The reason it was hard to choose the Reader Requests today was because I had about 30 to review and they were all outstanding choices. Therefore, I picked the best to write about and have listed the rest that I really liked in the "Stocks to Consider" area.

It finally came down to looking at weekly charts and in some cases monthly charts to break the tie. The majority were from the Energy, Financial and Materials sectors which I agree are showing the most strength overall. That is probably why it was so hard to choose! I decided it was not necessary for me to pick my own today because I doubt I could've found stocks much better than the ones requested.

I'm pretty exhausted from yesterday's vaccine, so like yesterday I will keep it short (although I did pick four stocks). Don't forget to register for tomorrow's Diamond Mine!

Today's "Diamonds in the Rough" are: CPG, PBF, PTEN and SU.

Stocks/ETFs to Consider (no order): TOT, FLR, MET, TPL, CVX, MTDR, DOW, RYI, UEC, GS, KEY and RF

Diamond Mine REGISTRATION Information:

Diamond Mine REGISTRATION Information:

When: May 7, 2021 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (5/7/2021) LIVE Trading Room

Register in advance for this webinar HERE.

After registering, you will receive a confirmation email containing information about joining the webinar, including the password. SAVE IT! Zoom doesn't always send out the reminders.

=======================================================================

Diamond Mine RECORDING Link:

Topic: DecisionPoint Diamond Mine (04/30/2021) LIVE Trading Room

Start Time : Apr 30, 2021 09:00 AM

Meeting Recording Link.

Access Passcode: April/30

***Click here to register for this recurring free DecisionPoint Trading Room on Mondays at Noon ET!***

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Free DP Trading Room RECORDING LINK:

Topic: DecisionPoint Trading Room with GREG SCHNELL, CMT

Start Time : May 3, 2021 09:00 AM

Meeting Recording for DP Trading Room.

Access Passcode: DP/May/03

For best results, copy and paste the access code to avoid typos.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "diamonds in the rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

Crescent Point Energy Corp. (CPG)

EARNINGS: 5/12/2021 (BMO)

Crescent Point Energy Corp. engages in the exploration, development and production of oil and gas properties. Its focus areas include: Viewfield Bakken, Flat Lake Torquay and Shaunavon. The company was founded on April 20, 1994 and is headquartered in Calgary, Canada.

CPG is currently down -2.11% in after hours trading. Also note that it is reporting earnings next week. I'm surprised to see it down so much in after hours trading, but as I always say, it offers a better entry tomorrow. The RSI is positive and not overbought and the PMO just triggered an oversold BUY signal. The OBV is confirming the rally and the SCTR is very strong and has been for some time. It's performing relatively well against its industry group and the SPX. The stop level is set near the 50-EMA, but if you get in at a lower price point, you could lower it to the March low.

The weekly RSI is positive and not overbought. The PMO is flattening out above the signal line and appears that it will turn back up before generating a crossover SELL signal. There is a beautiful bull flag and this week price is breaking out of the flag. I've put a very conservative upside target. If we go by the calculation of the minimum upside target of this flag, it would put price at the next area of overhead resistance which would be a very nice upside return.

PBF Energy Inc. (PBF)

EARNINGS: 7/30/2021 (BMO)

PBF Energy, Inc. engages in the operation of a petroleum refiner and supplies unbranded transportation fuels, heating oil, petrochemical feed stocks, lubricants, and other petroleum products in the United States. It operates through the following segments: Refining and Logistics. The Refining segment refines crude oil and other feed stocks into petroleum products. The Logistics segment owns, leases, operates, develops, and acquires crude oil and refined petroleum products terminals, pipelines, storage facilities, and logistics assets. The company was founded on March 1, 2008 and is headquartered in Parsippany, NJ.

PBF is down -0.56% in after hours trading. I like this one a lot on the pullback as it held above the confirmation line of the double-bottom formation on this decline. The minimum upside target of this formation would take it above overhead resistance at the March high. The RSI is positive and not overbought. The PMO generated a crossover BUY signal last Friday. The OBV is confirming this rally. It has performed very well over the past two and half weeks. the stop is set at about the 20-EMA at $14.60.

