I found all five picks today from the Diamond PMO Scan. Three of them are ETFs that you might find interesting and then I ended up with two Energy stocks. All five were up multiple percentage points today so be prepared for a pullback to breakout points. That will offer better entries.

The ETFs happen to all be iShares as they came up in the scan results. Obviously, if you have a favored ETF for the industries today's cover, I would think they would be bullish as well.

I'm completely running around trying to straddle the line of care for my mother-in-law, preparation for my trip Wednesday and DP reports. You'll find my five selections but no other stocks to review. I know I've covered some of today's picks before, but I won't be going back and linking to reports, etc. No time. If you are interested, I will at least list the dates and you can look them up using the blog archive links on the website.

Thank you again for your patience. You will get five picks today and five picks tomorrow, but no Diamond Mine or Recap this week. Next week there will be no Diamonds reports.

Today's "Diamonds in the Rough": DVN, EWZ, IEO, PICK and PXD.

*** Working VACATION March 23 to April 1 ***

I will be taking a trip to the Netherlands and Belgium to see the tulips! As always, I will post pictures and give you a brief diary of my adventures for those interested. Here is how publishing will be affected.

Schedule:

DP Alert - The DPA will be published each market day as usual, but comments will be abbreviated. You will get the latest charts, but if there are no significant changes, comments will be carried over.

DP Diamonds - Week of March 21st: Five picks on 3/21 and five picks on 3/22 - No Diamond Mine or Recap // Week of March 28th: No Diamonds Reports or Diamond Mine (You will be compensated with an additional week added to the end of your subscription)

RECORDING LINK (3/18/2022):

Topic: DecisionPoint Diamond Mine (3/18/2022) LIVE Trading Room

Start Time: Mar 18, 2022 09:00 AM

Meeting Recording Link.

Access Passcode: March$18

REGISTRATION FOR Friday 4/8 Diamond Mine:

When: Apr 8, 2022 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (4/8/2022) LIVE Trading Room

Register in advance for this webinar HERE.

Save the registration confirmation email with login instructions in case Zoom doesn't notify you in time.

Free DP Trading Room (3/14) RECORDING LINK:

Topic: DecisionPoint Trading Room

Start Time: Mar 14, 2022 09:01 AM

Meeting Recording Link.

Access Passcode: March@14

For best results, copy and paste the access code to avoid typos.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight ten "Diamonds in the Rough" per week. These are selected from the results of my DecisionPoint Scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

"Predefined Scans Triggered" are taken from StockCharts.com using the "Symbol Summary" option instead of a "SharpChart" on the workbench.

