Lots of great requests this week! It was a struggle to pick the five I did. You'll notice there are a large number of "Stocks to Review". That is a function of your picks being excellent. If I didn't include them in today's report as a "Diamond in the Rough" or a "Stock to Review", it doesn't mean your stock didn't have merit, I just had to pare the list down so it would be manageable. Bring your symbols to tomorrow's Diamond Mine trading room. Here is the LINK to register.

Today's "Diamonds in the Rough" are: BKE, CNR, CORE, MOS and PLMR.

Stocks to Review ** (no order): ALL, COIN, AFRM, TGH, ANF, SFL, MKC, GOGL, TMST, RH, DAC and CCK.

** The "Stocks to Review" are stocks that were on my short list for the day.

RECORDING LINK FOR Wednesday 8/4 Bonus Diamond Mine:

Topic: DecisionPoint Make-Up Diamond Mine (8/4/2021) LIVE Trading Room

Start Time : Aug 4, 2021 09:00 AM

Meeting Recording Link HERE.

Access Passcode: August/4

RECORDING LINK Friday (8/6):

Topic: DecisionPoint Diamond Mine (8/6/2021) LIVE Trading Room

Start Time : Aug 6, 2021 08:59 AM

Meeting Recording Link HERE.

Access Passcode: August/6

REGISTRATION FOR FRIDAY 8/13 Diamond Mine:

When: Aug 13, 2021 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (8/13/2021) LIVE Trading Room

Register in advance for this webinar HERE.

Save the registration confirmation email with login instructions in case Zoom doesn't notify you in time.

Free DP Trading Room (8/9) RECORDING LINK:

Topic: DecisionPoint Trading Room

Start Time : Aug 9, 2021 09:00 AM

Meeting Recording Link HERE.

Access Passcode: August-9th

For best results, copy and paste the access code to avoid typos.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "Diamonds in the Rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

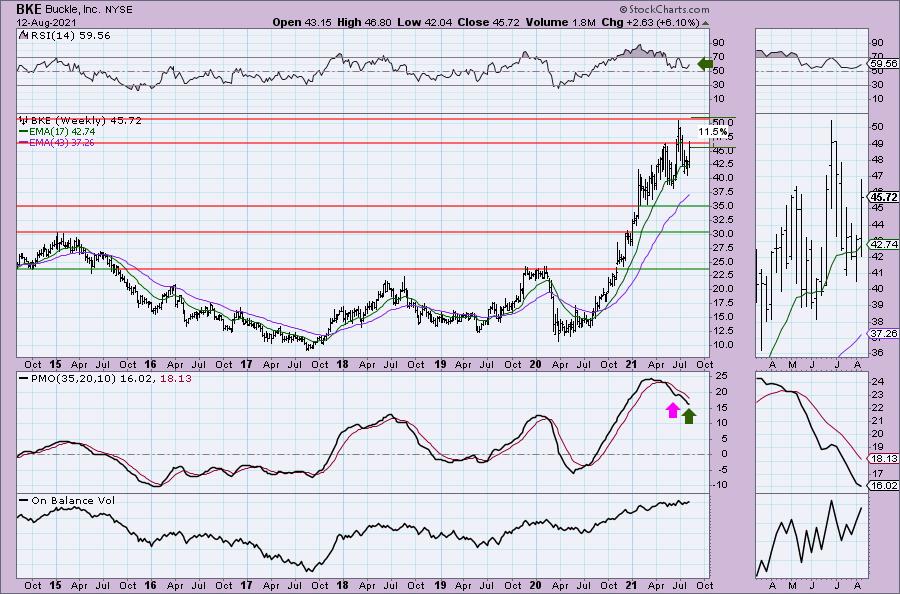

Buckle, Inc. (BKE)

EARNINGS: 8/20/2021 (BMO) ** Reports Next Friday **

The Buckle, Inc. engages in retailing of casual apparel, footwear, and accessories for men and women. It offers brands such as BKE, Buckle Black, Red by BKE, Daytrip denim, Gimmicks, Gilded Intent, FITZ + EDDI, Willow & Root denim, Outpost Makers, Departwest, Reclaim, Nova Industries, and Veece. The company was founded by David Hirschfeld in 1948 and is headquartered in Kearney, NE.

