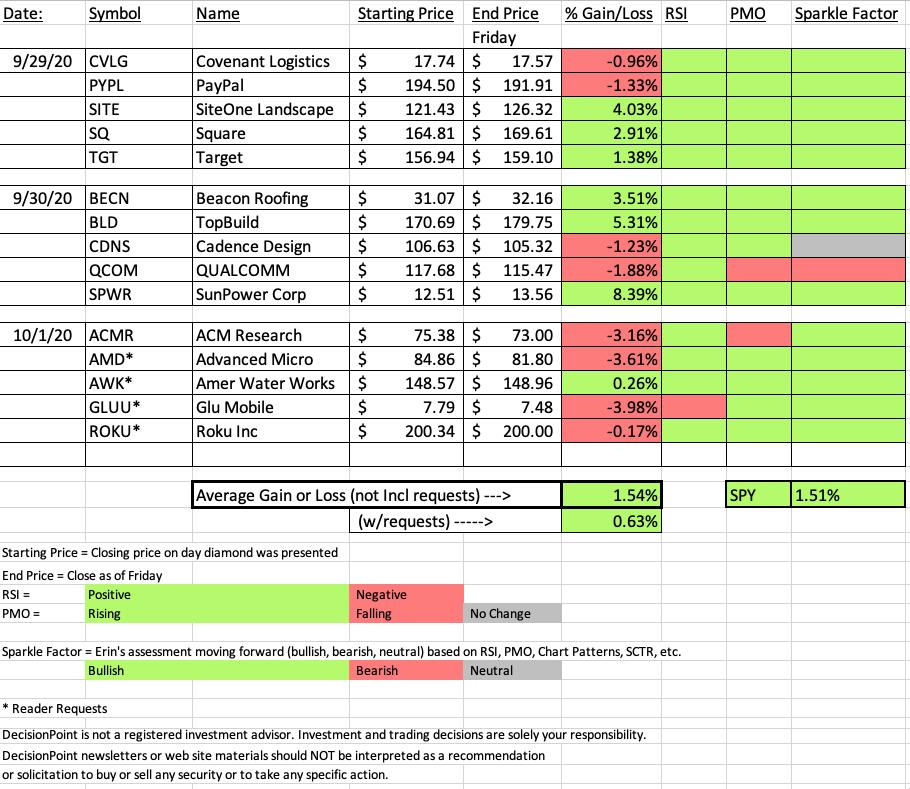

Based on my review of this week's Diamonds in the Diamond Mine trading room this AM, I knew we would have a pretty good week. After the close and inputing the data into my spreadsheet I'm pleased with this week's results. Thursday picks continue to depress our weekly outcome due to only one day of trading, but that's just the way it is.

