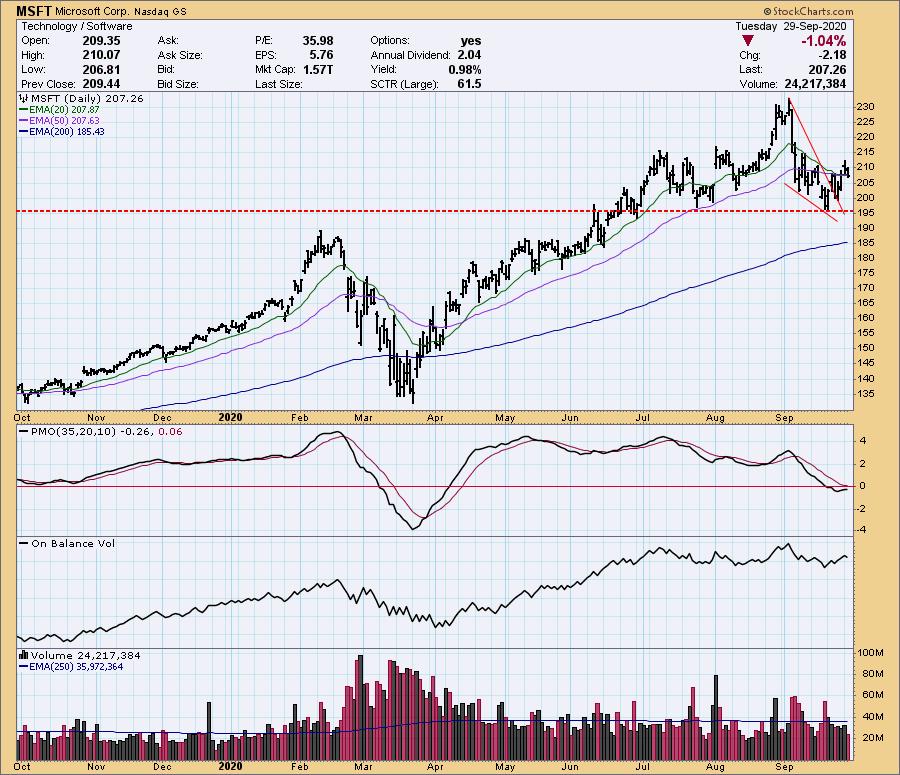

I'm finally beginning to see more results in my Diamond PMO Scan. I had ten software stocks appear in the 32 total results. Interestingly, I went through the entire list of 32 and none of them ended up in my top five. I did want to give you a heads up that momentum is positive in that industry group, so you may want to review your favorites. I currently own Microsoft (MSFT) which is rallying after breaking out of a bullish falling wedge.

Ultimately the five stocks that I picked include three big names that I'm sure you'll recognize. The industry group that is looking particularly bullish is the Computer Services group within the Technology sector (XLK). I have two names there. Additionally, I have liked the look of the Truckers industry group and today I have a Trucker to share.

Today's "Diamonds in the Rough": CVLG, PYPL, SITE, SQ, and TGT.

Diamond Mine Information:

Diamond Mine Information:

Recording from Today (9/25/2020) is at this link. Access Passcode: w+*x#H00

Register in advance for the next "DecisionPoint Diamond Mine" trading room on Friday (10/2/2020) 12:00p ET:

Here is this week's registration link. Password: bull-bear

Please do not share these links! They are for Diamonds subscribers ONLY!

Don't miss the October 5th free DP Trading Room! I will have guest Julius de Kempenaer from RRG Research. He will show us how he uses RRG to trade!

***Click here to register for this recurring free DecisionPoint Trading Room!***

Did you miss the 9/28 trading room? Here is a link to the recording (password: 2Ai3a=r4).

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "diamonds in the rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

Covenant Logistics Group, Inc (CVLG)

EARNINGS: 10/26/2020 (AMC)

Covenant Logistics Group, Inc. is a holding company, which engages in the provision of freight and logistics services. It operates through the following segments: Highway Services and Dedicated Contract Services. The Highway Services Segment includes two separate service offerings: Expedited Services (Expedited) and Over-the-Road Services (OTR), both of which transport one-way freight over nonroutine routes. The Dedicated Contract Services Segment provides similar transportation services, but does so pursuant to agreements whereby equipment available to a specific customer for shipments over particular routes at specified times. The company was founded by David Ray Parker in 1985 and is headquartered in Chattanooga, TN.

Here is the Trucker that came to my attention. I like that today's pullback offset some of the big gains from yesterday. Of course, I don't care for it happening below resistance. The RSI is positive and the PMO has now reached positive territory. The 20-EMA was able to reverse direction and miss a negative crossover the 50-EMA which would have triggered a Neutral signal. I have a deep stop set, but you don't need to give it that much rope if you don't want to.

There is a bull flag on the weekly chart and if you look at it in the thumbnail, the declining trend is being broken this week. The PMO has decelerated its descent and looks to be turning back up. There is a positive OBV divergence and a positive RSI. If it can recapture its August high, that would be a 30% gain.

