The Real Estate sector (XLRE) has been a clear out-performer of late (one of last week's "Diamonds in the Rough" is continuing to outperform), but is it too late to get in on the rally? I don't believe so, especially when you see today's "Diamonds in the Rough" from that sector. Additionally, I found a Biotech and an Industrial that have great setups right now.

One of the REITs I presented as the "Diamond of the Week" on yesterday's DecisionPoint Show was Iron Mountain (IRM). One thing I love about the live Trading Rooms is that you put a great setup right in front of me and IRM was definitely one of those. Thank you, Dennis!

Do not forget that I have a "make-up" Diamond Mine tomorrow. It will have to run only one-hour as I have a meeting at 1p ET. Since we won't be doing the typical 'recap' of the week, I think we'll have plenty of time to explore your requests and find some new and interesting ones as well. The link to register is below and the recording link will be posted as always.

Today's "Diamonds in the Rough" are: ARQT, EGP, GPX and IRM.

Stocks to Review (no order): GFI, AEE, BNKU, ALLY, KRO and SO.

Diamond Mine Information:

Diamond Mine Information:

RECORDING LINK Wednesday (6/23):

Topic: BONUS DecisionPoint Diamond Mine Wednesday (6/23)

Start Time : Jun 23, 2021 09:01 AM

6/23 Diamond Mine Recording Link.

Access Passcode: June-23rd

** REGISTRATION LINK FOR MAKE-UP (Wednesday 7/14) **:

When: Jul 14, 2021 09:00 AM Pacific Time (US and Canada)

Topic: Make-up DecisionPoint Diamond Mine (7/14/2021) LIVE Trading Room

Register in advance for this MAKE-UP webinar HERE

REGISTRATION FOR FRIDAY (7/16) Diamond Mine:

When: Jul 16, 2021 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (7/16/2021) LIVE Trading Room

Register in advance for this webinar HERE.

Save the registration confirmation email with login instructions in case Zoom doesn't notify you in time.

Free DP Trading Room RECORDING LINK:

Topic: DecisionPoint Trading Room

Start Time : Jul 12, 2021 09:00 AM

Meeting Recording for DP Trading Room is HERE.

Access Passcode: W72^WzSb

For best results, copy and paste the access code to avoid typos.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "Diamonds in the Rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

Arcutis Biotherapeutics Inc. (ARQT)

EARNINGS: 8/3/2021 (AMC)

Arcutis Biotherapeutics, Inc. engages in the development and commercialization of treatments for dermatological diseases. Its pipeline consists of topical treatments for plaque psoriasis, atopic dermatitis, hand eczema, vitiligo, scalp psoriasis, alopecia areata, and seborrheic dermatitis. The company was founded by Bhaskar Chaudhuri and David W. Osborne in June 2016 and is headquartered in Westlake Village, CA.

ARQT is down -0.70% in after hours trading. Biotechs can be speculative and I am trying to avoid that type of stock. However, I couldn't resist this one given that large bullish double-bottom that is accompanied by a positive OBV divergence. Add to that the newly positive RSI and brand new PMO crossover BUY signal and you could have a winner here. The group itself is performing about as well as the SPX, but ARQT is outperforming both the group and the SPX. Price currently has to deal with overhead resistance at the 50/200-EMAs, but we are seeing a potential ST Trend Model BUY signal as the 5-EMA is nearing a positive crossover the 20-EMA. If you want the stop below the pattern, it is a big 12%, I decided to go with my default of 8%.

There isn't enough data on the weekly chart to make any sweeping conclusions, but the weekly RSI is negative and the PMO is falling. Upside potential is about 34.5%.

