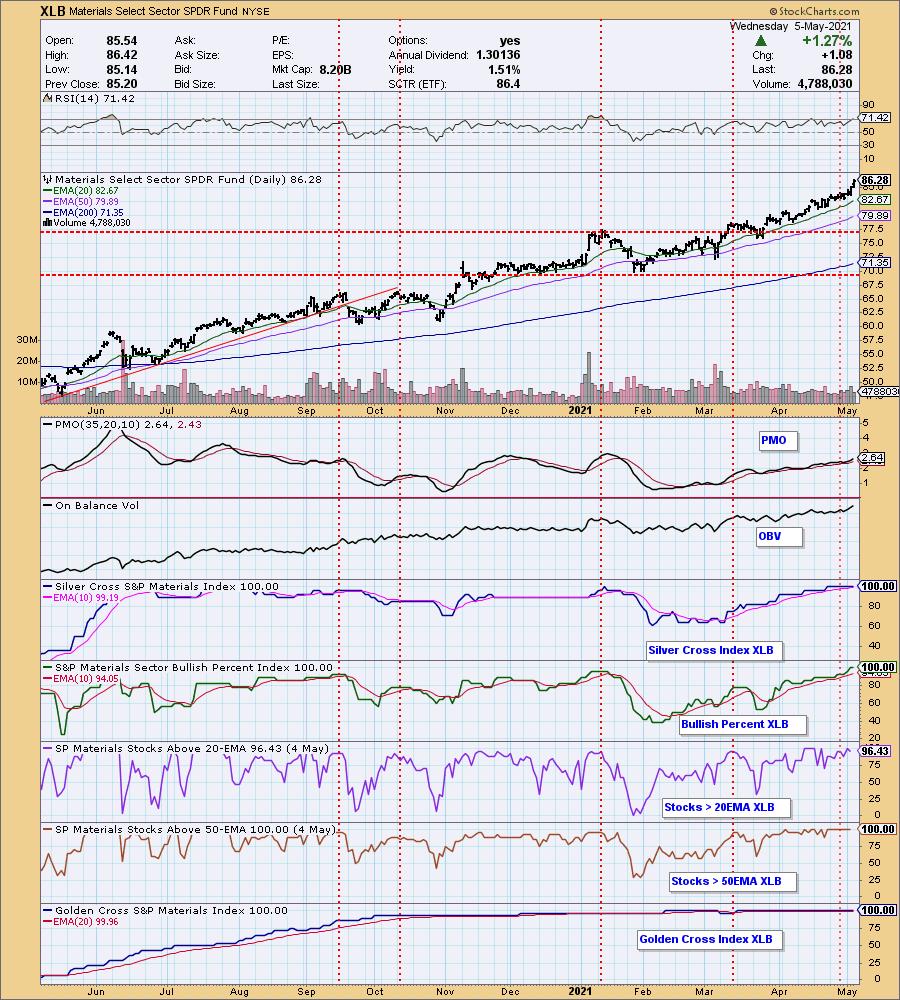

Yesterday I spotlighted the Energy Sector (XLE) and today I'm spotlighting the Materials Sector (XLB). This sector chart looks great minus some overbought readings on participation. However, the PMO is rising gently and isn't overbought. The RSI is positive but a little on the overbought side.

I picked two "diamonds in the rough" from this sector for your review today. Additionally, I added another Energy stock.

I just had my 2nd Moderna vaccine so I'll keep this short.

Today's "Diamonds in the Rough" are: DD, NTR and TALO.

Stocks/ETFs to Consider (no order): BERY, HDV, HTH, DOW, LYB, NWL, PFS, TOT, TGT, TKR and VOD.

Diamond Mine REGISTRATION Information:

Diamond Mine REGISTRATION Information:

When: May 7, 2021 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (5/7/2021) LIVE Trading Room

Register in advance for this webinar HERE.

After registering, you will receive a confirmation email containing information about joining the webinar, including the password. SAVE IT! Zoom doesn't always send out the reminders.

=======================================================================

Diamond Mine RECORDING Link:

Topic: DecisionPoint Diamond Mine (04/30/2021) LIVE Trading Room

Start Time : Apr 30, 2021 09:00 AM

Meeting Recording Link.

Access Passcode: April/30

***Click here to register for this recurring free DecisionPoint Trading Room on Mondays at Noon ET!***

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Free DP Trading Room RECORDING LINK:

Topic: DecisionPoint Trading Room with GREG SCHNELL, CMT

Start Time : May 3, 2021 09:00 AM

Meeting Recording for DP Trading Room.

