I had numerous requests come across my desk today, too many for me to list them all here as I often do. I had two readers request the same symbol so that was an obvious symbol for inclusion. The others weren't so easy to decide on. I ended up making sure that I covered requests from different subscribers.

I apologize for the delay tonight. My mother-in-law broke her back while I was at ChartCon. Her boys have it under control and she wasn't paralyzed or anything, but I am now the "go to" for problems during the day when no one else is available. Today was one of those days I was needed...twice. Thank you as always for your patience and understanding. DP subscribers are the best!

Quite a market day to be away from desk! We never found a reason except for short covering for the incredible reversal in the markets today. This does bode well for tomorrow. Let me get to the symbols! I will be ready for all of you in tomorrow's Diamond Mine with some of the requests I didn't cover. Sign up links are below the Diamonds logo.

Good Luck & Good Trading!

Erin

Today's "Diamonds in the Rough": COWZ, ET, KDP and SGML.

We didn't have a Diamond Mine trading room last week due to my appearance at ChartCon so here is the prior link:

RECORDING LINK (9/30/2022):

Topic: DecisionPoint Diamond Mine (9/30/2022) LIVE Trading Room

Start Time: Sept 30, 2022 09:00 AM

Passcode: Sept#30th

REGISTRATION LINK (10/14/2022):

When: Oct 14, 2022 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (10/14/2022) LIVE Trading Room

Register in advance for this webinar HERE.

Here is the Monday 10/10 recording:

Welcome to DecisionPoint Diamonds, wherein I highlight ten "Diamonds in the Rough" per week. These are selected from the results of my DecisionPoint Scans which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

"Predefined Scans Triggered" are taken from StockCharts.com using the "Symbol Summary" option instead of a "SharpChart" on the workbench.

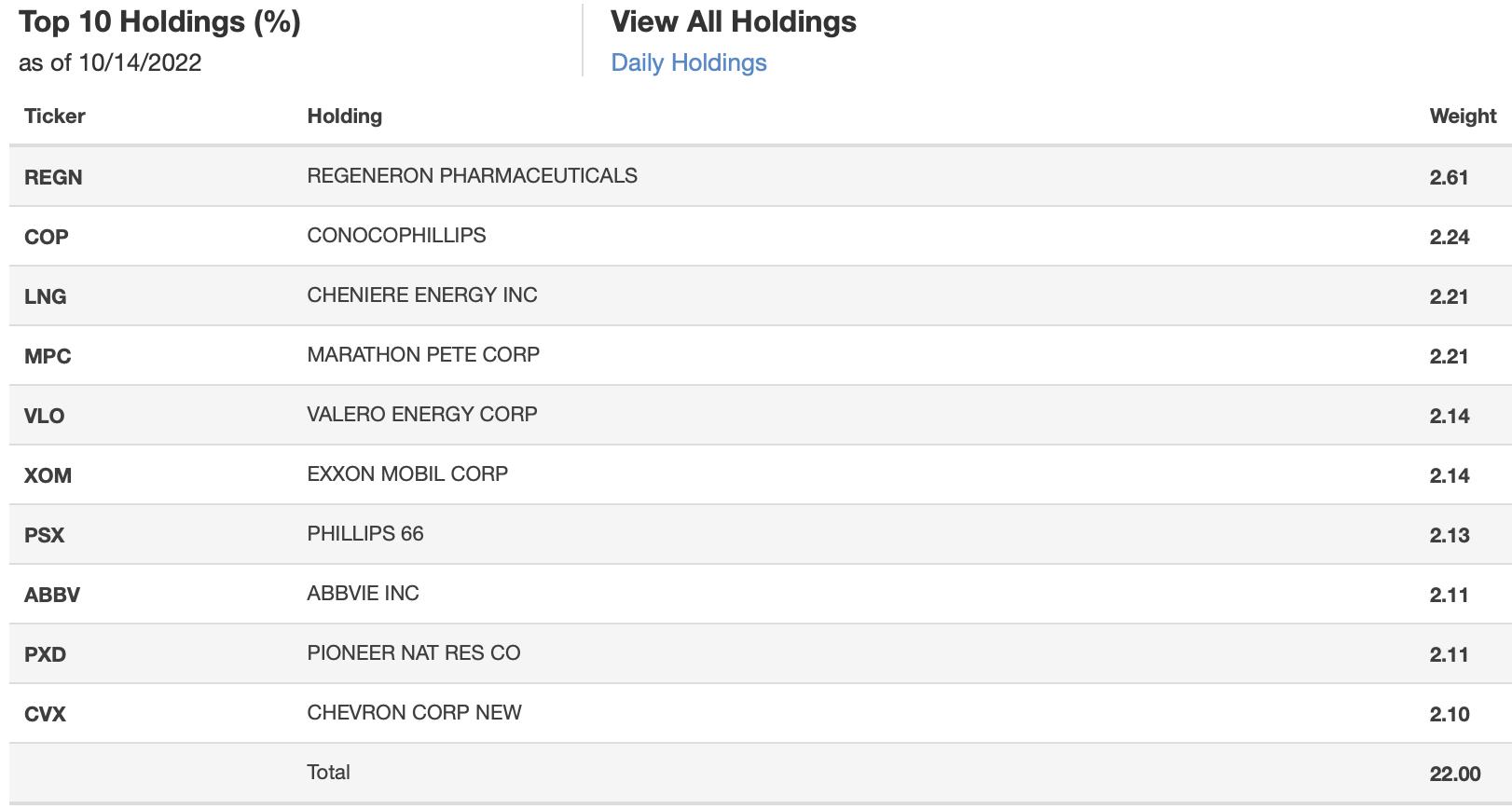

Pacer US Cash Cows 100 ETF (COWZ)