The weekly PMO just bottomed above the signal line which is especially bullish. This looks like another bull flag. I would prefer to see price above overhead resistance at the 2016/2017 lows. There is a double-bottom formation, but it failed as price came down to test the 43-week EMA. The RSI is positive and not overbought.

Patterson-UTI Energy, Inc. (PTEN)

EARNINGS: 7/29/2021 (BMO)

Patterson-UTI Energy, Inc. engages in the provision of drilling and pressure pumping services, directional drilling, rental equipment and technology. It operates through the following segments: Contract Drilling Services, Pressure Pumping Services, and Directional Drilling Services. The Contract Drilling Services segment markets its services to major and independent oil and natural gas operators. The Pressure Pumping Services segment provides pressure pumping services to oil and natural gas operators primarily in Texas and the Appalachian Basin. The Directional Drilling Services segment offers downhole performance motors and equipment to provide services including directional drilling, downhole performance motors, motor rentals, directional surveying, measurement-while-drilling, and wireline steering tools, in most major onshore oil and natural gas basins. The company was founded by Cloyce A. Talbott and A. Glenn Patterson in 1978 and is headquartered in Houston, TX.

PTEN is up +0.50% in after hours trading. The RSI is positive and not overbought. Not only is the PMO on a BUY signal, we just had an IT Trend Model "Silver Cross" BUY signal when the 20-EMA crossed above the 50-EMA. The SCTR is very healthy and it has been a steady out-performer over the past week. The stop is set just below support at the early April tops.

In this case, price has gotten above overhead resistance at the 2019 lows. If it can reach the next level of overhead resistance its a 33.3% gain. The weekly PMO did trigger a crossover SELL signal, but that is about to be reversed, likely tomorrow or next week.

