Every Monday when Carl and I tape the DecisionPoint Show on StockChartsTV, I give out a "Diamond of the Week". Typically they come from a Diamonds report the week before. This time it came from a scan I did right before the show. It was up over 4.3% today and I am feeling I let my Diamond Reports readers down by not sending it out last night. The good news is that I do think it can climb much further. Microsoft hit my scan results today. I've been watching MSFT carefully for my own possible entry point and given it is now a Diamond PMO Scan result, I think I might pull that trigger this week.

Finally, we held our first Diamond Mine trading last Friday (8/21). It was so much fun and I can't wait to return this Friday! If you want to register, the link is below. You will have to register each week since this is for Diamond-subscribers only and we don't want anyone there that doesn't belong. I apologize, but I forgot to turn the recording on last Friday so I don't have a recording link to share this time, but I promise to have it available after this Friday's webinar.

FRIDAY (8/28) at Noon EST for this week's "DecisionPoint Diamond Mine" trading room!

"The DecisionPoint Diamond Mine" will be an opportunity for us to talk live, review current and past Diamonds for possible entries/exits/stops/targets and take your questions and symbol requests in this intimate trading room.

Register in advance for the "DecisionPoint Diamond Mine" Friday (8/28) 12:00p EST:

https://zoom.us/webinar/register/WN_O61IKESvSVGFrBIMTHDh4A

Password: Leo

This trading room is for Diamond subscribers only. Please do not share this link.

Click here to register in advance for the recurring free DecisionPoint Trading Room! Did you miss the 8/24 trading room? Here is a link to the recording.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "diamonds in the rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

