Glad to be home! It was a whirlwind trip that was very exhausting, but so amazing as well! It was great to share some of our country's great National Parks with my youngest daughter. Soon she won't have the flexibility to join us so it was nice to have her.

This week we ended in the positive category. I went "all-in" on Railroads Wednesday and that hurt our percentages this week. No surprise that both were the "Duds" of the week.

The "Darling" this week was Knight-Swift (KNX) which was up +5.27% on the week. Overall we did about as well as the SPX.

Definitely read the sections on what to watch for next week. I think I found a sleeper sector and a strong industry group to take advantage of it. I've also thrown in two stock ideas.

I realized I've had mislabeled links for the Diamond Mine pretty much all week long. Please take a look below for information on how to register for next week's "Make-up" Diamond Mine on Wednesday at Noon ET. Additionally, the registration link for next Friday is also below.

Diamond Mine Information:

Diamond Mine Information:

RECORDING LINK Wednesday (6/23):

Topic: BONUS DecisionPoint Diamond Mine Wednesday (6/23)

Start Time : Jun 23, 2021 09:01 AM

6/23 Diamond Mine Recording Link.

Access Passcode: June-23rd

RECORDING LINK Friday (6/25):

Topic: DecisionPoint Diamond Mine (6/25) LIVE Trading Room

Start Time : Jun 25, 2021 09:00 AM

Meeting Recording 6/25 Link.

Access Passcode: June-25th

REGISTRATION FOR Wednesday 7/14 (Make-up) Diamond Mine:

When: Jul 14, 2021 09:00 AM Pacific Time (US and Canada)

Topic: Make-up DecisionPoint Diamond Mine (7/14/2021) LIVE Trading Room

Register in advance for this webinar HERE.

REGISTRATION FOR FRIDAY 7/16 Diamond Mine:

When: Jul 16, 2021 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (7/16/2021) LIVE Trading Room

Register in advance for this webinar HERE.

Save the registration confirmation email with login instructions in case Zoom doesn't notify you in time.

Free DP Trading Room RECORDING LINK:

Topic: DecisionPoint Trading Room

Start Time : Jun 21, 2021 08:49 AM

Meeting Recording for Free DP Trading Room HERE.

Access Passcode: June-21st

For best results, copy and paste the access code to avoid typos.

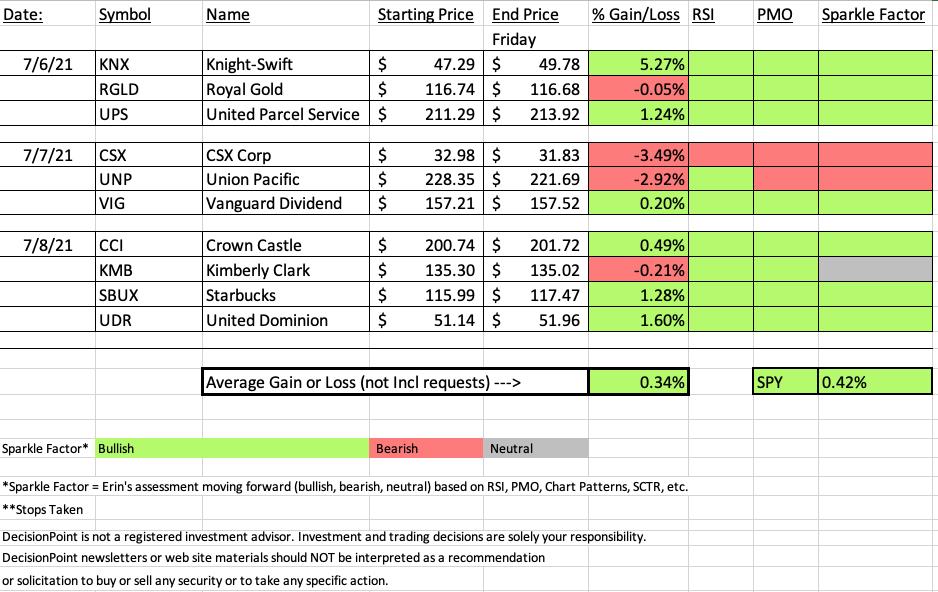

A few items about the spreadsheet: I decided it only fair to denote "reader requests" as I shouldn't get to take credit if they turn out great! I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

Darling:

Knight-Swift Transportation Holdings Inc. (KNX)

EARNINGS: 7/21/2021 (BMO)

Knight-Swift Transportation Holdings, Inc. engages in the provision of multiple truckload transportation and logistics services. It operates through the following business segments: Trucking, Logistics, and Intermodal. The Trucking segment comprises irregular route and dedicated, refrigerated, expedited, flatbed, and cross-border operations. The Logistics segment include brokerage and other freight management services. The Intermodal segment consists revenue generated by moving freight over the rail in the containers and other trailing equipment, combined with the revenue for drayage to transport loads between the railheads and customer locations. The company was founded in 1966 and is headquartered in Phoenix, AZ.