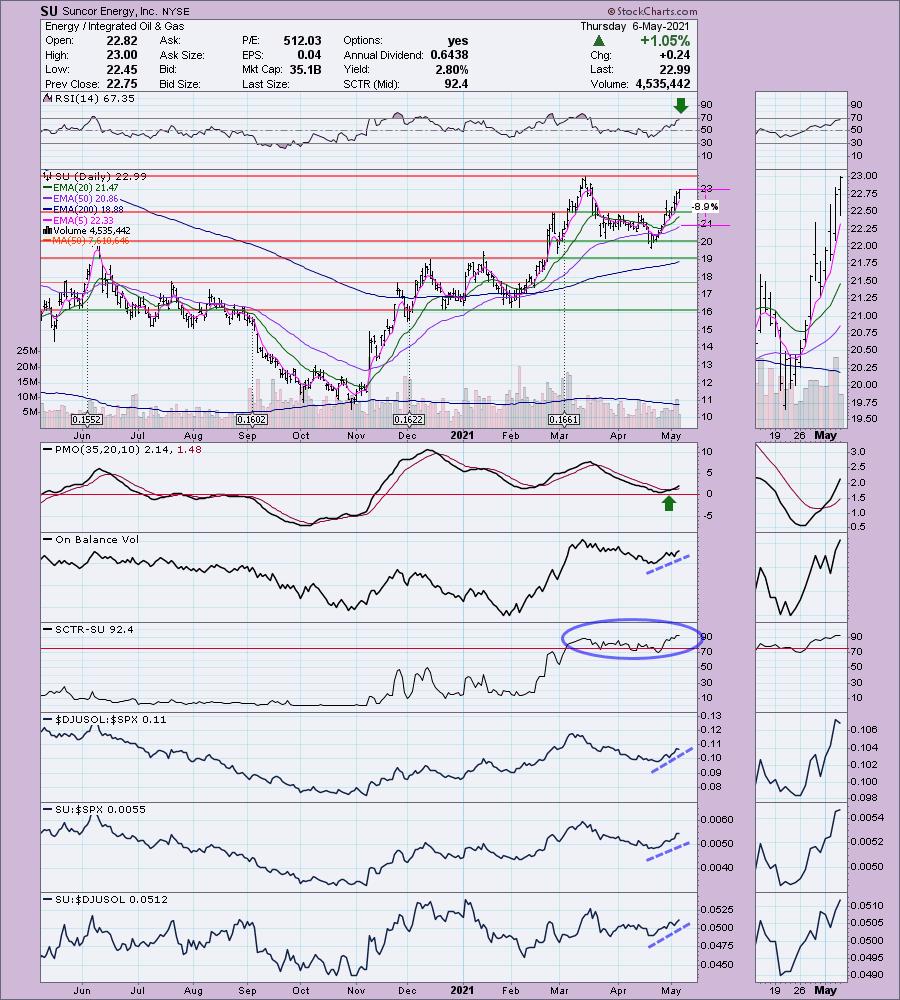

Suncor Energy, Inc. (SU)

EARNINGS: 7/21/2021 (AMC)

Suncor Energy, Inc. is an integrated energy company, which develops petroleum resource basins. Its activities include oil sands development, and upgrading, onshore and offshore oil and gas production, petroleum refining, and product marketing. The company operates through the following business segments: Oil Sands; Exploration & Production; and Refining & Marketing. The Oil Sands segment refers to the operations in the Athabasca oil sands in Alberta to develop and produce synthetic crude oil and related products through the recovery and upgrading of bitumen from mining and in situ operations. The Exploration and Production segment includes offshore activity in East Coast Canada the exploration and production of crude oil and natural gas in the United Kingdom, Norway, Libya, and Syria, and exploration and production of natural gas and natural gas liquids in Western Canada. The Refining & Marketing segment is the refining of crude oil products and the distribution & marketing of these and other purchased products through retail stations located in Canada and the United State, as well as a lubricants plant located in Eastern Canada. The company was founded in 1917 and is headquartered in Calgary, Canada.

SU is up +0.48% in after hours trading. The RSI is positive but is trying to get overbought so be careful. Otherwise everything else is very positive. The PMO is on a crossover BUY signal, the OBV is confirming the rally and the SCTR is in the "hot zone" above 75 (meaning it is in upper quartile of all mid-cap stocks based on internal strength). It has been performing extremely well against the SPX and its industry group.

We have a double-bottom that is still in play. Notice that price nearly closed the gap on the last rally. I would expect it to vault it this time given the weekly PMO bottom above the signal line and positive and not overbought RSI. If it gets past overhead resistance, I think we could see it challenge the 2020 high.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

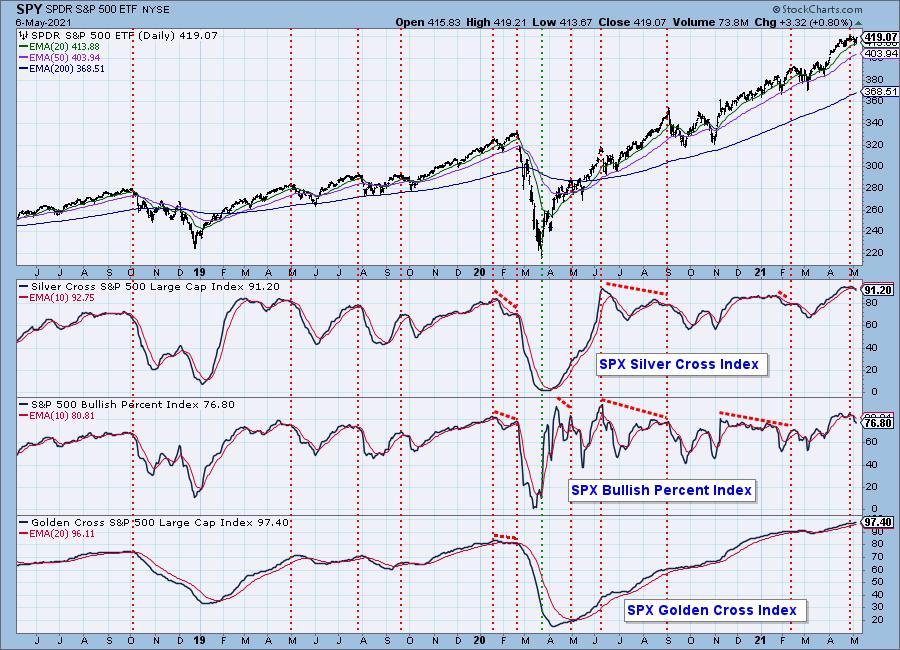

Current Market Outlook:

