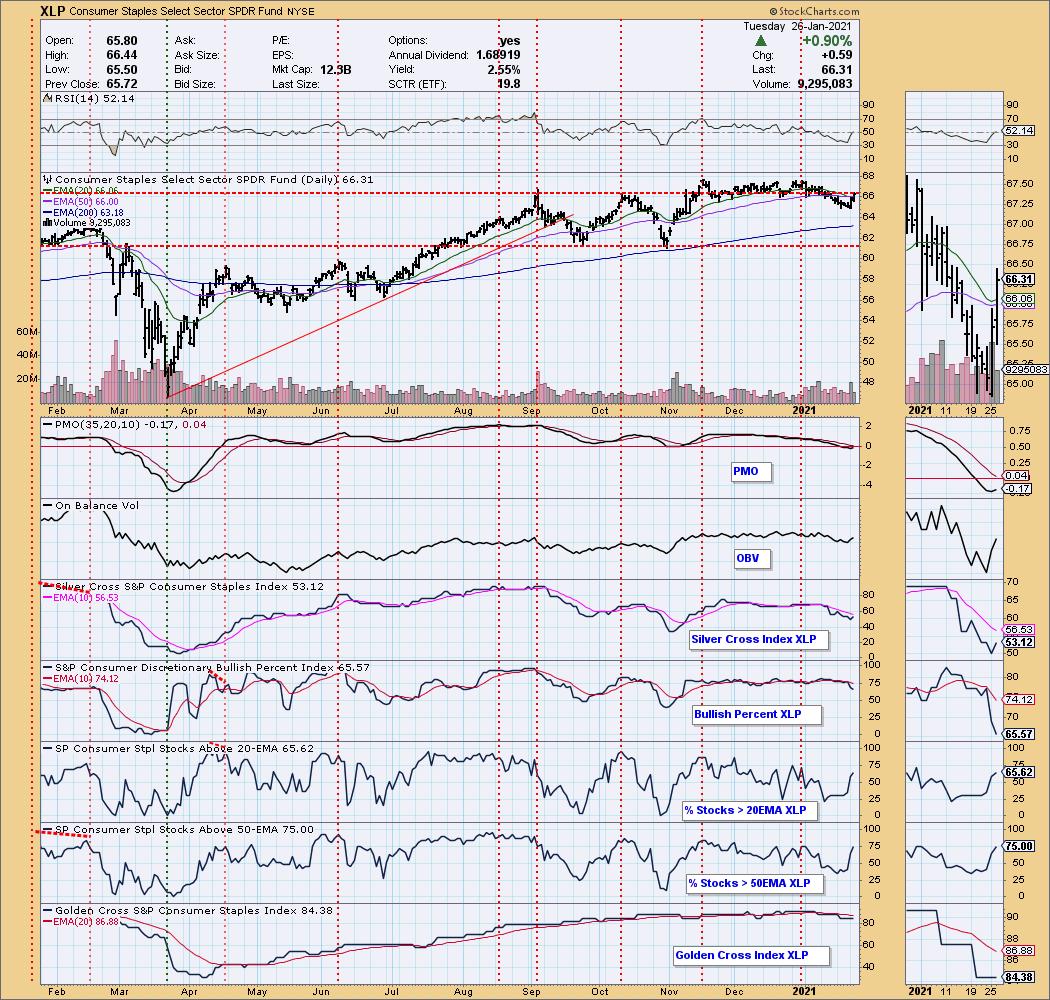

I was surprised to see some Consumer Staples stocks hitting the scans today. This hasn't been a very vibrant area of the market so I was surprised. In fact, one of the stocks has been in the scan results the last two days, making a third appearance today. When I took a look at the Consumer Staples (XLP) chart, I was surprised to see that it is beginning to look quite bullish:

Notice the curling up of the PMO, the newly positive RSI and improved participation based on the %stocks > 20/50-EMAs. Right now XLP is hitting overhead resistance, but given the look of the indicators, I would look for a breakout.

I picked two Staples stocks today and a grab bag of others. I will give you the heads up that Retail REITs had a good showing in today's scan results, so I'll be keeping an eye on this particular group tomorrow. I wasn't enamored of the charts presented in the scans, but they may ripen more tomorrow.

A little housekeeping--be sure to register right away for this week's Diamond Mine. I will be manually sending out the "join" links via email only to those who are registered.

