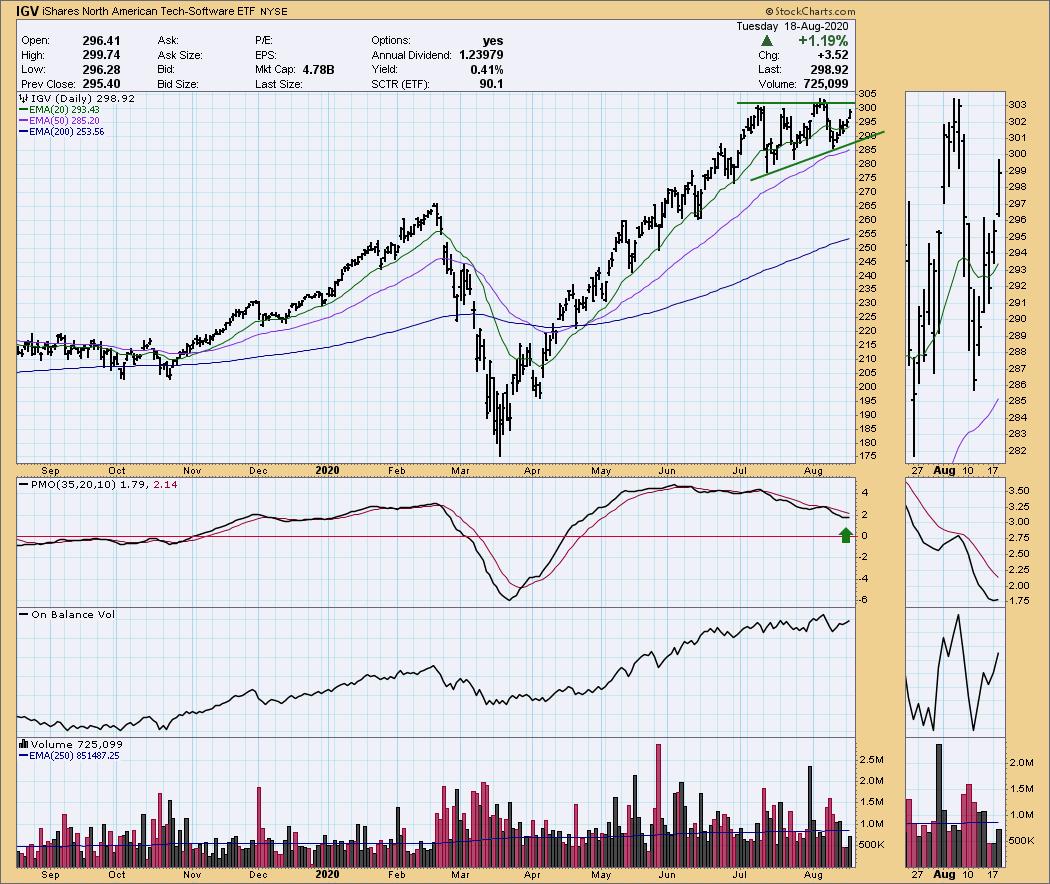

As Mary Ellen and I prepared for our WealthWise Women show that airs Thursday, she and I discussed "What's Hot and What's Not". We both agreed that Miners, Software and Truckers were coming back after the recent pullbacks. I'm covering two Gold Miners and two Software stocks today. Here's a link to my August 12th Diamond Report where I discussed Truckers in particular. Below are the charts for Gold Miners and Software. Miners haven't quite recaptured the original rising trend but they are nearing that. Software has a bullish ascending triangle along with other positive indicators.

OPENING FRIDAY at Noon EST! The "DecisionPoint Diamond Mine" trading room!

I'll post passwords and login information inside the Diamond Reports for the week and also send out notifications via email. I'll get all the information out to you by Thursday afternoon if not sooner! Similarly, I will post information to enter the free Monday "DecisionPoint Trading Room" within my blogs and via email.