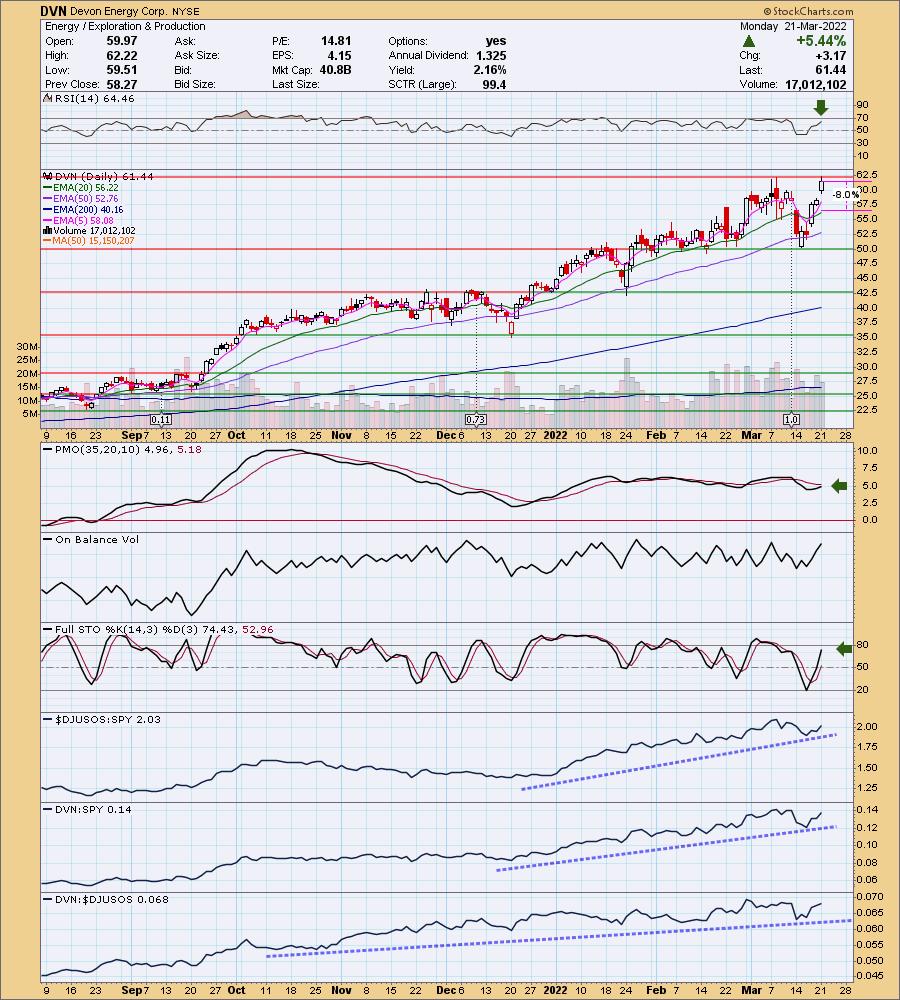

Devon Energy Corp. (DVN)

EARNINGS: 5/3/2022 (AMC)

Devon Energy Corp. engages in the exploration, development, and production of oil and natural gas properties. It develops and operates Delaware Basin, Eagle Ford, Heavy Oil, Barnett Shale, STACK, and Rockies Oil. The company was founded by J. Larry Nichols and John W. Nichols in 1971 and is headquartered in Oklahoma City, OK.

Predefined Scans Triggered: New CCI Buy Signals, New 52-week Highs, Parabolic SAR Buy Signals and P&F Double Top Breakout.

DVN is up +0.02% in after hours trading. I covered DVN on December 2nd 2021. DVN just hit overhead resistance. I'm not worried that it stopped there, it was already up over 5%. The indicators suggest we will see a breakout. RSI is positive, PMO is going in for a crossover BUY signal and Stochastics are rising and nearing territory above 80. We want Stochastics to get above 80 and stay there. That implies internal strength. Relative performance is great across the board. The stop is set at about the 20-day EMA give or take.

The weekly chart shows a very overbought weekly RSI, but amazingly it is still rising. Also be sure to note that it has spent time overbought since October of last year. So overbought conditions are nothing new for DVN. We would just want to be careful should it begin to dip below 70.

Looking quickly at the monthly chart, I've marked my upside target just above $70.

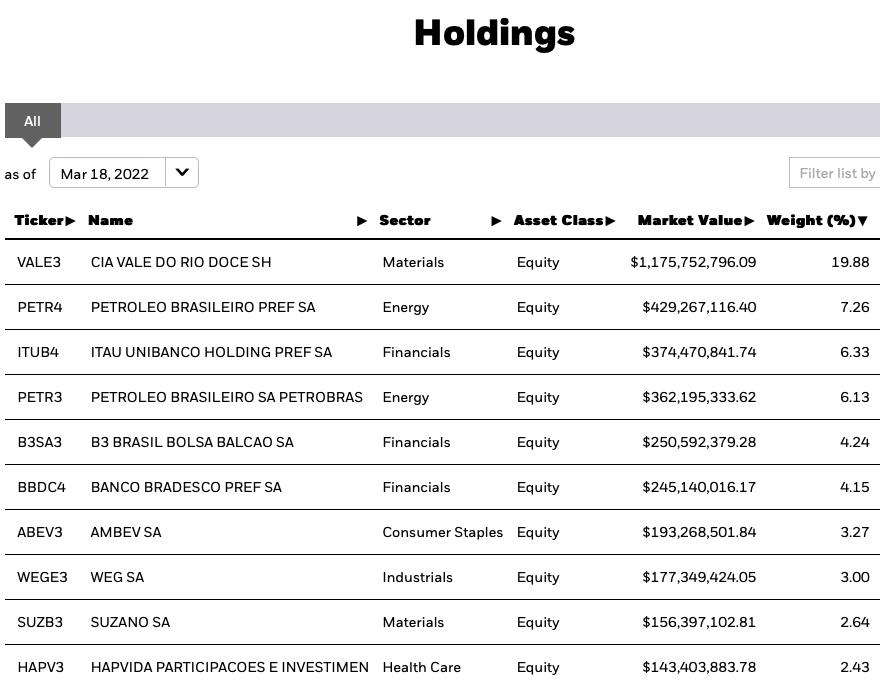

iShares MSCI Brazil Capped ETF (EWZ)

EARNINGS: N/A

EWZ tracks a market-cap-weighted index of Brazilian firms covering the entire market-cap spectrum.

Predefined Scans Triggered: improving Chaikin Money Flow, Moved Above Upper Keltner Channel, Moved Above Upper Bollinger Band, Moved Above Upper Price Channel and Bullish 50/200-day MA Crossovers.

EWZ is up +0.39% in after hours trading. It has been in a pretty messy and wide trading range, but it broke out today on a gap up. The RSI is positive and the PMO nearing a crossover BUY signal. OBV is confirming the breakout. Stochastics are now above 80 and relative performance against the SPY is bullish. The stop is set at the 20-day EMA.

