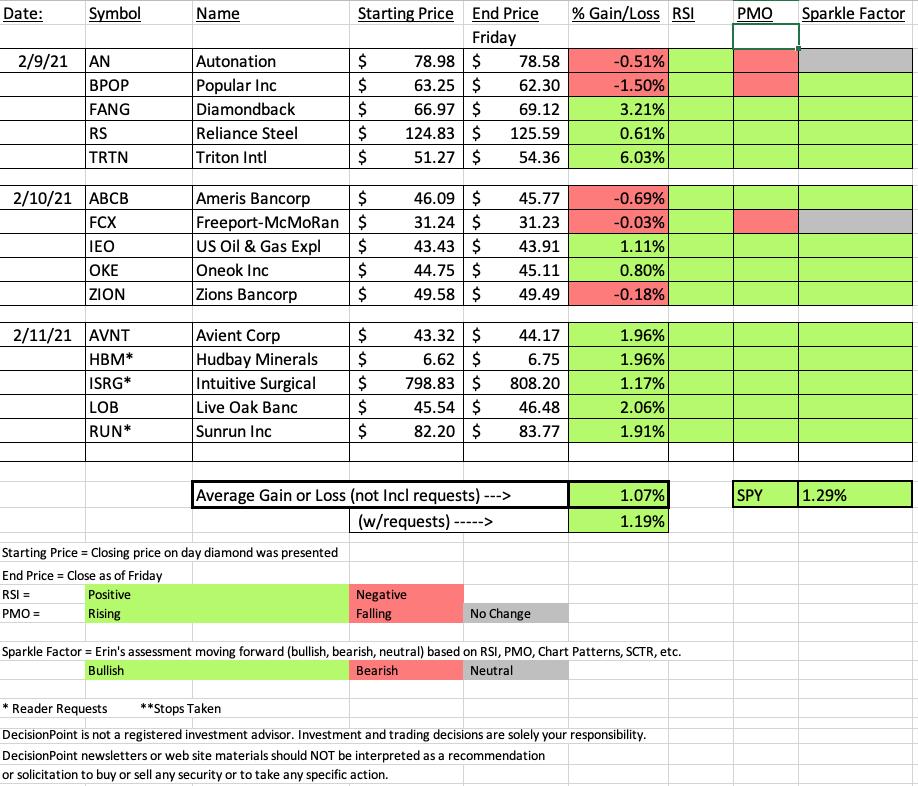

The market was up 1.29% this week and Diamonds finished similarly. The big winner this week was from the Industrial sector in the Transportation Services industry group. Of the fifteen "diamonds in the rough" I like all but two going forward; however, I did mark both of them as "neutral" moving forward, not "bearish". The RSIs are positive and price action is suspect, but not terrible.

I'll look at the Big Winner, Triton Int'l (TRTN) and then I'll review the Big Loser, Popular Inc. (BPOP). Our big loser was only down 1.5% this week.

This week I unveiled the Diamond Ratio in chart form. I'll be putting that at the end of all of the Diamond Reports. We don't have a lot of data, but the Diamond Dog results do point to reversal when they climax. Unfortunately, they don't spike that frequently. I'll continue to watch and keep up with the data. We'll see how the Ratio fairs moving forward.

Monday is a holiday next week. It doesn't affect Diamond subscribers since I don't publish that day. However, I will be moving the free DP Trading Room to Tuesday morning. If you're registered, you should have gotten notice that I changed the time (although Zoom is not very good with email notifications). Just log into the room on Tuesday morning. I'll be opening it on Monday, but only with a notice to come back Tuesday morning.

I really enjoyed today's Diamond Mine. I welcome questions and especially comments on how I can improve it. Have a great three day weekend! See you in the DP Trading Room on Tuesday morning.

Diamond Mine Information:

RECORDING LINK:

https://zoom.us/rec/share/WN0G-DgAPyVXxfUcSqghEVaDe_T6ocJXUG9w7IXoNm6J5ozyXijElyx4eRYEAZEY.N0molEcrpV-QMi0M

Access Passcode: 2vi+nYV*

REGISTRATION -- Feb 12, 2021 09:00 AM Pacific Time (US and Canada):

https://zoom.us/webinar/register/WN_45P3AHvzSyeaUcNy3nZKPQ

Please do not share these links! They are for Diamonds subscribers ONLY!

