Greetings on Reader Request Day! Very interesting symbols peppered my inbox this week. Some of them powered higher this week so I hope those who requested got in on few of those winners. There was a great group of stocks to pick from.

One of the "Stocks to Review" yesterday, took off today. Thank you to Fred who let me know that WRAP had a stellar day. I'll be analyzing it below as I think it has more upside potential and you might be able to swoop in on a pullback tomorrow. Yes, the spreadsheet will take a hit if it does pullback, but that's not the point of "Diamonds in the Rough". I want to present interesting opportunities that have potential moving forward and WRAP does appear ready to continue higher even if it pulls back tomorrow.

Two others from the "Stocks to Review" that had great days were REGN and ILMN as Biotechs continue to roll.

The other four stocks are very strong, including another Renewable Energy stock (SEDG). The group took a hit as far as the ETF is concerned, but yesterday's SHLS was up (Full disclosure: I own it). ENPH backed off (Full disclosure: I own it) and TAN also pulled back. I still like the group on the pullback, but advise caution should support levels not hold.

Sign up for tomorrow's Diamond Mine Trading Room here. I'll be testing out a new camera and mic so I'd appreciate your feedback on whether it is an improvement or not. The ring light should arrive this weekend and that'll remove the shadows. You'll probably see all of my wrinkles now in HD.

Today's "Diamonds in the Rough" are: CWK, GOSS, PRGO, SEDG and WRAP.

Stocks to Review ** (no order): EDOC, CMRE, TXT, GDYN, NVT, APAM, GBT and WPP.

** The "Stocks to Review" are stocks that were on my short list for the day.

RECORDING LINK Friday (7/23):

Topic: DecisionPoint Diamond Mine (07/23/2021) LIVE Trading Room

Start Time : Jul 23, 2021 09:00 AM

Recording link for 7/23 Diamond Mine is HERE.

Access Passcode: July/23rd

THERE WAS NO RECORDING FOR FRIDAY (7/30), I forgot to hit record.

RECORDING LINK FOR Wednesday 8/4 Bonus Diamond Mine:

Topic: DecisionPoint Make-Up Diamond Mine (8/4/2021) LIVE Trading Room

Start Time : Aug 4, 2021 09:00 AM

Meeting Recording Link HERE.

Access Passcode: August/4

REGISTRATION FOR FRIDAY 8/6 Diamond Mine:

When: Aug 6, 2021 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (8/6/2021) LIVE Trading Room

Register in advance for this webinar HERE.

Save the registration confirmation email with login instructions in case Zoom doesn't notify you in time.

Tom Bowley joined Erin in the DP Trading Room August 2nd!

Free DP Trading Room (8/2) RECORDING LINK:

Topic: DecisionPoint Trading Room

Start Time : Aug 2, 2021 08:41 AM

Meeting Recording Link HERE.

Access Passcode: August/2nd

For best results, copy and paste the access code to avoid typos.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "Diamonds in the Rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

