I actually have a rather long list of ETFs that I found interesting today. I tried to avoid inverse ETFs, particularly leveraged or "juiced" ETFs. The major indexes all have inverses popping up in today's scans from small-caps to large-caps. However, I'm not ready to short the market overall. I think you certainly could, but I like things to look especially bad on the charts and especially good on the inverse market ETFs. With the exception of the inverse QQQs, the rest aren't bearish enough. I nearly picked KCCA which has a very nice chart, but it was down over 3% in after hours trading so opted to leave it alone, but on the runners-up list. I noticed muni-bond ETFs looking good, but I'm not ready to hedge interest rates with any kind of bond purchase.

I accidentally published Monday so I skipped yesterday. Reader Request Day is tomorrow so get your symbols in. There is a shortage of good looking symbols right now so I'm curious about what you'll come up with! Just email them to erin@decisionpoint.com.

Good Luck & Good Trading!

Erin

Today's "Diamonds in the Rough": EUM, FTXG and YANG.

Runners Up: ZSL, BERZ, BTAL, CORN, HDGE, KCCA, IVOL, MLN, AVUV, DWSH, EPV, FMB, PSQ, SARK & TECS.

We didn't have a Diamond Mine trading room last week due to my appearance at ChartCon so here is the prior link:

RECORDING LINK (9/30/2022):

Topic: DecisionPoint Diamond Mine (9/30/2022) LIVE Trading Room

Start Time: Sept 30, 2022 09:00 AM

Passcode: Sept#30th

REGISTRATION LINK (10/14/2022):

When: Oct 14, 2022 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (10/14/2022) LIVE Trading Room

Register in advance for this webinar HERE.

Here is the Monday 10/10 recording:

Welcome to DecisionPoint Diamonds, wherein I highlight ten "Diamonds in the Rough" per week. These are selected from the results of my DecisionPoint Scans which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

"Predefined Scans Triggered" are taken from StockCharts.com using the "Symbol Summary" option instead of a "SharpChart" on the workbench.

ProShares Short MSCI Emerging Markets (EUM)

EARNINGS: N/A

EUM provides inverse exposure to an index representing 85% of the market cap in emerging markets. For more information click HERE.

Predefined Scans Triggered: P&F Ascending Triple top Breakout and P&F Double Top Breakout.

EUM is up +0.23% in after hours trading. Yesterday it broke out above short-term support. Today it pulled back slightly but didn't lose support. Despite being mostly overbought, the RSI is managing to stay out of overbought territory. The PMO has bottomed above the signal line which is especially bullish. The OBV is confirming the current uptrend. Stochastics are back above 80 and clearly EUM is carrying strong relative strength against the SPY. Not surprising given the uptrend in September. I like that you can set a reasonable stop around 6% or $16.01.

We see a solid rising trend on the weekly chart. It is technically parabolic, but the rise is still very gentile. If we start seeing a vertical move higher, then we can worry. The weekly RSI and PMO are certainly overbought, but rising nonetheless. I like the PMO whipsaw back into a BUY signal. Long-term resistance has been overcome. I believe we could see this one hit a 25% gain.

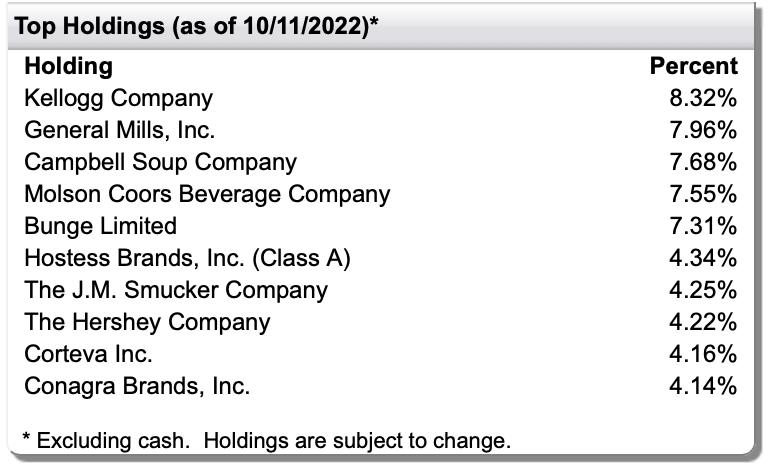

First Trust Nasdaq Food & Beverage ETF (FTXG)

EARNINGS: N/A

FTXG follows a liquidity-selected, multi-factor-weighted index of US food & beverage companies. Click HERE for more information.

