Before I begin, I want to extend my sincere thanks to all veterans who have served or are serving our country today. I would especially like to thank my father, Carl Swenlin (20 years USAF), and my husband, John Wood (22 years USN). You were my first hero, Dad; and John, you have joined ranks alongside him. My life has been forever changed by these two extraordinary men. Thank you! I will continue to complain that the stock market remains open on such an important day; not to mention, that I don't get to enjoy Veteran's Day with my husband even though I served too (although I'm looking forward to our complimentary dinner tonight from a local restaurant!).

Industrials still have the best charts by far! I am including four industrials today and a tobacco company in Consumer Staples.

Today's "Diamonds in the Rough" are: CAI, FIX, GBX, PM and ROP.

Diamond Mine Information:

Diamond Mine Information:

Here is Friday's (11/6/2020) recording link. Access Passcode: #g8G^J&3

Register in advance for the next "DecisionPoint Diamond Mine" trading room on Friday (11/13/2020) 12:00p ET:

Here is the registration link for Friday, 11/13/2020. Password: warmer

Please do not share these links! They are for Diamonds subscribers ONLY!

It's Free!

***Click here to register for this recurring free DecisionPoint Trading Room on Mondays at Noon ET!***

Did you miss the 11/9 free trading room? Here is a link to the recording. Access Code: UxEj0^3e. For best results, copy and paste the access code to avoid typos.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "diamonds in the rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

CAI International Inc. (CAI)

EARNINGS: 3/4/2021 (AMC)

CAI International, Inc. is a transportation finance and logistics company, which engages in the provision of intermodal shipping containers. It operates through the following segments: Container Leasing and Logistics. The Container Leasing segment focuses in the ownership and leasing of containers and fees earned for managing container portfolios on behalf of third-party investors. The Logistics segment provides logistics services. The company was founded by Hiromitsu Ogawa on August 3, 1989 and is headquartered in San Francisco, CA.

CAI is set up with a positive RSI that is not overbought. The PMO is rising toward a crossover BUY signal. The SCTR is in the "hot zone" which shows CAI is in the top 11% of all small-caps. The stop was difficult to figure out on this one as picking either support level wasn't the right amount. If we go below $27 it is a 12%+ stop, but it's only 3.5% to the closest support level. I chose the stop to be halfway between those two levels.

Price overcame important resistance at the early 2020 top. The PMO is rising and not overbought. The RSI is positive and not overbought.

Comfort Systems U S A, Inc. (FIX)

EARNINGS: 2/24/2021 (AMC)

Comfort Systems USA, Inc. engages in the provision of mechanocal and electrical contracting services. It operates through Mechanical Services, Electrical Services, and Corporate segments. The Mechanical Services segment includes heating, ventilation, and air conditioning systems, plumbing, piping, and controls, as well as off-site construction, monitoring, and fire protection. the Electrical services segment handles installation and servicing of electrical systems. The company was founded by Alfred J. Giardinelli, Jr. on December 12, 1996 and is headquartered in Houston, TX.

It was a deadly drop in late October on earnings. I don't usually like to look at stocks that didn't report good earnings, but this one is coming out of the basement. Price closed above the 50-EMA yesterday and today. The RSI is just reaching positive territory and the PMO is headed for a crossover BUY signal. I've set the stop at the 200-EMA.

The weekly PMO could look better but it is decelerating and trying to turn back up. The weekly RSI is positive.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

