I mentioned yesterday that scan results had begun to thin; meaning, I have had far less charts to investigate to present in the Diamonds Reports. The theme in today's results were numerous Bond funds. While I think there is upside potential in Bonds, interest rates are still in a rising trend channel and holding above support. I think the current falling rate environment will reverse soon, but for the short-term trader tiptoeing into some Bond funds isn't a terrible idea.

I am not, however, presenting any Bond funds. As I mentioned above, I think upside potential is limited. I do have three interesting stocks to present to you. Two are Technology stocks and one is an Industrial.

I might've jumped on Biotechs a little too early yesterday. We'll see if we get a reversal on yesterday's Diamonds in the Rough by Friday.

UNG found its way into one of my scan result lists. I still like it and after the recent pullback I believe it is still a strong area to invest in. Renewable Energy is also clicking so you may want to revisit last week's Report where I listed two I like.

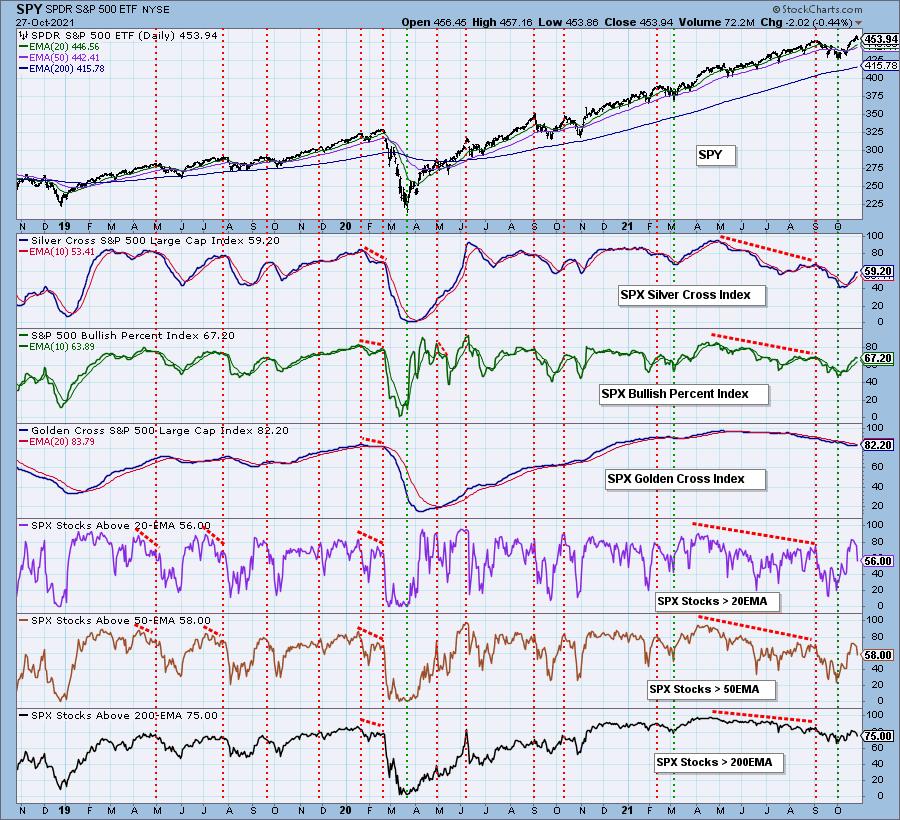

Be careful out there, the market is ready to pullback based on what I'm seeing on our indicators, particularly participation which you can see in the final chart of this report is moving down swiftly.

Today's "Diamonds in the Rough": INVE, SMTC and TREX.

"Stocks to Review": IMTX, KNX, PLL, STRO, HRTX, SIMO and YNDX.

RECORDING LINK Friday (10/22):

Topic: DecisionPoint Diamond Mine (10/22/2021) LIVE Trading Room

Start Time : Oct 22, 2021 09:00 AM

Meeting Recording Link HERE.

Access Passcode: October@22

REGISTRATION FOR FRIDAY 10/29 Diamond Mine:

When: Oct 29, 2021 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (10/29/2021) LIVE Trading Room

Register in advance for this webinar HERE.