Save the registration confirmation email with login instructions in case Zoom doesn't notify you in time.

A few items about the spreadsheet: I decided it only fair to denote "reader requests" as I shouldn't get to take credit if they turn out great! I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

Monday Holiday - Free Trading Room MOVED to Tuesday

***Click here to register for this recurring free DecisionPoint Trading Room on Mondays at Noon ET!***

Feb 8, 2021 RECORDING LINK:

Topic: Free DecisionPoint Trading Room

Meeting Recording:

https://zoom.us/rec/share/hI3wvzGTvqnUsAV0C8CLTEdyMhibIqPywZpy7fcw6DMpiu5e2Vk2RB2i8j_Dppxx.mbjFOyqeDQUiCRa2

Access Passcode: H!2B$fn3

For best results, copy and paste the access code to avoid typos.

Darling:

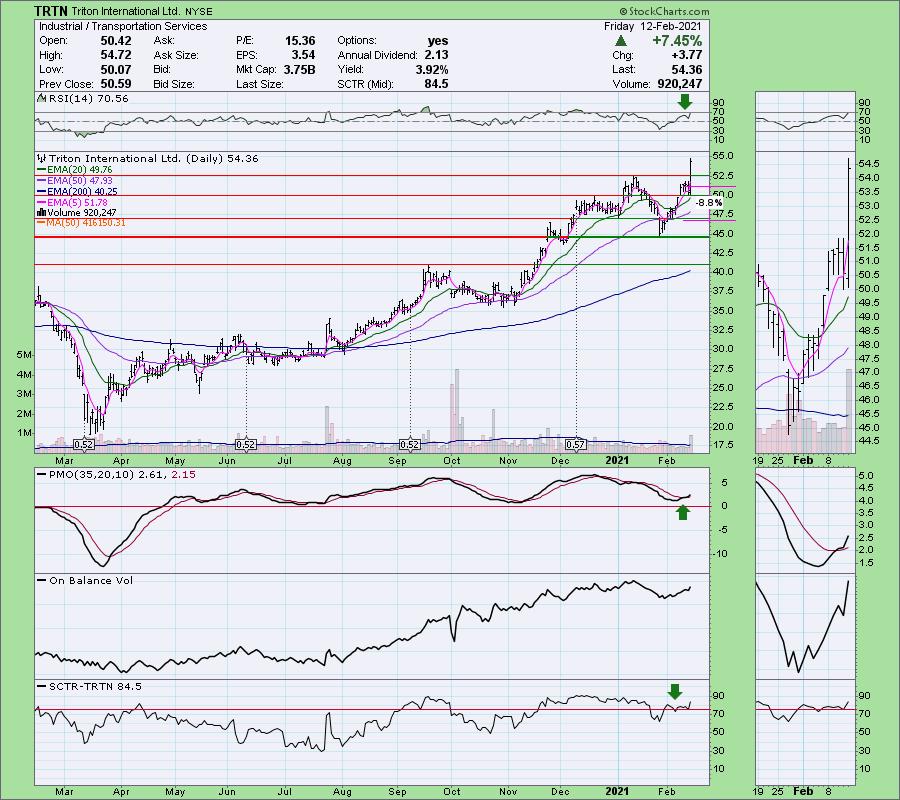

Triton International Ltd. (TRTN)

EARNINGS: 2/16/2021 (BMO)

Triton International Ltd. is engaged in the operation and management of fleet of intermodal marine dry, refrigerated, and cargo containers. It operates through the Equipment Leasing and Equipment Trading segments. The Equipment Leasing segment involves in owning, leasing, and disposing containers and chassis from lease fleet, as well as managing containers owned by third parties. The Equipment Trading segment focuses on the purchase containers from shipping line customers, and other sellers of containers, and resells containers to container retailers and users of containers for storage or one-way shipment. The company was founded on September 29, 2015 and is headquartered in Hamilton, Bermuda.

