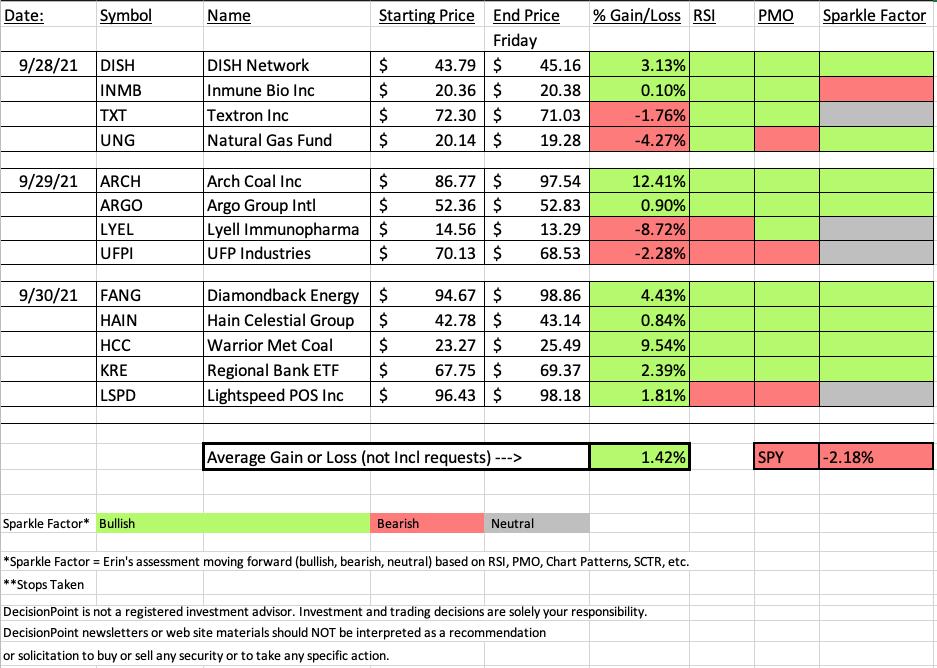

The SPY was down on the week by -2.18% and this weeks "Diamonds in the Rough" averaged to +1.42%. One of the main reasons our performance was elevated is because of Coal. Like Natural Gas (UNG), our thought is that it will also see price move higher as the winter months approach and demand for both natural gas and coal will increase. Coal pulled back last week, but began its rally in earnest this week.

You may recall that last week's Diamond "Dud" was coal company Ramaco Resources (METC). I noted at the time that I didn't think it was a true "dud". Below is my commentary:

"The "Dud" wasn't that terrible. It was the coal stock that I added, METC. I think coal is on the rebound, but the indicators went somewhat south. It only had one day of trading so the -2.55% loss since yesterday didn't help. I would still keep coal and this stock on your watchlist. Coal pulled back and it should begin rising again."

Today METC rallied +14.05%! Coal is looking good and the two additions this week of ARCH and HCC (I own this one) really helped the spreadsheet this week with each being up +12.41% and +9.54% respectively.

This week's "Darling" is ARCH and this week's "Dud" is LYEL. The 9% stop was nearly hit on LYEL. The chart doesn't look that great moving forward, but it is watchlist material.

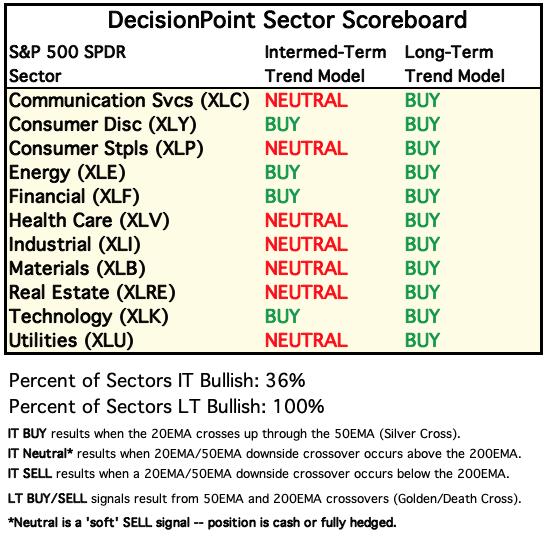

Three sectors lost their "Silver Cross" BUY signals this week: XLC, XLV and XLRE. This leaves only four out of twelve sectors on "Silver Cross" BUY signals. This week's sector to watch is the only sector to finish higher this week.

Register now for next Friday's Diamond Mine trading room below or right HERE.

RECORDING LINK Friday (10/1):

Topic: DecisionPoint Diamond Mine (10/1/2021) LIVE Trading Room

Start Time : Oct 1, 2021 09:00 AM

Meeting Recording Link HERE.

