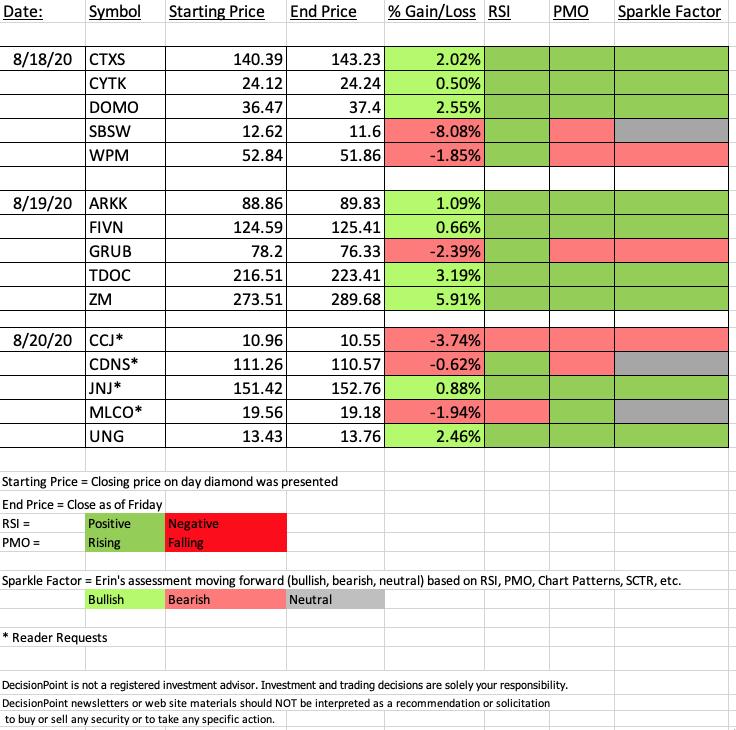

Every Friday, I will be doing a quick recap of the performance of this week's Diamonds and giving you my perspective going forward through the spreadsheet below. I plan to typically review the charts of two "darlings" and one "dud" for the week, but I reserve the right to add or subtract depending on the week.

A few items about the spreadsheet: I decided it only fair to denote "reader requests" as I shouldn't get to take credit if they turn out great! I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

A note on ARKK from 8/19: A reader mentioned to me that this ETF carries some "high flyers" like TSLA and should the market turn on some of those big players, this ETF could hit the skids quickly so he says that a hard stop is probably a good idea.

Looking at the spreadsheet, it was a pretty good week! I think a look at SBSW as this week's diamond dog is in order. I also want to show you two big winners, TDOC and ZM which I continue to like.

Diamond Mine Registration for 8/28:

"The DecisionPoint Diamond Mine" is an opportunity for us to talk live, review current and past Diamonds for possible entries/exits/stops/targets and take your questions and symbol requests.

Register in advance for the "DecisionPoint Diamond Mine" Friday (8/28) 12:00p EST:

Here is this week's registration link.

Password: Leo

Teladoc Health Inc (TDOC) - Earnings: 10/28/2020 (AMC)

Teladoc Health, Inc. engages in the provision of telehealthcare services using a technology platform via mobile devices, the Internet, video and phone. Its portfolio of services and solutions covers medical subspecialties from non-urgent, episodic needs like flu and upper respiratory infections, to chronic, complicated medical conditions like cancer and congestive heart failure.

I still love this chart. TDOC had a nice breakout today that really put the "sparkle" on this Diamond. The RSI is still positive and we are about to see a PMO crossover BUY signal. Today's pullback offers a better entry going into Monday.