Predefined Scans Triggered: P&F Low Pole.

FTXG appears not to trade after hours. Looking at the holdings above for this ETF I will tell you that HSY was a scan result today and of course, while it isn't on the list, Monday had Darling Ingredients (DAR) as a "Diamond in the Rough". This seems one of the few areas with potential right now. We have a bullish double-bottom about to be confirmed with a breakout from the early October high. This is the second time price closed above the 20-day EMA since breaking down at the beginning of September. The RSI isn't positive yet, but should get above net neutral (50) shortly. The PMO triggered a new crossover BUY signal today. Stochastics are now in positive territory. It has been a super performer over the past week. I set a very thin stop of 4.4% (could be lengthened, but no need) around $24.46.

With such a thin stop, an upside target of 16% makes sense. I like that this one is typically a less volatile ETF. The weekly RSI is negative, but rising. The weekly PMO has abruptly stopped its decline and the SCTR is respectable at 88.3%.

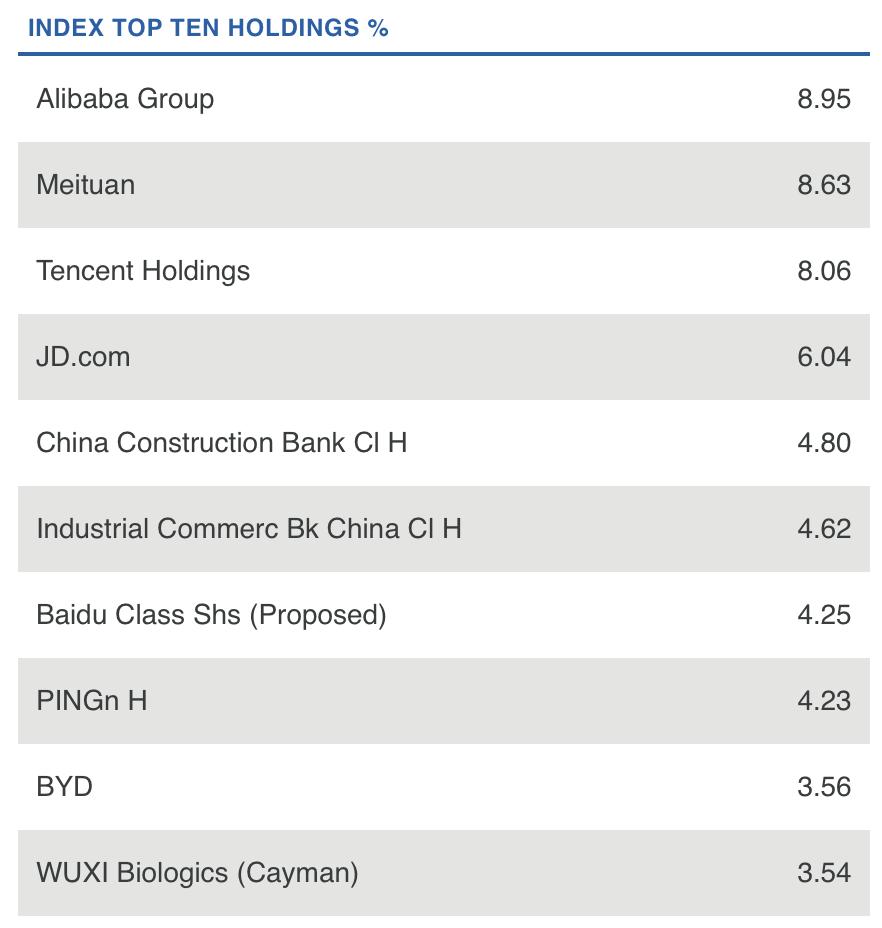

Direxion Daily FTSE China Bear 3x Shares (YANG)

EARNINGS: N/A

YANG provides daily 3x inverse leveraged exposure to a market-cap-weighted index of the 50 largest Chinese stocks traded in Hong Kong. Click HERE for more information.