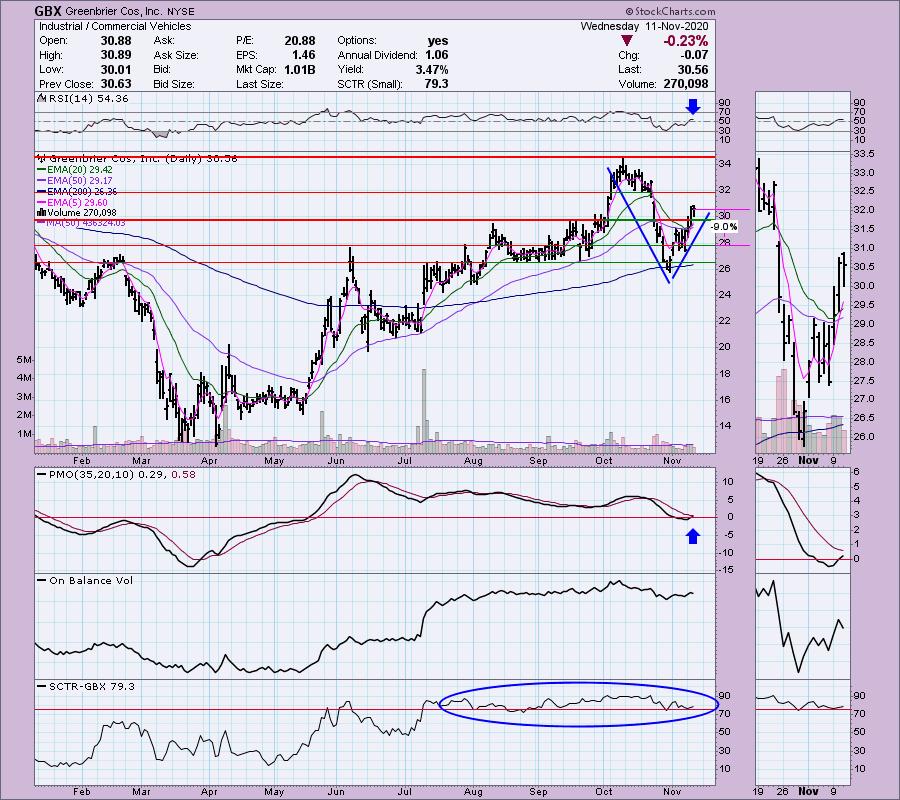

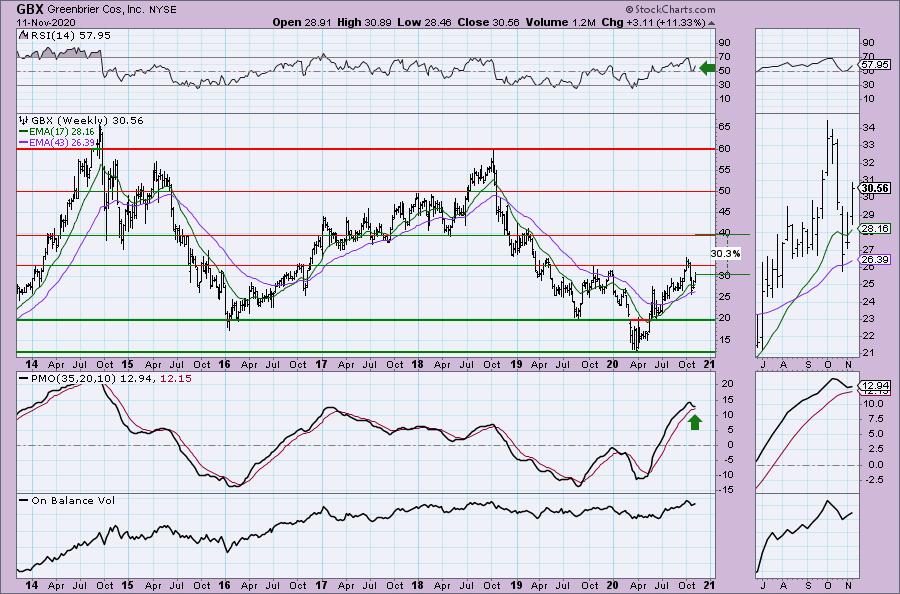

Greenbrier Cos, Inc. (GBX)

EARNINGS: 1/6/2021 (BMO)

Greenbrier Cos., Inc. engages in the design, manufacture, and marketing of railroad freight car equipment. It operates through the following segments: Manufacturing; Wheels, Repair and Parts; and Leasing and Services. The Manufacturing segment includes double-stack intermodal railcars, tank cars, and marine vessels. The Wheels, Repair and Parts segment performs wheel and axle servicing; railcar repair, refurbishment and maintenance; as well as production of a variety of parts for the rail industry in North America. . The Leasing and Services segment offers management solutions to railcars for railroads, shippers, and carriers. The company was founded in 1981 and is headquartered in Lake Oswego, OR.

Here we have a "V" bottom that has triggered as it has retraced 1/3 of the decline into the bottom. Price broke above overhead resistance yesterday and despite a down day was able to remain above the previous resistance level. The RSI is positive and the PMO just entered positive territory itself. The PMO is very near a crossover BUY signal. The SCTR is in the "hot zone" above 75.

I like the rising trend on the weekly chart, but do note that overhead resistance is nearing at the late 2019 tops. The RSI is positive and the PMO is trying to turn back up above its signal line.

Philip Morris Intl Inc. (PM)

EARNINGS: 2/4/2021 (BMO)

Philip Morris International, Inc. is a holding company, which engages in manufacturing and sale of cigarettes, tobacco and nicotine-containing products. It operates through the following geographical segments: European Union, Eastern Europe, Middles East & Africa, South & Southeast Asia, East Asia & Australia and Latin America & Canada. The company was founded by Philip Morris in 1847 and is headquartered in New York, NY.

