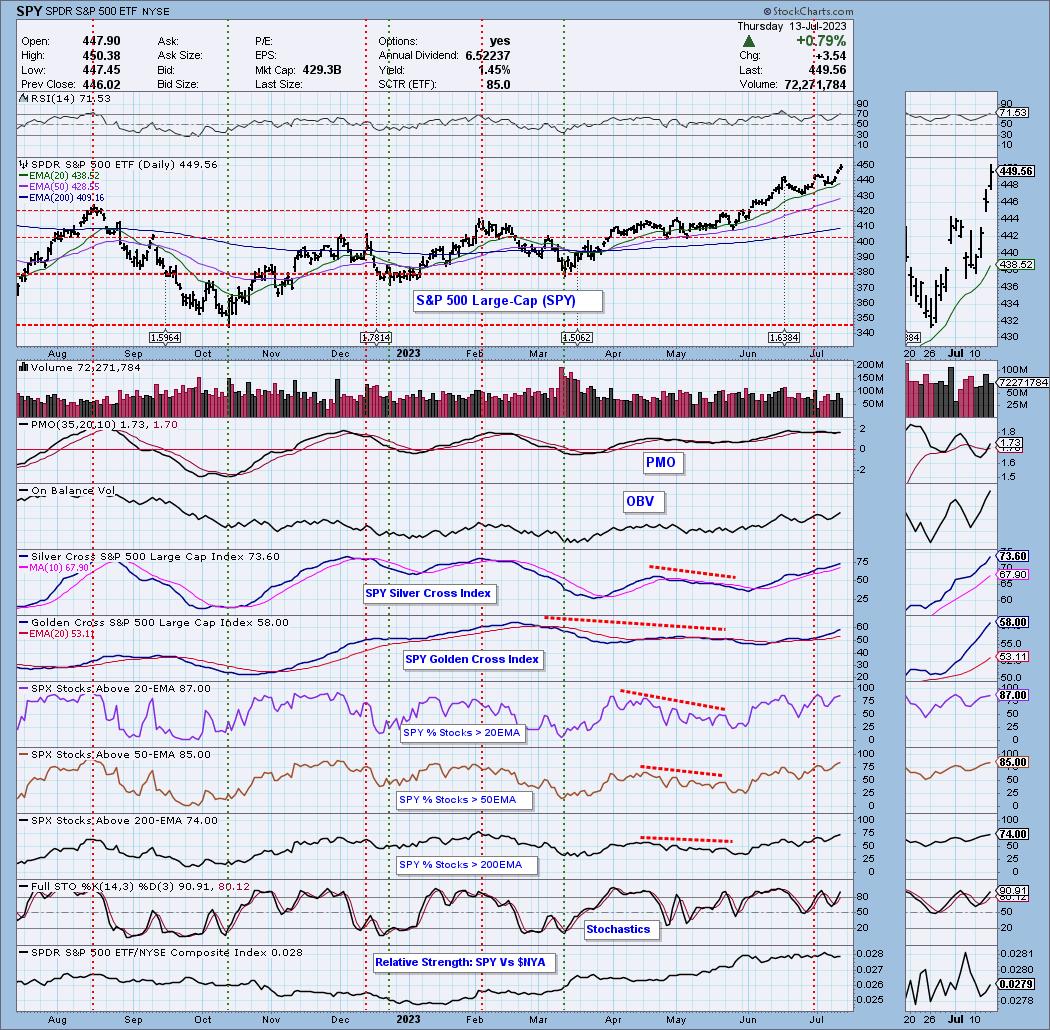

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Full Disclosure: I am 50% long, 0% short.

I'm required to disclose if I currently own a stock I mention and/or may buy/short it within the next 72 hours.

"Technical Analysis is a windsock, not a crystal ball." - Carl Swenlin

(c) Copyright 2023 DecisionPoint.com

Watch the latest episode of DecisionPoint Trading Room with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "Diamonds in the Rough."

Regarding BUY/SELL Signals: The signal status reported herein is based upon mechanical trading model signals and crossovers. They define the implied bias of the price index/stock based upon moving average relationships and momentum, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links:

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com