First, thank you all for your patience in receiving the DP DIAMONDS RECAP on Sunday versus Friday.

It was a productive week even though we averaged a little lower than I'd like. The biggest gains were from three of our reader requests. Great job on giving me excellent selections to pick from.

This week's "Dud" was selected somewhat on "intuition" in addition to the technicals. I still like the chart and currently own a small position in Overstock (OSTK). This week's "Darling" was Coupang (CPNG) which I found in my scans so I feel good about that one. We'll look at both of their current charts.

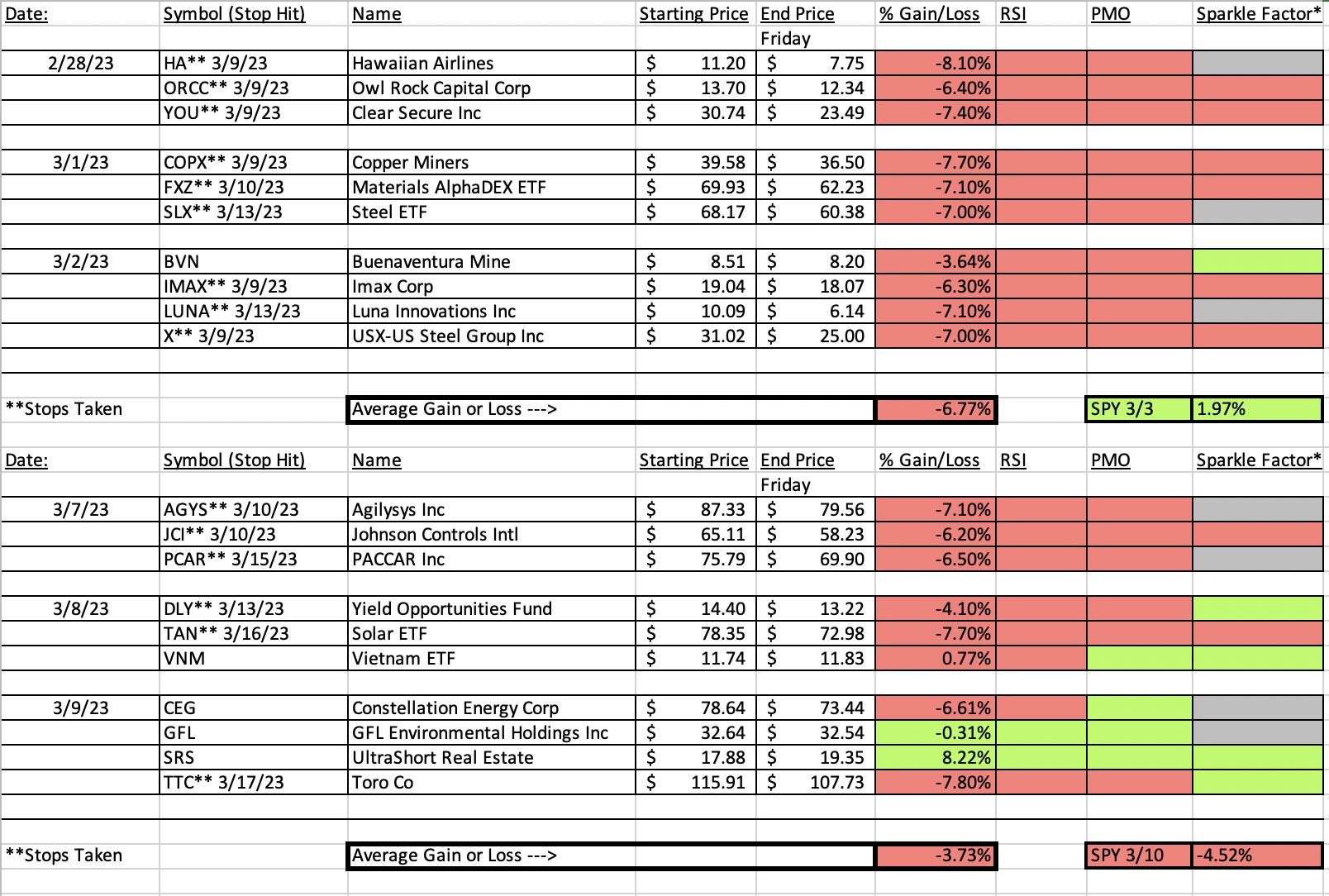

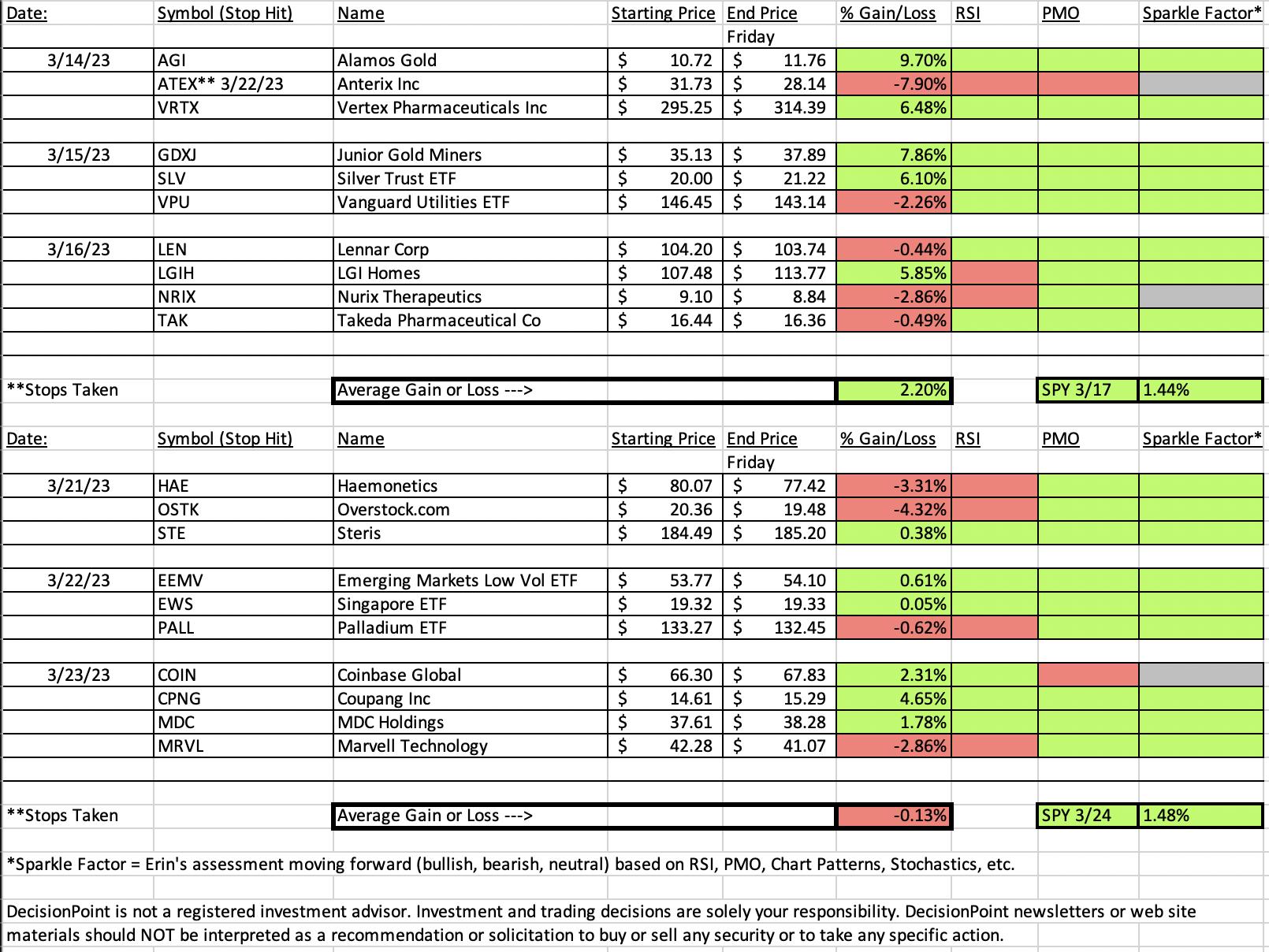

I'll be happy to get rid of the top two months on the spreadsheet. Those positions were slashed on the deep decline we saw in early March. Those selected after 3/14 are still open with the exception of one.

Continue to exercise great care with your portfolios. The market bias is improving in the short term, but the intermediate- and long-term biases are still bearish.

See you in the free DecisionPoint Trading Room tomorrow!

Good Luck & Good Trading,

Erin

RECORDING LINK (3/24/2023):

Topic: DecisionPoint Diamond Mine (3/24/2023) LIVE Trading Room

Recording Link

Passcode: March#24

REGISTRATION for 4/3/2023:

When: Apr 3, 2023 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (4/3/2023) LIVE Trading Room

Register in advance for this webinar HERE

After registering, you will receive a confirmation email containing information about joining the webinar.

Our latest DecisionPoint Trading Room recording (3/20/2023):