Below is the commentary and chart from 7/6:

"KNX was unchanged in after hours trading. I covered KNX in the midst of the bear market on March 18th 2020. Of course the 8.2% stop was hit later that month and price dove down to $27 before it bottomed. I like the breakout today from the bullish falling wedge. Additionally, price broke above resistance at the August/September tops. The 5-EMA is nearing a positive cross above the 20-EMA for a ST Trend Model BUY signal. The RSI is positive and the PMO just triggered a crossover BUY signal. The SCTR is improving. The industry group has been underperforming the market, but KNX is beginning to outperform the market and its group. The stop is set at a reasonable 6.7%."

Here is today's chart:

This one still looks good, the only issue is that price wasn't able to overcome resistance. However, with a newly positive PMO and a positive and not overbought RSI, I expect a breakout.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Dud:

CSX Corp. (CSX)

EARNINGS: 7/21/2021 (AMC)

CSX Corp. engages in the provision of rail-based freight transportation services. Its services include rail service, the transport of intermodal containers and trailers, rail-to-truck transfers and bulk commodity operations. The company was founded in 1827 and is headquartered in Jacksonville, FL

Below is the commentary and chart from 7/7:

"CSX was unchanged in after hours trading. I've covered CSX twice before. First on August 11th 2020, the stop was never hit and so it is up +33.3% since. Second, on February 16th 2021, the stop was never hit so it is up a modest +9.6% since then. It is set up nicely once again. Price broke out of a bullish falling wedge. The RSI is positive and the PMO just triggered a crossover BUY signal. Additionally, there is a ST Trend Model BUY signal that triggered today as the 5-EMA crossed above the 20-EMA. Performance looks like it is improving across the board. I like that you don't have to set a deep stop. 6% puts us at support at the November high."

Below is today's chart:

The chart was really lined up for a rally continuation with that strong breakout from the bullish falling wedge. It improved greatly today, but I don't like the negative PMO and RSI. That PMO top below the zero line isn't good. The industry group itself really took a hit as you can see by the relative strength collapse. This one isn't completely dead, it might be watch list worthy.

THIS WEEK's Sector Performance:

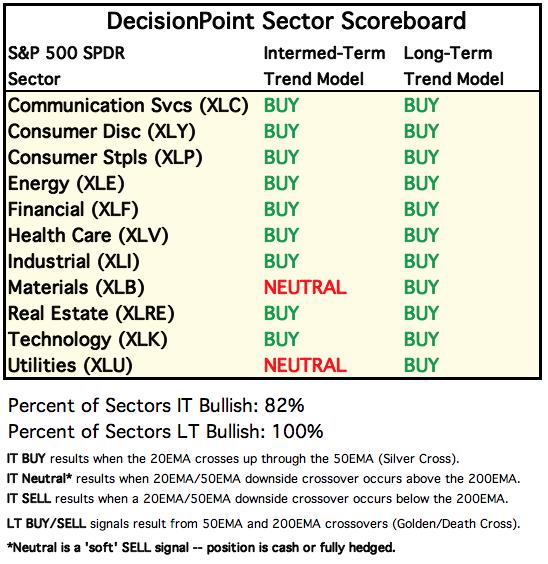

DecisionPoint Sector Scoreboard (Mechanical Trend Model Signals):

Click Here to view Carl's annotated Sector ChartList!

CONCLUSION:

When I reviewed the sector charts, I noted the improvement on XLRE, XLU and XLF. However, the only sector with decent participation was Consumer Staples (XLP). With the market getting shaky and more investors looking for high yields, this sector is a great fit. You can see all of our sector charts that have participation included in our "Sector ChartList" on our website. Here is a direct link.

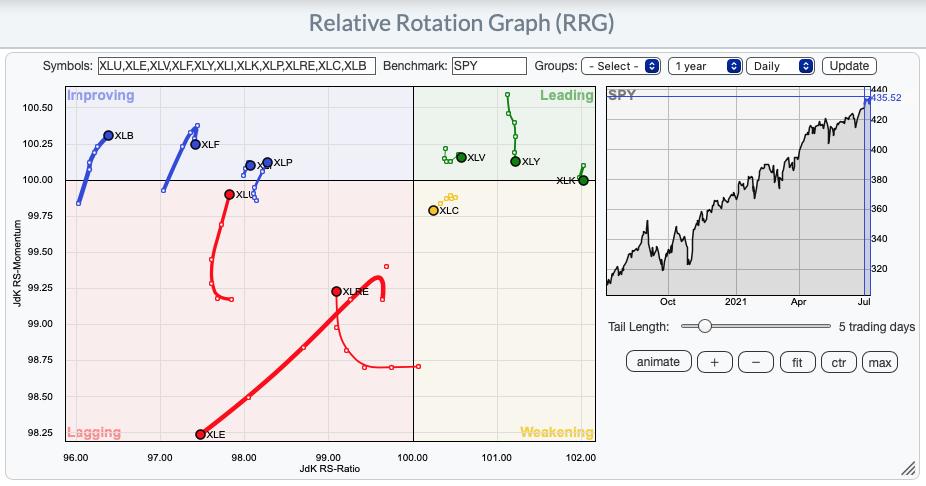

Short-term RRG:

