Thank you to all who sent in symbol requests this week! I can't cover them all, so don't feel bad if yours was not included. I have them written down so if we have time in tomorrow's Diamond Mine trading room, I'll look at them. Requests were definitely weighted toward Energy, particularly Crude Oil related stocks. That's not a surprise given what I'm seeing on those charts.

I've put the symbol requests that I saw some potential as runners-up.

I wanted to mention the crazy rally in Solar stocks today. I looked at the Solar ETF (TAN) and I like what I see. They rallied very strongly so tomorrow could see a pullback and an opportunity to possibly get in. I reviewed a few charts and I liked PLUG. BEEM came up in one of my scans today and ENPH looks great too.

Carl and I took a look at the mega-cap stocks while I was over helping Mom and all of them are nearing "Silver Crosses" (20-day EMA moves above 50-day EMA). We're not so sure the bear market is over, but there are some indications that this rally will continue. AAPL reported this evening and is up +3.05% in after hours trading. AMZN also reported this evening and is up a whopping +13.44% in after hours trading. Investors are restless and apparently looking for reasons to get back in.

Don't forget to sign up for the Diamond Mine trading room! The link is below.

Good Luck & Good Trading!

Erin

Today's "Diamonds in the Rough": AEHR, CRK, CTRA, SQM and TGRP.

Runners-Up: MRNS, ADPT, CYXT, EXAI, SOXL, ADC, CF, GFF, MOS, PARR, PLAB, PXD, SBOW, SGML, TMUS and WAT.

RECORDING LINK (7/15/2022. There was no Diamond Mine 7/22):

Topic: DecisionPoint Diamond Mine (7/15/2022) LIVE Trading Room

Start Time: Jul 15, 2022 09:01 AM

Meeting Recording Link

Access Passcode: July%15th

REGISTRATION Friday, 7/29 Diamond Mine:

When: Jul 29, 2022 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (7/29/2022) LIVE Trading Room

Register in advance for this webinar HERE

Save the registration confirmation email with login instructions in case Zoom doesn't notify you in time.

StockChartsTV is now producing the recording for the free DP Trading Room! It airs at 3p ET, much sooner than I was able to get out the recording links. Carl has joined so you can "ask the master" all those questions you've always wanted his opinion on! If you haven't registered to attend live at Noon ET, you can do so HERE.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight ten "Diamonds in the Rough" per week. These are selected from the results of my DecisionPoint Scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

"Predefined Scans Triggered" are taken from StockCharts.com using the "Symbol Summary" option instead of a "SharpChart" on the workbench.

Aehr Test Systems (AEHR)

EARNINGS: 9/22/2022 (AMC)

Aehr Test Systems engages in the design, manufacture and marketing of test and burn-in products to the semiconductor manufacturing industry. Its products include wafer contact test systems, test during burn-in systems, test fixtures and die carriers. The company was founded by Rhea J. Posedel on May 25, 1977 and is headquartered in Fremont, CA.

Predefined Scans Triggered: Ichimoku Cloud Turned Green

AEHR is down -0.18% in after hours trading. AEHR pulled back and rebounded right off support at the June top and 200-day EMA. The RSI is positive, rising and not yet overbought. The PMO has accelerated higher (although it is on the overbought side). Volume is coming in as noted by the OBV. Stochastics turned up in positive territory. Relative strength is bullish. The stop is tricky. If you put it beneath support, like I prefer to, it is too deep at 12% or so. So I picked the high side of my stop percentages at around 8%.

The weekly chart shows us a double bottom that executed last week, price is staying above the confirmation line. The weekly RSI is positive and the weekly PMO just turned up and is nearing a crossover BUY signal. The SCTR is excellent. Upside potential is around 35%.

Comstock Resources, Inc. (CRK)

EARNINGS: 8/1/2022 (AMC)

Comstock Resources, Inc. engages in the acquisition, development, and exploration of oil and natural gas. The firm operations concentrated in the Haynesville shale, a premier natural gas basin located in East Texas. The company was founded in 1919 and is headquartered in Frisco, TX.