Access Passcode: October/1st

REGISTRATION FOR FRIDAY 10/8 Diamond Mine:

When: Oct 8, 2021 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (10/8/2021) LIVE Trading Room

Register in advance for this webinar HERE.

Save the registration confirmation email with login instructions in case Zoom doesn't notify you in time.

Free DP Trading Room (9/27) RECORDING LINK:

Topic: DecisionPoint Trading Room

Start Time : Sep 27, 2021 08:58 AM

Meeting Recording Link HERE.

Access Passcode: Sept*27th

For best results, copy and paste the access code to avoid typos.

A few items about the spreadsheet: I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

Darling:

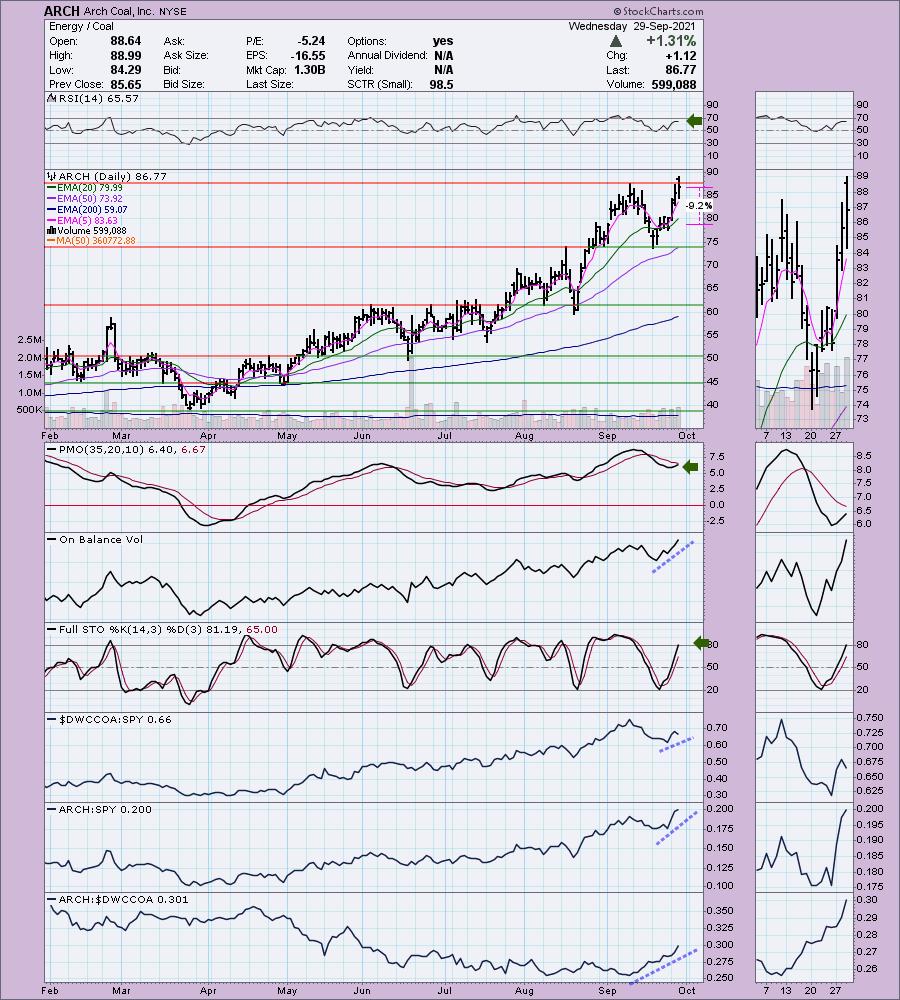

Arch Coal, Inc. (ARCH)

EARNINGS: 10/21/2021 (BMO)

Arch Resources, Inc. engages in the production and distribution of thermal coal. It operates through the following segments: Powder River Basin, Metallurgical and Other Thermal. The Powder River Basin segment contains thermal operations in Wyoming. The Metallurgical segment contains metallurgical operations in West Virginia. The Other Thermal segment contains supplementary thermal operations in Colorado, Illinois and the Coal Mac thermal operations in West Virginia. The company was founded in 1969 and is headquartered in St. Louis, MO.

Predefined Scans Triggered: New 52-week Highs, Filled Black Candles, P&F Double Top Breakout.

Below are the commentary and chart from Wednesday (9/29):

"ARCH is up +3.42% in after hours trading so we know the breakout will likely continue tomorrow. I picked METC last week in the coal industry and today I'm presenting another small-cap coal company. This one has already had a sizable rally, but given the bullish indicators I suspect it will continue higher. The PMO is nearing a crossover BUY signal and the RSI is positive. Stochastics are entering overbought territory, but are still rising strongly. The OBV is confirming the rally and relative strength has been strong for ARCH. The industry group is beginning to outperform again and this one is a leader. The stop is set well below the 20-EMA to accommodate any pullbacks."