BKE is down -1.03% in after hours trading. BKE has been in my scan results for two days now so it only made sense to present it today given it is also a reader request. I must admit seeing right now that it is down in after hours trading bothers me somewhat, but that could be something you could use to your advantage tomorrow. We have an upside breakout from a bearish descending triangle (flat bottoms, declining tops) which is generally especially bullish. All three EMAs have configured to produce both a ST and IT Trend Model BUY signals. The PMO just had a positive crossover in oversold territory and the RSI has just reached positive territory. The SCTR is now in the "hot zone" above 75 (meaning it is in the upper quartile of all mid-cap stocks as far as relative strength). The group has been performing well and BKE is outperforming the SPX and beginning to outperform its group. The stop is set under the 50-EMA.

The weekly chart is okay. The weekly RSI is positive and the PMO is bottoming. The problem is the weekly PMO bottomed previously and it turned out to be a fake out. I like that OBV bottoms are on the rise. If it reaches all-time highs that is over 11%+ profit, but I suspect at that point it will begin making new all-time highs.

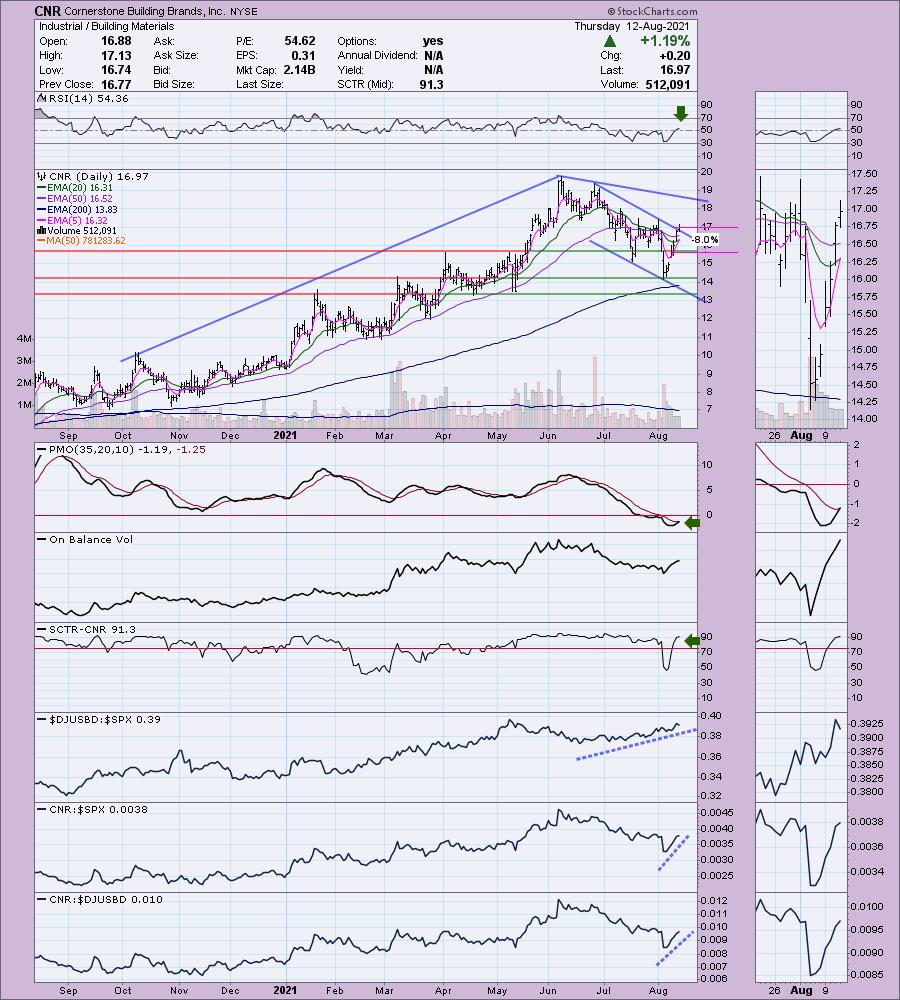

Cornerstone Building Brands, Inc. (CNR)

