Reader Request Day has arrived! I received a handful of symbols, enough to present three reader submissions and I added one of my own. I have a list of the stocks that popped onto my radar today, but I'm only presenting one of them. I also have the list of other Reader Requests that might interest you.

The market is taking a pause or it could be more related to the big tech/FAANG+ drag that is limiting upside movement. Apple (AAPL) reported after the bell. It was already down more than 3% today and currently it is down -0.78% in after hours trading. BTW, they beat estimates. Fortunately, we are seeing great rotation and pockets of strength in spite of those big tech leaders failing.

That brings us to today's "Diamonds in the Rough". Two groups are really starting to catch fire, Biotechnology and Renewable Energy. Both offer incredible upside opportunity, but of course, these groups also experience a high amount of volatility. Make sure you're okay with the risk/reward.

Tomorrow is the Diamond Mine trading room. The registration link is below. If you don't receive notice before broadcast, you can always re-register to get the join information. The recording links are also below the Diamonds logo. Look forward to talking with you!

Good Luck & Good Trading!

Erin

Today's "Diamonds in the Rough": ALT, ARRY, AVAV and CVBF.

Erin's runner-ups: ENVX, STEM, KRTX, RXDX, BLDR, JKS and NOVA.

Other requests: ALPN, DINO, MCD, VVNT, DXLG, NMIH, RJF and LPLA.

RECORDING LINK (10/21/2022):

Topic: DecisionPoint Diamond Mine (10/21/2022) LIVE Trading Room

Passcode: Oct-21st

REGISTRATION LINK (10/28/2022):

When: Oct 28, 2022 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (10/28/2022) LIVE Trading Room

Register in advance for this webinar HERE

After registering, you will receive a confirmation email containing information about joining the webinar.

Here is the Monday 10/24 recording:

Welcome to DecisionPoint Diamonds, wherein I highlight ten "Diamonds in the Rough" per week. These are selected from the results of my DecisionPoint Scans which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

"Predefined Scans Triggered" are taken from StockCharts.com using the "Symbol Summary" option instead of a "SharpChart" on the workbench.

Altimmune, Inc. (ALT)

EARNINGS: 11/8/2022 (BMO)

Altimmune, Inc. is a clinical stage biopharmaceutical company, which focuses on the development of novel peptide-based therapeutics for the treatment of obesity and liver diseases. The company's lead product candidate, pemvidutide, is a GLP-1/glucagon dual receptor agonist that is being developed for the treatment of obesity and NASH. In addition, Altimmune is developing HepTcell, an immunotherapeutic designed to achieve a functional cure for chronic hepatitis B. The company was founded in 1997 and is headquartered in Gaithersburg, MD.

Predefined Scans Triggered: P&F Low Pole.

ALT is down -4.04% in after hours trading. Ah, the woes of the volatility in Biotechs. This big decline after hours won't necessarily affect tomorrow's trading, but if it does, it would give you a decent entry as long as the PMO continues to rise. I like the rounded price bottom and move above both the 20-day EMA and 200-day EMA. Price pulling back here would be natural after yesterday's breakout. The RSI just moved into positive territory and the PMO has triggered an oversold BUY signal. Stochastics just moved above 80. Biotechs, as I mentioned in the opening, are showing an increase in outperformance and ALT is holding up well against the group and the SPY. You'll note I added a percentage on the left. That 33.7% is upside potential should it reach gap resistance. The stop is deep, but after hours trading down 4% explains why. It would be too easy to be stopped out with a thinner stop. I've set it at 9% or around $11.27.

Upside potential becomes even more jaw dropping on the weekly chart. I wouldn't set my expectations too high. A 33% gain would be sufficient. If it gets there, I'd halve my position. The weekly RSI just moved into positive territory and the weekly PMO is turning up and preparing for a whipsaw crossover BUY signal. The SCTR is at an exceptional 99%. This means that ALT is in the top 1% of small-caps as far as trend and condition.