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

- The Bullish Percent Index (BPI) shows the percentage of SPX stocks on Point & Figure BUY signals.

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

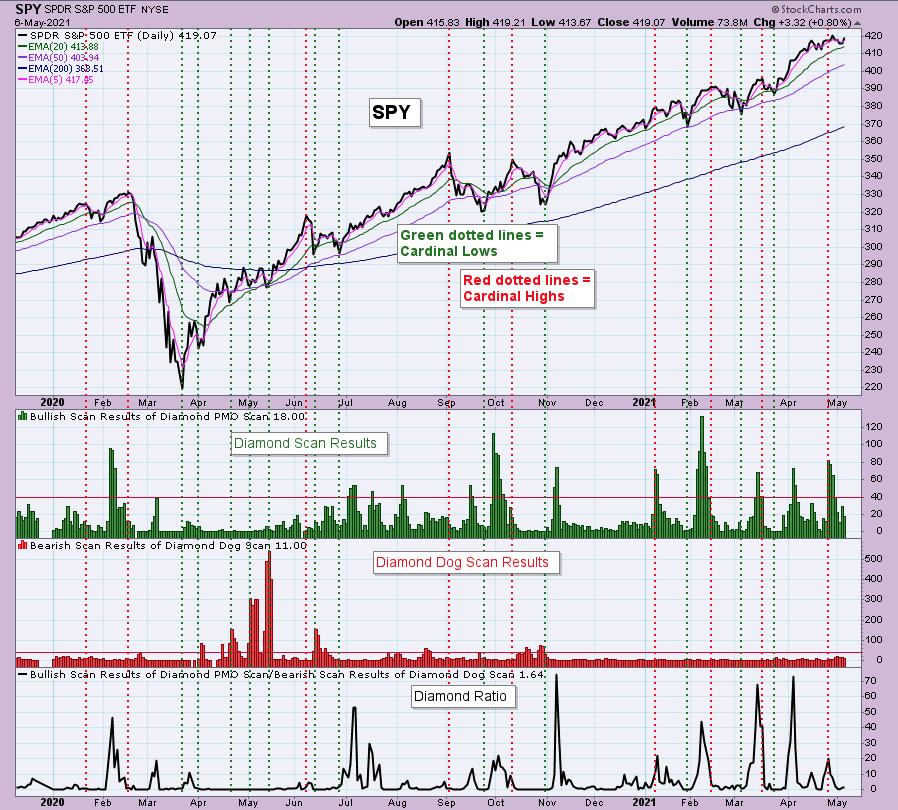

Diamond Index:

The Diamond Index chart looks at the number of scan results from my bullish Diamond PMO Scan and the number of scan results from the inverse Diamond Dog Scan. The Diamond Ratio divides the bullish results by the bearish results.

I only have data going back to October 2019 so I won't make any sweeping conclusions about the Diamond Index chart. I have marked cardinal tops with red dotted vertical lines and cardinal price bottoms with green dotted vertical lines. I believe that when the Diamond Dog results spike, it usually comes at a price bottom, or marks a strong continuation of the rising trend.

Unfortunately, the Diamond PMO Scan result numbers aren't providing much insight. The Diamond Ratio has promise, but again I don't see a clear correlation to the market tops/bottoms right now. I need to study and manipulate the data some more. Keep you posted!

Full Disclosure: I'm about 70% invested and 30% is in 'cash', meaning in money markets and readily available to trade with.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!