Today's "Diamonds in the Rough" are: CHEF, COLL, IDYA, LPX and SKYY.

Diamond Mine Information:

Diamond Mine Information:

Here is last Friday's (1/22/2021) recording link. Access Passcode: 9W%Y..HU

===============================================================================

Register in advance for the next "DecisionPoint Diamond Mine" trading room on FRIDAY (1/29/2021) 12:00p ET:

Here is the Registration Link & Entry Password: diamonds

Please do not share these links! They are for Diamonds subscribers ONLY!

Save the registration confirmation email with login instructions in case Zoom doesn't notify you in time. I will send out the link to join right before the webinar to REGISTERED attendees. Register early.

It's Free!

Mark Young, CMT of WallStreetSentiment.com will be joining me in the free trading room on February 1st! He has all the latest sentiment data and will give his opinion on your symbol requests too!

Mark Young, CMT of WallStreetSentiment.com will be joining me in the free trading room on February 1st! He has all the latest sentiment data and will give his opinion on your symbol requests too!

"Investor sentiment is one of the most powerful forces in the stock market. It can make the difference between selling out at a market low and buying there." -- Mark Young, CMT

***Click here to register for this recurring free DecisionPoint Trading Room on Mondays at Noon ET!***

Did you miss the 1/25 trading room? Here is a link to the recording -- access code: y&aLh1Xr

For best results, copy and paste the access code to avoid typos.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "diamonds in the rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

Chefs' Warehouse, Inc. (CHEF)

EARNINGS: 2/10/2021 (BMO)

The Chefs' Warehouse, Inc. engages in the distribution of specialty food products. It focuses on serving the specific needs of chefs who own and operate some of the menu-driven independent restaurants, fine dining establishments, country clubs, hotels, caterers, culinary schools, bakeries, patisseries, chocolatiers, cruise lines, casinos and specialty food stores. Its product portfolio includes artisan charcuterie, specialty cheeses, unique oils and vinegars, truffles, caviar, chocolate and pastry products. The firm operates through East Coast, Midwest and West Coast segments. It also offers a line of center-of-the-plate products, including custom cut beef, seafood and hormone-free poultry, as well as broad line food products, such as cooking oils, butter, eggs, milk and flour. The company was founded by Christopher Pappas, John D. Pappas, and Dean Facatselis in 1985 and is headquartered in Ridgefield, CT.

CHEF is unchanged in after hours trading. It's on an accelerating rally that has finally triggered a PMO BUY signal. The RSI is positive although slightly overbought. The OBV is confirming the rally as accumulation has picked up in the last week. The SCTR is in the "hot zone" above 75. It isn't obvious that overhead resistance is around $32.50 until you look at the weekly chart. The stop is set just below the December top.

CHEF has some overhead resistance to power through. Currently it has popped above resistance at the 2019 lows with the next area of resistance at $32.50. I'm not too concerned about it having problems at that particular level given the strong PMO rising and the positive RSI. My one regret is that with a 2.27% gain today, there is a distinct possibility this one will pull back some today's gains tomorrow. Of course, that affords a better entry.

Collegium Pharmaceutical, Inc. (COLL)

EARNINGS: 2/25/2021 (AMC)

Collegium Pharmaceutical, Inc. operates as a pharmaceutical company, which engages in the developing and planning to commercialize next generation, abuse-deterrent products for the treatment of patients suffering from chronic pain and other diseases. Its products include Xtampza ER, Nucynta ER and Nucynta IR. The Xtampza ER provides pain control while maintaining its extended-release drug release profile after being subjected to common methods of abuse and accidental misuse. The Nucynta ER for the treatment of chronic pain and neuropathic pain associated with diabetic peripheral neuropathy. The Nucynta IR is a release formulation of tapentadol indicated for the management of acute pain severe enough to require an opioid analgesic. The company was founded by Michael Thomas Heffernan in October 2003 and is headquartered in Stoughton, MA.

COLL is currently unchanged in after hours trading. Unlike CHEF above, COLL had a sizable pullback today which I believe will set it up for a rally tomorrow. It is struggling with overhead resistance a bit, but the PMO is still rising and the RSI has left overbought territory. The PMO is on the overbought side, but I believe the current rising trend, even as steep as it is, will continue.