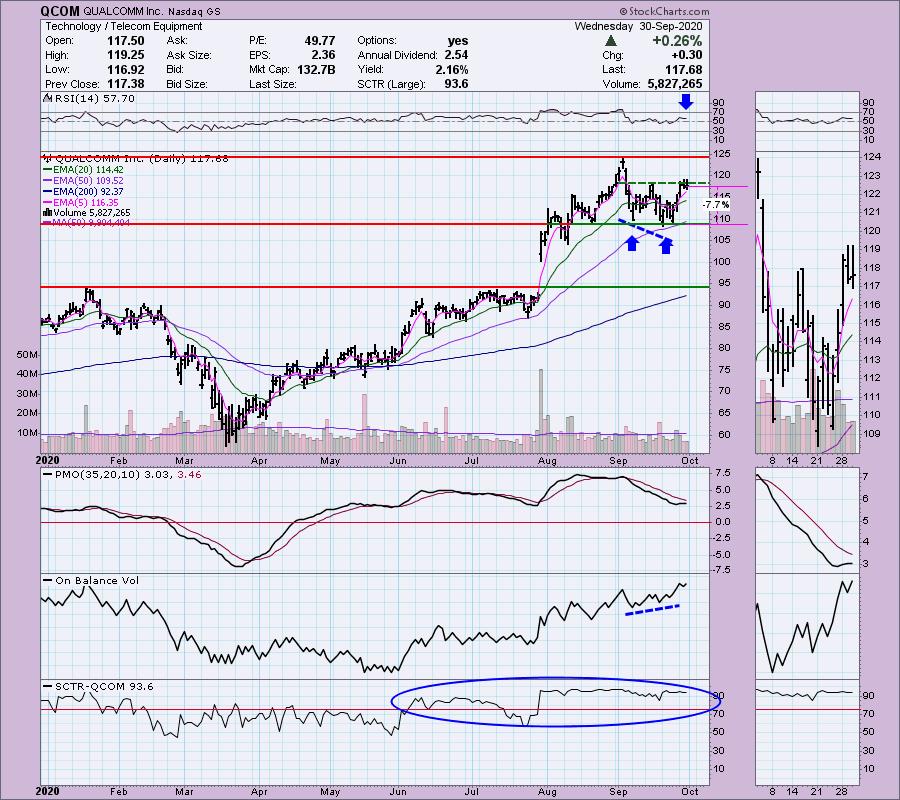

It didn't help to pick a semiconductor the eve before a pullback. In fact, that was our 'lump of coal' for the week, but it still has a bullish sparkle factor. Instead of reviewing the biggest loser (ACMR), I'm going to review the only Diamond this week that has a bearish sparkle factor based on my analysis (QCOM).

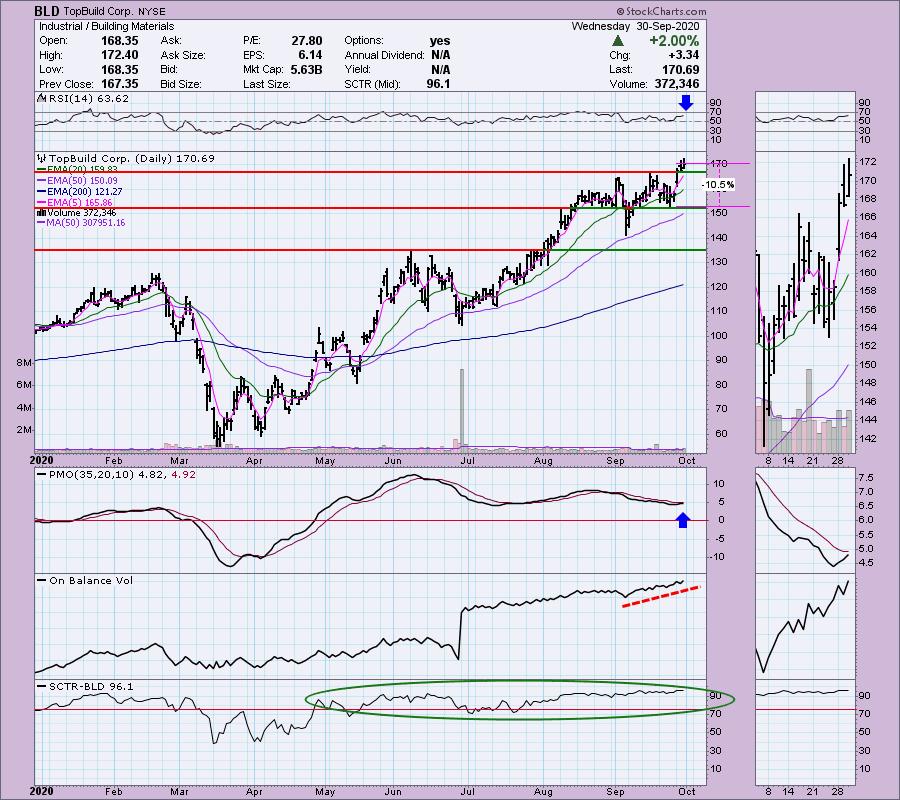

I'm opting not to look at our biggest winner, SPWR. It's headed straight up as part of the Renewable Energy industry group and I expect that run to continue. Two days as a Diamond and it is up 8.39% after already running up much more than that. I want to look at the runner-up, TopBuild (BLD). I love this chart and expect more good things.

Diamond Mine Information:

Diamond Mine Information:

Recording from Today (10/2/2020) is at this link. Access Passcode: kvm=m6zU

Register in advance for the next "DecisionPoint Diamond Mine" trading room on Friday (10/9/2020) 12:00p ET:

Here is the registration link for Friday, 10/9/2020. Password: diamonds

Please do not share these links! They are for Diamonds subscribers ONLY!