EARNINGS: 11/9/2021 (AMC)

Cornerstone Building Brands, Inc. engages in the design, engineer and manufacture external building products. It operates through the following segments: Commercial, Siding, and Windows. The Commercial segment produces and distributes metal products for the nonresidential construction market. The Siding segment comprises of vinyl siding and skirting, steel siding, vinyl and aluminum soffit, aluminum trim coil, aluminum gutter coil, aluminum gutters, aluminum and steel roofing accessories, wide crown molding, window and door trim, fascia, undersill trims, outside and inside corner posts, rain removal systems, and injection molded designer accents. The Windows segment consists of vinyl, aluminum-clad vinyl, aluminum, wood and clad-wood windows and patio doors and steel, wood, and fiberglass entry doors that serve both the new construction and the home repair, and remodeling sectors. The company was founded by Johnie Schulte in 1984 and is headquartered in Cary, NC.

CNR is unchanged in after hours trading. I really liked today's breakout and new PMO crossover BUY signal. Add to that a newly positive RSI and relative outperformance and you could be looking at a winner. We also have a new ST Trend Model BUY signal as the 5-EMA crossed above the 20-EMA. I like this group given the new infrastructure bill that recently passed through congress. This group could continue to prosper. The stop is set just under support at the April and early May tops.

I annotated it above, but you can see a bull flag formation. The weekly RSI is positive. I'm not thrilled with the weekly PMO declining, but it is trying to decelerate its fall.

