Today the scans were quite clear...Tech is where it is at. I presented CIENA Corp (CIEN) last Monday (7/27) and I made it today's "Diamond of the Week" on the Your Daily Five show this morning. You've already seen it, but wanted you to know that it would be a sixth "diamond in the rough" today.

Natural Gas (UNG) had an excellent day today, up almost 17%! A reminder this one was a Diamond of the Week in ChartWatchers a week ago and I presented it to you after the 4% decline on 7/23. I love it when we see action like today's! I'm still holding it although I'm prepared for a pullback. I don't think this one is done performing. Watch for a possible entry on a pullback.

** IMPORTANT NEWS for my current Diamonds subscribers, on August 15th the price of Diamonds Reports will be doubling to $50/mo. You do NOT need to concern yourself if you're happy with what you have. Your rate will stay at $25/month as long as your subscription continues in good standing. You can also switch to annual at the current rate of $250/yr at anytime.

However, you should consider our Bundle package if you aren't already a DP Alert subscriber. DPA will be going from $30/mo to $40/mo so adding DP Alert later will be more expensive by far. If you add DP Alert after 8/15, it will cost you an additional $40/mo or $400/yr.

To summarize, if you don't already have the Bundle, you'll want to do that now before it becomes very expensive. The higher rate will be in effect if you add the DP Alert later. You will always be able to move a monthly subscription to an annual one and only pay for 10 months.

Other good news! I will be incorporating a 1-hour trading room, "The DecisionPoint Diamond Mine" once a week for Diamond subscribers only on Fridays! It will be an opportunity for us to talk live, review current and past Diamonds for possible entries/exits and take your questions and symbol requests in this intimate trading room. There will also be a once a week free trading room, "DecisionPoint Trading Room" for 1 hour on Tuesdays (we will keep our "diamonds" to ourselves though). But wait, there's more! I will be adding a Friday Diamonds Recap where I will look at the performance of that week's Diamonds and their prospects moving forward. Over the weekend we clean the slate and start over again. I hope you enjoy the new changes that will be underway soon! **

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "diamonds in the rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

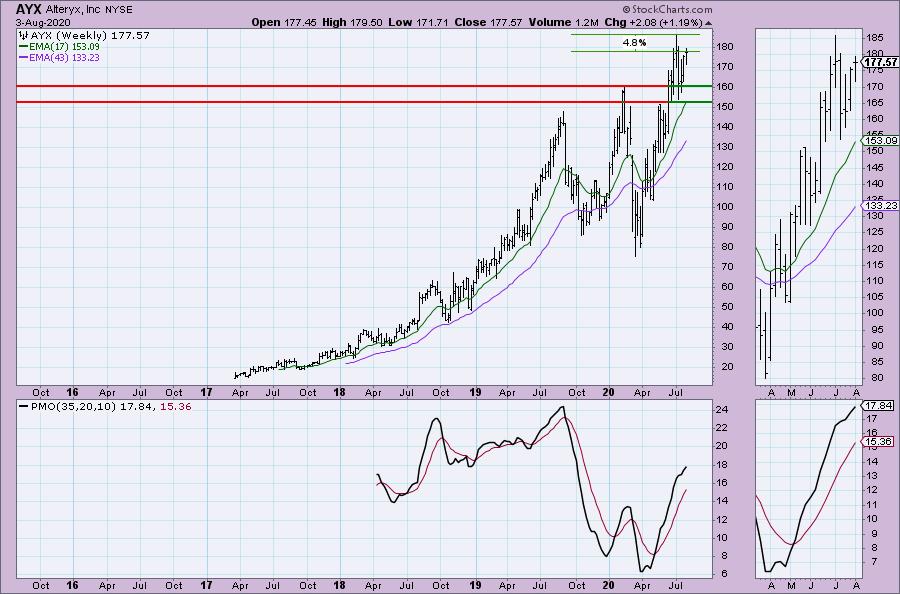

Alteryx Inc (AYX) - Earnings: 8/6/2020 (AMC)

Alteryx, Inc. engages in the provision of self-service data analytics software. Its subscription-based platform allows organizations to prepare, blend, and analyze data from a multitude of sources and benefit from data-driven decisions.

This stock was a Diamond in the April 9th Diamond Report. At last check, it is up 0.24% in after hours trading. I'm liking the chart. First notice the head and shoulders pattern (red arrows) and the 'neckline' around $152. When price came down to possible execute that bearish pattern, price reversed and didn't even test the neckline. Changing a very bearish pattern into a bullish reversal is impressive. While it isn't 'textbook', there is a double-bottom that I've annotated with green arrows (this is a reversal pattern and as such should come at the bottom of a decline, not the tail end of a rising trend). It broke the confirmation line at $175 and is poised to move higher. The RSI is positive, volume is coming in and the PMO has turned back up.