This is the exception to the Industrials rule of the diamonds in the rough today. I really like the set up on PM. We have a new PMO BUY signal and newly positive RSI today on a breakout above both the 50/200-EMAs. We have a bullish double-bottom that has triggered and suggests a minimum upside target that would take us at least to the October tops. The SCTR isn't great, but we do have rising OBV bottoms to confirm the rising trend.

The weekly PMO is on a SELL signal, but it has decelerated likely in preparation for a reversal and new BUY signal. The RSI just entered positive territory. PM is already up over 6.6% this week, so we'll see how much more we are able eke out before the Friday Recap.

Roper Technologies, Inc. (ROP)

EARNINGS: 1/28/2021 (BMO)

Roper Technologies, Inc. is diversified technology company, which engages in the provision of engineered products and solutions for the global niche markets. It operates through the following segments: Application Software, Network Software & Systems, Measurement & Analytical Solution, and Process Technologies. The company was founded by George D. Roper on December 17, 1981 and is headquartered in Sarasota, FL.

Up +0.91% in after hours trading, ROP is trying very hard to overcome resistance at the 50-EMA. Given the PMO turning toward a clean BUY signal and the RSI just entered positive territory, I would expect to the June top resistance level cleared. There is the low SCTR to contend with and a reverse divergence on the OBV. Notice that the most recent OBV reading is higher than its previous top. This tells us that despite extra volume pouring in on ROP, price was unable to overcome that previous price top.

Clearly this is likely the weakest diamond in the rough today (watch it skyrocket before Friday lol). The weekly chart does show a newly positive RSI, but intermediate-term momentum is very negative. We do have the possibility of about a 13-14% gain.

Full Disclosure: I got NFLX. I'm about 45% invested and 55% is in 'cash', meaning in money markets and readily available to trade with.

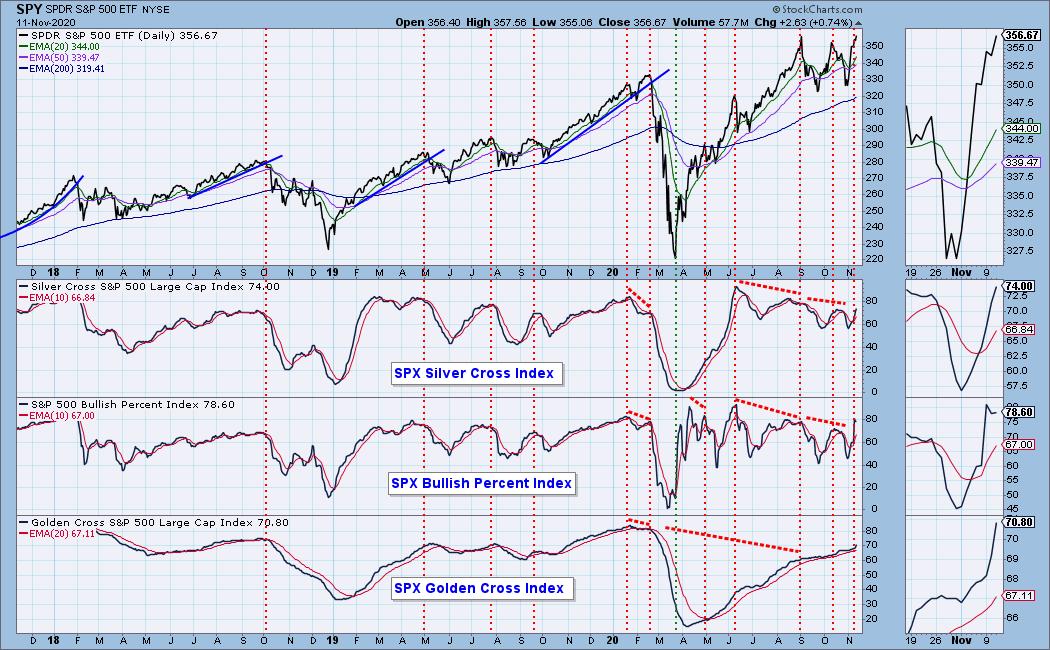

Current Market Outlook:

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

- The Bullish Percent Index (BPI) shows the percentage of SPX stocks on Point & Figure BUY signals.

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Diamond Index:

- Diamond Scan Results: 12

- Diamond Dog Scan Results: 1

- Diamond Bull/Bear Ratio: 12.00

I'm in the process of trying to plot the Diamond Index, but with time at a premium, it is on the back burner.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!