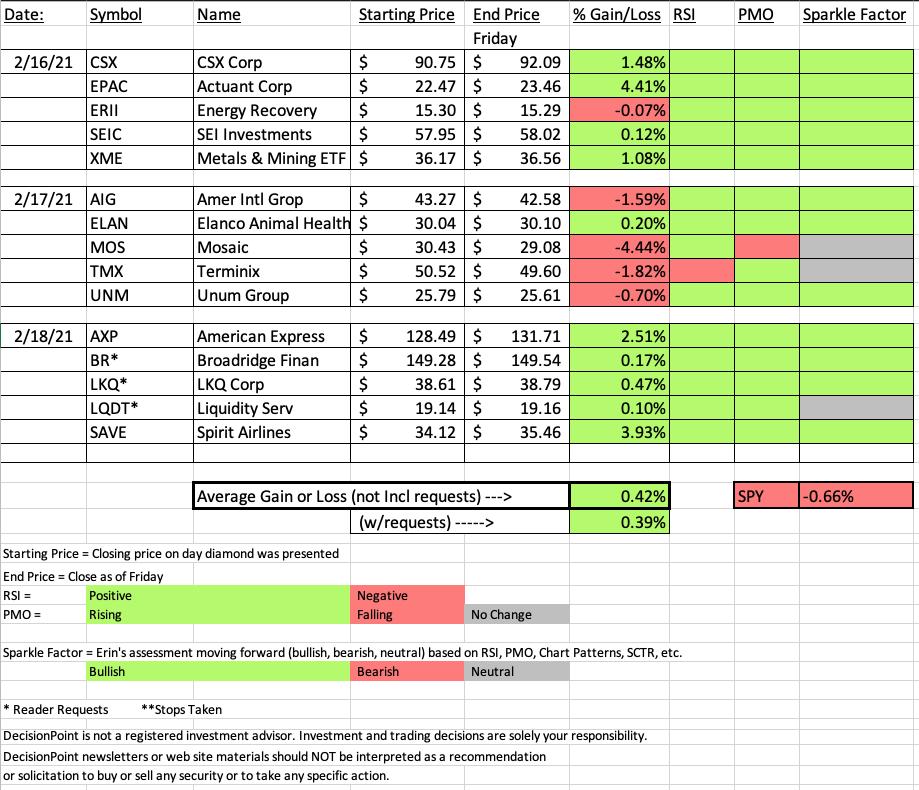

Outperformed the SPY this week. Our "Diamonds in the Rough" finished higher on the week (+0.42%) while the SPY finished -0.66% on the week. The biggest winner was up +4.41%.

Recovery stocks are the talk of the town as COVID vaccines continue to rollout and some semblance of normal is slowly appearing. I was a little late in the game on presenting recovery stocks like airlines, cruise lines and travel/tourism stocks. However, we did get in on BJK the gambling ETF. Next week I believe more individual investors are going to roll into those recovery areas. Going into next week, consider Spirit Airlines (SAVE) as the airline and Carnival (CCL) as the cruiseline and Expedia (EXPE) as the travel/tourism stock. Finally on the credit card front for travel, American Express (AXP) looks great still. I covered SAVE and AXP yesterday.

The big loser due to earnings, Mosaic (MOS), which was my favorite Materials stock of the week got killed on the first day it hit the Diamond Recap spreadsheet. However, it did make up half of its original loss of nearly 10% to be down -4.44% on the spreadsheet. I still like Mosaic, but the chart is getting sour so there may be a better entry upcoming. After reviewing the industry group's relative strength, I probably should've saved this one. If you did buy it, I would consider it good enough for a "hold" but keep the stop in play.

The big winner was actually an industrial (although SAVE nearly beat it out), Actuant Corp (EPAC). I'll look at that stock below.

Diamond Mine information is below. As I always suggest, register now, it only takes a few seconds that way I can get the "join" information to you if Zoom doesn't send it. If you lose the registration receipt, just slip me an email before I start and I'll send you the room number to join and the password.

Diamond Mine Information:

TODAY'S (02/19/2021) RECORDING LINK:

Access Passcode: v^9Yi2.c

REGISTRATION:

When: Feb 26, 2021 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (02/26/2021) LIVE Trading Room

Register in advance for this webinar:

https://zoom.us/webinar/register/WN_MeUlJ9HZRCStunv7yK5-LA

Please do not share these links! They are for Diamonds subscribers ONLY!

Save the registration confirmation email with login instructions in case Zoom doesn't notify you in time.

A few items about the spreadsheet: I decided it only fair to denote "reader requests" as I shouldn't get to take credit if they turn out great! I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

Free DecisionPoint Trading Room on Mondays, Noon ET

David Keller, CMT, Chief Technical Analyst at StockCharts.com will be joining Erin in the free DP Trading Room on March 1st! Dave will give us his take on the market and share his trading methodologies as both of us discuss your symbol requests.

