The market is looking especially bearish right now so it is time to play defense. There are a few ways you can do this. On the conservative side you can tighten stops, close positions and move to cash. Or, rotate positions into sectors or groups showing relative strength. Aggressive traders can consider hedging, using options or shortening the trading timeframe. My preferred way to play defense is by rotating positions into cash as well as in groups that tend to weather the storm with high dividends and yields. To the extreme, I will move completely to cash. That is still on my mind right now.

Utilities of course pulled back today, rendering entries into yesterday's "Diamonds in the Rough" mostly non-existent today based on the 5-minute candlestick charts. However, they have merit and buy points on those 5-min charts are already beginning to materialize, NRG and EIX in particular.

I'll continue to tease out the stocks/ETFs that should continue higher, barring a market meltdown. That would take everyone down with it.

TOMORROW IS READER REQUEST DAY! Send in your symbol requests and I just may cover it in tomorrow's Diamond Report!

Today's "Diamonds in the Rough" are: EGLE, PARR and SUPN.

Stocks/ETFs to Review (no order): NUVA, UTHR, MORN and TRTN.

** UPCOMING VACATION - June 28th to July 9th **

It's that time of year again! Last year it was a road trip to Alabama and back, this year it is a road trip to Utah and back! We plan on dropping in Las Vegas, Zion, Spanish Fork, Bryce Canyon, back to the Grand Canyon, Bull Head City and finally back home. I'll include my travel diary and pictures just like last year for Diamonds readers!

I plan on writing, but trading rooms will be postponed until I return home. Blog articles may be delayed depending on WIFI service and/or our travel for the day. You'll miss two Diamond Mines (I'll make them up in the coming weeks).

Diamond Mine REGISTRATION Information:

Diamond Mine REGISTRATION Information:

When: Jun 18, 2021 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (06/18/2021) LIVE Trading Room

Register in advance for the Diamond Mine HERE.

After registering, you will receive a confirmation email containing information about joining the webinar, including the password. SAVE IT! Zoom doesn't always send out the reminders.

=======================================================================

Diamond Mine RECORDING Link:

Topic: DecisionPoint Diamond Mine (6/11/2021) LIVE Trading Room

Start Time : Jun 11, 2021 08:59 AM

Diamond Mine Recording Link.

Access Passcode: June-11th

***Click here to register for this recurring free DecisionPoint Trading Room on Mondays at Noon ET!***

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Free DP Trading Room RECORDING LINK:

Topic: DecisionPoint Trading Room

Start Time : Jun 14, 2021 09:00 AM

Free Trading Room Recording Link

Access Passcode: June/14th

For best results, copy and paste the access code to avoid typos.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "diamonds in the rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

Eagle Bulk Shipping Inc. (EGLE)

EARNINGS: 8/5/2021 (AMC)

Eagle Bulk Shipping, Inc. is a holding company, which engages in the ocean transportation of a broad range of dry bulk cargoes worldwide through the ownership, charter, and operation of dry bulk vessels. It operates Supramax and Handymax vessels that transport minor and major bulk cargoes, including iron ore, coal, grain, cement, and fertilizer. The company was founded by Sophocles N. Zoullas on March 23, 2005 and is headquartered in Stamford, CT.

EGLE is up +3.49% in after hours trading, so we're definitely onto something here. Today it broke out strongly from a bullish ascending triangle. The RSI is positive and not quite overbought. The PMO is going to trigger a crossover BUY signal very soon. Notice that the OBV made a new high as price broke out. That is excellent confirmation of this breakout move. The SCTR is top-notch. While the industry group isn't doing much relative to the SPX, EGLE is outperforming both the group and the SPX.

Please note that this is a log scale chart. I like to present the same timeframe, same setting charts so we can get a clear comparison. In the case of EGLE, you can't see any price movement without making it a log scale. One important thing to remember about log scale is that trendlines and chart patterns aren't as valid. Support levels are key. So, seeing this breakout from the 2017-2021 resistance level is excellent. Notice it broke above and then consolidated the move. Now it is off to the races again. I do note that the RSI is overbought, but that is a condition that will definitely persist for some time if this one continues to roll. The weekly PMO is turning up above its signal line.

Par Pacific Holdings Inc. (PARR)

EARNINGS: 8/9/2021 (AMC)

Par Pacific Holdings, Inc. engages in the operation of energy and infrastructure businesses. It operates through the following segments: Refining, Retail, Logistics, and Other. The Refining segment produces ultra-low sulfur diesel, gasoline, jet fuel, marine fuel, low sulfur fuel oil, and other associated refined products. The Retail segment sells gasoline, diesel, and retail merchandise. The Logistics segment involves in terminals, pipelines, a single-point mooring, and trucking operations to distribute refined products throughout the islands of Oahu, Maui, Hawaii, Molokai, and Kauai. The company was founded on December 21, 1984 and is headquartered in Houston, TX.