Array Technologies Inc. (ARRY)

EARNINGS: 11/8/2022 (AMC)

Array Technologies, Inc. manufactures ground-mounting systems used in solar energy projects. The company sells its products to engineering, procurement and construction firms that build solar energy projects and to large solar developers, independent power producers and utilities, master supply agreements or multi-year procurement contracts. It has offices in Europe, Central America, and Australia. The company's products include DuraTrack and SmarTrack. Array Technologies was founded by Ronald P. Corio in 1989 and is headquartered in Albuquerque, NM.

Predefined Scans Triggered: P&F Low Pole and Entered Ichimoku Cloud.

ARRY is up +0.53% in after hours trading. This is my pick for the day. I love the Solar space right now. It is starting to attract investor interest. Like Biotechs it can be rather volatile so be prepared for a bumpy ride. This one looks great. We have a breakout that confirmed the bullish falling wedge. There is a positive OBV divergence that would suggest this rally will be extended. The RSI is now in positive territory and the PMO is about to trigger a crossover BUY signal. Stochastics are rising strongly and should get above 80 shortly. This stock is outperforming the group and is beginning to outperform the SPY as well. I've set the stop at 7.9%, below the 200-day EMA around $15.67.

I love seeing the bullish cup with handle pattern on the weekly chart. The weekly RSI is back in positive territory above net neutral (50). The weekly PMO has bottomed above the signal line. The SCTR is a healthy 99.2% putting it in the top 1% of all mid-caps. I've marked upside potential to the 2022 top.

AeroVironment Inc. (AVAV)

EARNINGS: 12/6/2022 (AMC)

AeroVironment, Inc. engages in the design, development, production, support and operation of unmanned aircraft systems and electric transportation solutions. The company was founded by Paul B. MacCready, Jr. in July 1971 and is headquartered in Arlington, VA.

Predefined Scans Triggered: New CCI Buy Signals, Moved Above Upper Bollinger Band and P&F Double Top Breakout.

AVAV is down -0.35% in after hours trading. It wasn't long ago that I presented ITA, the Defense ETF. Consequently I already knew that I'd probably like this one. We have a nice cup-shaped price low and a new breakout above the 50/200-day EMAs. The RSI is in positive territory and the PMO is rising on a crossover BUY signal. Stochastics are now above 80 suggesting internal strength. The group continues to outperform the SPY and AVAV is beginning to outperform both. The stop is set below the September lows at 8.4% around $80.88.

The weekly chart is getting more favorable. The weekly RSI just moved above net neutral (50) and the weekly PMO is rising. The SCTR just entered the "hot zone" above 70 (I consider SCTRs of 70 or above to have bullish biases in the intermediate to long terms). Upside potential should it test the 2022 high is over 30%.

CVB Financial Corp. (CVBF)

EARNINGS: 1/25/2023 (AMC)

CVB Financial Corp. is a bank holding company, which engages in the provision of relationship-based banking products, services, and solutions for small to mid-sized companies, real estate investors, non-profit organizations, professionals, and other individuals through its subsidiary, Citizens Business Bank. Its products include loans for commercial businesses, commercial real estate, multi-family, construction, land, dairy and livestock and agribusiness, consumer and government-guaranteed small business loans. The company was founded by George A. Borba on April 27, 1981 and is headquartered in Ontario, CA.

Predefined Scans Triggered: New CCI Buy Signals, Parabolic SAR Buy Signals and P&F Double Top Breakout.

CVBF is unchanged in after hours trading. The PMO is what sold me on this one. I almost didn't have to look at the other indicators. A PMO bottom above the signal line is especially bullish in my opinion. The RSI is rising in positive territory. Stochastics turned up before having to test the bottom of the range. They should get above 80 soon. Overall, relative strength is in a rising trend. The condition improved this week as Banks began to outperform the SPY. The stop can be set thinly below the 50-day EMA at 5.4% around $26.33.