Predefined Scans Triggered: Bullish MACD Crossovers and Moved Above Ichimoku Cloud.

YANG is up +0.04% in after hours trading. You'll notice that there is some overlap between this ETF and the short Emerging Markets ETF (EUM). If you have a higher risk appetite, you could certainly short some of these holdings yourself without having to be exposed to a 3x short ETF. The chart is enticing (this is on my buy list for tomorrow). The RSI is overbought, but we've seen similar in March. We just want to be careful should it reach the heights it did back then before the deep drop. The PMO has bottomed above its signal line (or whipsawed) which is especially bullish. Stochastics are rising strongly above 80. The OBV is confirming this rising trend and it is outperforming the SPY in a big way. The stop is set below gap support around 7.9% or $23.44.

Be aware that this ETF is up over 20% on the week so it could see a pullback to support around $22.50. Should avoid limit orders. The 17-week EMA has crossed above the 43-week EMA and the PMO is moving quickly higher on its own crossover BUY signal. The OBV is confirming the rising trend. Forgot to talk about the weekly RSI which is bullish as it rises in positive territory and not overbought.

Don't forget, on Thursdays I look at reader-requested symbols, click HERE to send me an email. I read every email I receive and try to answer them all!

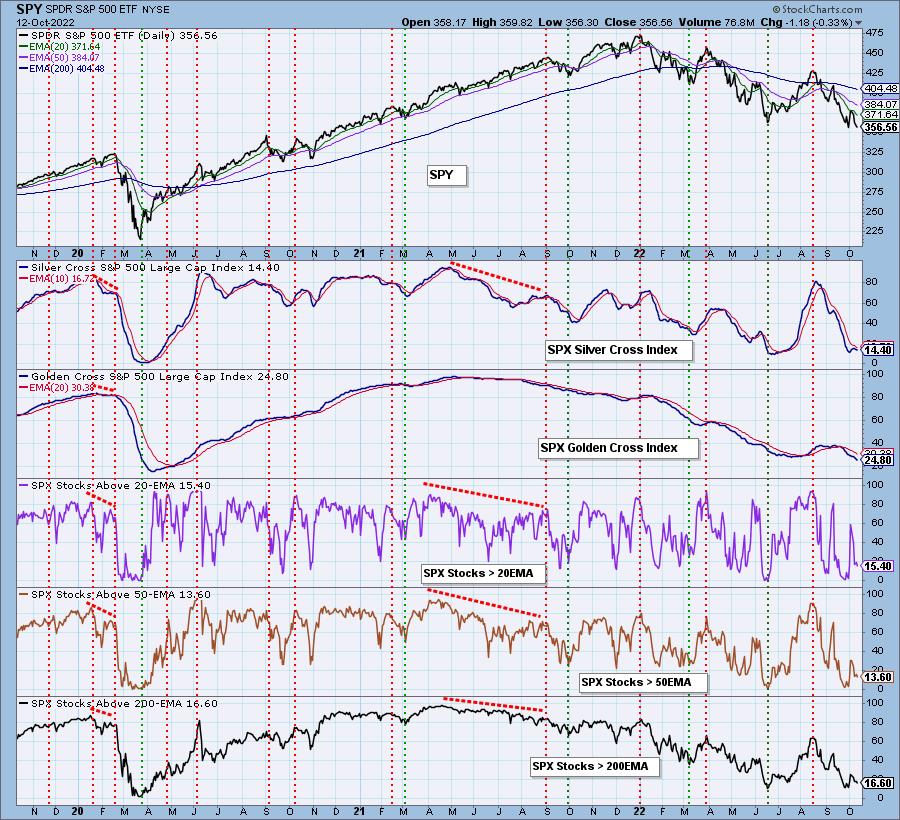

Current Market Outlook:

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Full Disclosure: I am 10% exposed with 5% hedge. YANG is on my buy list tomorrow.

I'm required to disclose if I currently own a stock I mention and/or may buy/short it within the next 72 hours.

"Technical Analysis is a windsock, not a crystal ball." - Carl Swenlin

(c) Copyright 2022 DecisionPoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "Diamonds in the Rough."

Regarding BUY/SELL Signals: The signal status reported herein is based upon mechanical trading model signals and crossovers. They define the implied bias of the price index/stock based upon moving average relationships and momentum, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com