The weekly chart is probably more favorable than all of today's "diamonds in the rough" given the new PMO crossover BUY signal accompanied with a positive RSI. It recently broke from a large symmetrical triangle. Upside potential is at its all-time highs.

Louisiana Pacific Corp. (LPX)

EARNINGS: 2/9/2021 (BMO)

Louisiana-Pacific Corp. engages in designing, manufacturing and marketing of products for the new home construction, repair and remodeling and outdoor structures markets. It operates through the following four segments: Siding, Oriented Strand Board (OSB), Engineered Wood Products, and South America. The Siding segment offers wood-based sidings, trim, soffit, fascia, and pre-finished lap and trim products in a variety of patterns and textures. The OSB segment manufactures and distributes oriented strand board structural panel products. The Engineered Wood Products segment includes laminated veneer lumber, laminated strand lumber, I-Joists, and other related products. The South American segment covers the distribution of OSB and siding products in South America and certain export markets. The company was founded on January 5, 1973 and is headquartered in Nashville, TN.

This one has been on my radar after a subscriber mentioned it in the Diamond Mine. I feel sheepish in that I didn't present it before last week's rally, but it never hit my scans. The chart is ripe. The one thing I don't care for on this chart is the long tail on today's OHLC bar. After breaking out intraday, it finished the day in the bottom of its trading range. However, the rest of the chart is great. First we have a breakout today from a bullish ascending triangle. The PMO is about to give us a crossover BUY signal and the RSI is positive and not overbought. The OBV is confirming the rally with rising bottoms, but also with a breakout of its own as today's top is higher than the previous. The stop level is set at the mid-month low, but any break of the rising trendline would have me out.

The weekly PMO has accelerated higher. The OBV isn't quite as bullish, but ultimately we do have rising bottoms on the OBV since the bear market low. I just don't like that it topped out at the summer OBV high.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Boston Beer Co. Cl A (SAM)

EARNINGS: 2/17/2021 (AMC)

Boston Beer Co., Inc. engages in the business of alcoholic beverages. Its brands include Samuel Adams, Twisted Tea, Angry Orchard, and Truly Hard Seltzer. The company was founded by C. James Koch in 1984 and is headquartered in Boston, MA.

SAM is unchanged in after hours trading. I always remember that my (first) husband and I tried to buy the IPO for SAM, but were unable to for some weird reason I don't remember. So I always am somewhat wistful when I see this stock. My husband and I discovered Truly Hard Seltzers about a year ago. We've been hooked ever since and numerous brewers have now entered that market. SAM is in an intermediate-term trading range and it is headed back up to the top after breaking from the short-term declining trend. The RSI has just turned positive and the PMO is rounding up for a crossover BUY signal.

The weekly PMO is on a SELL signal and continuing lower which is a problem, but the RSI is positive and the OBV rising bottoms are confirming the rally. There is a slight reverse divergence with the OBV in the thumbnail. Basically we have higher OBV tops, meaning higher volume, but price tops are declining so price isn't following volume.