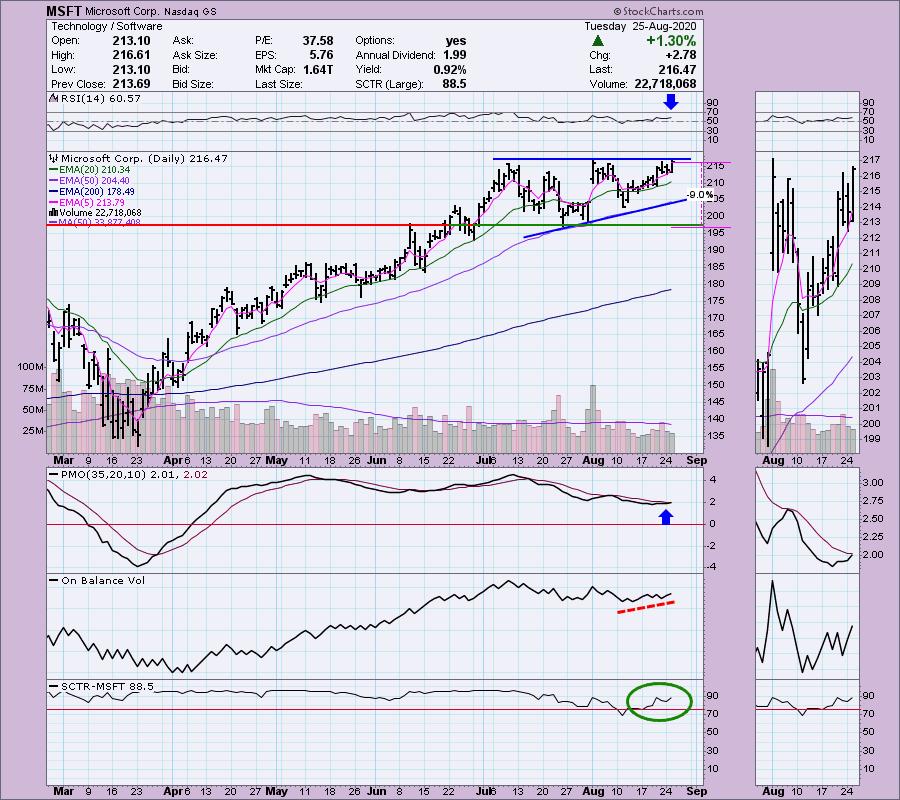

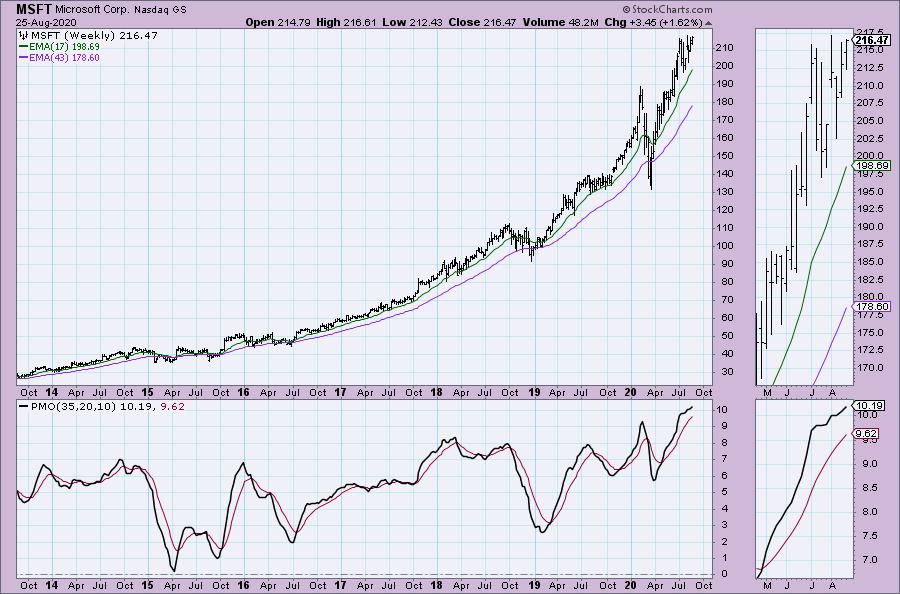

Microsoft Corp (MSFT) - Earnings: 10/21/2020 (AMC)

Microsoft Corp. engages in the development and support of software, services, devices, and solutions. It operates through the following business segments: Productivity and Business Processes; Intelligent Cloud; and More Personal Computing. The Productivity and Business Processes segment comprises products and services in the portfolio of productivity, communication, and information services of the company spanning a variety of devices and platform. The Intelligent Cloud segment refers to the public, private, and hybrid serve products and cloud services of the company which can power modern business. The More Personal Computing segment encompasses products and services geared towards the interests of end users, developers, and IT professionals across all devices. The firm also offers operating systems; cross-device productivity applications; server applications; business solution applications; desktop and server management tools; software development tools; video games; personal computers, tablets; gaming and entertainment consoles; other intelligent devices; and related accessories.

Up 0.71% in after hours trading, MSFT has been a past Diamond on 3/10, 4/17 and 6/9. I have no problem repeating previous Diamonds if they appear to be offering another entry and MSFT fits that bill. We have a bullish ascending triangle. The expectation is an upside breakout with an informal upside target measured from the back of the pattern and added to the breakout point. That would gives us an upside target around $235. The RSI has been positive for the past 5 months. The PMO was able to decompress downward while MSFT moved mostly sideways. We are now lining up for a PMO BUY signal. The OBV is confirming the current rally. The SCTR has just moved back into the "hot zone" above 75. I've put the stop just under the lows in late July, but honestly, a drop below the 20-EMA is a warning flag and tells us to reassess the chart.

The weekly PMO is overbought but it is rising.