David Keller, CMT is Chief Market Strategist at StockCharts.com, where he helps investors minimize behavioral biases through technical analysis. He is a frequent host on StockCharts TV, and he relates mindfulness techniques to investor decision making in his blog, The Mindful Investor. David is also President and Chief Strategist at Sierra Alpha Research LLC, a boutique investment research firm focused on managing risk through market awareness. He combines the strengths of technical analysis, behavioral finance, and data visualization to identify investment opportunities and enrich relationships between advisors and clients.

*Click here to register for this recurring free DecisionPoint Trading Room on Mondays at Noon ET!*

=======================================

BELOW is a link to Monday's recording:

Topic: DecisionPoint Trading Room

Start Time : Feb 16, 2021

Meeting Recording:

https://zoom.us/rec/share/G4hnZKpDiDxpK3jFBaao-qVqCJWjEgJNyWn9lueufB-sO-iomygo7tot1vaFKbu7.6013TODA9_Zlb0Jc

Access Passcode: i^96E7mf

For best results, copy and paste the access code to avoid typos.

Darling:

Actuant Corp. (EPAC)

EARNINGS: 3/18/2021 (BMO)

Enerpac Tool Group Corp. is a diversified industrial company. The firm engages in the designing, manufacturing, and distribution of industrial products and systems to various end markets. It operates through the following segments: Industrial Tools and Services; and Other. The Industrial Tools and Services segment supplies both products and services to a broad array of end markets, including industrial, energy, mining and production automation markets. The Other operating segments designs and manufactures high performance synthetic ropes and biomedical assemblies. The company was founded in 1910 and is headquartered in Menomonee Falls, WI.

Below is the chart and commentary from Tuesday 2/16:

"EPAC is unchanged in after hours trading. I really liked this chart as soon as I saw it. Today's breakout is impressive. The 20-EMA is about to cross above the 50-EMA which will trigger an IT Trend Model BUY signal. The OBV showing plenty of accumulation. Unfortunately the OBV is in a reverse divergence with price. The OBV has broken above its previous tops, but price has not. So despite heavy volume, the OBV suggests we should be at higher prices. I'll forgive that given the new PMO BUY signal and the RSI now in positive territory. The SCTR is very low but is beginning to improve. The stop is set well below the 200-EMA. You could actually tighten that up somewhat."

Here is today's chart:

Everything continues to go right for this chart. The PMO is now above the zero line and the RSI is positive but not overbought yet. You can probably ride this one up to $25.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Dud:

Mosaic Co. (MOS)

EARNINGS: 2/17/2021 (AMC) - REPORTED TODAY

The Mosaic Co. engages in the production and marketing of concentrated phosphate and potash crop nutrients. The company operates its businesses through its wholly and majority owned subsidiaries. It operates through the following segments: Phosphates, Potash, and Mosaic Fertilizantes. The Phosphates segment owns and operates mines and production facilities in North America which produces concentrated phosphate crop nutrients and phosphate-based animal feed ingredients, and concentrated crop nutrients. The Potash segment owns and operates potash mines and production facilities in North America which produce potash-based crop nutrients, animal feed ingredients, and industrial products. The Mosaic Fertilizantes segment produces and sell phosphate and potash-based crop nutrients, and animal feed ingredients, in Brazil. The company was founded on October 22, 2004 and is headquartered in Plymouth, MN.

Below is the chart and commentary from Wednesday:

"MOS reported earnings after the bell and is already up +2.69%. The Materials sector is healthy, but this industry group is not. This did not preclude me from including it. Look at how it has been consistently outperforming its industry group and the market for some time. Yesterday price broke out from a bullish ascending triangle. The back of the napkin minimum upside target of the pattern would take price to $34. The PMO is about to trigger a crossover BUY signal and the RSI is positive and not quite overbought."

Below is today's chart:

I was very excited about adding relative strength to the Diamonds ChartStyle, but I forgot an important concept. Specialty Chemicals industry group has been underperforming the SPY for some time. If the industry group as a whole is underperforming, just because you find the "outperformer" in the group doesn't mean its a good investment, it could mean that the stock is losing at a slower rate than the group as a whole. This is why we must have the price relative to the SPX. That confirms it as a good stock...although, if the SPX is in a bear market, the stock or group may be outperforming it by declining more slowly.

MOS doesn't look that bad after today's recovery. However, the PMO is especially ugly right now. If you bought it, I'd hold it but drop it if it loses the short-term rising trend. This stock has been an outperformer against the SPX, it should continue.

THIS WEEK's Sector Performance:

Click Here to view Carl's annotated Sector ChartList!