Below is the commentary and chart from Tuesday 2/9:

"The Industrial sector has been showing strength. TRTN is down -0.51% in after hours trading. That would still put it above support at the December tops. The PMO is nearing a new crossover BUY signal. The RSI is positive and not overbought. I'd like to see more volume to get the OBV closer to its previous top. There's still some time. The SCTR is back in the "hot zone" above 75."

Here is today's chart:

Today's pop erased what was going to be a slight loss on the week. It's a powerful upside move. Remember that earnings are reported on Tuesday right before the market open. My guess is they're going to be quite good given today's push. I'd watch the 5-minute candlestick on Tuesday morning for a pullback and possible entry. It's tough though, once reported before the open we could see a big gap up and a continuation. This one is enticing.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Dud:

Popular, Inc. (BPOP)

EARNINGS: 4/29/2021 (BMO)

Popular, Inc. is a holding company, which engages in the provision of banking and financial services. It operates through the Banco Popular de Puerto Rico and Popular U.S. segments. The Banco Popular de Puerto Rico segment includes retail, mortgage, and commercial banking services through banking subsidiary. The Popular U.S. segment represents operations of the retail branch network in the U.S. mainland under the name of Popular. The company was founded on October 5, 1893 and is headquartered in San Juan, Puerto Rico.

Below is the commentary and chart from Tuesday 2/9:

"BPOP is currently unchanged in after hours trading. Price broke out last week. The PMO is ready to trigger a crossover BUY signal. The RSI is positive and not overbought. It has a respectable SCTR. Notice that the OBV is confirming these new highs as it sets new highs for itself. The stop level puts you below the 20-EMA at the December tops."

Below is today's chart:

I wanted to pick a bank from the many that appeared in my scan results. I don't think I picked the best one. LOB which I presented on Thursday is a much better choice. This one doesn't look terrible which is why I left it in "neutral". We didn't see much of a breakdown below support at the January top. The RSI is still positive. It's the PMO top below the signal line which gives me pause. This one should bounce off the 20-EMA. If it doesn't I wouldn't want it.

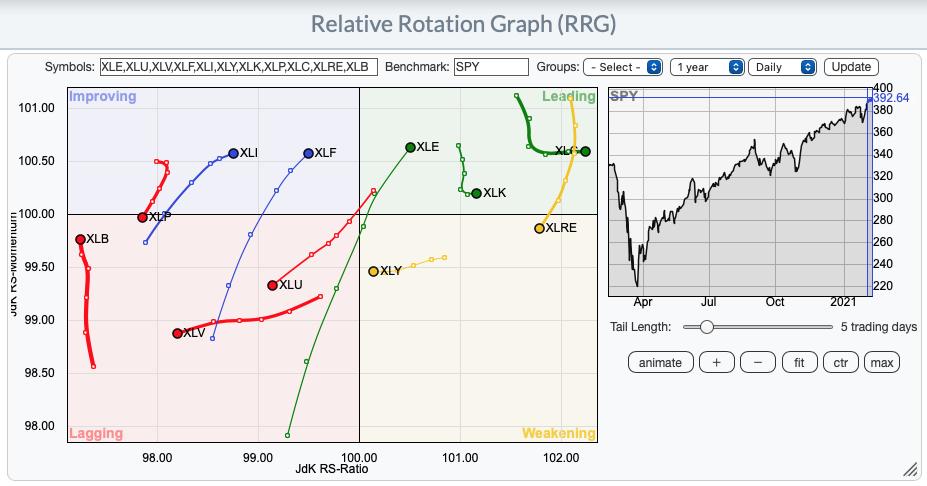

THIS WEEK's Sector Performance:

Click Here to view Carl's annotated Sector ChartList!

CONCLUSION:

I write again this week saying that the market is weak and we should see a downturn very soon. I will also write again that we should tighten stops and prepare to ride the "wall of worry" for as long as possible. Energy is a good place to watch as it continues to outperform. In particular I like Neutral Gas. Renewable Energy and Semiconductors in the Technology sector look great going into next week. Below is the daily Sector RRG -- a short-term view of where the sectors are heading.