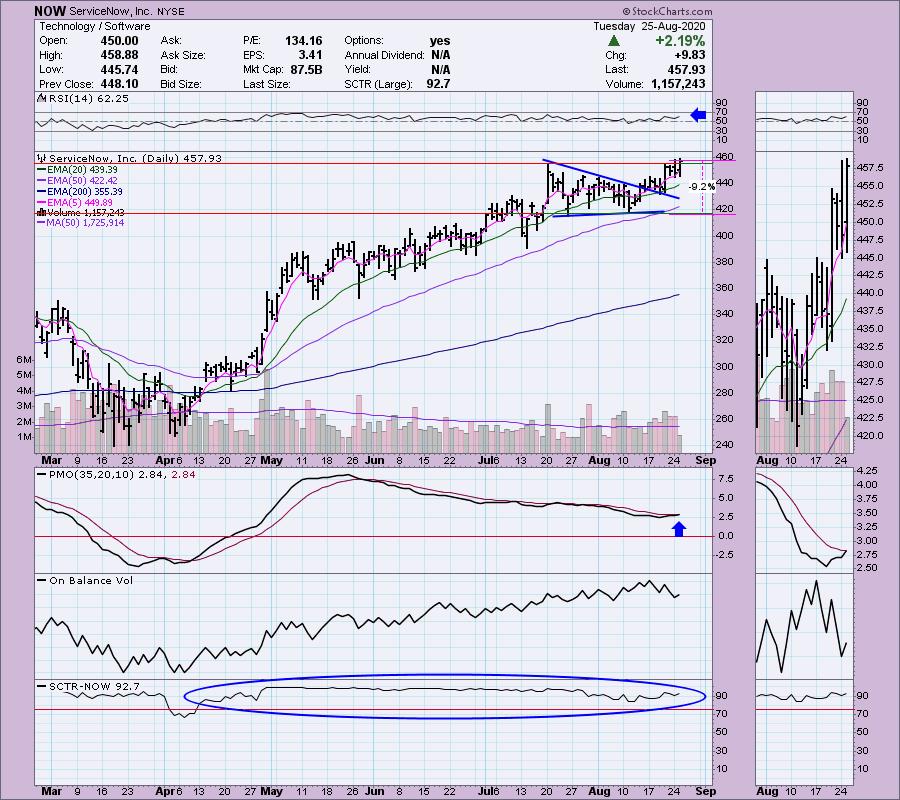

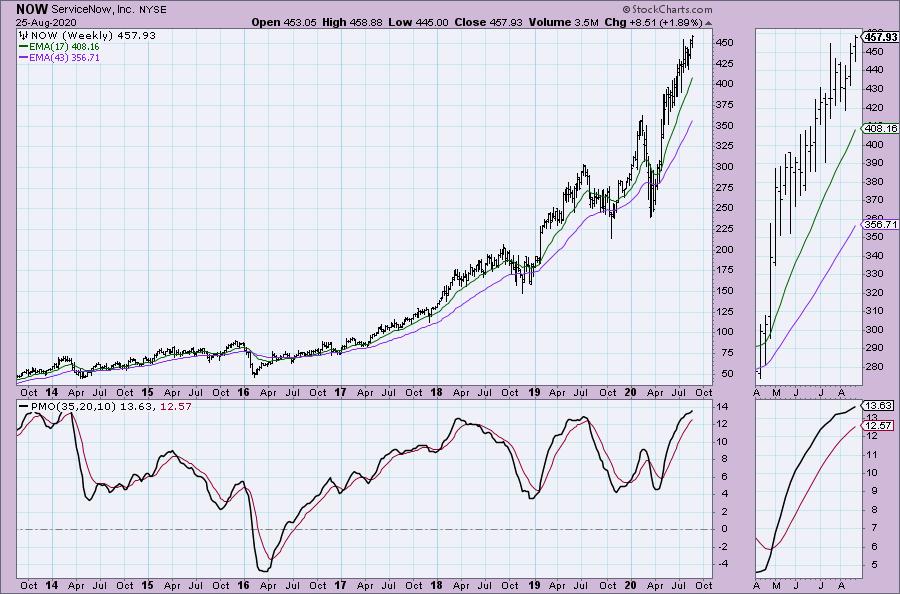

ServiceNow Inc (NOW) - Earnings: 10/28/2020 (AMC)

ServiceNow, Inc. engages in the provision of enterprise cloud computing solutions. It offers customer and facilities service management, orchestration core, service mapping, cloud and portfolio management, edge encryption, performance analytics, service portal designer, visual task boards and configuration management database. The firm offers its solutions for the industries under the categories of Healthcare, Education, Government and Financial services.

Up 1.76% in after hours trading, NOW was a previous Diamond on 5/21 and very recently 8/13. I know that I just reviewed this one a little over a week ago, but I think it is work another viewing. The PMO should trigger a BUY signal tomorrow. The RSI is positive. The OBV is mixed; it has rising bottoms for August, but in the very short term, the tops are declining. I like today's breakout and close above the July top.