CONCLUSION:

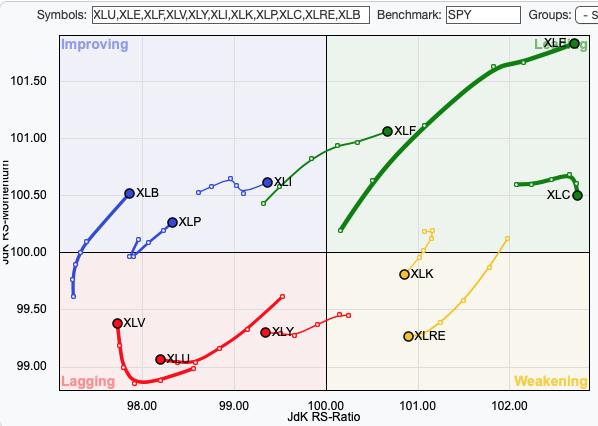

Recovery stocks should begin to gain even more traction as the media begins to talk up the return to normality. In the opening I mentioned a few of the stocks to watch in those areas. As far as sector, I looked at the CandleGlance of all the sectors at the end of the Diamond Mine and thought that based on the PMO that Materials were strongest with Industrials following up. I realize plenty of 'recovery' stocks are listed in Consumer Discretionary, but Airlines and American Express (AXP) are in different sectors. Cruiselines are still interesting in XLY, but based on the short-term Relative Rotation Graph (RRG), XLY isn't ripe yet.

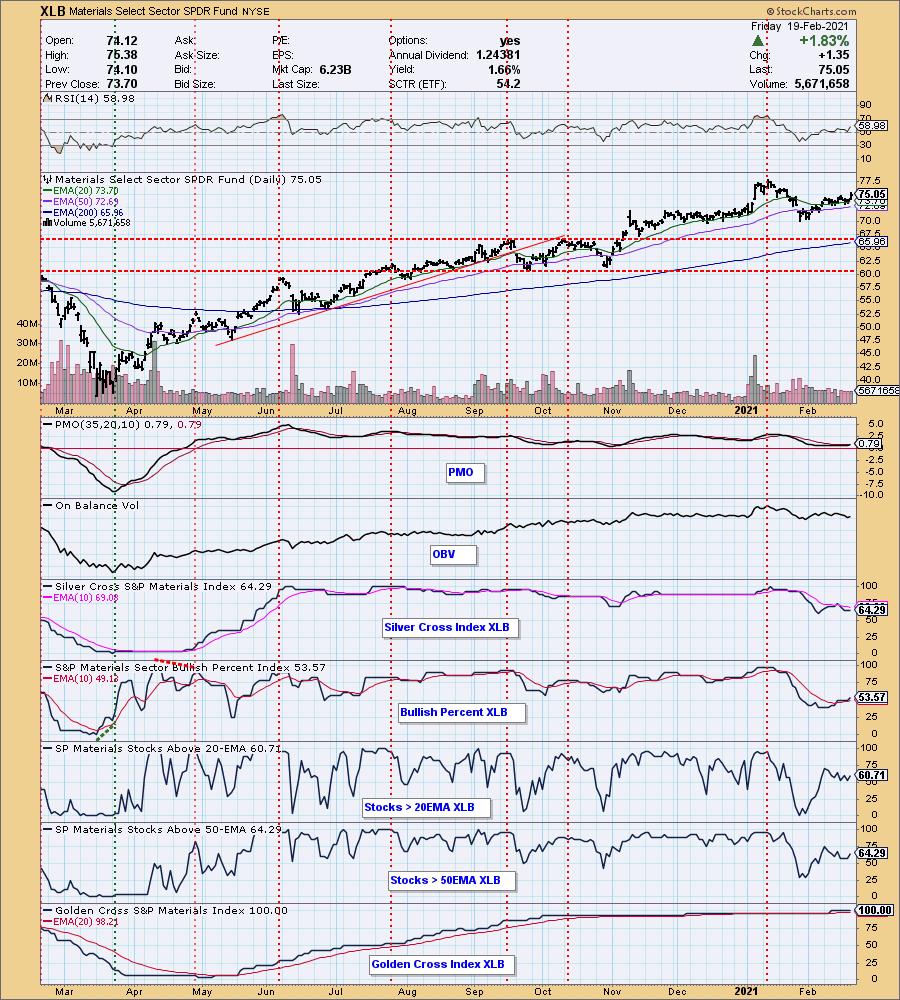

Sector to Watch: Materials (XLB)

It was kind of a tie today between Industrials (XLI) and Materials (XLB). To break the tie I went with the PMO's configuration. The PMO on XLB has just given us a crossover while XLI is showing a decelerating PMO.

Industry Group to Watch: Airlines ($DJUSAR)

I believe this is only the beginning for the Airlines. They are getting a lot press and we should see more retail investors pile in to take advantage of this strength. The only I don't care for is the RSI is getting overbought. However in this case, it should be able to keep those conditions and be fine given the strong bullish bias.

Go to our Sector ChartList on DecisionPoint.com to get an in depth view of all the sectors.

Technical Analysis is a windsock, not a crystal ball.

Have a great weekend & Happy Charting!

- Erin

erin@decisionpoint.com

Full Disclosure: I'm about 80% invested right now and 20% is in 'cash', meaning in money markets and readily available to trade with. I will not be adding to my portfolio unless stocks within the defensive sectors are looking positive enough to swap out a more aggressive position for a more defensive position.

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)