The weekly RSI is positive and rising. The weekly PMO looks very healthy as it has now moved above the zero line and is not overbought. Upside potential at all-time highs is over 22%.

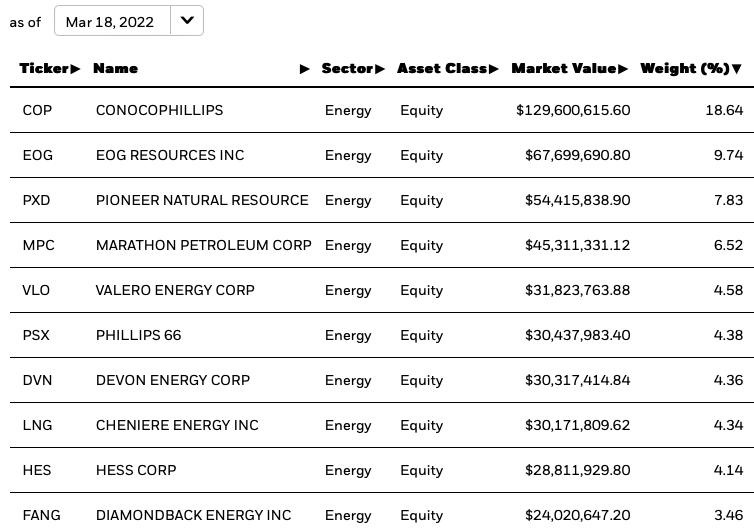

iShares U.S. Oil & Gas Exploration & Production ETF (IEO)

EARNINGS: N/A

IEO tracks a market cap weighted index of companies in the U.S. oil and gas exploration and production space according to Dow Jones.

Predefined Scans Triggered: Improving Chaikin Money Flow, New CCI Buy Signals, Parabolic SAR Buy Signals and P&F Double Top Breakout.

IEO is up +0.13% in after hours trading. You'll note that the two stocks I picked today are actually part of the holdings of IEO (DVN & PXD) so if you want exposure to those stocks but aren't interested in investing in them separately, this ETF has you covered. I covered IEO twice before on February 10th 2021 and April 29th 2021.

It has hit overhead resistance and stopped, but it was up over 4% so it makes sense it would exhaust there. The indicators are ripe with the RSI positive and rising with a PMO that is very close to a crossover BUY signal. Stochastics are rising after reversing almost in positive territory above 50. On the pullback relative performance dipped, but it is beginning to outperform the SPY once again. The stop is set below the February highs.

The weekly chart is very healthy given the positive weekly RSI and weekly PMO rising on a BUY signal. Both indicators are overbought right now, but I expect this part of the market to remain overbought for some time. Given it is flirting with all-time highs, consider setting a 17% upside target at $97.20.

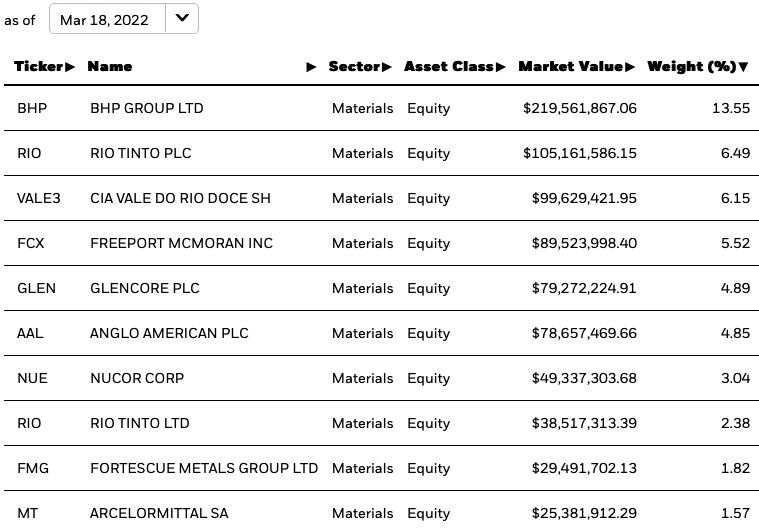

iShares MSCI Global Metals & Mining Producers ETF (PICK)

EARNINGS: N/A

PICK tracks a market-cap-weighted index of global metals mining, extraction or production firms, excluding gold and silver mining firms.

Predefined Scans Triggered: New CCI Buy Signals and Parabolic SAR Buy Signals.