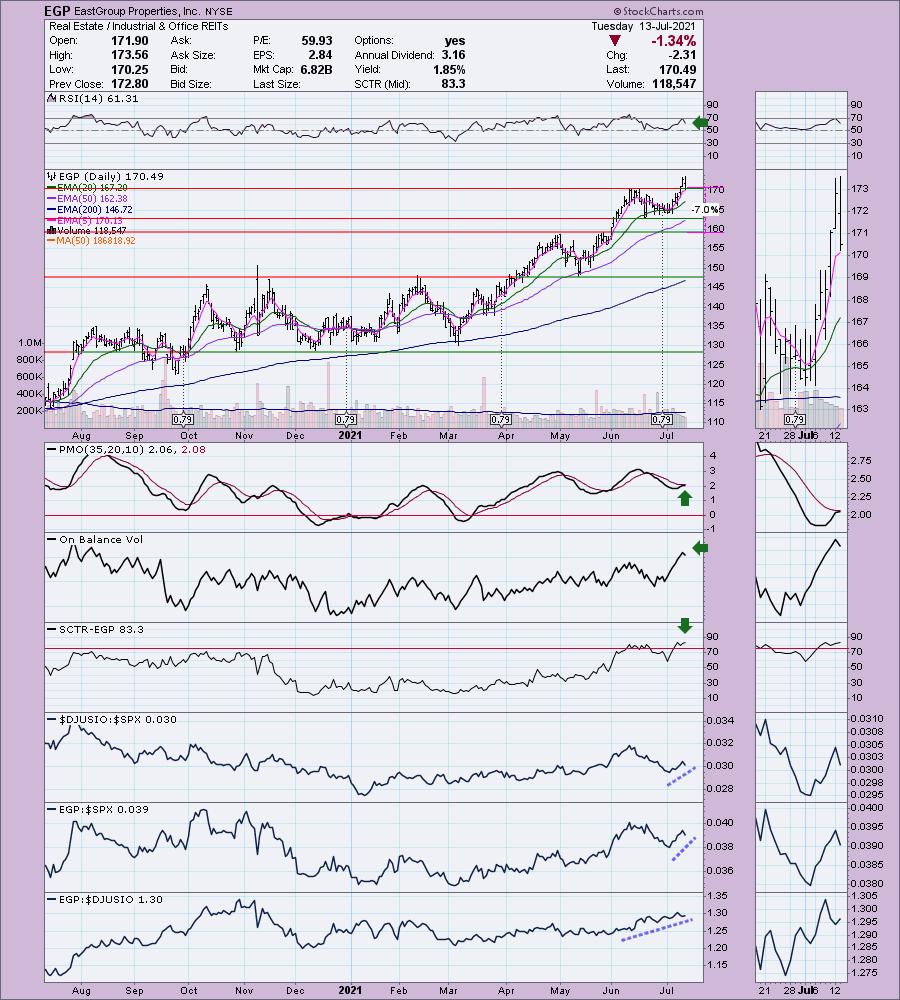

EastGroup Properties, Inc. (EGP)

EARNINGS: 7/27/2021 (AMC)

EastGroup Properties, Inc. is an equity real estate investment trust, which engages in the development, acquisition and operation of industrial properties in the United States. It operates through Industrial Properties segment. Its portfolio consists of distribution facilities in Florida, California, Texas, Arizona, and North Carolina. The company was founded in 1969 and is headquartered in Ridgeland, MS.

EGP is unchanged in after hours trading. I covered EGP back on December 16th, 2020. The stop was never hit so the position is up +24.6% since. It is always pleasing when I get a repeat and the stop wasn't hit. Is it me or are the majority of these repeats still going without hitting the stop? One of these days I'll go back and research, but that is hundreds of "Diamonds in the Rough" to plow through.

I think the timing on this one could be good. You also have an opportunity to watch what it does at support before entering on this pullback. Price broke out yesterday and pulled right back to the breakout point. The RSI is positive and the PMO is nearing a crossover BUY signal. We got volume on the breakout as represented by the OBV breakout. Notice also that today's selling didn't hurt that OBV much. The SCTR is in the "hot zone" above 75 (meaning it is in the upper quartile of all mid-cap stocks). Performance of the group and stock against the SPX is good. The stop can be set even tighter if you like, but a 7% one gets us just below support at the April/May tops.

Price is at an all-time high, so the upside target can be determined to be twice the stop percentage or about 14% upside potential. At that point, a reevaluation would be necessary. The weekly PMO is on a BUY signal and rising, something we don't see that often on the short-term "diamonds in the rough" that I present.