"The DecisionPoint Diamond Mine" will be an opportunity for us to talk live, review current and past Diamonds for possible entries/exits/stops/targets and take your questions and symbol requests in this intimate trading room.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "diamonds in the rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

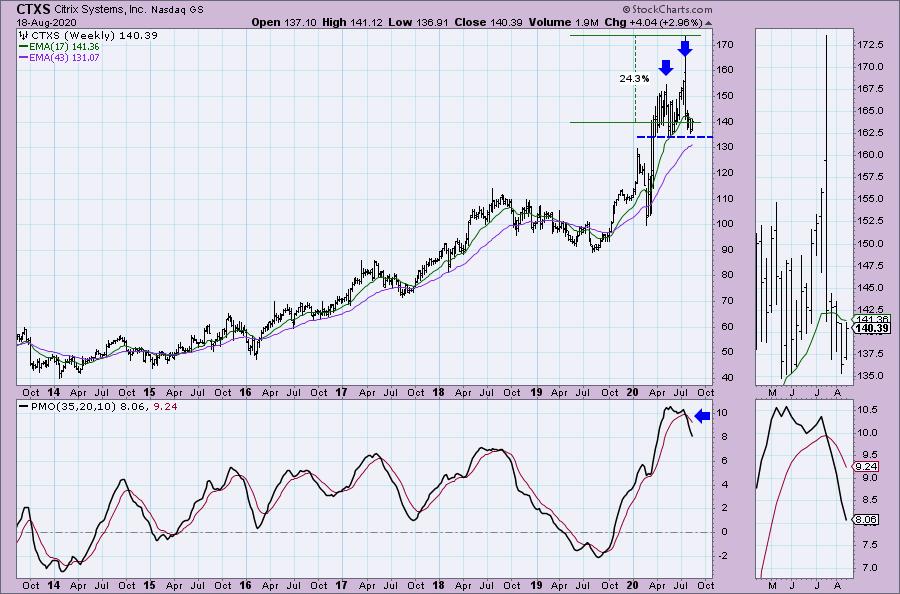

Citrix Systems Inc (CTXS) - Earnings: 10/22/2020 (BMO)

Citrix Systems, Inc. engages in the design, development, and marketing of information technology solutions. It provides digital workspace that unifies apps, data, and services. It markets and licenses its products directly to customers through web, systems integrators, value-added resellers, and service providers.

Competitor, Zoom (ZM) has gotten most of the love, but CTXS is now ready to take part. We have a double-bottom that is in a positive divergence with the OBV. These usually lead to an upside rally. The PMO has now turned up in oversold territory. The RSI isn't positive yet, but we could be getting to this one early.

Admittedly I'm not thrilled with the weekly chart. There is a PMO SELL signal and possible double-top. I'd likely not consider this for an intermediate-term investment, but I think we can get close to that July top.

Cytokinetics Inc (CYTK) - Earnings: 10/29/2020 (AMC)

Cytokinetics, Inc. operates as a biopharmaceutical company, which focuses on the discovery and development of muscle activators as potential treatment for debilitating diseases. It conducts a Phase 2 clinical trials program for tirasemtiv, including a Phase 2b clinical trial in patients with ALS, known as BENEFIT-ALS (Blinded Evaluation of Neuromuscular Effects and Functional Improvement with Tirasemtiv in ALS).

This is the odd man out as it is in the Biotech space. That hasn't been the best place to be, but I like this turn around. Price didn't even have to test the major support level at $20 before turning back up. The RSI is positive and the PMO is reaching up toward a crossover BUY signal. This PMO bottom occurred just above the zero line which is a good sign as well.

My first thought when I looked at the thumbnail was, "uh oh, possible head and shoulders top". But looking more closely, it really isn't as the neckline would be very steep. The weekly PMO is turning up which is good.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Domo Inc (DOMO) - Earnings: 9/3/2020 (AMC)

Domo, Inc. designs, develops, and markets executive management software solutions. It offers customized software tools for business operations, customer relationship management, human resources, and financial reporting.

Down 1.25% in after hours trading, DOMO could give us a better entry tomorrow. I like the short-term bull flag and the recent PMO BUY signal. The RSI is positive and the SCTR is in the "hot zone" above 75.

I like this weekly chart. The PMO is accelerating higher now and upside potential could be quite good if it can break above overhead resistance.

Sibanye Stillwater Ltd (SBSW) - Earnings: 8/27/2020 (BMO)

Sibanye Stillwater Ltd. engages in the provision of precious metals mining services. Its portfolio includes the platinum group metal (PGM) operations in the United States, South Africa, and Zimbabwe; gold operations and projects in South Africa; and copper, gold and PGM exploration properties in North and South America.

Down 0.47% in after hours trading, I'd watch to make sure that support can hold here or add it to a watch list and wait to see if that gap gets covered to the downside. I like this area of the market and I do expect it to continue to rise overall, it just might be a little bit tricky to enter. The rest of the chart is very positive with the RSI above net neutral (50) and the PMO nearly triggering a crossover BUY signal. The SCTR is strong.