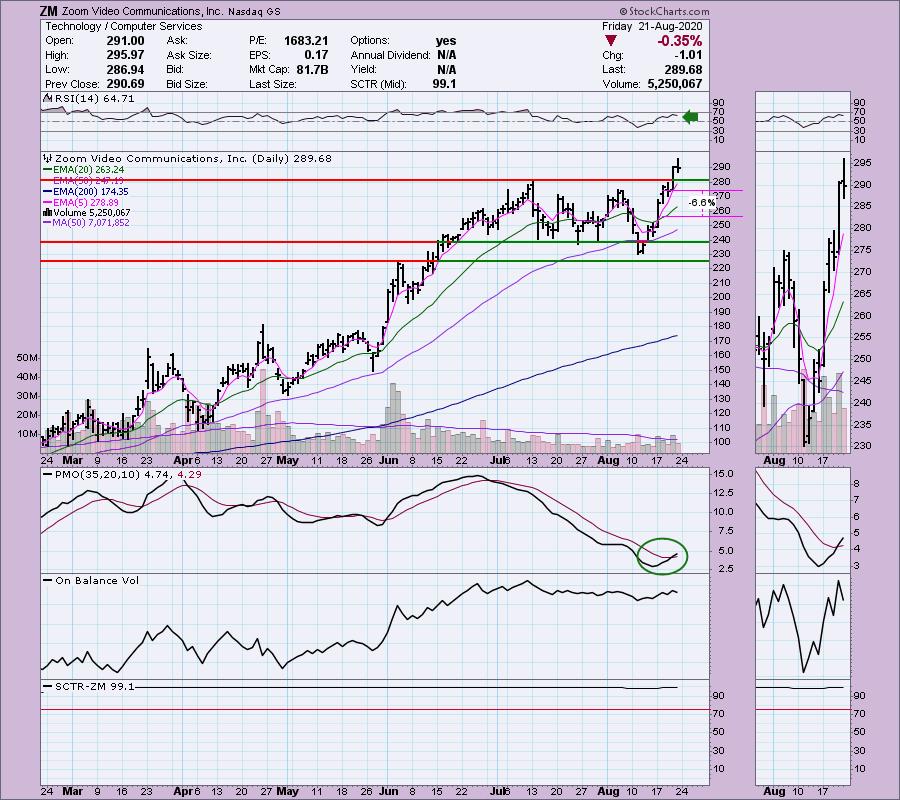

Zoom Video Comm Inc (ZM) - Earnings: 8/31/2020 (AMC)

Zoom Video Communications, Inc. engages in the provision of video-first communications platform. It connects people through frictionless video, voice, chat and content sharing, and enable face-to-face video experiences for thousands of people in a single meeting across disparate devices and locations. It focuses on customer and employee happiness, a video-first cloud architecture, recognized market leadership, viral demand, an efficient go-to-market strategy, and robust customer support.

Really happy with the follow-through on Zoom. Even better, the RSI is not overbought. The PMO gave us a crossover BUY signal. OBV is continuing to confirm the rally. If you aren't in, you could move the stop a bit higher, I'd watch the 20-EMA in particular.

Sibanye Stillwater Ltd (SBSW) - Earnings: 8/27/2020 (BMO)

Sibanye Stillwater Ltd. engages in the provision of precious metals mining services. Its portfolio includes the platinum group metal (PGM) operations in the United States, South Africa, and Zimbabwe; gold operations and projects in South Africa; and copper, gold and PGM exploration properties in North and South America.

Ouch! As I mentioned in today's Diamond Mine, Gold Miners were stinky this week. I would still keep them in a watch list. If you're in, you'll have to determine how far down is enough. The drop dead area on this chart is support around $10.50. I wouldn't want to own it if it couldn't hold that level.

CONCLUSION:

Sector to Watch: Communications (XLC)

Industry Groups to Watch: Internet and Mobile Telecommunications

That does it for the first Diamonds Recap. I'll take comments and suggestions on ways to make it work best for you. No promises I'll make the changes. The slate is now wiped clean!

Happy Charting!

- Erin

erin@decisionpoint.com

Full Disclosure: Of the stocks listed today, I own UNG. I'm about 60% invested right now and 40% is in 'cash', meaning in money markets and readily available to trade with.

Technical Analysis is a windsock, not a crystal ball.

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!