Access Passcode: DP/May/03

For best results, copy and paste the access code to avoid typos.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "diamonds in the rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

DuPont de Nemours, Inc. (DD)

EARNINGS: 7/29/2021 (BMO)

DuPont de Nemours, Inc. operates as a holding company, which engages in the development of specialty materials, chemicals, and agricultural products. It operates through the following segments: Electronics & Imaging, Nutrition & Biosciences, Transportation & Industrial, Safety & Construction, and Non-Core. The Electronics & Imaging segment provides permanent and process chemistries for the fabrication of printed circuit boards to include laminates and substrates, electroless and electrolytic metallization solutions, as well as patterning solutions and materials and innovative metallization processes for metal finishing, decorative, and industrial applications. The Nutrition & Biosciences segment provides solutions for the global food and beverage, dietary supplements, pharma, home and personal care, energy and animal nutrition markets. The Transportation & Industrial segment engineering resins, adhesives, silicones, lubricants and parts to engineers and designers in the transportation, electronics, healthcare, industrial and consumer end-markets to enable systems solutions for demanding applications and environments. The Safety & Construction segment provides engineering products and integrated systems for a number of industries including, worker safety, water purification and separation, aerospace, energy, medical packaging and building materials. The Non-Core segment supplier of key materials for the manufacturing of photovoltaic cells and panels, including SOLAMET metallization pastes, TEDLAR backsheet materials, and FORTASUN silicone encapsulants and adhesives. The company was founded in 1897 and is headquartered in Wilmington, DE.

DD is up +0.10% in after hours trading. They reported earnings yesterday. I covered DD in the March 3rd 2021 Diamonds Report. The stop was never hit so it is up +8.5% since I picked it. The chart is setting up nicely with a new oversold PMO BUY signal above the zero line. The RSI is positive and volume has come in on this breakout rally. The SCTR is not in the "hot zone" above 75 yet ("hot zone" meaning it is in the upper quartile of all large-cap stocks). The group is performing quite well and DD is outperforming the group. It has also begun outperforming the SPX. The stop level is set below the trading range.

At first glance the weekly chart may not seem healthy, but the weekly PMO has turned up and the RSI is positive and not overbought. It would be especially bullish if it had overcome resistance at the 2019 high, but it looks ready to breakout. If it can reach its 2018 top, that would be a nearly 27% gain.