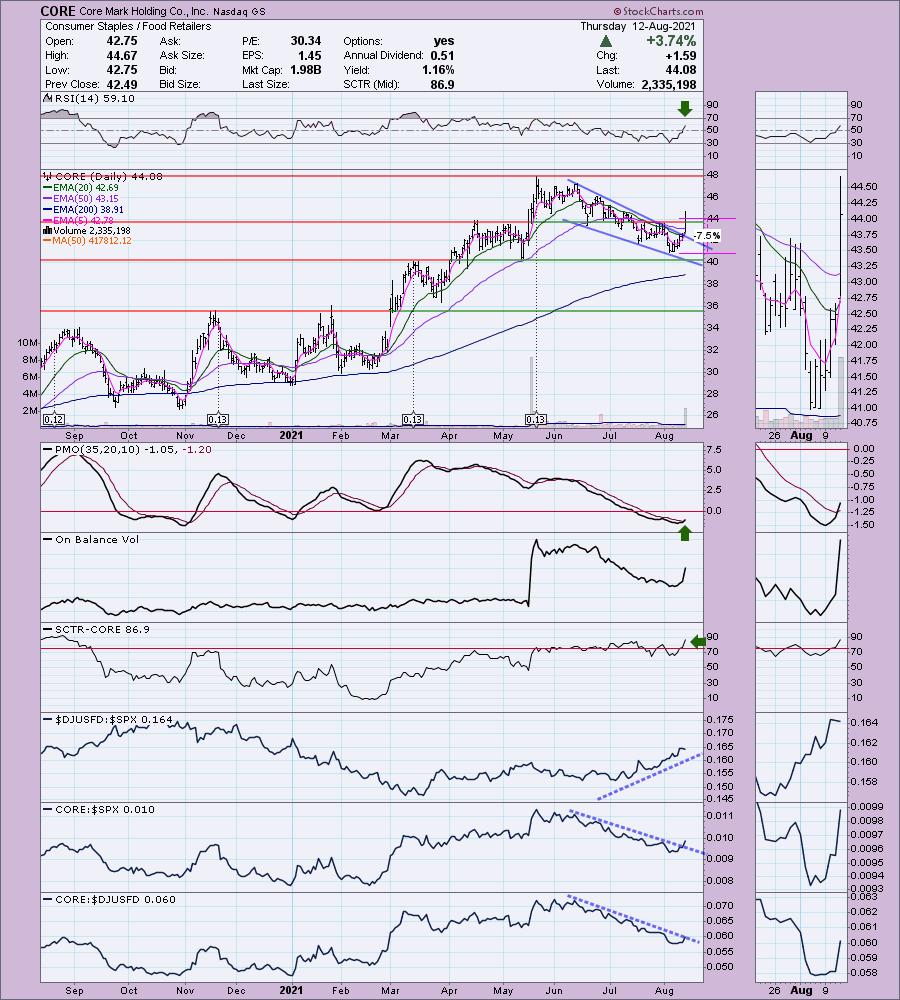

Core Mark Holding Co., Inc. (CORE)

EARNINGS: 11/4/2021 (BMO)

Core-Mark Holding Co., Inc. engages in distribution and marketing of consumer goods. It offers products, marketing programs, and technology solutions. It operates through United States, and Canada, and Corporate geographical segments. The company was founded in 1888 and is headquartered in South San Francisco, CA.

CORE is down -1.52% in after hours trading. I don't see after hours trading until I start writing so I'm always dismayed when I see they are down, but that doesn't change the look of today's closing chart and it doesn't always mean it will decline the next day. It makes sense after today's big breakout move and it is one of the characteristics that I really liked on this chart. I covered CORE in the November 3rd 2020 Diamonds Report. The stop was never hit so the position is up 50.7%.

The RSI just hit positive territory and the PMO had a crossover BUY signal today. Volume definitely came in. Today's breakout triggered a ST Trend Model BUY signal as the 5-EMA crossed above the 20-EMA. The SCTR is back in the "hot zone". My one caution is that it isn't performing well relatively against the group or the SPX. However, this breakout could change things. This breakout also is coming from a bullish falling wedge which implies more upside. The stop is set underneath support at the August low.

This company took a huge hit at the end of 2017 when it was proven that their faulty lines caused a major fire in Northern California that killed 84 people. The state of California ended up bailing them out in 2019 after they donated $2.1 million to California politicians' campaigns (article here). The settlement required handouts of stock in order to cover the lawsuits, diluting it further at the end of 2018. While the stock rebounded in late 2019, it did nothing to repair the damage of 2017-2018. I could go on about California's mismanagement of wildfire prevention, but this isn't the place for it (but, if you're interested, read an NPR article on how Governor Newsom cut the forest management budget! We're in the process of trying to recall him).

We have a very nice bull flag on the weekly chart and this week's breakout could execute it. The weekly RSI is positive. The PMO isn't good, but it seems to be decelerating. It is a little over 8% away from all-time highs, but if the flag executes, we should see much higher prices.