PARR is unchanged in after hours trading. With crude oil prices on the rise, the Energy sector is chugging higher. This industry group has been performing very well relative to the SPX. PARR has a positive RSI and just broke out from a trading zone or somewhat messy double/triple-bottom pattern. The minimum upside target of the pattern(s) would take price to the March high. The PMO just moved back into positive territory on a BUY signal. The SCTR is just about to enter the "hot zone" above 75 (meaning it is in the upper quartile of all small-cap stocks in the intermediate and long terms). It continues to outperform. The stop is rather deep and lines up just below those April tops.

I love that price bounced off important and strong support. The weekly PMO has turned up and the RSI is positive. While I've set the upside target at the 2019 high, I think there's a better chance it will challenge the 2017/2018 tops. That would be just under 30% upside potential.

Supernus Pharmaceuticals, Inc. (SUPN)

EARNINGS: 8/4/2021 (AMC)

Supernus Pharmaceuticals, Inc. engages in the development and commercialization of products for the treatment of central nervous system diseases. It offers Trokendi XR, Oxtellar XR, APOKYN, XADAGO, and MYOBLOC products. The company was founded by Jack A. Khattar on March 30, 2005 and is headquartered in Rockville, MD.

SUPN is up +1.24% in after hours trading even after today's spectacular breakout. The RSI is on the overbought side, but we've seen this before and it can last. The PMO is on a new BUY signal and is rising. The OBV broke out with price. The SCTR just entered the "hot zone" above 75. Although the industry group hasn't been doing that great since last week, in the longer term, the group is doing very well. SUPN is a winner within this group and it has performed exceptionally well against the SPX. You can easily set a thin stop on this one.

We now have a second PMO bottom above the signal line. Those usually very bullish signals. Note also that the weekly PMO isn't at all overbought. The OBV is confirming the move and the RSI is positive. Notice how this week, SUPN broke above long-term support. I don't really see any clear resistance levels until we hit the 2017 top, so upside potential is over 50%.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Current Market Outlook:

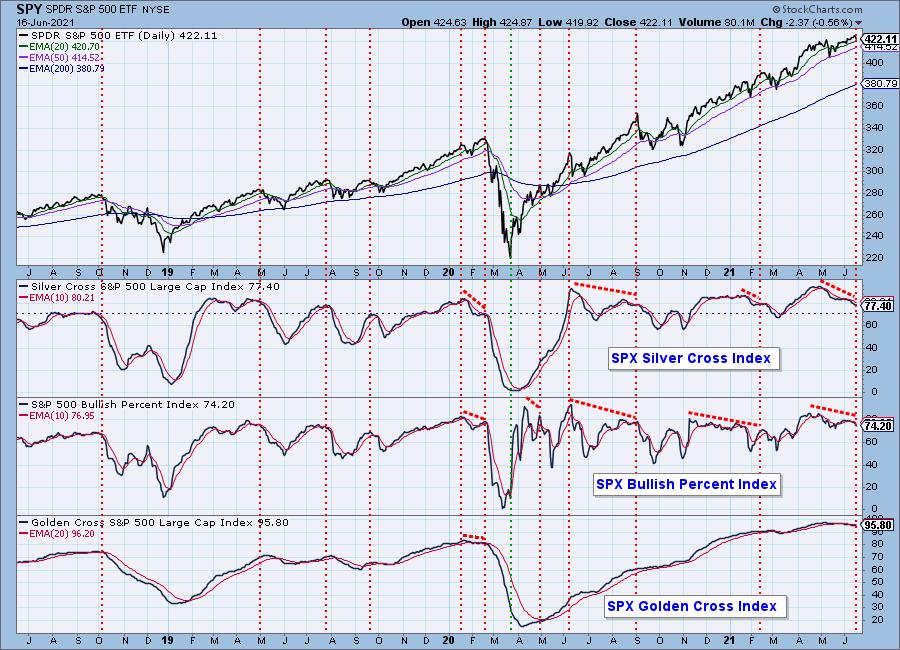

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

- The Bullish Percent Index (BPI) shows the percentage of SPX stocks on Point & Figure BUY signals.

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Diamond Index:

The Diamond Index chart looks at the number of scan results from my bullish Diamond PMO Scan and the number of scan results from the inverse Diamond Dog Scan. The Diamond Ratio divides the bullish results by the bearish results.

I only have data going back to October 2019 so I won't make any sweeping conclusions about the Diamond Index chart. I have marked cardinal tops with red dotted vertical lines and cardinal price bottoms with green dotted vertical lines. I believe that when the Diamond Dog results spike, it usually comes at a price bottom, or marks a strong continuation of the rising trend.

Unfortunately, the Diamond PMO Scan result numbers aren't providing much insight. The Diamond Ratio has promise, but again I don't see a clear correlation to the market tops/bottoms right now. I need to study and manipulate the data some more. Keep you posted!

Full Disclosure: I'm about 50% invested and 50% is in 'cash', meaning in money markets and readily available to trade with. Closed some positions so I'm now 50% in cash. Never got an entry on EIX or the other diamonds from yesterday. I'll be watching again tomorrow and keeping an eye on today's selections on the 5-min charts.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com