Here is today's chart:

It is overbought based on the RSI and Stochastics, that's about the only negatives I can say. The PMO triggered a crossover BUY signal after we picked it. We could see a digestion period for coal in general, similar to what we are seeing in Natural Gas, but I expect it to continue higher. Consider any pullback a possible buying opportunity.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Dud:

Lyell Immunopharma Inc. (LYEL)

EARNINGS: 10/28/2021 (AMC)

Lyell Immunopharma, Inc. operates as a holding company, which engages in the development of cell-based immunotherapies for human diseases. The company was founded by Richard D. Klausner, Stan Riddell, and Crystal Mackall in June 2018 and is headquartered in South San Francisco, CA.

Predefined Scans Triggered: Bullish MACD Crossovers and P&F Low Pole.

Below are the commentary and chart from Wednesday 9/29:

"LYEL is down -0.07% in after hours trading. This isn't generally my kind of trade (volatile biotech, lower priced and little data). However, this "V" bottom looks great and the indicators are very positive based on the data available. The RSI just hit positive territory, the PMO is nearing a positive crossover and the Stochastics are very bullish. We even have a positive OBV divergence. The stop is deep mainly because this one is volatile and will likely require an iron stomach. While Biotechs have been floundering, LYEL is outperforming both the group and most importantly, the SPY."

Below is today's chart:

This is one of the reasons I don't invest in stocks with less than a year's worth of data. Additionally, it is a Biotech and they have struggled. It was up yesterday, but it took all of those gains and then some. It barely closed above the stop level. The PMO is still rising and the chart pattern looks like a bullish cup and handle. However, the handle has broken below support at the 20-EMA and the July low. Might be good on a watchlist, but it's a risky proposition right now.

THIS WEEK's Sector Performance:

DecisionPoint Sector Scoreboard (Mechanical Trend Model Signals):

Click Here to view Carl's annotated Sector ChartList!

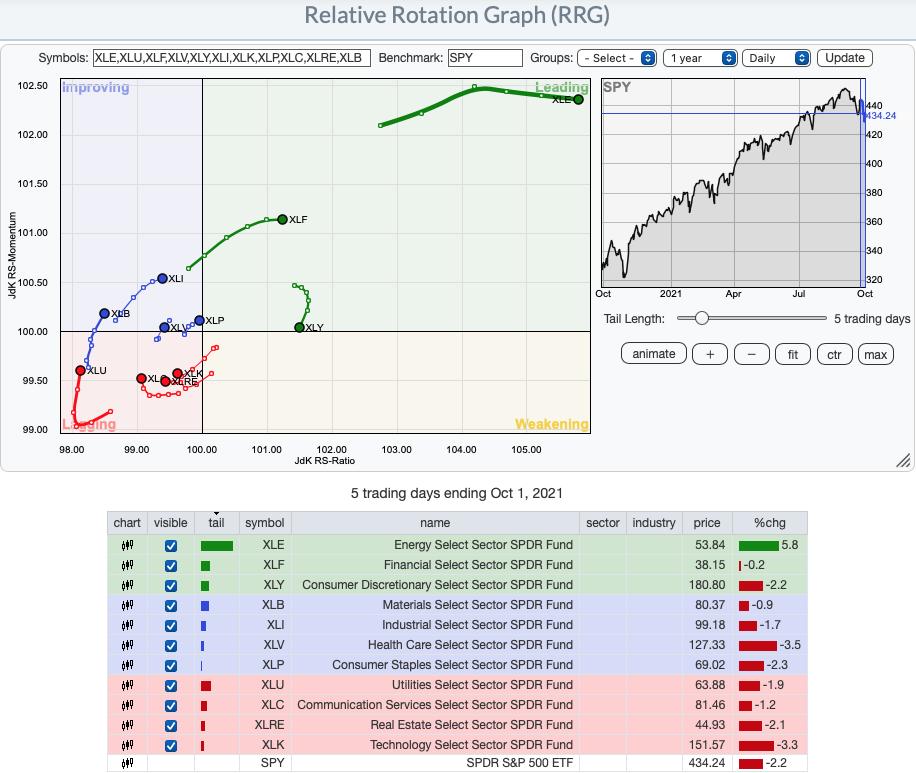

Short-term RRG: XLE, XLF and XLY are in Leading, however XLY has started to underperform and will be entering Weakening soon. Despite all of the sectors but Energy finishing lower, relative strength-wise we are seeing some improving sectors: XLB, XLI and XLP. XLU is beginning to reach toward Improving. All of the others are still looking relatively weak.