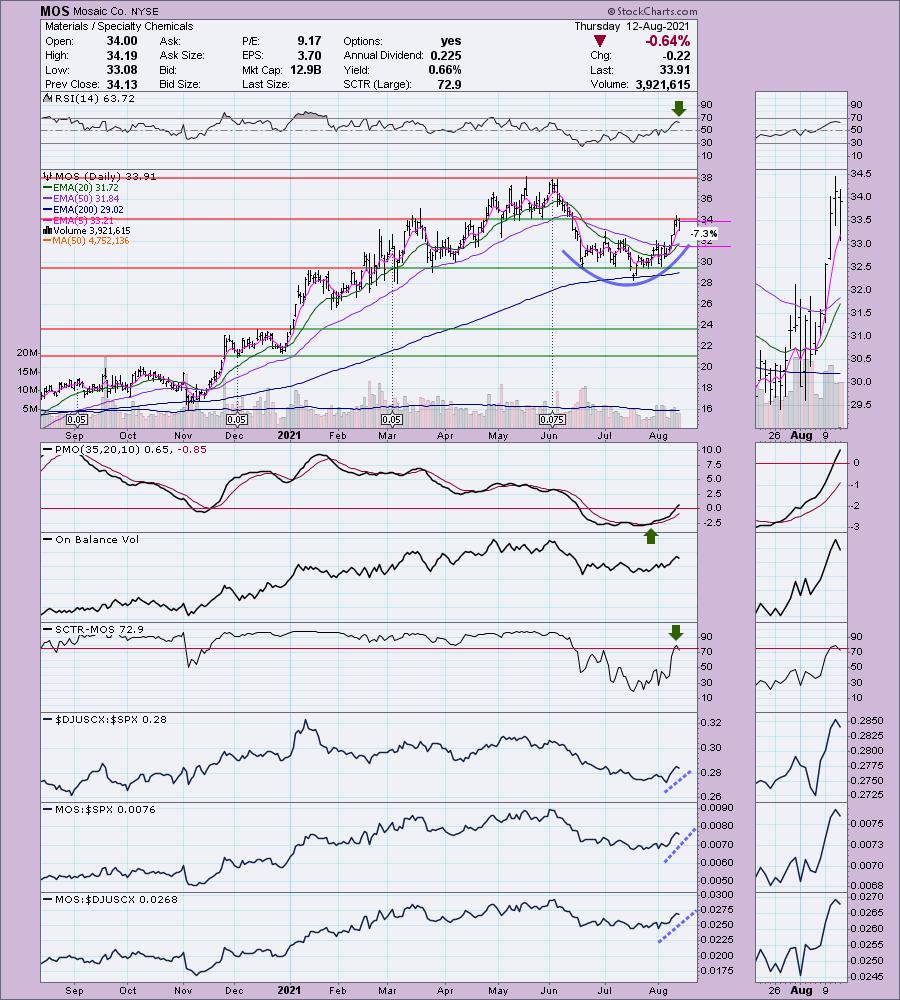

Mosaic Co. (MOS)

EARNINGS: 11/1/2021 (AMC)

The Mosaic Co. engages in the production and marketing of concentrated phosphate and potash crop nutrients. The company operates its businesses through it's wholly and majority owned subsidiaries. It operates through the following segments: Phosphates, Potash, and Mosaic Fertilizantes. The Phosphates segment owns and operates mines and production facilities in North America which produces concentrated phosphate crop nutrients and phosphate-based animal feed ingredients, and concentrated crop nutrients. The Potash segment owns and operates potash mines and production facilities in North America which produce potash-based crop nutrients, animal feed ingredients, and industrial products. The Mosaic Fertilizantes segment produces and sells phosphate and potash-based crop nutrients, and animal feed ingredients, in Brazil. The company was founded on October 22, 2004 and is headquartered in Plymouth, MN.

MOS is down -0.41% in after hours trading. I covered MOS in the February 17th 2021 Diamonds Report. The stop never hit so the position is up a modest +11.4%. I like the new cup shape price bottom. It looks a little like a complex reverse head and shoulders pattern. Price did pull back somewhat after hitting overhead resistance at the May lows, but given the PMO has risen above the zero line after an oversold crossover BUY signal, it looks good. We should see an IT Trend Model "Silver Cross" BUY signal shortly as the 20-EMA nears a positive crossover the 50-EMA. The SCTR is near the hot zone. Relative performance is positive as well. I've set the stop below the 50-EMA.

The weekly chart is good with a positive RSI, possible flag formation and a PMO that is trying to bottom. I'm not thrilled that the OBV is setting a new high but price is not, that's considered a reverse divergence. If we get a breakout above the 2018 top, there is plenty of upside potential.