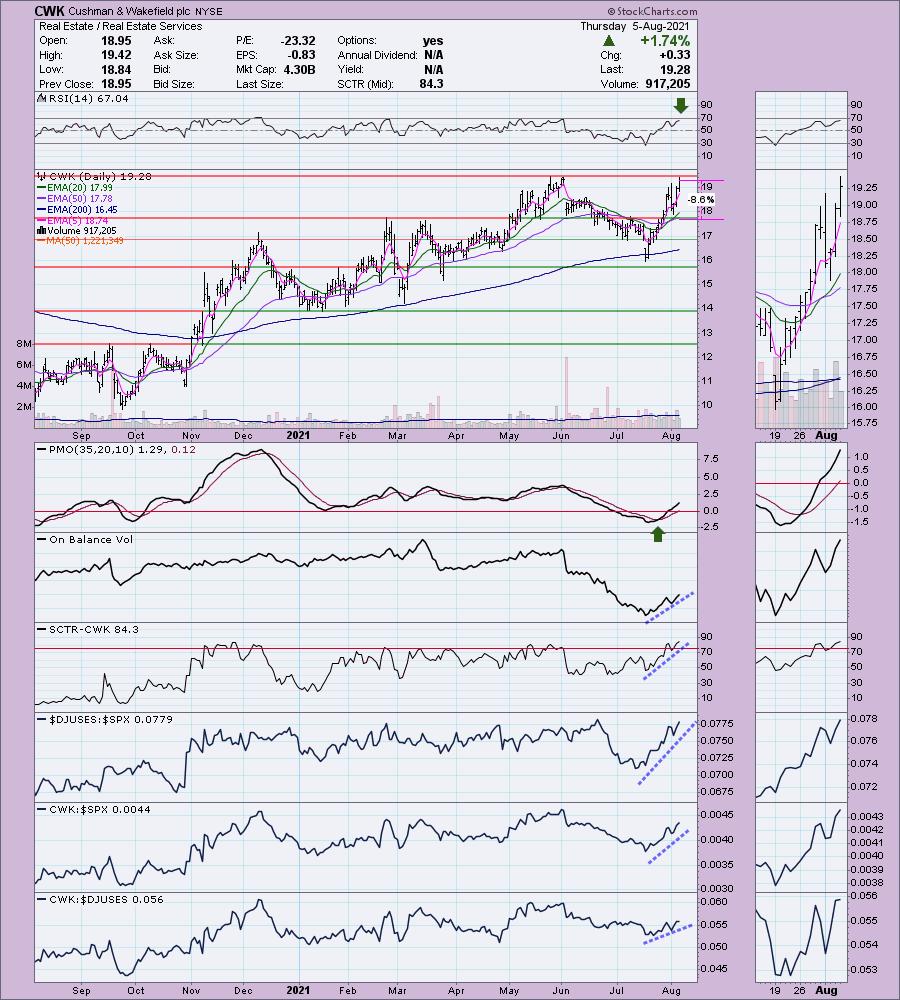

Cushman & Wakefield plc (CWK)

EARNINGS: 8/5/2021 (AMC) ** Reported Today **

Cushman & Wakefield Plc engages in the provision of commercial real estate services It operates through the following geographical segments: Americas; Europe, the Middle East and Africa (EMEA); and Asia Pacific (APAC). The Americas segment consists of operations located in the United States, Canada and key markets in Latin America. The EMEA segment includes operations in the UK, France, Netherlands and other markets in Europe and the Middle East. The APAC segment comprises of operations in Australia, Singapore, China and other markets in the Asia Pacific region. The company was founded in 1917 is headquartered in London, the United Kingdom.

CWK reported earnings after the bell and is up +2.7% in after hours trading. The only problem with this chart is that price was turned away at resistance; however, given its after hours trading, it is above that resistance right now. The RSI is positive and not overbought. The PMO is on a crossover BUY signal. Volume is coming in, but we could see an OBV negative divergence tomorrow with price breaking out to a higher high, while the OBV is not even close to where it was at the June high. The SCTR is in the "hot zone" above 75 (meaning it is in the upper quartile of mid-cap stocks). There's no denying this one is a strong relative performer in a strong group. While the sector is cooling off, this group is not. The stop is set just below the February/March highs.

I like the weekly chart given the positive RSI and weekly PMO that just ticked back up. Price is in a rising trend channel and is nearing all-time highs. Given that, the upside target should be around $23.

Gossamer Bio, Inc. (GOSS)

EARNINGS: 8/9/2021 (AMC) ** Reports next week **

Gossamer Bio, Inc. engages in discovering, acquiring, developing, and commercializing therapeutics in the disease areas of immunology, inflammation, and oncology. Its primary product candidate, GB001, is intended for the treatment of moderate-to-severe eosinophilic asthma and other allergic conditions. The company was founded by Faheem Hasnain and Sheila Gujrathi on October 25, 2015 and is headquartered in San Diego, CA.

GOSS is down -0.12% in after hours trading. GOSS shot up today above its 50-EMA and broke the current declining trend. This is the beginning of a possible breakout from a bullish falling wedge. The RSI is positive and the PMO is on a BUY signal. I would just warn that the 50-EMA is well below the 200-EMA which gives it a bearish bias. Additionally with this 5%+ move today, there is a high likelihood it will pullback tomorrow. Still the group is performing very well and GOSS is performing inline with it. The stop is set just under the May low.

We're seeing improvement on the weekly chart, but the weekly RSI is still in negative territory and GOSS is coming off an all-time low. At least we have a rising PMO and a bullish falling wedge. It could see a move up to $12 if this breakout sees some follow-through.

