It was an interesting week as we embarked on a trip into the Renewable Energy industry group as well as the Biotech industry group. The results were somewhat mixed.

The weird thing is that our big loser is a solar company and our big winner is also a solar company. I felt that picking Enphase (ENPH) would result in a big win given it is a leader in the renewable energy space. However, it turned out to be our biggest loser. Meanwhile, the "Darling" was Shoals (SHLS) another renewable energy stock. Seeing mixed results with these companies is a bit concerning and does make me question the viability of solar moving into next week. Keep an eye on your positions. I own both ENPH and SHLS. ENPH came close to hitting my stop. I'll talk more about it later.

We held an extra Diamond Mine trading room on Wednesday because I forgot to restart the recording last Friday. The recording for today's Diamond Mine and Wednesday's are below.

Don't forget to send in your reader requests before Thursday's report! Register for Friday's trading room below.

RECORDING LINK Wednesday (8/4):

Topic: DecisionPoint Make-Up Diamond Mine (8/4/2021) LIVE Trading Room

Start Time : Aug 4, 2021 09:00 AM

Meeting Recording Link for 8/4 HERE.

Access Passcode: August/4

RECORDING LINK Friday (8/6):

Topic: DecisionPoint Diamond Mine (8/6/2021) LIVE Trading Room

Start Time : Aug 6, 2021 08:59 AM

Meeting Recording for Friday 8/6 is HERE.

Access Passcode: August/6

REGISTRATION FOR FRIDAY 8/13 Diamond Mine:

When: Aug 13, 2021 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (8/13/2021) LIVE Trading Room

Register in advance for this webinar HERE.

Save the registration confirmation email with login instructions in case Zoom doesn't notify you in time.

Tom Bowley joined Erin in the DP Trading Room August 2nd!

Don't miss the recording!

Topic: DecisionPoint Trading Room

Start Time : Aug 2, 2021 08:41 AM

Meeting Recording for free DP Trading Room HERE.

Access Passcode: August/2nd

A few items about the spreadsheet: I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

Darling:

Shoals Technologies Group Inc. (SHLS)

EARNINGS: 8/10/2021 (AMC)

Shoals Technologies Group, Inc. provides electrical balance of system solutions for solar energy projects. Its EBOS components include cable assemblies, inline fuses, combiners, disconnects, recombiners, wireless monitoring systems, junction boxes, transition enclosures and splice boxes. The company was founded by Dean Solon in November 1996 and is headquartered in Portland, TN.

Below is the commentary and chart from Wednesday:

"SHLS is unchanged in after hours trading. This one came up on a scan and I'd honestly never had heard of it. I love the chart and it is quite tempting, but I do note they report earnings on 8/10, so if you get in, keep that in mind. The RSI is positive and rising and the PMO just triggered a crossover BUY signal just below the zero line. It's too young to have a SCTR, although if you ask StockCharts to start calculating it, they might. Volume is coming in based on the OBV and price has broken above resistance at those late January-early February lows. The 5-EMA just crossed above the 20-EMA for a ST Trend Model BUY signal. Relative performance is excellent. The stop is set just below the mid-July tops and the mid-June lows."

Here is today's chart:

This chart still looks very positive even though we saw damage done to the Solar ETF (TAN) and ENPH as well as RUN. I still like this one and plan on keeping it in my portfolio next week. We could see a pullback ahead, so you may want to revisit this one if you didn't get in it this week.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Dud:

Enphase Energy Inc. (ENPH)

EARNINGS: 10/26/2021 (AMC)

Enphase Energy, Inc. engages in the design, development, manufacture and sale of micro inverter systems for the solar photovoltaic industry. Its products include IQ 7 Microinverter Series, IQ Battery, IQ Envoy, IQ Microinverter Accessories, IQ Envoy Accessories and Enlighten & Apps. The company was founded by Raghuveer R. Belur and Martin Fornage in March 2006 and is headquartered in Fremont, CA.

Below is the commentary and chart from Tuesday:

"ENPH is down -0.40% in after hours trading. I've covered this one frequently. In order, May 4th 2020 (We were eventually shaken out of the position and the 7.6% stop was hit, but that was after being up over 56%), July 6th 2020 (Best timed position, stop never hit and position up 284%!), April 27th 2021 (stop hit, jumped the gun), and May 20th 2021 (Better timing, position is up 35.8%).

ENPH is one of the strongest performers in the Renewable Energy space and looking at relative strength, it's a strong performer against the SPX. Right now, even after a 5% plus gain today, this one looks very good. The RSI is positive and PMO is nearing a crossover BUY signal. There is a reverse head and shoulders that is about to execute (rising neckline not punctured). However, I don't think we have to wait for the neckline to be punctured."

Below is today's chart:

I'm not happy with current price action and as I mentioned I do own this one (sadly it shaved my profits from SHLS). Currently support is being held, barely. I will be looking to sell this one on Monday if it doesn't rebound off this level of support. The RSI is still positive, but just barely. The PMO looks pretty ugly, another hint that I should cut this one loose.