EARNINGS: N/A

COWZ tracks a free cash flow-weighted index of companies selected from the Russell 1000 Index. Click HERE for more information.

Predefined Scans Triggered: Elder Bar Turned Green and P&F Low Pole.

COWZ is down -0.72% in after hours trading. You'll see huge bullish engulfing candlesticks on most stocks and ETFs today given the crazy trading day. This is an interesting ETF, but I didn't see anything unique about their holdings. I love the breakout from the bull flag and the accompanying acceleration of the PMO. The RSI is positive and Stochastics have reversed and are headed back toward 80. Relative strength is exactly what you need right now given that the benchmark SPY is in a strong bear market trend. I set the stop below support, but you could lengthen it if you wish to account for a breakdown from the flag should it travel lower again. The stop is around 5.9% or $41.79.

We have a bullish falling wedge on the weekly chart. The weekly RSI is negative, but is at least rising. The weekly PMO has bottomed bullishly and the SCTR is a respectable 86%.

Energy Transfer LP (ET)

EARNINGS: 11/1/2022 (AMC)

Energy Transfer LP provides natural gas pipeline transportation and transmission services. It operates through the following segments: Intrastate Transportation and Storage, Interstate Transportation and Storage, Midstream, NGL and Refined Products Transportation and Services, Crude Oil Transportation and Services, Investment in Sunoco LP, Investment in USAC, and All Other. The Intrastate Transportation and Storage segment owns and operates natural gas transportation pipelines. The Interstate Transportation and Storage segment includes transportation pipelines, storage facilities and gathering systems and delivery of natural gas to industrial end-users and other pipelines. The Midstream segment consists of natural gas gathering, compression, treating, processing, storage, and transportation. The NGL and Refined Products Transportation segment engages in the operations transport, store and execute acquisition and marketing activities utilizing a complementary network of pipelines, storage and blending facilities, and strategic off-take locations that provide access to multiple NGL markets. The Crude Oil Transportation and Services segment provides transportation, terminalling, acquisition, and marketing services to crude oil markets. The Investment in Sunoco LP segment engages in the distribution of motor fuels to independent dealers, distributors, and other commercial customers and the distribution of motor fuels to end-user customers at retail sites. The Investment in USAC segment provides compression services to its customers in connection with infrastructure applications including both allowing for the processing and transportation of natural gas through the domestic pipeline system and enhancing crude oil production through artificial lift processes. Energy Transfer was founded in 1996 and is headquartered in Dallas, TX.

Predefined Scans Triggered: Elder Bar Turned Green.

ET is up +0.09% in after hours trading. This is the one requested by two subscribers and I can see why. Today was a big breakout from a bull flag. We also have a bullish engulfing candlestick. The PMO is finally accelerating away from the signal line and the RSI is now positive. Stochastics are just about above 80 and relative strength is very good. If you're going to go with a Pipeline stock this one has been outperforming its group since July. The stop is set at 6.2% which would take price below the October low around $10.98.

The weekly chart is favorable with a positive weekly RSI and weekly PMO that is trying to trigger a crossover BUY signal. The SCTR has been in the "hot zone" above 70 almost all year. If it reaches overhead resistance, that would be a 15% gain which is more than double our stop percentage.

Keurig Dr Pepper Inc. (KDP)

EARNINGS: 10/27/2022 (BMO)

Keurig Dr Pepper, Inc. engages in the production and marketing of non-alcoholic beverages. It operates through the following segments: Coffee Systems, Packaged Beverages, Beverage Concentrates, and Latin America Beverages. The Coffee Systems segment includes the manufacture and distribution of finished goods relating to coffee, pods, and brewers. The Packaged Beverages segment offers finished beverages and other products, including owned brands and third-party brands. The Beverage Concentrates segment sells branded concentrates and syrup to third-party bottlers. The Latin America Beverages segment refers to sales in Mexico, the Caribbean, and other international markets from the production of concentrates, syrup, and finished beverages. The company was founded in 2018 and is headquartered in Burlington, MA.

Predefined Scans Triggered: P&F High Pole, Moved Above Upper Price Channel and Entered Ichimoku Cloud.