A few items about the spreadsheet: I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

Darling:

Coupang Inc. (CPNG)

EARNINGS: 05/10/2023 (AMC)

Coupang, Inc. engages in operating an e-commerce platform. It operates through the Product Commerce and Growth Initiatives segments. The Product Commerce segment provides core retail and marketplace offerings and Rocket Fresh, as well as advertising products associated with these offerings. The Growth Initiatives segment includes nascent offerings and services, including Coupang Eats, Coupang Play, international and fintech initiatives. The company was founded in 2010 and is headquartered in Seattle, WA.

Predefined Scans Triggered: None.

Below are comments and chart from Thursday 3/23:

"CPNG is up +0.07% in after hours trading. Price has been rallying this week and it has definitely changed the technical picture. The RSI is now in positive territory above net neutral (50). The PMO just triggered a crossover BUY signal and Stochastics look great as they rise strongly in positive territory. The industry group is performing slightly better than the SPY. CPNG started to reverse its weak performance against the group and SPY almost two weeks ago. This looks like a solid rally. I've set the stop about halfway between the last low and December low around 7.2% or $13.55."

Here is today's chart:

CPNG continued to rally on Friday and managed to move above the 50-day EMA. It is nearing overhead resistance at $16. That would be the place I would look for a slight pullback and another opportunity to enter. The chart ripened further with the RSI moving well into positive territory and the PMO rising strongly after a crossover BUY signal. Stochastics moved above 80 on Friday. Notice the very high volume that is coming in on this rally. We should see a continuation and price making a move to $18.50.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Dud:

Overstock.com Inc. (OSTK)

EARNINGS: 04/27/2023 (BMO)

Overstock.com, Inc. operates an online shopping site. It also sells these products through www.overstock.com, www.o.com, and www.o.biz. It operates through the following business segments: Retail, tZERO, and MVI. The Retail Segment engages in e-commerce sales through its website. The tZERO Segment focuses on securities transaction through its broker-dealers. The MVI segment consists of the Medici business. The company was founded on May 5, 1997 and is headquartered in Midvale, UT.

Predefined Scans Triggered: New CCI Buy Signals.

Below are the commentary and chart from Tuesday 3/21:

"OSTK is down -0.74% in after hours trading so it appears it could be time for a pause after the strong rally of the past week. This could offer an entry better than the price set today. The RSI is positive, rising and not overbought. The PMO just triggered an oversold crossover BUY signal. Volume is coming in based on the OBV's steep rise. Stochastics are now above 80. As I mentioned in the opening, my biggest hesitation with this chart was the underperformance by the industry group. OSTK is showing new leadership and is starting to outperform the SPY. I wouldn't give it too much rope. I think a 7.3% stop is good. It could be adjusted lower based on your purchase price."