Overhead resistance could be difficult to surpass, but if it does, I would look for a move to at least $15.

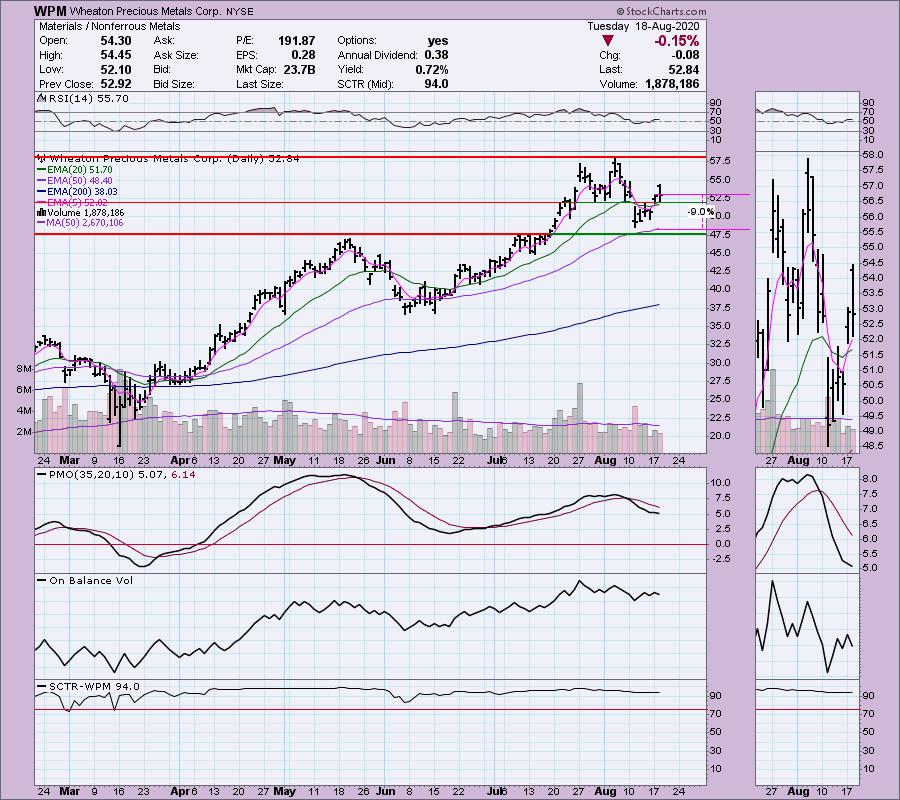

Wheaton Precious Metals Corp (WPM) - Earnings: 11/12/2020 (AMC)

Wheaton Precious Metals Corp. is a mining company, which engages in the sale of precious metals and cobalt production. It operates through the following segments: Gold, Silver, Palladium, Cobalt, and Other. It focuses on the following precious metals streams: Salobo, Penasquito, Antamina, Constancia, Stillwater, San Dimas, Sudhury, Zinkgruvan, Yauliyacu, Neves-Corvo, Pascua-Lama, Rosemont, Voisey's Bay, and others.

This was the "Diamond of the Week" for Monday's DecisionPoint Show. It isn't a gold miner, but miners in general are making the same move after their pullbacks. The RSI just reached positive territory. The PMO isn't rising just yet, but it is acting like it will as it decelerates its descent. I like that price didn't have to go all the way down to test support at the May top. A bounce off the 50-EMA looks good and that SCTR has been strong all year.

It appeared that WPM's weekly PMO was going to top, but so far not yet. It is very overbought, but given the near vertical ascent that's not surprising. I've marked 10% as an upside target, but I expect it to go higher.

Current Market Outlook:

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

- The Bullish Percent Index (BPI) shows the percentage of SPX stocks on Point & Figure BUY signals.

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Diamond Index:

- Diamond Scan Results: 3

- Diamond Dog Scan Results: 32

- Diamond Bull/Bear Ratio: 0.09

Full Disclosure: I'm about 65% invested right now and 35% is in 'cash', meaning in money markets and readily available to trade with.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

ANNOUNCEMENT:

I have the information for my VIRTUAL presentation at The Money Show! My presentation will on August 19th at 1:20p EST! Click here for information on how to register to see me!

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!