PayPal Holdings, Inc. (PYPL)

EARNINGS: 10/28/2020 (AMC)

PayPal Holdings, Inc. engages in the development of technology platform for digital payments. Its solutions include PayPal, PayPal Credit, Braintree, Venmo, Xoom, and Paydiant products. The firm manages a two-sided proprietary global technology platform that links customers, which consist of both merchants and consumers, to facilitate the processing of payment transactions. It allows its customers to use their account for both purchase and paying for goods, as well as to transfer and withdraw funds. The firm also enables consumers to exchange funds with merchants using funding sources, which include bank account, PayPal account balance, PayPal Credit account, credit and debit card or other stored value products. It offers consumers person-to-person payment solutions through its PayPal Website and mobile application, Venmo and Xoom. The company was founded in December 1998 and is headquartered in San Jose, CA.

Up +0.26% in after hours trading, PYPL has a very bullish chart. The RSI is rising and has hit positive territory. The PMO just entered positive territory and is closing in on a crossover BUY signal. The OBV is confirming the rally and the SCTR has been in the "hot zone" above 75 for most of this year.

The weekly PMO is problematic, but we can see that it is decelerating its descent. Price bounced off the 17-week EMA. The good thing about this pullback is that it brought the RSI out of overbought territory. If PYPL can reach its August top that would be a 10%+ gain.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

SiteOne Landscape Supply, Inc. (SITE)

EARNINGS: 10/28/2020 (BMO)

SiteOne Landscape Supply, Inc. engages in the distribution of commercial and residential landscape supplies. Its products include outdoor lighting, nursery, landscape supplies, fertilizers, turf protection products, grass seed, turf care equipment, and golf course accessories for green industry professionals. The company was founded in 2001 and is headquartered in Roswell, GA.

Industrials continue to show strength in sector rotation. I really like this chart! We have a short-term double-bottom with a recent breakout. Should the pattern fulfill its minimum upside target, that would bring price to the August top. The PMO is nearing a BUY signal and the RSI just entered positive territory. The stop is set at the bottom of the pattern. The 5-EMA just crossed above the 20-EMA for a ST Trend Model BUY signal. This chart would've been perfect had I seen OBV bottoms rising along the double-bottom instead of falling. It's on the verge of being a negative divergence with declining OBV tops and rising price tops.

The weekly PMO tells us to keep a short-term frame of mind on this trade. It did just trigger an overbought crossover SELL signal, but it is decelerating. I still like this week's breakout. A move to the August top is a 9.6%+ gain.

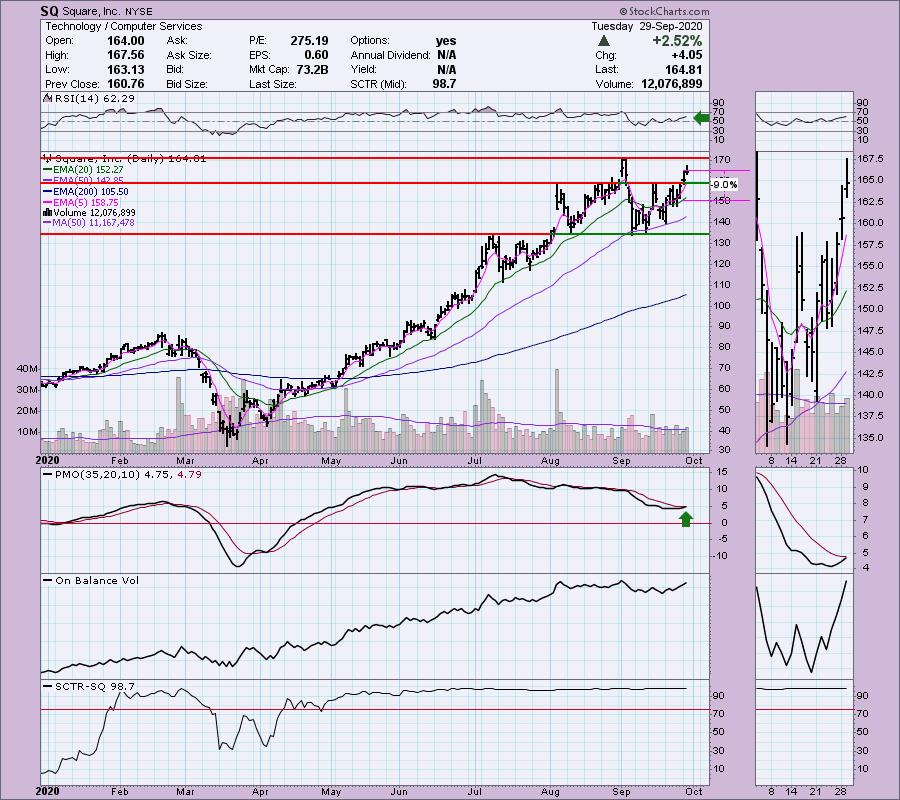

Square, Inc. (SQ)

EARNINGS: 11/5/2020 (AMC)

Square, Inc. engages in the provision of credit card payment processing solutions. It is a cohesive commerce ecosystem that helps sellers start, run, and grow their businesses. The firms sellers downloads the Square Point of Sale mobile app, they can quickly and easily take their first payment, typically within minutes. Its system, sellers gain access to features such as next-day settlements, digital receipts, payment dispute management, data security, and Payment Card Industry compliance. The firm offers additional point-of-sale services, financial services, and marketing services. The company was founded by Jack Dorsey and Jim McKelvey in February 2009 and is headquartered in San Francisco, CA.