The weekly PMO looks great and is not overbought.

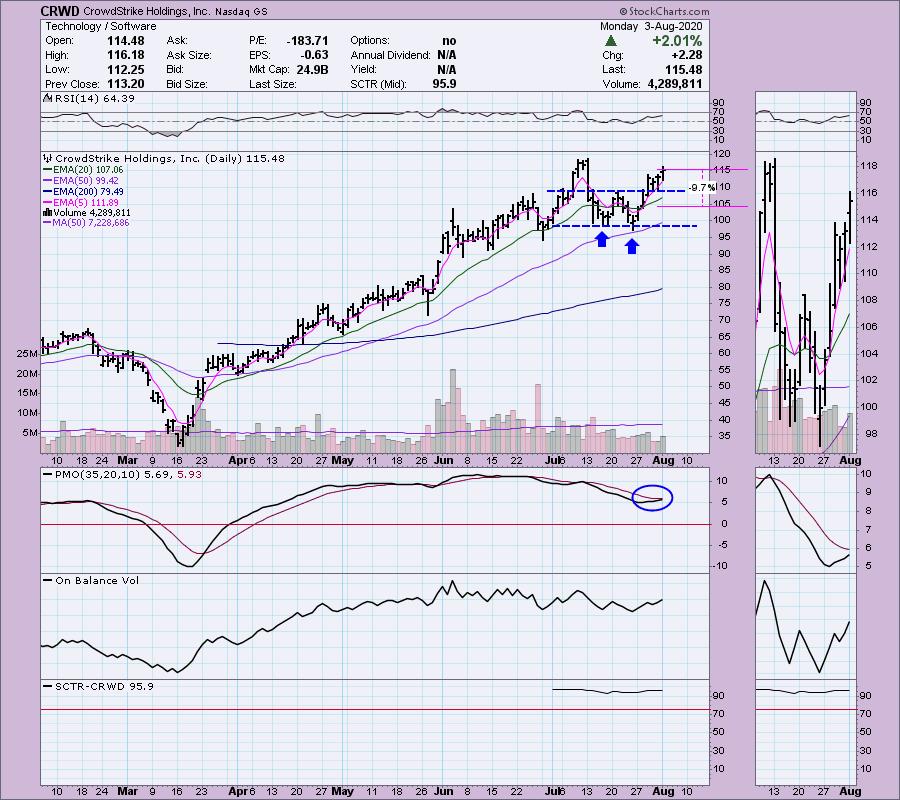

CrowdStrike Holdings Inc (CRWD) - Earnings: 9/3/2020 (AMC)

CrowdStrike Holdings, Inc. is a holding company, which engages in the provision of cloud-delivered solution for next-generation endpoint protection that offers cloud modules on its Falcon platform through SaaS subscription-based model. It operates through Domestic and International geographical segments. The firm's services include incident response services; proactive services, tabletop exercises, adversary emulation, clod security assessment, and blue team exercises.

This chart looks very much like AYX--a busted head and shoulders followed by a bullish double-bottom. The PMO has nearly given us a crossover BUY signal and the RSI is positive. There is the issue of overhead resistance at around $119, but upside momentum suggests a breakout ahead.

Not much info on the weekly chart as there is a lack of data.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