Palomar Holdings, Inc. (PLMR)

EARNINGS: 11/9/2021 (AMC)

Palomar Holdings, Inc. operates as an insurance holding company. The firm focuses on the residential and commercial earthquake markets in earthquake-exposed states such as California, Oregon, Washington and states with exposure to the New Madrid Seismic Zone. It offers property and casualty insurance. The company was founded on October 4, 2013 and is headquartered in La Jolla, CA.

PLMR is unchanged in after hours trading. I've covered PLMR twice before. First on March 24th 2020. The stop on that position was never hit so the it is up 68.6%. Second on September 3rd 2020. The stop was hit quickly so the position finished at -8.2%.

I've noticed this industry group as well as other insurance related industry groups breaking out. This one has been a great relative performer within the group and against the SPX. The RSI is in positive territory. There is a LT Trend Model "Golden Cross" BUY signal on the way. The PMO is on a crossover BUY signal and just accelerated higher today. The SCTR is improving. I've set a stop right at the 50/200-EMAs.

I like the breakout on the weekly chart. It's the only weekly PMO today that is on a crossover BUY signal. The weekly RSI is also positive. Upside potential is nearly 30%.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Current Market Outlook:

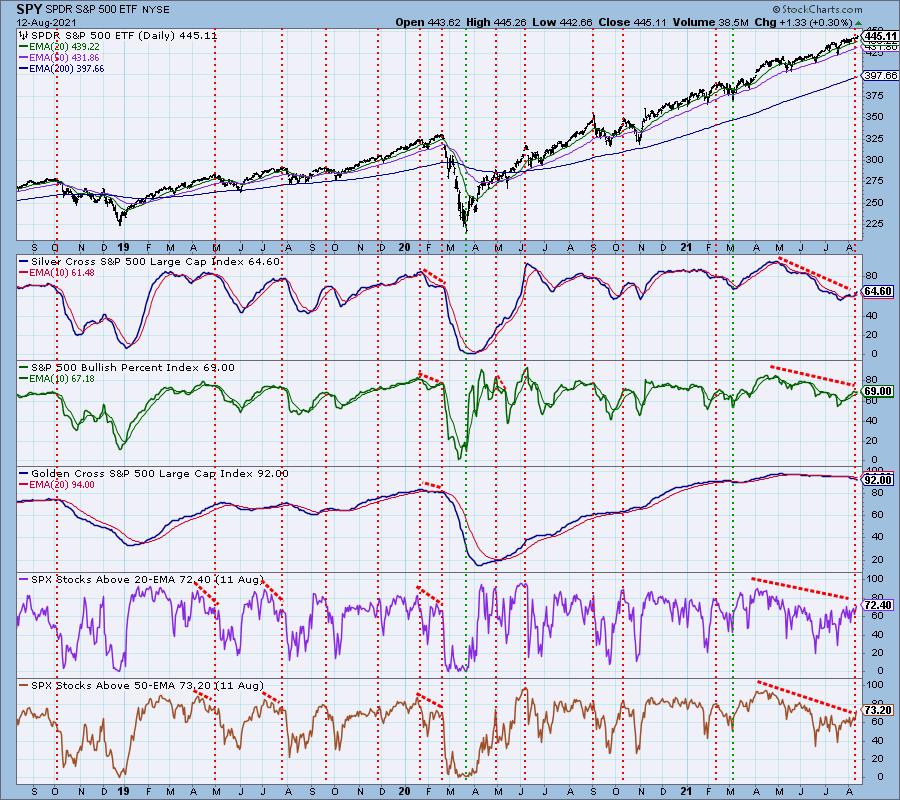

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

- The Bullish Percent Index (BPI) shows the percentage of SPX stocks on Point & Figure BUY signals.

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Full Disclosure: I'm about 50% invested and 50% is in 'cash', meaning in money markets and readily available to trade with.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "Diamonds in the Rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com