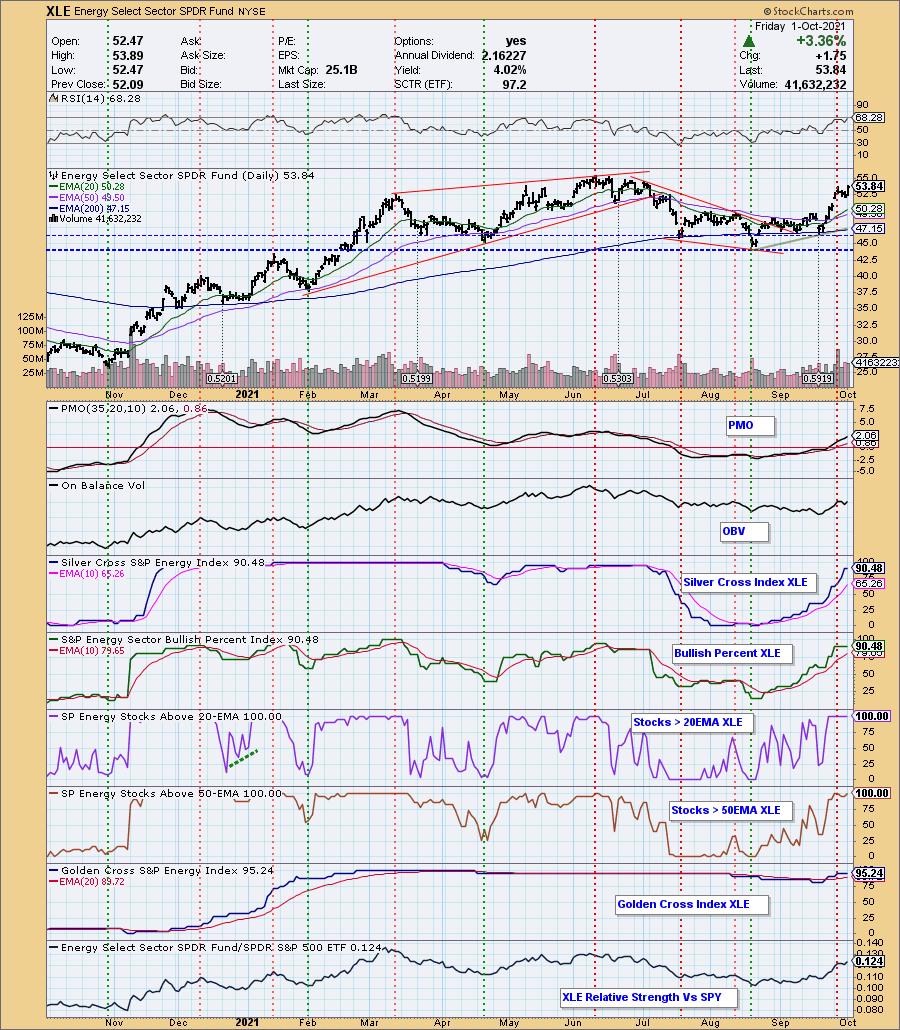

Sector to Watch: Energy (XLE)

It was an obvious decision to pick Energy as the sector to watch. It is the only one with positive momentum and good participation. Financials still look interesting, but given the bull flag triggering on today's breakout, it is really a no-brainer to pick Energy.

Industry Group to Watch: Airlines ($DJUSSB)

Airlines had a terrible week until today. I didn't pick an Energy industry group primarily because I believe all of them are strong moving forward. We have a bullish reverse head and shoulder (or triple/quadruple bottom). Price broke above the neckline and then pulled back to it. On the pullback it held support at the EMAs and the neckline. Now it is moving higher. We had a new "Silver Cross" BUY signal as the 20-EMA crossed above the 50-EMA. The PMO has a bottom well above its signal line. Neither the PMO or RSI are overbought. Relative strength has been picking up. We examined Southwest Airlines (LUV) in the Diamond Mine and I did like it.

Go to our Sector ChartList on DecisionPoint.com to get an in depth view of all the sectors.

Technical Analysis is a windsock, not a crystal ball.

Have a great weekend & Happy Charting! Next Diamonds Report is Tuesday 10/5.

- Erin

erin@decisionpoint.com

Full Disclosure: I'm about 70% invested right now and 30% is in 'cash', meaning in money markets and readily available to trade with. I have moved primarily into energy and materials. I will be offloading a position or two next week that would bring my exposure to 60% or lower depending on how many and how much.

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

(c) Copyright 2021 DecisionPoint.com