SQ was up +0.13% in after hours trading. While I didn't annotate it, this looks like a breakout from a bullish ascending wedge (flat top, rising bottoms). The RSI is positive and not overbought. The PMO is nearing a BUY signal. Overhead resistance at the August top is arriving soon, but I really like the volume coming in off this rebound from the 50-EMA. The SCTR is top-notch. Nothing exciting on the OBV, but no negative divergences either. I set a 9% stop mainly to capture the 20-EMA as support.

Price is definitely overbought on the weekly chart which could be a problem, but given the rising PMO and confirming OBV, it's okay.

Target Corp. (TGT)

EARNINGS: 11/18/2020 (BMO)

Target Corp. engages in owning and operating of general merchandise stores. It offers curated general merchandise and food assortments including perishables, dry grocery, dairy, and frozen items at discounted prices. The company was founded by George Draper Dayton in 1902 and is headquartered in Minneapolis, MN.

TGT is up +0.35% in after hours trading. TGT was a "diamond in the rough" in the July 29th Diamonds Report. Not a bad call I'd say. Another diamond in the rough that I wish I'd bought, but isn't that the way it goes sometimes? Today saw a continuation of yesterday's breakout move. The RSI is a bit overbought, but not too much. The PMO is rising and ready for a crossover BUY signal. The OBV is confirming the rally and indeed, broke out with price yesterday. The SCTR is excellent. Target is one of the major retailers that have managed the hybrid sales during COVID nicely. They have a solid online presence and have managed in-store shopping well (at least here in CA where restrictions are tight).

I love the weekly PMO here. You can see how nice this breakout is as price is making new all-time highs. I did want to point out that the RSI is quite overbought and we can see that isn't always the best situation for TGT. Additionally, notice that OBV tops are declining and price tops are rising steeply. Unfortunately that is a negative divergence.

Full Disclosure: I am not adding any new positions. I'm about 35% invested and 65% is in 'cash', meaning in money markets and readily available to trade with.

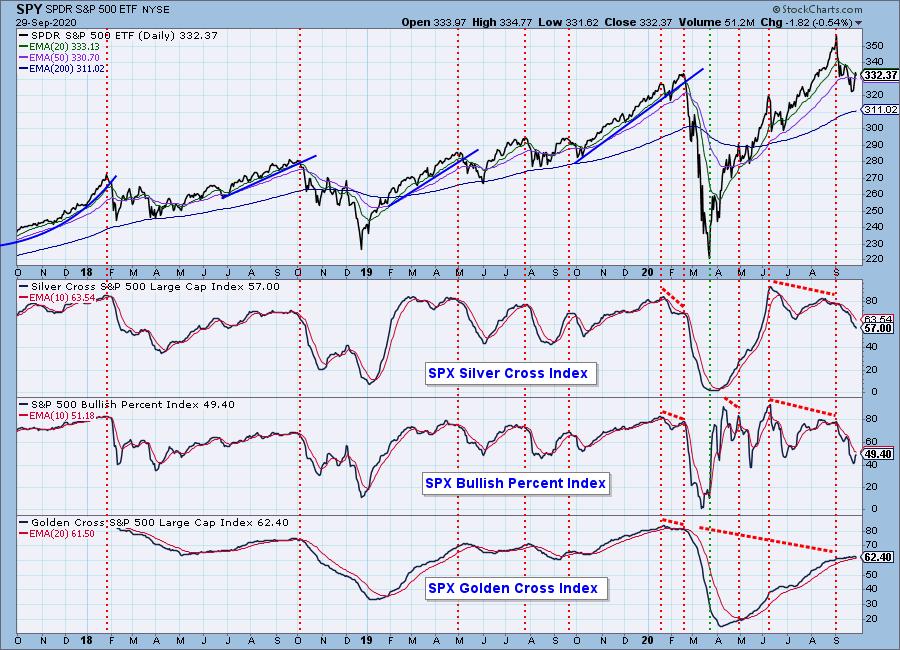

Current Market Outlook:

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

- The Bullish Percent Index (BPI) shows the percentage of SPX stocks on Point & Figure BUY signals.

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Diamond Index:

- Diamond Scan Results: 32

- Diamond Dog Scan Results: 3

- Diamond Bull/Bear Ratio: 10.67

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!