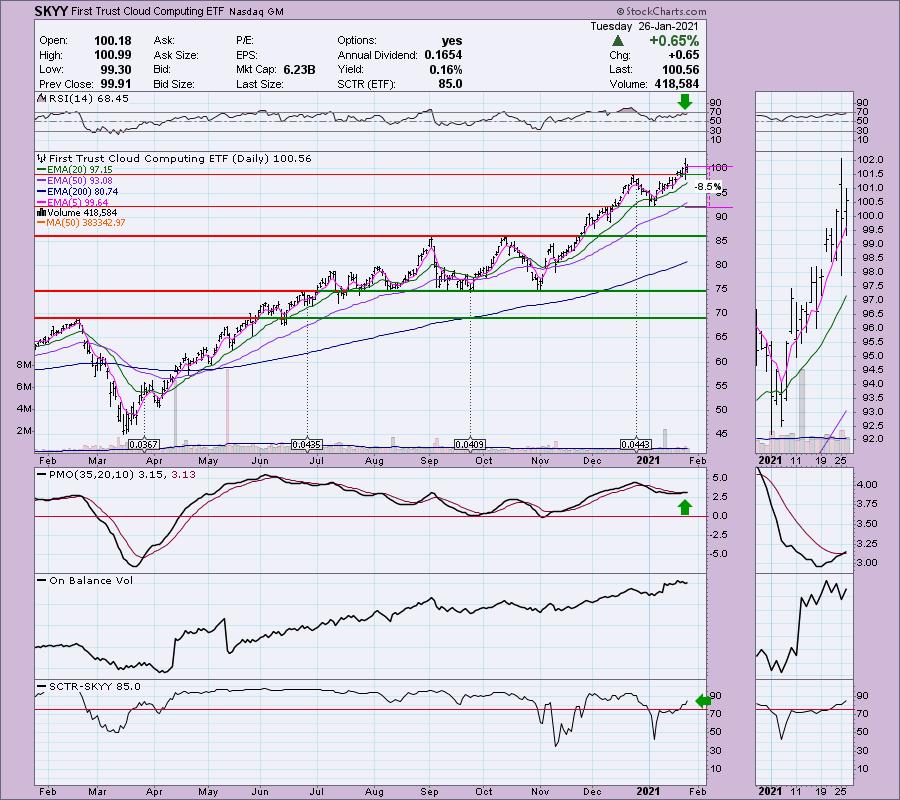

First Trust Cloud Computing ETF (SKYY)

EARNINGS: N/A

SKYY tracks an index of companies involved in the cloud computing industry. Stocks are modified-equally-weighted capped at 4.5%.

SKYY is unchanged in after hours trading. I covered SKYY in the August 25th Diamonds Report. It never activated its stop and is up 26.9% since. I think we have another entry opportunity. The PMO has just triggered a crossover BUY signal and the RSI is positive and not yet overbought. We have a recent breakout above short-term resistance at the December top. OBV bottoms and tops are confirming the rally and breakout move.

It's at all-time highs, but it will likely continue to make more. The RSI is overbought, but given the strength of the rally and the rising PMO, I think that condition will persist or be relieved with a price pause.

Full Disclosure: I'm about 85% invested and 15% is in 'cash', meaning in money markets and readily available to trade with. I sold Sunrun (RUN) this morning and have set a very tight stop (that will likely be hit) on BLL.

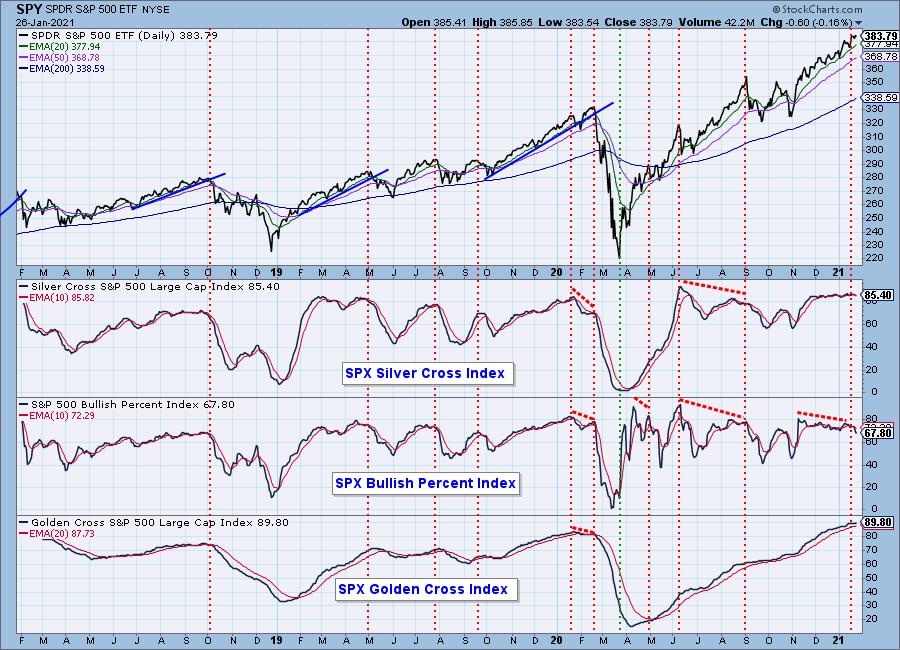

Current Market Outlook:

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

- The Bullish Percent Index (BPI) shows the percentage of SPX stocks on Point & Figure BUY signals.

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Diamond Index:

- Diamond Scan Results: 7

- Diamond Dog Scan Results: 2

- Diamond Bull/Bear Ratio: 3.50

I'm in the process of trying to plot the Diamond Index, but with time at a premium, it is on the back burner.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!