Here is today's chart:

I do still own this one, but not at the price that it was selected so my stop isn't quite as tight as this one right now. The chart really doesn't look too bad. The RSI did drop into negative territory, but a rally will have it back in positive territory. The PMO decelerated a bit, but is rising nonetheless. Stochastics aren't good and tells us that the stop should definitely be honored. Relative strength has now flattened out, but I do note that the industry group did see an improvement in relative strength Friday so this one could turn around here, just don't wait too long. I would likely avoid opening a new entry here, but holding makes sense for now.

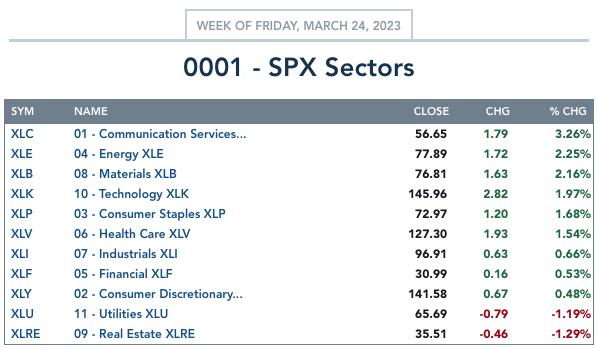

THIS WEEK's Sector Performance:

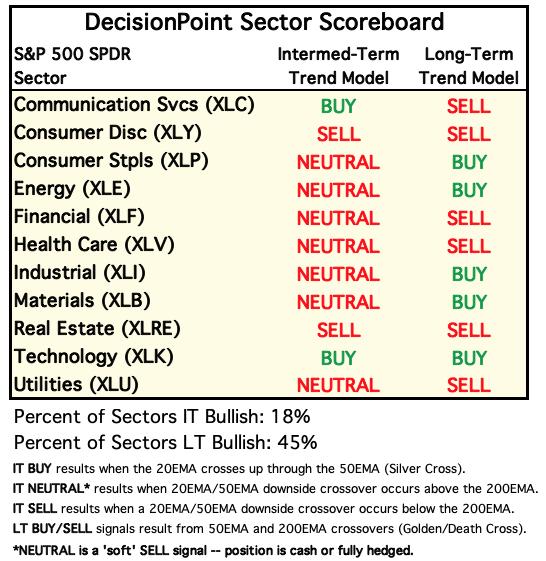

DecisionPoint Sector Scoreboard (Mechanical Trend Model Signals):

Click Here to view Carl's annotated Sector ChartList!