Predefined Scans Triggered: Elder Bar Turned Blue and P&F Low Pole

CRK is down -1.51% in after hours trading. I've covered it twice before on March 10th 2022 (position is open and up +58.18%) and April 7th 2022 (position is closed). I like the breakout and the decline today that helped to digest it. We could see more pullback which would offer a better entry. The chart certainly suggests more upside ahead. RSI is still positive and the PMO saw no damage on this decline. The OBV is confirming. Stochastics are oscillating above 80 which implies internal strength. Relative strength is very good. Should it pull back below $14, I wouldn't enter. If you buy now, I would set a stop beneath the 50-day EMA.

This one has been volatile of late but it is tied to Natural Gas which has been very volatile. The weekly RSI just moved back into positive territory. The weekly PMO is turning up and the SCTR is outstanding.

Coterra Energy Inc. (CTRA)

EARNINGS: 8/2/2022 (AMC)

Coterra Energy Inc. is a diversified energy company, which engages in the exploration, development, and production of oil and natural gas properties. Its portfolio includes projects in the Permian Basin, the Marcellus Shale, and the Anadarko Basin. The company was renamed to Coterra Energy Inc. on October 1, 2021 in connection with the merger involving Cabot Oil & Gas Corp. and Cimarex Energy Co. Coterra Energy was founded in 1989 and is headquartered in Houston, TX.

Predefined Scans Triggered: Elder Bar Turned Blue

CTRA is up +0.60% in after hours trading. I covered it on November 24th 2020 (position closed). This is a great bottoming pattern coming off the 200-day EMA and just above support at $24. The RSI is positive. The PMO is nearing positive territory. Stochastics are oscillating above 80. Relative strength is slowly improving for the group. This one is a clear leader as far as relative strength against the group. The stop can be set below support at 7.7%.

This reversal came right on long-term support. Notice their dividends are increasing as they go. The weekly RSI is rising in positive territory and isn't overbought. The PMO is beginning to decelerate and possibly turn back up. The SCTR is excellent.

Sociedad Quimica Y Minera (SQM)

EARNINGS: 8/17/2022 (AMC)

Sociedad Quimica y Minera de Chile SA engages in the production and distribution of fertilizers, potassium nitrate, iodine, and lithium chemicals. It operates through the following segments: Specialty Plant Nutrients, Iodine and Derivatives, Lithium and Derivatives, Industrial Chemicals, Potassium, and Other Products and Services. The Specialty Plant Nutrients segment produces potassium nitrate, sodium nitrate, sodium potassium nitrate, and specialty blends. The Iodine and Derivatives segment manufactures iodine and iodine derivatives, which are used in a wide range of medical, pharmaceutical, agricultural, and industrial applications. The Lithium and Derivatives segment covers lithium carbonate for electrochemical materials for batteries, frits for the ceramic and enamel industries, heat-resistant glass, air conditioning chemicals, continuous casting powder for steel extrusion, primary aluminum smelting process, pharmaceuticals, and lithium derivatives. The Industrial Chemicals segment comprises industrial chemicals including sodium nitrate, potassium nitrate, and boric acid. The Potassium segment produces potassium chloride and potassium sulfate. The Other Products and Services segment deals with other fertilizers and blends. The company was founded on June 17, 1968 and is headquartered in Santiago, Chile.

Predefined Scans Triggered: Improving Chaikin Money Flow, Stocks in a New Uptrend (ADX), Filled Black Candles, P&F Ascending Triple Top Breakout and P&F Double Top Breakout

SQM is up +0.72% in after hours trading. The rally is solid despite the up/down flip everyday. The rising trend is intact. The RSI is positive. The EMAs are configured positively with fastest on top and slowest on the bottom. You'll note today we had a breakout above the late June top. Technically, the minimum upside target of the small double-bottom has been met, but this one looks like it has room to run higher. Stochastics are oscillating above 80 and I like the relative strength. Stop is set below the 20-day EMA, but could be set deeper depending on your risk profile.

This week's rally shows price staying above support at the March top. The weekly PMO is turning back up and the RSI is staying in positive territory. The SCTR is exceptional.