The weekly PMO is about to trigger a crossover BUY signal. The weekly RSI has spent all year in positive territory. The SCTR has been in the "hot zone" all year. This one looks pretty good in the intermediate term as well as the short term. However, we still need a breakout to smooth the way. given it is at all-time highs, consider a 15% upside target around $32.02.

Don't forget, on Thursdays I look at reader-requested symbols, click HERE to send me an email. I read every email I receive and try to answer them all!

Current Market Outlook:

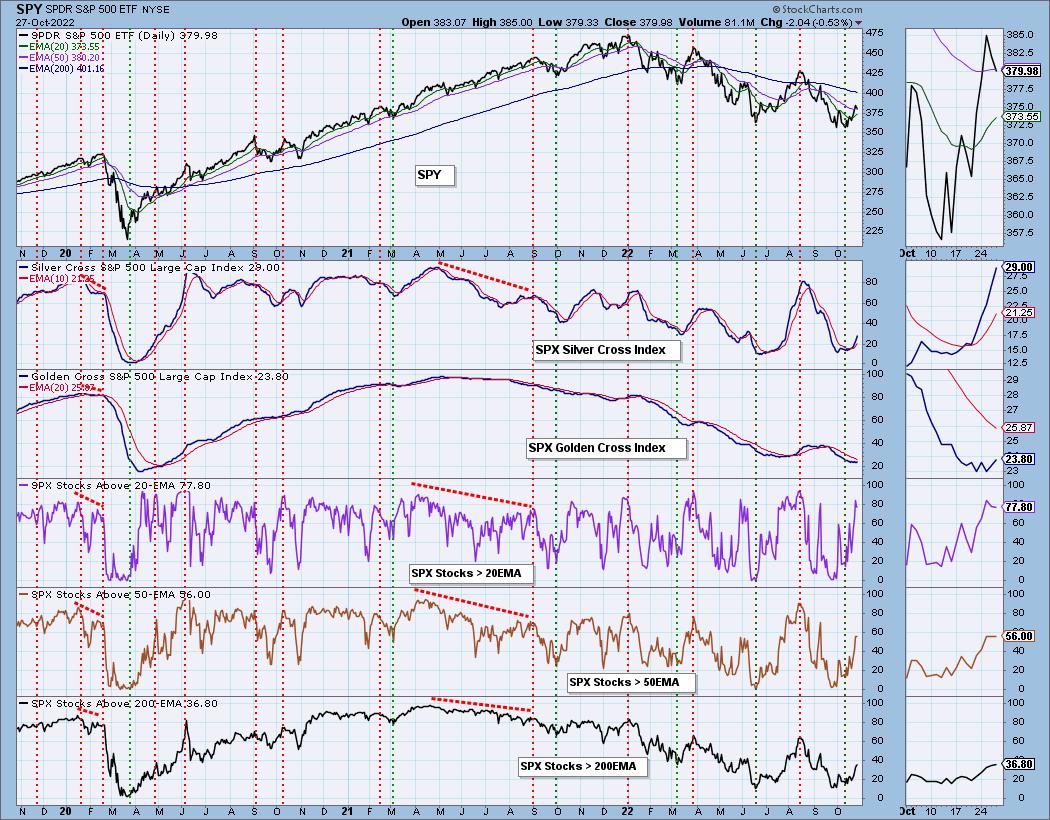

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Full Disclosure: I am 55% exposed.

I'm required to disclose if I currently own a stock I mention and/or may buy/short it within the next 72 hours.

"Technical Analysis is a windsock, not a crystal ball." - Carl Swenlin

(c) Copyright 2022 DecisionPoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "Diamonds in the Rough."

Regarding BUY/SELL Signals: The signal status reported herein is based upon mechanical trading model signals and crossovers. They define the implied bias of the price index/stock based upon moving average relationships and momentum, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com