Save the registration confirmation email with login instructions in case Zoom doesn't notify you in time.

Free DP Trading Room (10/18) RECORDING LINK:

Topic: DecisionPoint Trading Room

Start Time: Oct 25, 2021 09:00 AM

Meeting Recording LINK.

Access Passcode: October#25

For best results, copy and paste the access code to avoid typos.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "Diamonds in the Rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

Identive Group (INVE)

EARNINGS: 11/2/2021 (AMC)

Identiv, Inc. engages in the provision of physical security and secure identification solutions. Its products include physical access control and video, logical access control, credentials, and RFID inlays and tags. The firm serves the government, healthcare, airports and aviation, and education. It operates through the Identity and Premises segments. The Identity segment consists of products and solutions enabling secure access to information serving the logical access and cyber security market and protecting assets and objects in the Internet of Things with radio frequency identification. The Premises segment offers solutions to address the premises security market for government and enterprise, including access control, video surveillance, analytics, customer experience, and other applications. The company was founded in 1990 and is headquartered in Fremont, CA.

Predefined Scans Triggered: Elder Bar Turned Green, Moved Above Ichimoku Cloud and P&F Double Bottom Breakout.

INVE is unchanged in after hours trading. We have a nice rounded bottom formation and price is beginning to breakout of it. Price managed to vault the 20-EMA today and popped above resistance at the June/August tops. The PMO has turned up and the RSI has just entered positive territory. In the thumbnail, we can see rising OBV bottoms aligning with falling price bottoms. That is a positive divergence and suggests this rally will see follow-through. Stochastics are very favorable as they have bottomed in oversold territory and are rising. Relative performance has been in the dumps, but we see that relative strength lines are breaking the declining trend. The group is performing fairly well. The stop is set below support.

I do not like the weekly PMO as it has topped below its signal line and hasn't shown any deceleration so far. The weekly RSI is positive and we do see price is in a solid rising trend. Upside potential is over 14.4% as I am looking for a breakout.

Semtech Corp. (SMTC)

EARNINGS: 12/1/2021 (AMC)

Semtech Corp. engages in the manufacture and supply of analog and mixed signal semiconductor products for high-end consumer, enterprise computing, communications, and industrial equipment. The firm operates through the following business segments: Protection, Signal Integrity, and Wireless & Sensing. It offers signal integrity, protection, wireless and sensing, and power and high-reliability products. The company was founded in 1960 and is headquartered in Camarillo, CA.

Predefined Scans Triggered: P&F Double Top Breakout.

SMTC is unchanged in after hours trading. Price broke out above resistance at the September/October tops and is ready to challenge overhead resistance just above $82. The RSI is positive and the PMO is nearing a crossover BUY signal. Stochastics are rising, and while overbought, it does tell us there is internal strength. Relative performance of the group continues to improve and SMTC is performing well against the group and the SPY. The stop can be set a number of ways. A conservative stop would be just under support at $80. I've chosen the 50-EMA as my stop level. If you are less risk averse, you can set a 10.5% stop below the October low.

The weekly chart looks good. The weekly RSI is positive and the weekly PMO is rising on a crossover BUY signal. Neither the RSI or PMO are overbought. Price is very close to all-time highs. I am looking for a move above that level.

Trex Co., Inc. (TREX)

EARNINGS: 11/8/2021 (AMC)

Trex Co., Inc. engages in the manufacture of wood-alternative decking and railing. Its products include deck framing and drainage, outdoor lighting, furniture, pergola and outdoor kitchens, fencing, collections, and accessory hardware. It operates through the following segments Trex Residential Products and Trex Commercial Products. The Trex Residential segment offers Fencing, Railing, Decking and Accessories. The Trex Commercial Products segment offers Architectural Railing System, Aluminum Railing Systems, Staging Equipment and Accessories. The company was founded by Andrew U. Ferrari and Roger A. Wittenberg on September 4, 1998 and is headquartered in Winchester, VA.