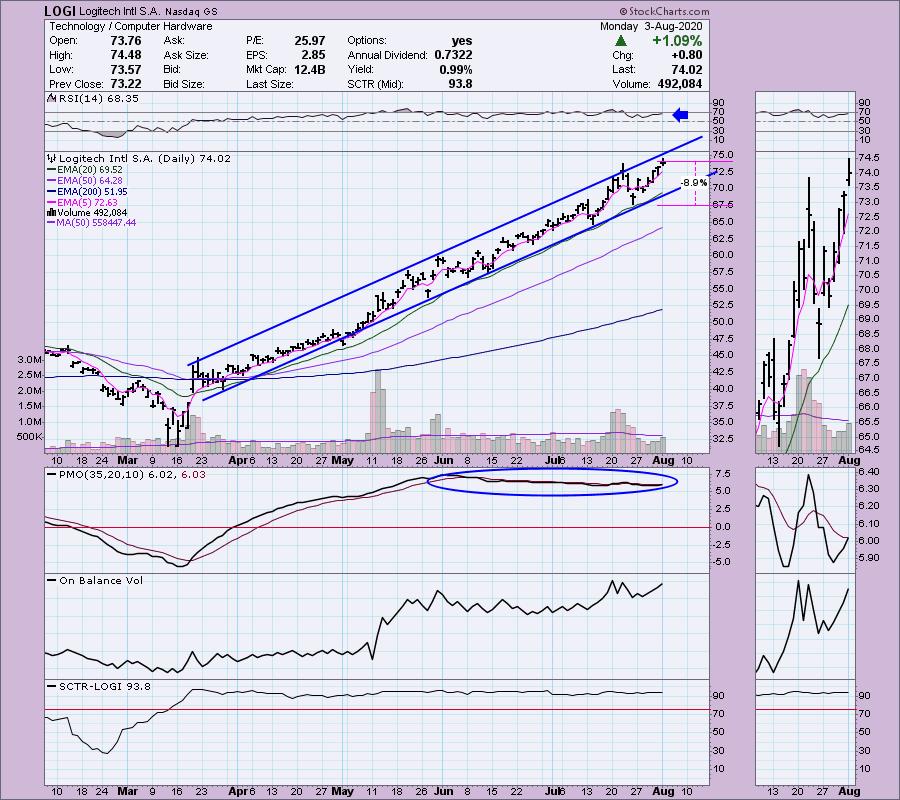

Logitech Intl SA (LOGI) - Earnings: 10/19/2020 (AMC)

Logitech International SA is a holding company, which engages in design, manufacture, and marketing of peripherals for PCs, tablets and other digital platforms. It offers headsets, speakers, mice, keyboards, and webcams. The firm's brand include Logitech, Jaybird, Ultimate Ears, Logitech G, ASTRO Gaming, and Blue Microphones.

I wish I'd found this chart much sooner. Talk about a steady rising trend, this one is still within a rising trend channel that developed back in April. Winners tend to keep on winning and this stock clearly has resisted the market storms. The PMO is very flat which makes sense as price has been steadily rising with no acceleration. The PMO is ready to trigger another BUY signal. I would set my stop around $67.50...somewhere that would show a breakdown from that rising trend channel.

The weekly PMO is rising and is not overbought. My main concern would be the steep rising trend, but as we've seen on the monthly chart it is holding up. Another reason why you'd want to consider selling the position when that rising trend is broken.