A few items about the spreadsheet: I decided it only fair to denote "reader requests" as I shouldn't get to take credit if they turn out great! I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

Don't miss the October 5th free DP Trading Room! I will have guest Julius de Kempenaer from RRG Research. He will show us how he uses RRG to trade!

***Click here to register for this recurring free DecisionPoint Trading Room!***

Did you miss the 9/28 trading room? Here is a link to the recording (password: FT&&l3#K). For best results, copy and paste the password to avoid typos.

TopBuild Corp. (BLD)

EARNINGS: 11/3/2020 (BMO)

TopBuild Corp. is an installer and distributor of insulation products and other building products to the U.S. construction industry. It operates through two segments: Installation and Distribution. The Installation segment provides insulation installation services nationwide through its TruTeam contractor services business branches located in the U.S. The Distribution segment distributes insulation and other building products, including rain gutters, fireplaces, closet shelving, and roofing materials through its Service Partners business. The company was founded in February 2015 and is headquartered in Daytona Beach, FL.

The breakout yesterday came the day after this one was selected a Diamond. That breakout is holding firm. The RSI is positive but not at all overbought. The PMO is closing in on a BUY signal. I can't complain about anything on this chart.

Repeat of Wednesday's review of weekly chart:

"Given the strong weekly PMO and RSI, this one could be a potential intermediate-term investment. I set very deep stops on my IT investments because I'm counting on the current trend and momentum to continue. Looking at the weekly chart, you could set a very deep stop at $125 or $135. You can see what to look for on a weekly chart to give you warning prior to big bearish declines in the intermediate term. Additionally, you can see what to look for to spot bottoms."

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

QUALCOMM Inc. (QCOM)

EARNINGS: 11/4/2020 (AMC)

QUALCOMM, Inc. engages in the development, design, and provision of digital telecommunications products and services. It operates through the following segments: Qualcomm CDMA Technologies (QCT), Qualcomm Technology Licensing (QTL), and Qualcomm Strategic Initiatives (QSI). The QCT segment develops and supplies integrated circuits and system software based on technologies for the use in voice and data communications, networking, application processing, multimedia, and global positioning system products. The QTL segment grants licenses and provides rights to use portions of the firm's intellectual property portfolio. The QSI segment focuses on opening new or expanding opportunities for its technologies and supporting the design and introduction of new products and services for voice and data communications. The company was founded by Franklin P. Antonio, Adelia A. Coffman, Andrew Cohen, Klein Gilhousen, Irwin Mark Jacobs, Andrew J. Viterbi, and Harvey P. White in July 1985 and is headquartered in San Diego, CA.

While this chart isn't overly bearish, I don't like that the intraday breakouts never held on it. The PMO has flattened but the RSI remains positive. Why would I take this off as a Diamond? By failing to overcome overhead resistance two days in a row, I sense that we will see a decline before we see a breakout. This is certainly good for a watch list and if it does manage a breakout that holds next week, I would characterize it as a 'diamond' again.

Wednesday's comments on the weekly chart:

"The weekly chart is positive, but the RSI is somewhat overbought. The PMO is overbought, but still rising."

THIS WEEK's Sector Performance:

CONCLUSION:

Sector to Watch: Real Estate (XLRE) & Utilities (XLU)

Industry Group to Watch: Industrial & Office REITS ($DJUSIO), Water ($DJUSWU)

Believe or not Real Estate REITs are looking up and I liked the $DJUSIO better than any of the others. It seems counterintuitive given the COVID office space exodus, but the chart is bullish. Utilities I've been watching closely since Wednesday and I like them. Really any of the industry groups in that sector look good, but I thought Water looked best. Financials are definitely perking up so keep that on the back burner as well. I pulled out Harley-Davidson (HOG) live in today's Diamond Mine and that will be my ChartWatchers Diamond of the Week. I'll forward my CW article out when I finish publishing it.

Go to our Sector ChartList on DecisionPoint.com to get an in depth view of all the sectors.

Have a Great Weekend! Happy Charting!

- Erin

erin@decisionpoint.com

Full Disclosure: I do not own any of the stocks on the spreadsheet. I'm about 40% invested right now and 60% is in 'cash', meaning in money markets and readily available to trade with. The market is still soft, I'd rather hold off and not add new positions.

Technical Analysis is a windsock, not a crystal ball.

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!