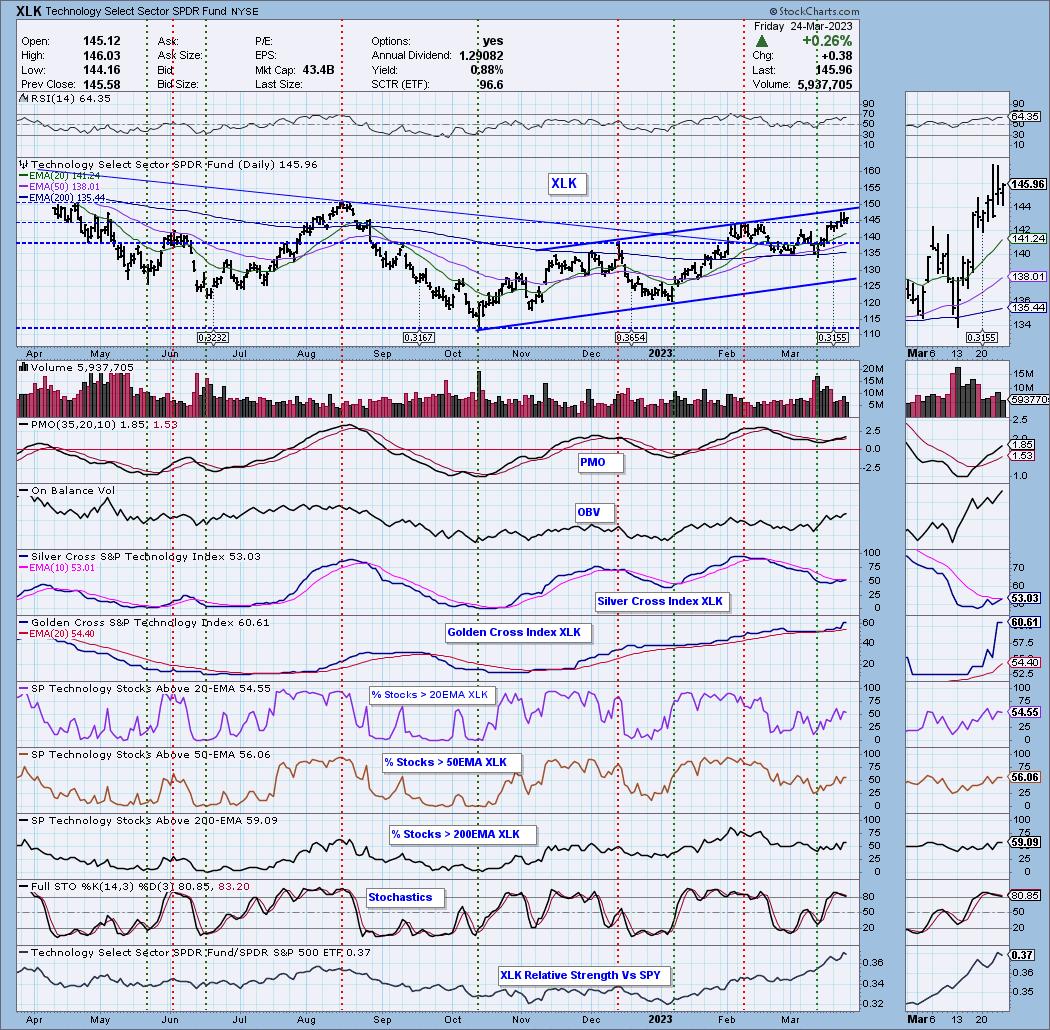

Sector to Watch: Technology (XLK)

Sorry for the repeat this week, but XLK still is looking the most bullish. One thing that confirmed this choice for me was the new crossover of the Silver Cross Index. The crossovers tend to result in higher prices. Participation of stocks above their key moving averages is angling higher and isn't overbought yet. The RSI is in positive territory and the PMO is rising on a BUY signal above the zero line. The Golden Cross Index is healthy and Stochastics are above 80. I believe we will continue to strength out of this sector this week.

Industry Group to Watch: Computer Hardware ($DJUSCR)

I like to pick groups that have ETFs, but unfortunately I couldn't find a good one for this group. That's okay as Apple (AAPL) is basically this industry group anyway and I like AAPL right now. I like the breakout on this group that is accompanied by very strong volume based on the OBV. The RSI is positive and the PMO is rising on a BUY signal and is not overbought. Stochastics did peak, but they are diving lower so I'll accept that. Other stocks of interest might be AGYS, SMCI and LPL as well as AAPL. Keep an eye on these this week! If they are ripe tomorrow you will likely see one of those charts.

Go to our Sector ChartList on DecisionPoint.com to get an in-depth view of all the sectors. On StockCharts.com you can find the Industry Summary.

Good Luck & Good Trading!

- Erin

erin@decisionpoint.com

Full Disclosure: I'm 15% long, 2% short.

Watch the latest episode of the DecisionPoint Trading Room with Carl & Erin Swenlin on Mondays 3:00p EST!

Technical Analysis is a windsock, not a crystal ball. --Carl Swenlin

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

(c) Copyright 2023 DecisionPoint.com