Targa Resources Corp. (TRGP)

EARNINGS: 8/4/2022 (BMO)

Targa Resources Corp. provides midstream natural gas and natural gas liquids services. It also provides gathering, storing, and terminaling crude oil, and storing, terminaling, and selling refined petroleum products. It operates through the following business segments: Gathering and Processing, and Logistics and Transportation. The Gathering and Processing segment includes assets used in the gathering of natural gas produced from oil and gas wells and processing this raw natural gas into merchantable natural gas by extracting NGLs and removing impurities, and assets used for crude oil gathering and terminaling. The Logistics and Transportation segment includes all the activities necessary to convert mixed NGLs into NGL products and provides certain value-added services such as the storing, fractionating, terminaling, transporting and marketing of NGLs and NGL products, including services to LPG exporters, and the storing and terminaling of refined petroleum products and crude oil and certain natural gas supply and marketing activities in support of its other businesses. The company was founded on October 27, 2005, and is headquartered in Houston, TX.

Predefined Scans Triggered: P&F Ascending Triple Top Breakout, P&F Double Top Breakout and Hanging Man

TRGP is up +3.77% in after hours trading. I covered it on June 2nd 2022 (terrible timing, the position is closed). It has a "hanging man" candlestick which is a bearish pattern and suggests a decline tomorrow. However, given how it is trading after hours, I think we'll be okay. The RSI is positive and the PMO is rising nicely. Stochastics are above 80. Relative strength is excellent for TRGP. The stop is set below support at the late June top and 20-day EMA.

This bounce is coming off strong support on the weekly chart. The weekly RSI just moved back into positive territory and the weekly PMO is turning up. The SCTR is strong at 90.4%.

Don't forget, on Thursdays I look at reader-requested symbols, click HERE to send me an email. I read every email I receive and try to answer them all!

Current Market Outlook:

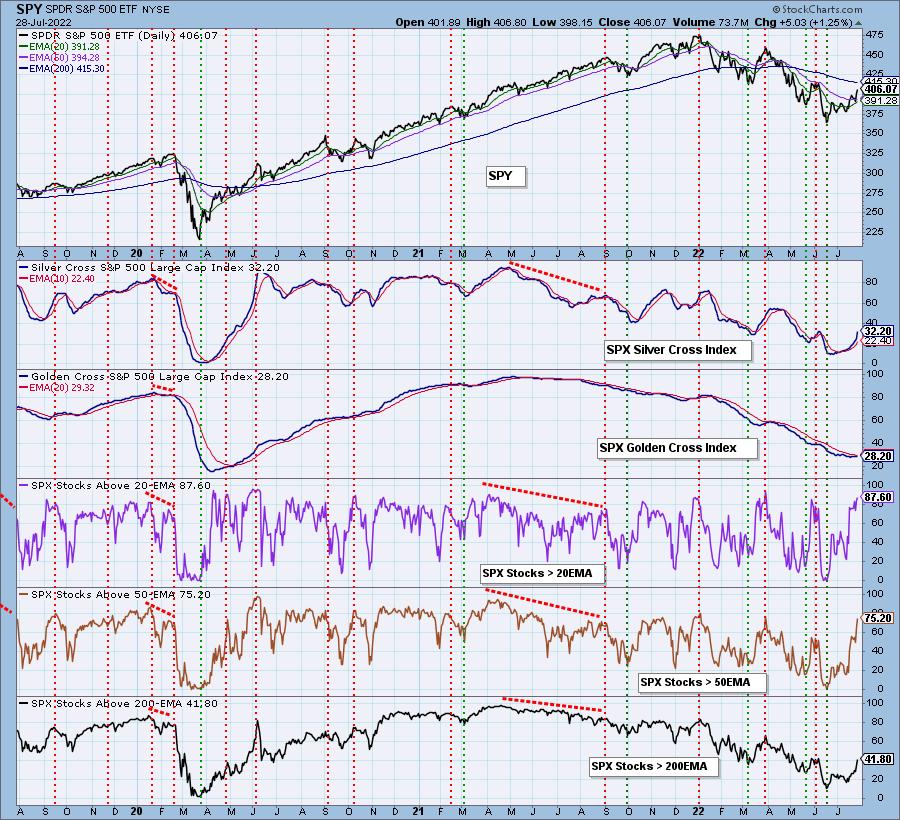

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Full Disclosure: I'm 50% exposed.

I'm required to disclose if I currently own a stock I mention and/or may buy/short it within the next 72 hours.

"Technical Analysis is a windsock, not a crystal ball." - Carl Swenlin

(c) Copyright 2022 DecisionPoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "Diamonds in the Rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com