There are three stand out sectors, XLI, XLF and XLE. Materials is headed in the right direction, but I like the headings of the three above. I looked at the sector charts and indicators and I like XLE the best. Let's discuss.

Sector to Watch: Energy (XLE)

The PMO has just given us a crossover BUY signal. The recent consolidation has kept the RSI from getting overbought. Conditions on the indicators are on the overbought side, but note how long overbought conditions persisted from November and December. There will likely be a few bargains left in this sector. The SCI is 100%, meaning 100% of Energy sector stocks have a 20-EMA > 50-EMA. That's a great foundation. I'd like to see the BPI move up again.

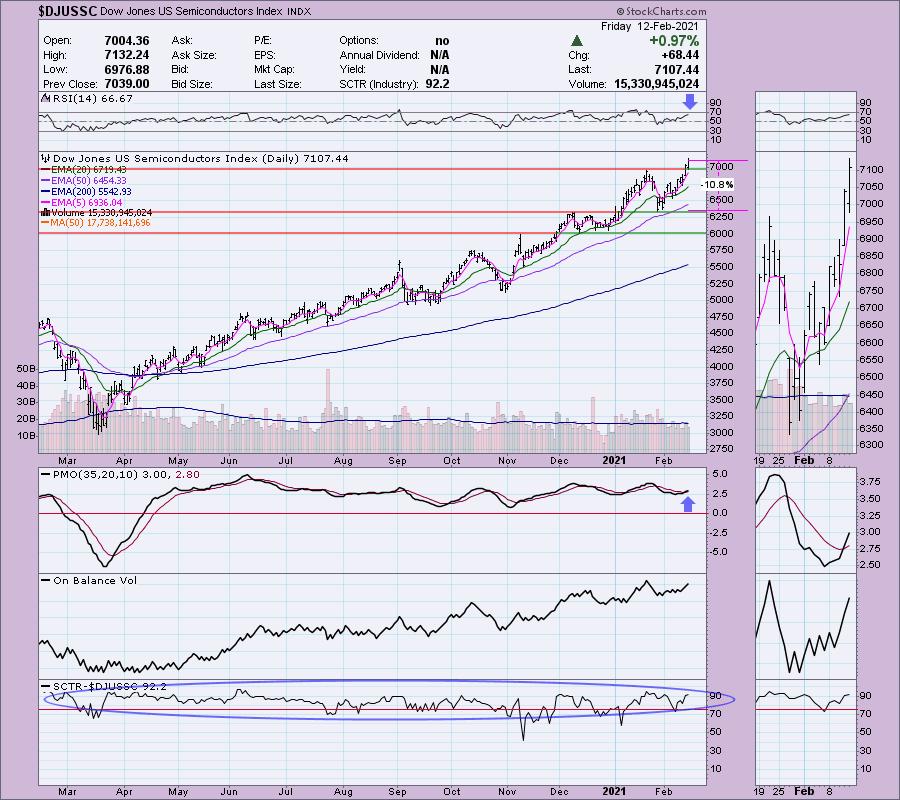

Industry Group to Watch: Semiconductors ($DJUSSC)

I think most of us agreed this morning in the Diamond Mine that Semiconductors is a group to watch. We have a new breakout, a positive RSI and the PMO has just given us a crossover BUY signal. The SCTR is great. We currently have a negative divergence with the OBV, but could be erased next week if volume continues to come in and it doesn't top.

Go to our Sector ChartList on DecisionPoint.com to get an in depth view of all the sectors.

Technical Analysis is a windsock, not a crystal ball.

Have a great holiday weekend & Happy Charting!

- Erin

erin@decisionpoint.com

Full Disclosure: I'm about 80% invested right now and 20% is in 'cash', meaning in money markets and readily available to trade with. I will not be adding to my portfolio unless stocks within the defensive sectors are looking positive enough to swap out a more aggressive position for a more defensive position.

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)