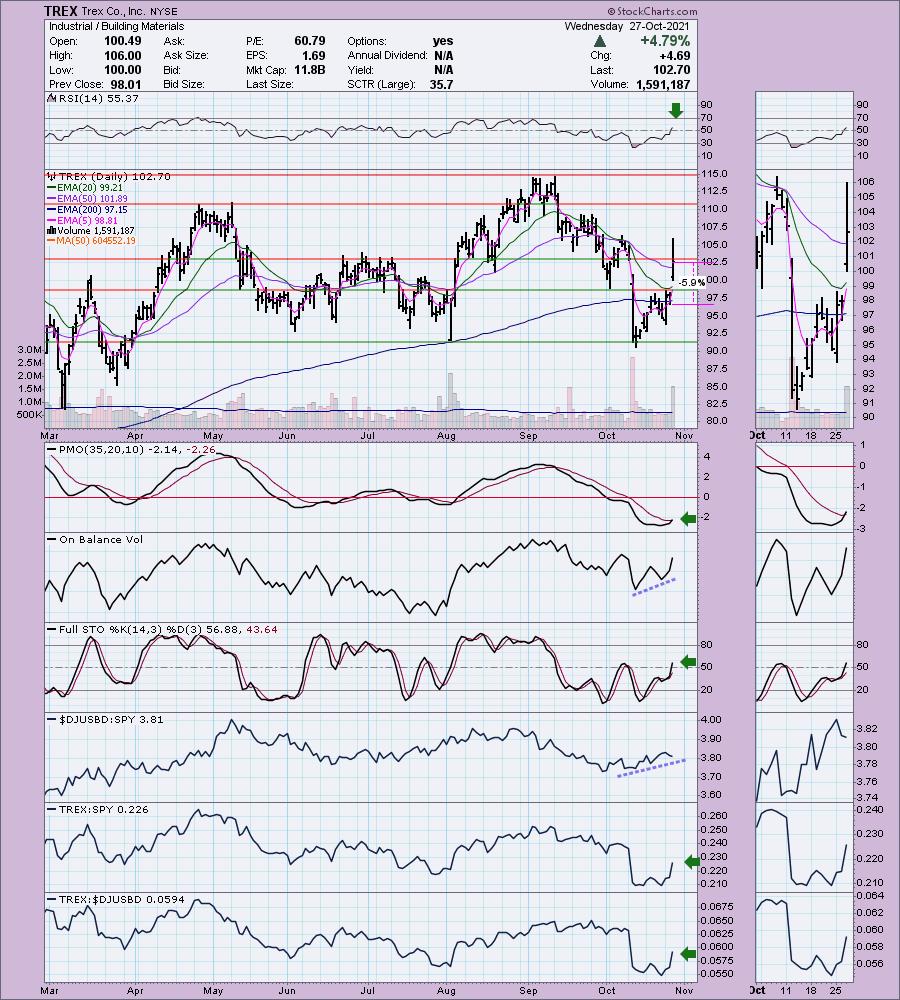

Predefined Scans Triggered: Parabolic SAR Buy Signals and P&F Double Top Breakout.

TREX is unchanged in after hours trading. Big rally day for TREX! I've covered TREX once before in the July 20th 2020 Diamonds Report. It has since had a split so the price in the article is currently not correct. The position never hit its stop and is now up 50.7% since. Price rallied above both the 20/50-EMAs and also closed above both. The PMO triggered a crossover BUY signal today and the RSI has now reached positive territory. The OBV is confirming the price rise and Stochastics are rising and have reached above net neutral (50). Relative strength studies show that the group as well as TREX are outperforming the SPY. TREX is showing strong relative strength against its group. The stop is thin. I don't think it needs to be much deeper. It is aligned with the 200-EMA and I think that is a good "line in the sand".

The weekly PMO is decelerating but is still moving lower. There is a positive OBV divergence and the weekly RSI has hit positive territory again. Upside potential is 13%+ as I believe we will see a rally past all-time highs.

Don't forget, on Thursdays I look at reader-requested symbols, click HERE to shoot me an email. I read every email I receive and try to answer them all!

Current Market Outlook:

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

- The Bullish Percent Index (BPI) shows the percentage of SPX stocks on Point & Figure BUY signals.

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Full Disclosure: I'm back to 85% invested and 15% is in 'cash', meaning in money markets and readily available to trade with.

I'm required to disclose if I currently own a stock and/or may buy it within the next 72 hours.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "Diamonds in the Rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com