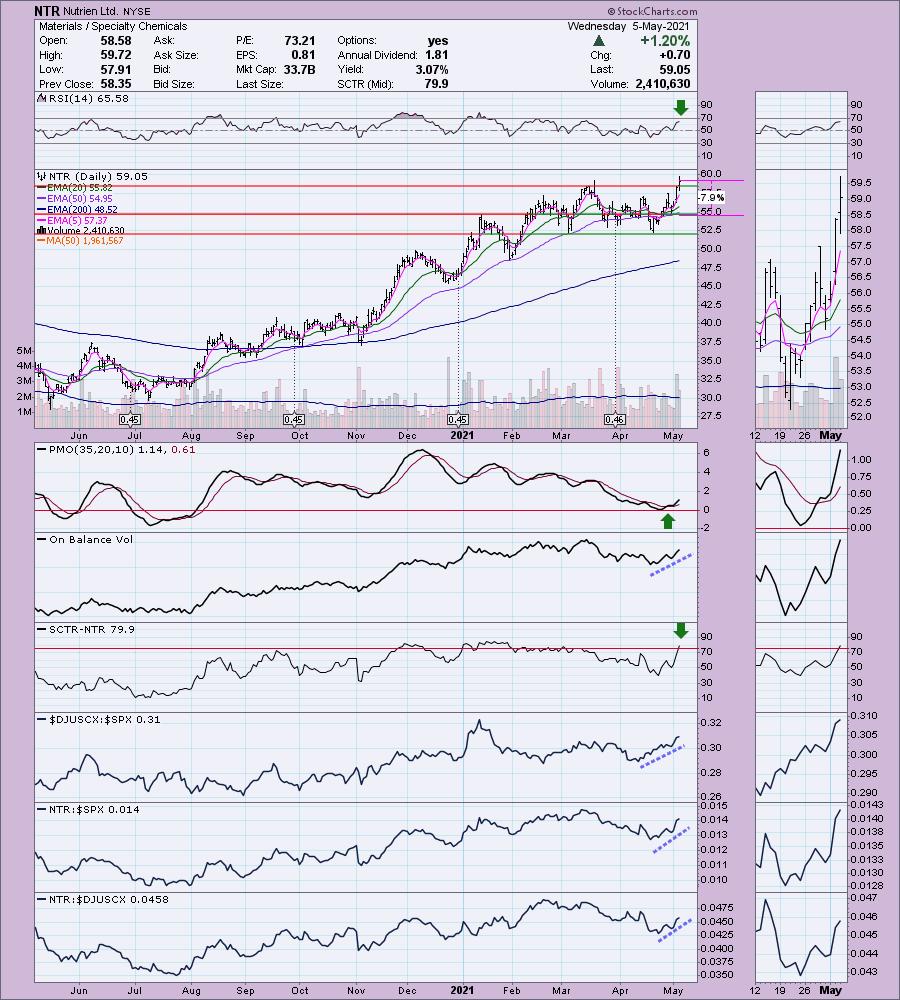

Nutrien Ltd. (NTR)

EARNINGS: 8/9/2021 (AMC)

Nutrien Ltd. is a crop nutrient company, which engages in the production and distribution of products for agricultural, industrial, and feed customer. It operates through the following segments: Retail, Potash, Nitrogen, and Phosphate. The Retail segment distributes crop nutrients, crop protection products, seed, and merchandise. The Potash, Nitrogen, and Phosphate segments produces differentiated chemical nutrient contained in each products. The company is headquartered in Calgary, Canada.

NTR is up +0.91% in after hours trading. I love this breakout to a new 2021 high. The PMO just gave us a crossover BUY signal. The OBV is confirming this rally and the SCTR just entered the "hot zone". The RSI is positive and not overbought. Performance looks great with the group and NTR outperforming the SPX. The stop level is set below the 50-EMA just below $55.

Here is another one with what looks like a negative PMO configuration; however, we can see in the thumbnail that it has turned up again. This is another I wish had already overcome overhead resistance, but the chart tells us it is likely to breakout very soon.

Talos Energy, Inc. (TALO)

EARNINGS: 5/5/2021 (AMC) ** Reported AMC Today **

Talos Energy, Inc. operates as a holding company. The firm engages in the exploration and production of oil and natural gas. It focuses on the exploration, acquisition, exploitation and development of shallow and deepwater assets near existing infrastructure in the United State Gulf of Mexico. The company was founded by John A. Parker, Stephen E. Heitzman and Timothy S. Duncan in 2012 and is headquartered in Houston, TX.

TALO is down -2.27% in after hours trading which isn't a big surprise given today's +6.37% move. This could provide a better entry tomorrow. The PMO has turned up just above the zero line and is going in for a crossover BUY signal. The RSI just hit positive territory and the SCTR just hit the "hot zone". This breakout from the bullish falling wedge looks promising. It has been outperforming the SPX. The industry group is outperforming and it is in line with the industry group. Over the past week it has begun to outperform the group. The stop level is deep mainly because of today's giant gain. I set it just above $11.

The weekly PMO just turned up above its signal line which is positive. It's hard to say if it is really overbought given we don't have that much data. If it can get above the 2021 high, there is plenty of upside available.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