The weekly PMO while overbought, has begun to accelerate higher.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

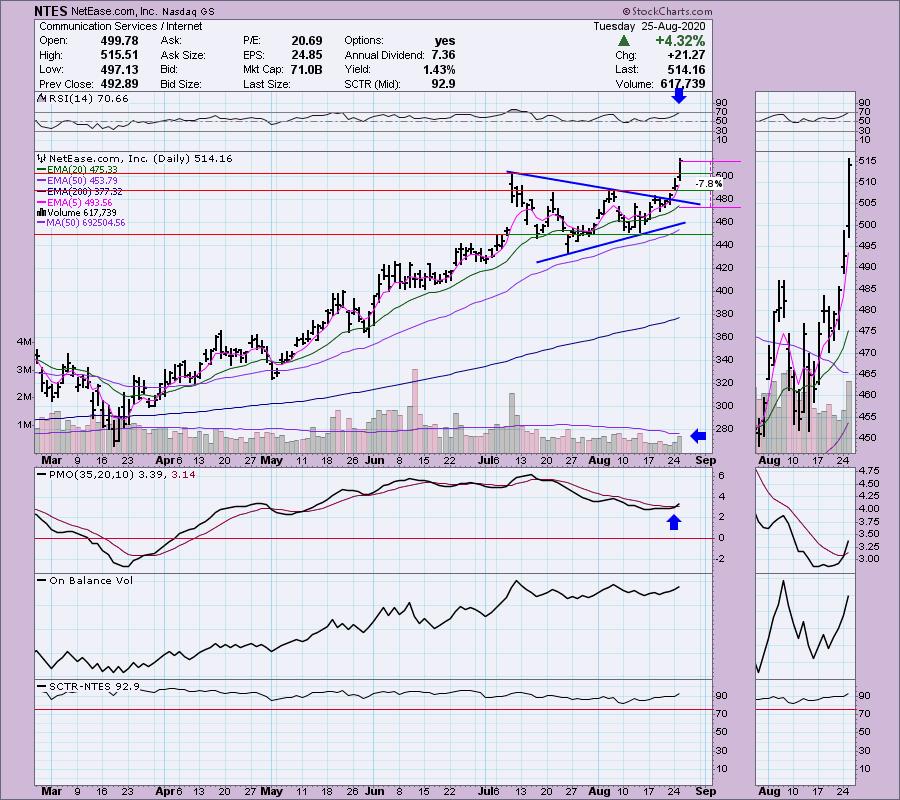

NetEase.com Inc (NTES) - Earnings: 11/12/2020 (BMO)

NetEase, Inc. is an internet technology company, which premium online services centered around content, community, communication and commerce. It develops and operates some of the most popular PC-client and mobile games in China. The firm also operates some of the most popular international online games in China by partnering with Blizzard Entertainment, Mojang AB (a Microsoft subsidiary) and other global game developers. NetEase also offers other innovative services, including the intelligent learning services of its majority-controlled subsidiary, Youdao, its music streaming platform, NetEase Cloud Music, and its private label e-commerce platform, Yanxuan. The company operates through following business segments: Online game services, Youdao, and Innovative businesses and others. The Online game services segment has produced some of China's most renowned and longest running online PC-client games, including Fantasy Westward Journey Online and New Westward Journey Online II, as well as other highly successful games, such as Tianxia III, New Ghost and Justice. The Youdao segment is an online education service provider in China. Through Youdao, the Company's majority-controlled subsidiary, NetEase is dedicated to developing and using technologies to provide learning content, applications and solutions to users of all ages. The Innovative businesses and others segment offers other innovative services, including live video streaming, music streaming and its private label e-commerce platform, Yanxuan.

NTES was yesterday's "Diamond of the Week" on the DecisionPoint Show. Again, I apologize to Diamond readers who didn't see the show. Next time I'll send out an 'alert' to the Diamonds email list. This chart looked great yesterday, but I think looks even better today (although you may want to follow it intraday to get the best entry). The PMO has triggered a crossover BUY signal, the RSI is positive albeit slightly overbought and volume is beginning to surge. The stop level I'm showing is meant to coincide with the 20-EMA.