GPStrategies Corp. (GPX)

EARNINGS: 8/6/2021 (BMO)

GP Strategies Corp. provides training, e-Learning solutions, management consulting and engineering services. It operates through the following Geographic Segments: North America, EMEA and Emerging Markets (Latin America and Asia Pacific countries). It provides Workforce Transformation Services into three primary solution sets: Organizational Performance Solutions (OPS), Technical Performance Solutions (TPS) and Automotive Performance Solutions (APS). The company was founded in 1959 and is headquartered in Columbia, MD.

GPX is thinly traded and doesn't trade after hours. There's no reason you can't enter a thinly traded stock, you just have to keep tabs on it given market makers can easily push price wherever they like. Looking at volume on the chart, it does appear that volume overall has picked up in general. This was another double-bottom chart that I had to present. The upside target of the pattern would take price very close to overhead resistance. The RSI is now positive and the PMO just had a crossover BUY signal. The group has been performing well overall and GPX is beginning to outperform again. The stop is rather deep at 9.1% but it does get us just below support at that second bottom. The OBV is accelerating on the formation of this pattern.

The weekly chart has a positive RSI and a bullish flag formation. The PMO is the only problem. If price can get above resistance on the daily chart, we could actually expect a fulfillment of the flag pattern that would take price to $30, but I've conservatively set the upside target at resistance of 2015-2017 lows.

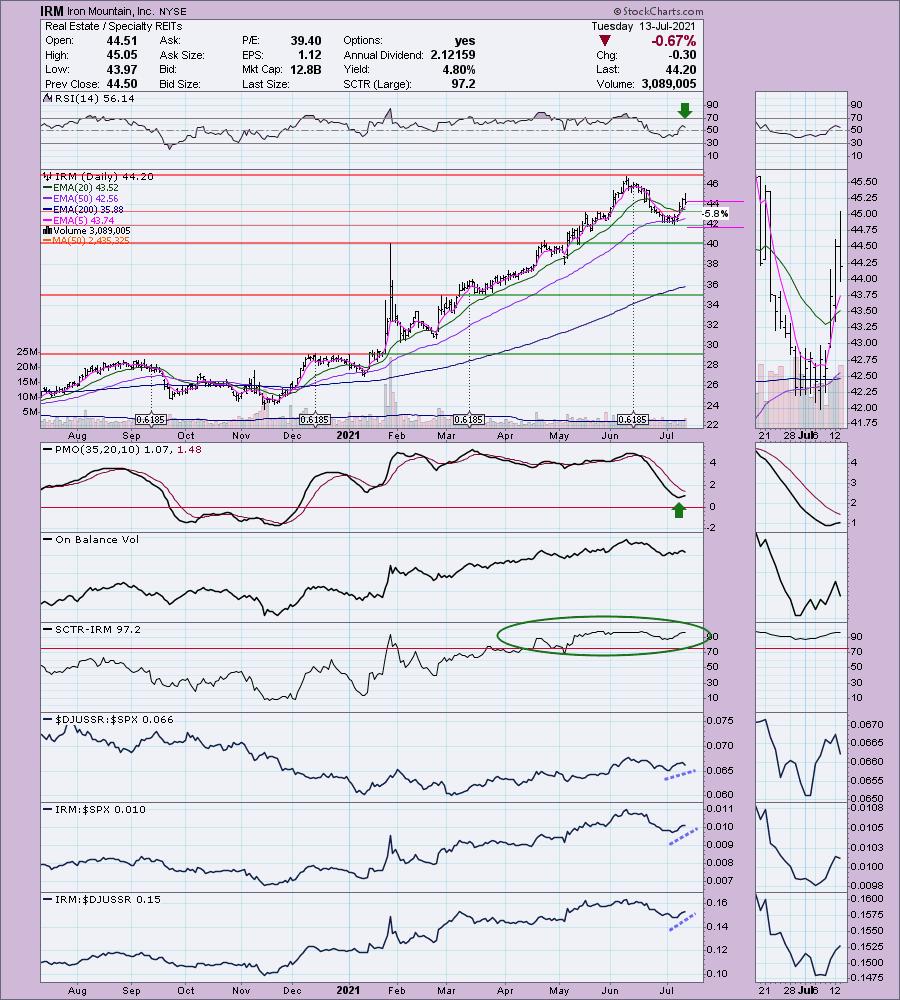

Iron Mountain, Inc. (IRM)

EARNINGS: 8/5/2021 (BMO)