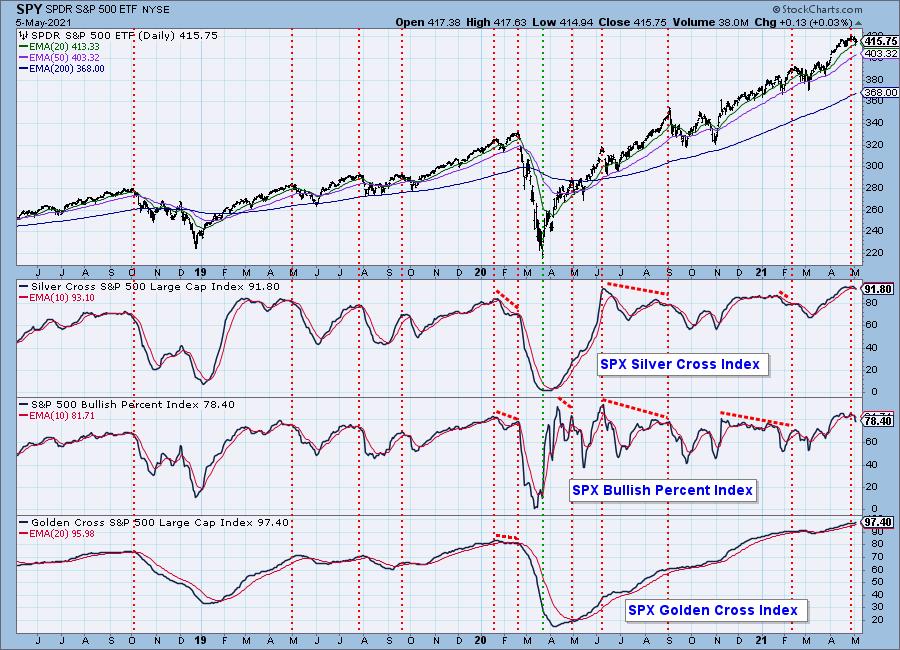

Current Market Outlook:

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

- The Bullish Percent Index (BPI) shows the percentage of SPX stocks on Point & Figure BUY signals.

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

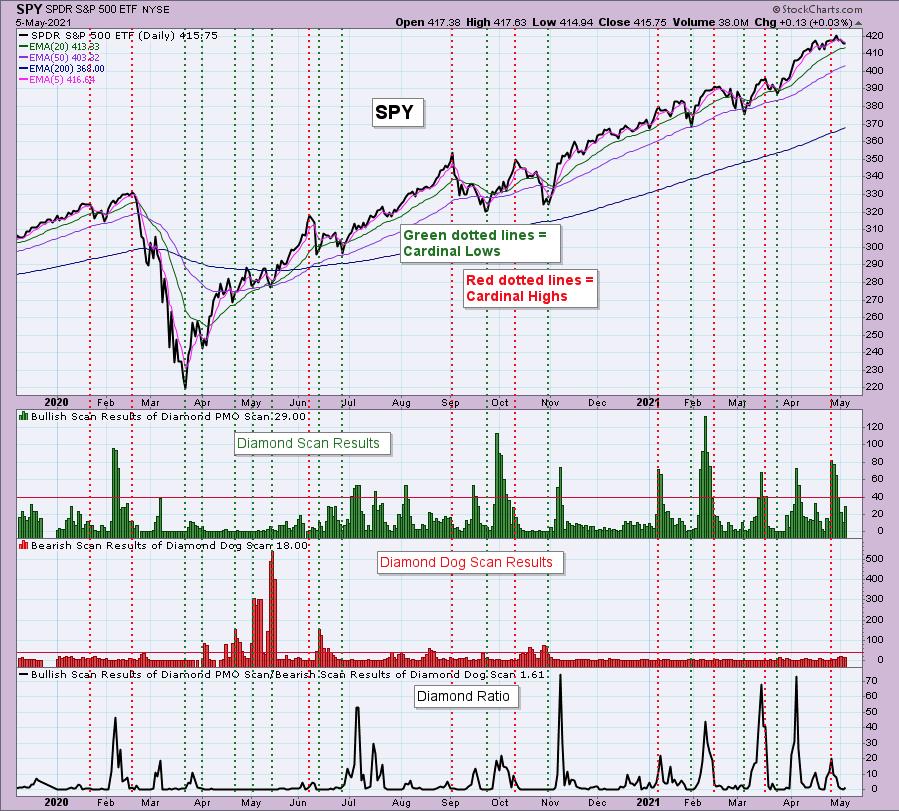

Diamond Index:

The Diamond Index chart looks at the number of scan results from my bullish Diamond PMO Scan and the number of scan results from the inverse Diamond Dog Scan. The Diamond Ratio divides the bullish results by the bearish results.

I only have data going back to October 2019 so I won't make any sweeping conclusions about the Diamond Index chart. I have marked cardinal tops with red dotted vertical lines and cardinal price bottoms with green dotted vertical lines. I believe that when the Diamond Dog results spike, it usually comes at a price bottom, or marks a strong continuation of the rising trend.

Unfortunately, the Diamond PMO Scan result numbers aren't providing much insight. The Diamond Ratio has promise, but again I don't see a clear correlation to the market tops/bottoms right now. I need to study and manipulate the data some more. Keep you posted!

Full Disclosure: I'm about 80% invested and 20% is in 'cash', meaning in money markets and readily available to trade with. Picked up MMP and VLO off the 5-minute candlestick charts.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!