Great looking weekly chart with a PMO that isn't at overbought extremes.

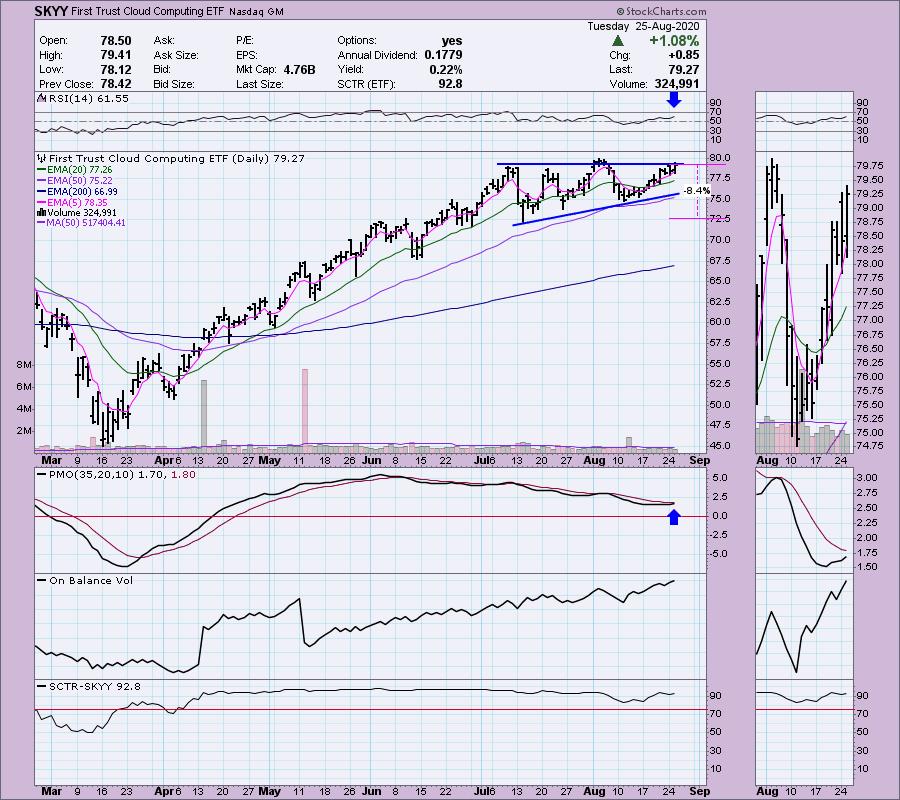

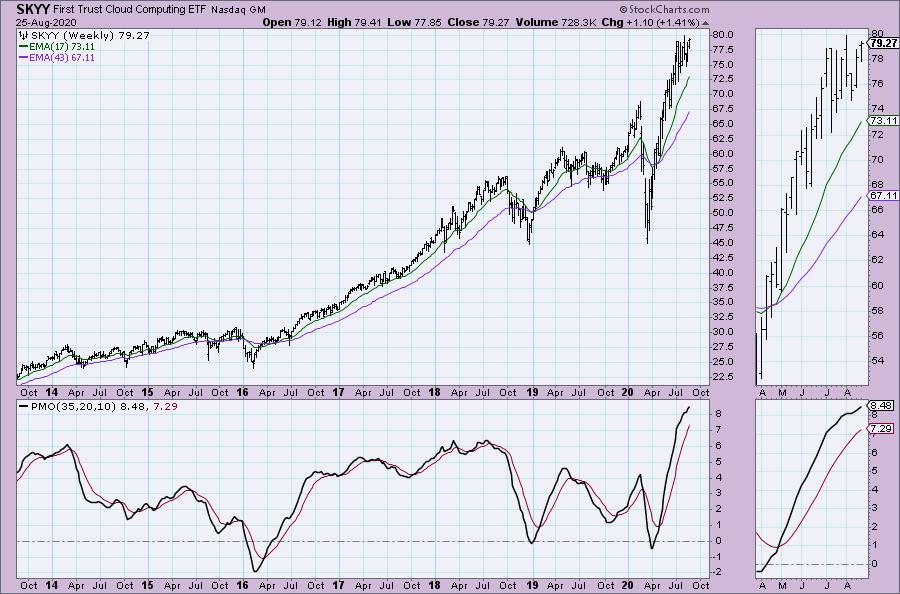

First Trust Cloud Computing ETF (SKYY) - Earnings: 5/14/2020 (BMO)

SKYY tracks an index of companies involved in the cloud computing industry. Stocks are weighted by sub-group: infrastructure, platform and software.