PICK is up +0.44% in after hours trading. It too is up against overhead resistance, but like the others, the indicators are bullish. The RSI is positive and not overbought. The PMO is nearing a crossover BUY signal and Stochastics are almost above 80. I'm not thrilled with the OBV as it has been in a negative divergence with price tops since February. Relative strength is faltering, but I still like this area of the market; particularly when I look at GDX, the other Gold Mining ETF. The stop is set below the 50-day EMA.

We have a giant bull flag and with this breakout above the 2021 high, it could see a long-term run-up. The weekly RSI is positive and the weekly PMO is rising on a crossover BUY signals and is not overbought. Consider a 15% upside target at $57.41.

Pioneer Natural Resources Co. (PXD)

EARNINGS: 5/3/2022 (AMC)

Pioneer Natural Resources Co. operates as an independent oil and gas exploration and production company. The firm engages in hydrocarbon exploration in the Cline Shale. It focuses on the operation of the Permian Basin, Eagle Ford Shale, Rockies, and West Panhandle projects. The company was founded by Scott Douglas Sheffield on April 2, 1997, and is headquartered in Irving, TX.

Predefined Scans Triggered: New CCI Buy Signals, New 52-week Highs, Moved Above Upper Bollinger Band, Moved Above Upper Price Channel and P&F Double Top Breakout.

PXD is up +0.32% in after hours trading. I covered PXD on June 3rd 2021. Unlike the others today, PXD has actually broken out. The RSI is positive and not overbought. The PMO is nearing a crossover BUY signal and isn't really overbought either. Stochastics just moved above 80 suggesting internal strength. Relative strength shows outperformance. The stop is set below the 20-day EMA.

The weekly RSI is overbought, but that is to be expected. It will likely remain that way for some time. The weekly PMO is rising on a BUY signal. It is on the overbought side, but with what we know about the rise in Energy costs, this one will likely continue higher. Upside target around 16% or $291.37.

Don't forget, on Thursdays I look at reader-requested symbols, click HERE to shoot me an email. I read every email I receive and try to answer them all!

Current Market Outlook:

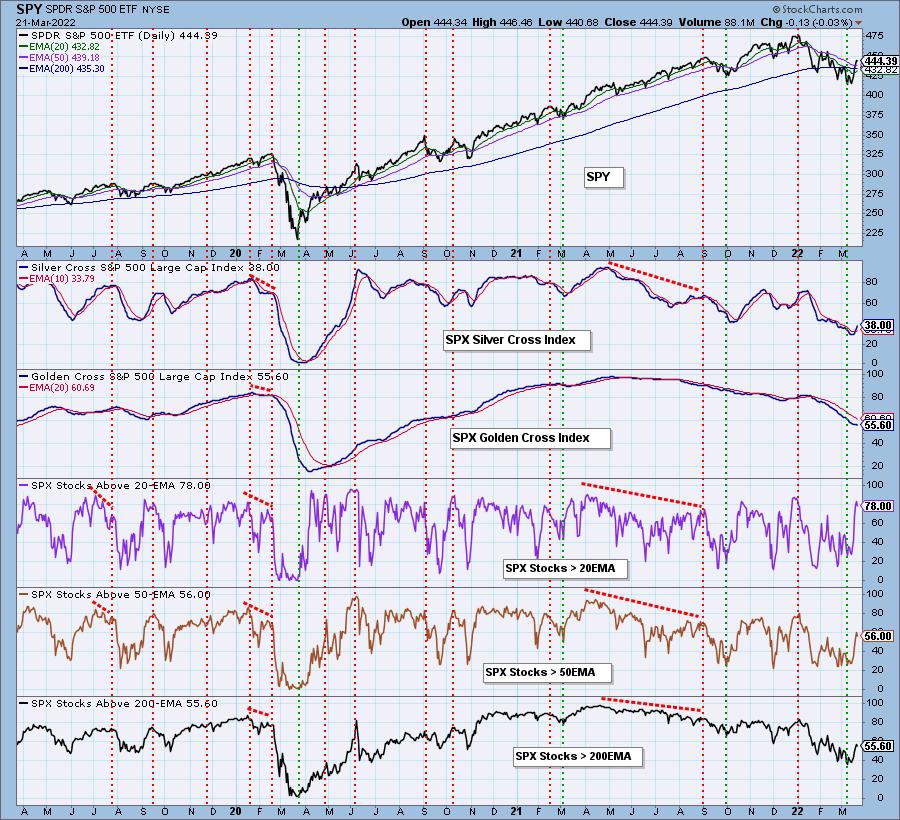

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Full Disclosure: I'm 15% invested and 85% is in 'cash', meaning in money markets and readily available to trade with.

I'm required to disclose if I currently own a stock and/or may buy it within the next 72 hours.

Good Luck and Good Trading!

- Erin

"Technical Analysis is a windsock, not a crystal ball." - Carl Swenlin

(c) Copyright 2022 DecisionPoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "Diamonds in the Rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com