THIS WEEK's Sector Performance:

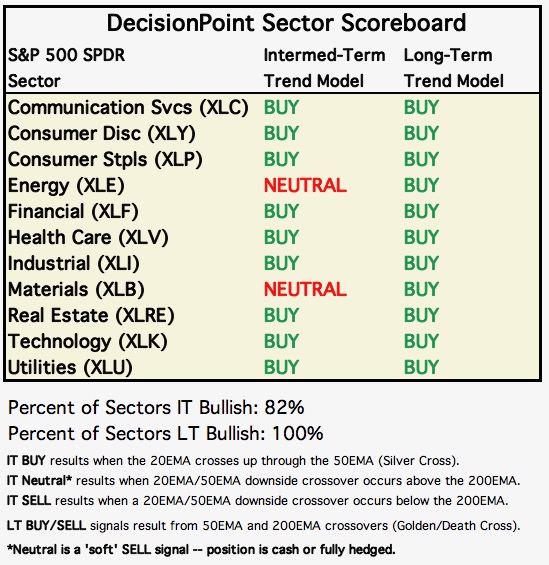

DecisionPoint Sector Scoreboard (Mechanical Trend Model Signals):

Click Here to view Carl's annotated Sector ChartList!

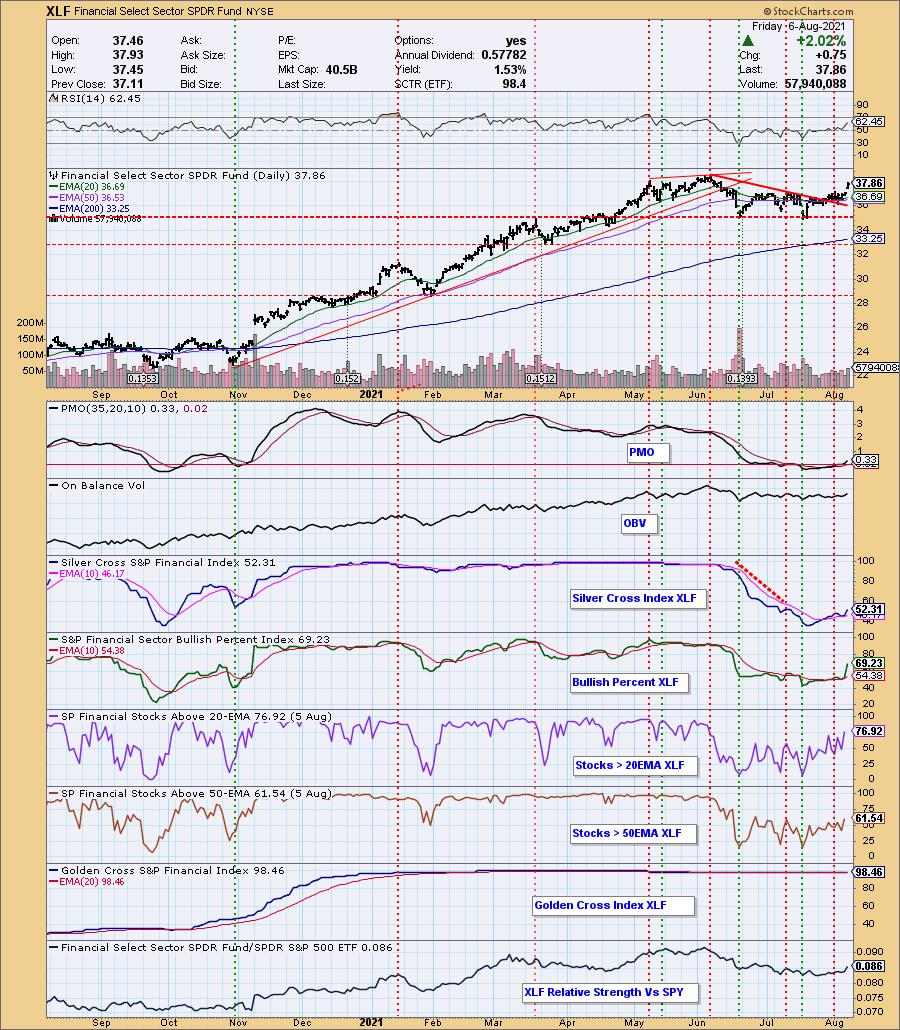

Short-term RRG: Healthcare (XLV) is Leading, but it has turned down toward Weakening. The Biotech industry group still looks strong though. Just be attentive to what industry group you are in within this sector. Utilities (XLU) look strong within the Leading category. My pick this week is Financials (XLF) which you can see is traveling strongly in the bullish northeast heading toward Leading. New momentum and strength became especially clear with today's trading.

Sector to Watch: Financials (XLF)

I nearly picked XLF last week as my sector to watch, but resistance was holding tightly. In actuality, this sector didn't really prove itself until today with the gap up. Participation is strong but not overbought. The SCI and BPI are moving higher quickly to confirm that positive participation.

Industry Group to Watch: Banks ($DJUSNF)

There are honestly quite a few industry groups in this sector that are worth watching. Many of the Insurance groups look good too. However, with today's strong breakout in Financials mainly coming from the Banks, I had to make this my pick for industry group to watch.

Go to our Sector ChartList on DecisionPoint.com to get an in depth view of all the sectors.

Technical Analysis is a windsock, not a crystal ball.

Have a great weekend & Happy Charting! Next Diamonds Report is Tuesday 8/9.

- Erin

erin@decisionpoint.com

Full Disclosure: I'm about 40% invested right now and 60% is in 'cash', meaning in money markets and readily available to trade with.

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

(c) Copyright 2021 DecisionPoint.com