Up 0.39% in after hours trading, SKYY has a possible bullish ascending triangle with an upside target around $87.50. The RSI is in positive territory and not yet overbought. The PMO is closing in on a crossover BUY signal and the SCTR is comfortably above the 75 line. I'm not totally thrilled with the OBV because we typically want to see price breaking out when the OBV breaks out. I've set the stop level near the July low but I don't think I'd give it much rope if it drops below the 50-EMA.

The weekly PMO is overbought, but given the near vertical climb out of March lows, it isn't surprising. What's most important is that it is rising.

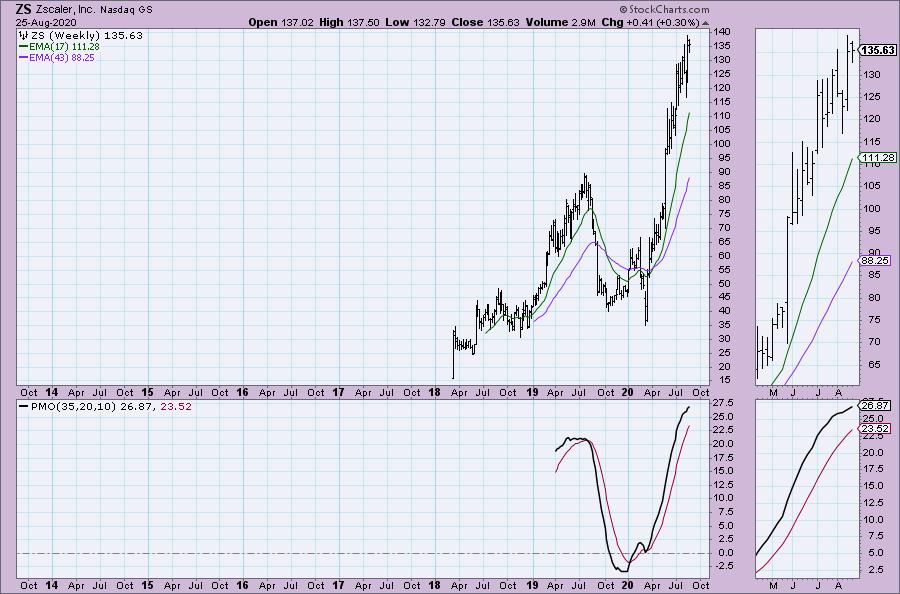

Zscaler Inc (ZS) - Earnings: 9/9/2020 (AMC)

Zscaler, Inc. engages in the provision of cloud-based internet security platform. It operates through the United States and Rest of the World geographical segments. It offers Zcaler internet access, private access, and platform.

Up 0.64% in after hours trading, ZS pulled back slightly today and closed near the breakout point. The PMO is still rising and the RSI is positive. The OBV is currently confirming the rally. This stop level is below the 20-EMA but above the 50-EMA. I'd say you should review it if it falls below the 20-EMA and seems ready to test the 50-EMA.

The weekly chart doesn't have much data but we do know that the weekly PMO is rising.

Current Market Outlook:

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

- The Bullish Percent Index (BPI) shows the percentage of SPX stocks on Point & Figure BUY signals.

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Diamond Index:

- Diamond Scan Results: 12

- Diamond Dog Scan Results: 8

- Diamond Bull/Bear Ratio: 1.50

Full Disclosure: I'm about 60% invested right now and 40% is in 'cash', meaning in money markets and readily available to trade with. I'm stalking MSFT and SKYY this week for possible entry.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!