Sector to Watch: Consumer Staples (XLP)

The PMO is in the midst of creating a crossover BUY signal. The RSI is positive and not overbought. The OBV is confirming the rally out of the June low. I really liked that the SCI was pointed upward. Additionally, participation is improving and the BPI just had a positive crossover. The relative strength line isn't great, but as I said I believe this is a "sleeper" sector for that reason.

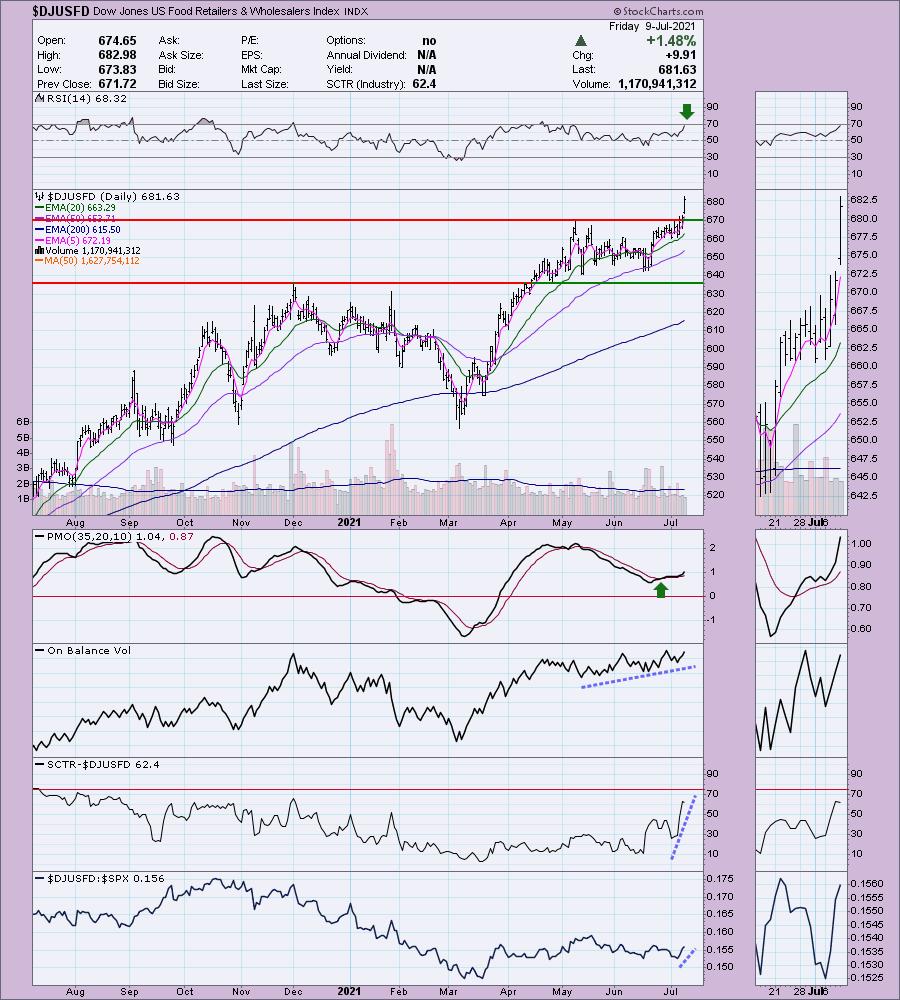

Industry Group to Watch: Food Retailers & Wholesalers ($DJUSFD)

This group broke out strongly today unlike most of the other industry groups in this sector. The RSI is positive and the PMO is definitely picking up speed to the upside. The SCTR is shooting higher. Currently it is in the top 38% of the industry groups as a whole based on the SCTR value. Relative strength is also picking up against the SPX. Two stocks to consider from this group: Kroger (KR) and Sprouts Farmer's Market (SFM).

Go to our Sector ChartList on DecisionPoint.com to get an in depth view of all the sectors.

Technical Analysis is a windsock, not a crystal ball.

Have a great holiday weekend & Happy Charting! Next Diamonds Report is Tuesday 7/6.

- Erin

erin@decisionpoint.com

Full Disclosure: I'm about 50% invested right now and 50% is in 'cash', meaning in money markets and readily available to trade with. I'm planning to book some profits this week and reduce my exposure to 30%.

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

(c) Copyright 2021 DecisionPoint.com