Iron Mountain, Inc. engages in the provision of storage and information management solutions. It operates through the following business segments: North American Records & Information Management Business, North American Data Management Business, Western European Business, Other International Business, Global Data Center Business and Corporate & Other Business. The North American Records & Information Management Business segment offers record management, destruction, and fulfilment services throughout U.S. and Canada. The North American Data Management Business segment handles data protection and recovery, server and computer backup services, and safeguarding of electronic and physical media in U.S. and Canada. The Western European Business segment offers records management, data protection and recovery services, and document management solutions throughout the United Kingdom, Ireland, Austria, Belgium, France, Germany, Netherlands, Spain, and Switzerland. The Other International Business segment offers storage and information management services throughout the remaining European countries, Latin America, the Middle East and Africa. The Global Data Center Business segment provides data center facilities to protect mission-critical assets and ensure the continued operation of its customers IT infrastructures, with secure and reliable colocation and wholesale options. The Corporate & Other Business segment consists of the storage, safeguarding and electronic or physical deliveries of physical media of all types and digital content repository systems to house, distribute, and archive key media assets, primarily for entertainment and media industry clients. The company was founded by Herman Knaust in 1951 and is headquartered in Boston, MA.

IRM is up +0.20% in after hours trading. I covered this one on March 2nd 2021. The stop was never hit so the position is up +25.7%. It looks very interesting again on the recent pullback. The strongest support level was $40, but price didn't need to drop that far before rebounding. The RSI is positive and not overbought. The PMO is rising nicely out of oversold territory. The OBV is rising with price. The SCTR has been in the "hot zone" since April. Relative performance is strong. The stop can be set thinly at about 5.8%.

I believe we have a bull flag on the weekly chart so a breakout to new all-time highs would give us very high upside potential. At this point, I'd set an upside target around $50 or $55. The weekly PMO and weekly RSI are both overbought with the PMO headed for a crossover SELL signal. I still think this one has room to run.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

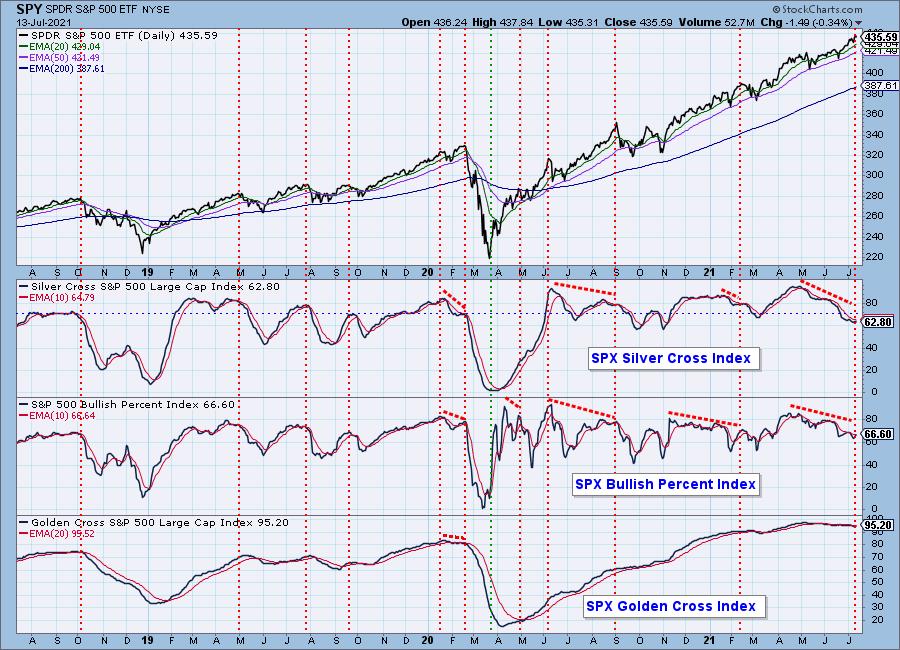

Current Market Outlook:

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

- The Bullish Percent Index (BPI) shows the percentage of SPX stocks on Point & Figure BUY signals.

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Full Disclosure: I'm about 50% invested and 50% is in 'cash', meaning in money markets and readily available to trade with.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "Diamonds in the Rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com