Perrigo Co. (PRGO)

EARNINGS: 8/11/2021 (BMO) ** Reports next week **

Perrigo Co. Plc provides self-care products and over-the-counter (OTC) health and wellness solutions. It enhances individual well-being by empowering consumers to proactively prevent or treat conditions that can be self-managed. The company was founded by Luther Perrigo in 1887 and is headquartered in Dublin, Ireland.

PRGO is unchanged in after hours trading. Price broke out above the July top and is pulling back toward that breakout point which is good. It did fail to overcome resistance, but it is now forming a bullish flag formation. The RSI is positive and the PMO is rising on a crossover BUY signal. The SCTR continues to improve and relative performance of the group is strong. PRGO itself has been outperforming the SPX, but isn't a top performer within the industry group. Of course it is competing with breakout stocks like MRNA and PFE among others. We need to be careful that this isn't a bearish double-top. I've set the stop just below the 200-EMA. I wouldn't give this one too much rope.

The weekly chart is very favorable with a positive RSI and rising weekly PMO that is not in overbought territory. In fact, it just made its way back above the zero line.

SolarEdge Technologies, Inc. (SEDG)

EARNINGS: 11/2/2021 (AMC)

SolarEdge Technologies, Inc. engages in the development of energy technology, which provides inverter solutions. The firm operates through the following segments: Solar and All Other. The Solar segment includes the design, development, manufacturing, and sales of an inverter solution designed to maximize power generation. The All Other segment includes the design, development, manufacturing and sales of UPS products, energy storage products, e-Mobility products, and automated machines. Its products and services include photovoltaic inverters, power optimizers, photovoltaic monitoring, software tools, and electric vehicle chargers. The company was founded by Guy Sella, Lior Handelsman, Yoav Galin, Meir Adest, and Amir Fishelov in 2006 and is headquartered in Herzliya, Israel.

SEDG is unchanged in after hours trading. I covered SEDG on November 23rd 2020. The position was up over 42% at the January top, but after the extended decline, the stop was eventually hit in March. I like this group as you know. It has pulled back sharply after the gap up on earnings. The RSI is still positive and the PMO wasn't shaken at all on this pullback which is bullish. I don't like the negative divergence on the OBV. The group is only beginning to come back to life and this is one of the strongest stocks in it based on relative strength. The SCTR was damaged by the pullback. I set a rather deep stop just below gap support.

I am seeing a messy reverse head and shoulders, but this week's rally has technically executed the pattern. The weekly RSI is positive and the weekly PMO is beginning to rise. The OBV on the weekly chart is confirming the rally out of the May low. Upside potential looks good at 32%+.

Wrap Technologies, Inc. (WRAP)

EARNINGS: 10/28/2021 (AMC)

Wrap Technologies, Inc operates as a development stage security technology company. It focuses on delivering solutions to customers, primarily law enforcement and security personnel. The firm products includes BolaWrap 100, which is a hand-held remote restraint device that discharges an eight-foot bola style Kevlar tether to entangle an individual at a range of 10-25 feet. The company was founded by Elwood G. Norris, Scot J. Cohen and James A. Barnes on March 2, 2016 and is headquartered in Las Vegas, NV.

WRAP is down -1.38% in after hours trading which isn't surprising given today's strong rally. This means you can find a better entry. We were already seeing a rounded bottom/double-bottom. I wish I'd picked it yesterday as a "Diamond in the Rough" instead of today, but I still think it has plenty of upside potential. The RSI is positive and not overbought. We just had a 5/20-EMA positive crossover for a ST Trend Model BUY signal. The SCTR just hit the "hot zone" above 75. One of the reasons I didn't present it was due to the groups underperformance. However, WRAP is performing much better than the group and is even outpacing the SPX right now. I had to set a deep stop given today's giant rally. Entry on a pullback would be interesting.

The weekly PMO has bottomed above the signal line which is especially bullish. I didn't annotate it, but it does look like a big cup and handle pattern. The OBV was in a positive divergence earlier this year. Currently it is confirming the rally on the weekly chart.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Current Market Outlook:

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

- The Bullish Percent Index (BPI) shows the percentage of SPX stocks on Point & Figure BUY signals.

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Full Disclosure: I'm about 60% invested and 40% is in 'cash', meaning in money markets and readily available to trade with.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "Diamonds in the Rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com