KDP is unchanged in after hours trading. We have another huge bullish engulfing candlestick. I really like the bottoming formation that looks like a bullish reverse head and shoulders. Yesterday's breakout confirmed the pattern, but it was a bearish filled black candlestick so today's confirmation is much better. The RSI is positive and not overbought. The PMO is rising on an oversold BUY signal. Stochastics are above 80 and relative strength is good, particularly for the group. The stop is set below support at 7% or $35.47. You don't have to wait that long. A break below the 200-day EMA would likely spell trouble.

The weekly chart is very nice given the positive weekly RSI as well as the bottom on the weekly PMO. It should trigger a crossover BUY signal soon. The SCTR is looking good at 88%. Since it is about to make all-time highs, consider an upside target around 15% or $43.86.

Sigma Lithium Corp. (SGML)

EARNINGS: N/A

Sigma Lithium Corp. engages in the production a lithium property. It focuses its project in Minas Gerais. The firm also plans to build a world-class commercial-scale lithium concentration plant. The company was founded on June 8, 2011 and is headquartered in Vancouver, Canada.

Predefined Scans Triggered: Elder Bar Turned Green, New CCI Buy Signals, New 52-week Highs and Moved Above Upper Price Channel.

SGML is up +1.24% in after hours trading. We another big bullish engulfing candlestick and a breakout to new all-time highs. It is traveling in a solid rising trend channel and appears ready to test the top of it again. The RSI is positive and the PMO is about to trigger a crossover BUY signal. Stochastics reversed and are back above 80. Relative strength for the group is alright, but I'd like to see a bit better. SGML is a strong performer within the group and it has been outperforming the SPY since the beginning of September (not a surprise given the rising trend channel). The stop unfortunately is set deeply at 9.1% or $27.77 because of today's big push and wide trading range. Basically I'd watch the bottom of the trend channel. A break below would have me out.

Not much to talk about on the weekly chart given it is a new issue, but the weekly RSI is overbought somewhat. Volume is certainly confirming its march higher. Since it is at all-time highs, consider an upside target around 18% (double our stop level) or $36.05.

Don't forget, on Thursdays I look at reader-requested symbols, click HERE to send me an email. I read every email I receive and try to answer them all!

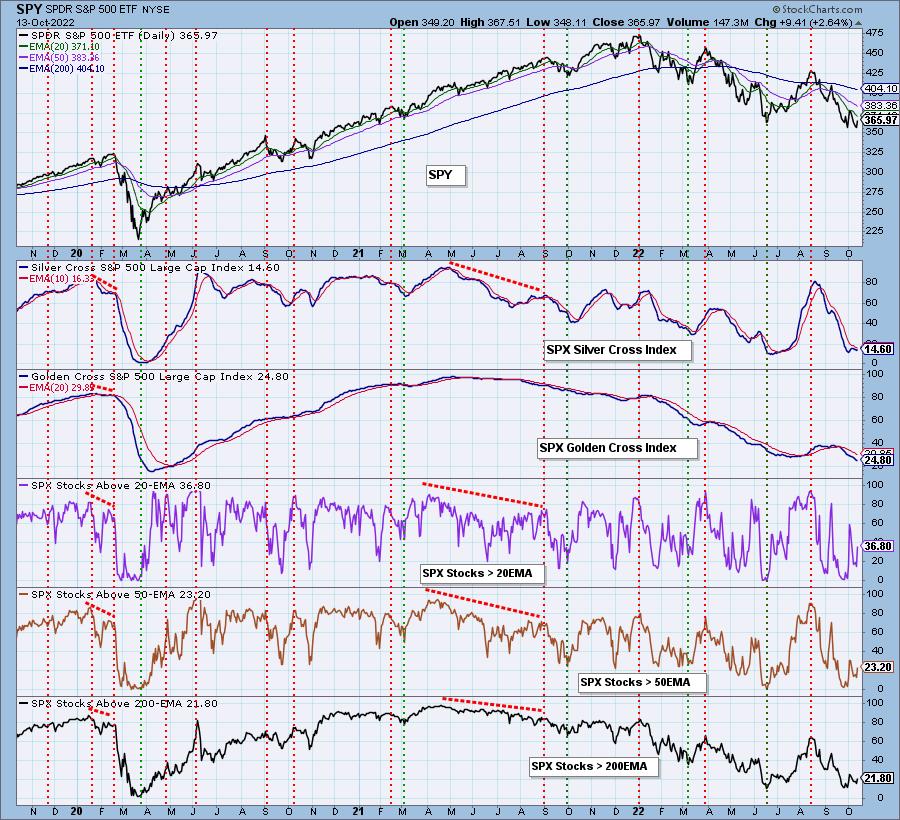

Current Market Outlook:

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Full Disclosure: I am 10% exposed with a 5% hedge.

I'm required to disclose if I currently own a stock I mention and/or may buy/short it within the next 72 hours.

"Technical Analysis is a windsock, not a crystal ball." - Carl Swenlin

(c) Copyright 2022 DecisionPoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "Diamonds in the Rough."

Regarding BUY/SELL Signals: The signal status reported herein is based upon mechanical trading model signals and crossovers. They define the implied bias of the price index/stock based upon moving average relationships and momentum, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com