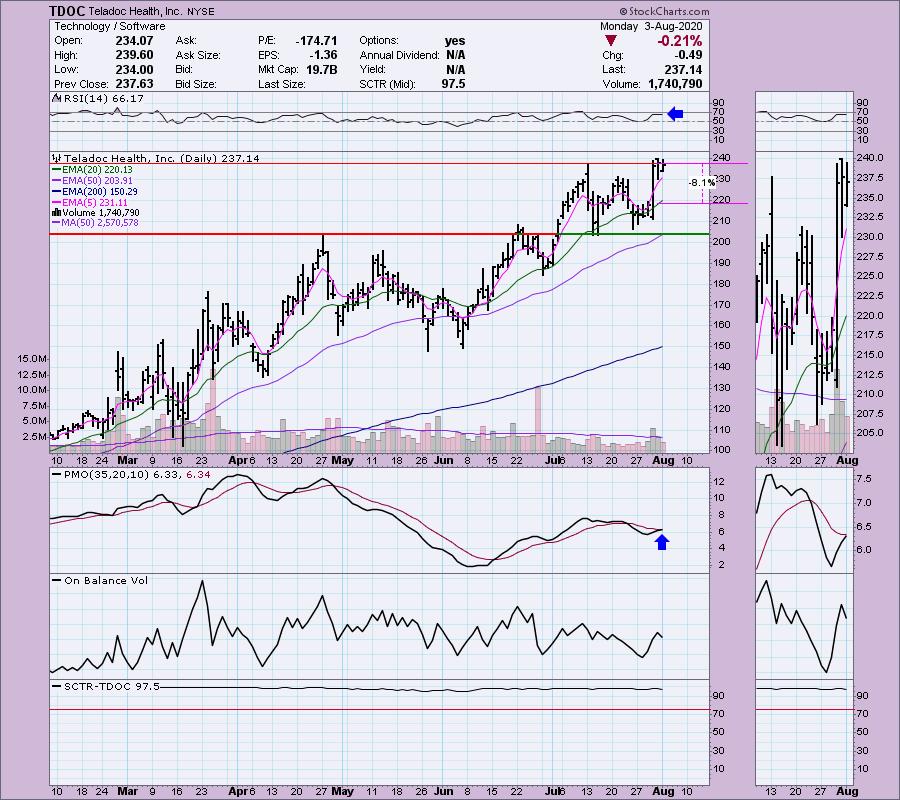

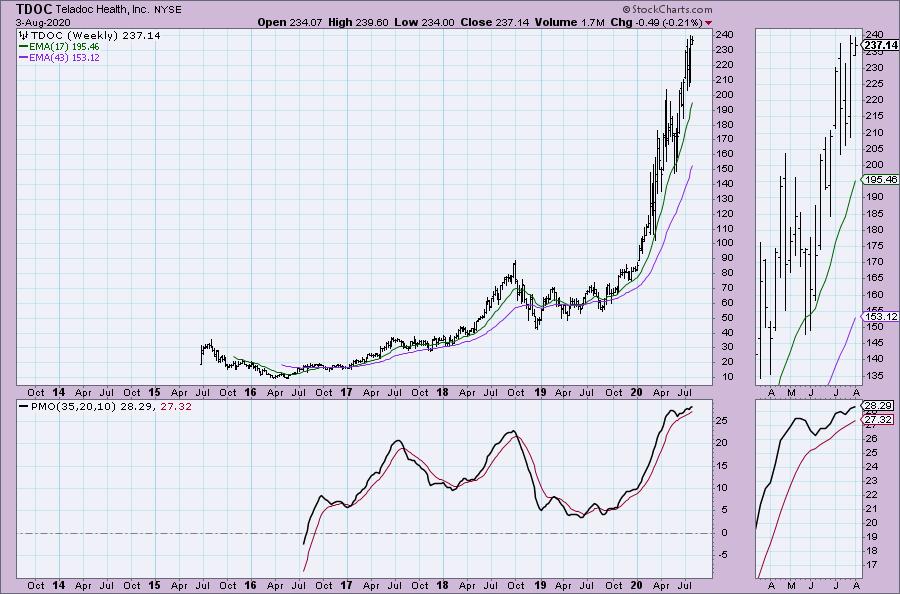

Teladoc Health Inc (TDOC) - Earnings: 10/28/2020 (AMC)

Teladoc Health, Inc. engages in the provision of telehealthcare services using a technology platform via mobile devices, the Internet, video and phone. Its portfolio of services and solutions covers medical subspecialties from non-urgent, episodic needs like flu and upper respiratory infections, to chronic, complicated medical conditions like cancer and congestive heart failure.

Last I checked, TDOC was up 1.83% in after hours trading so maybe we're onto something good here. The RSI is positive and the PMO is about to trigger a BUY signal. You could make a case for a double-bottom, but as I said above, the textbooks only allow for it to develop have a declining trend, not rising. We haven't gotten a decisive 3% breakout, but the chart is shaping up for a breakout.

I like the weekly chart, although the PMO is decelerating in overbought territory.

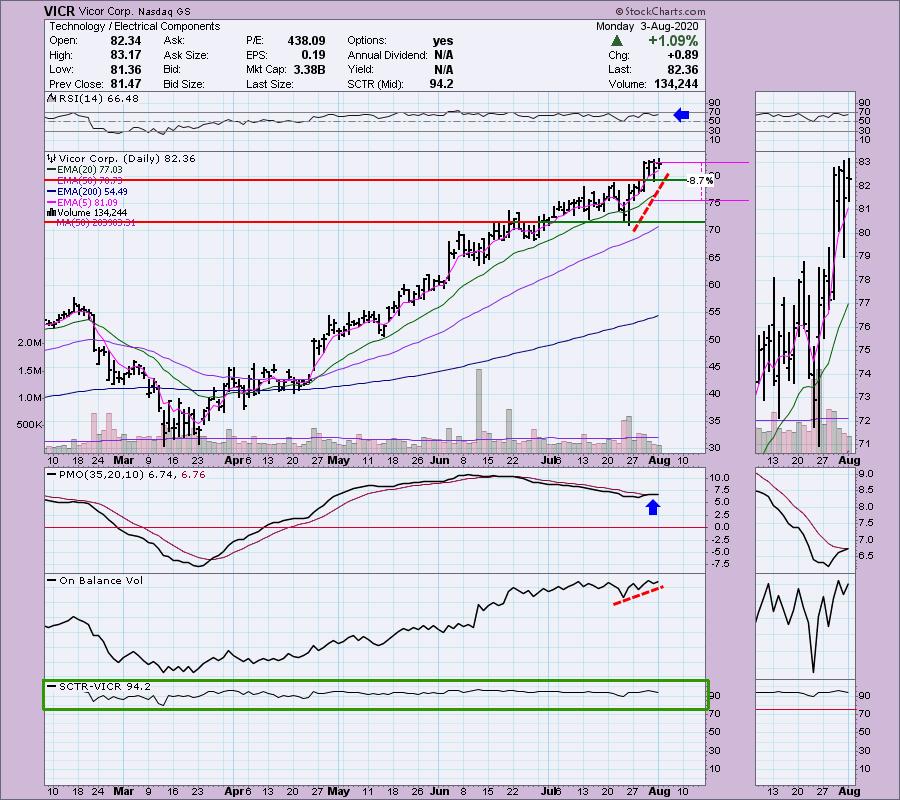

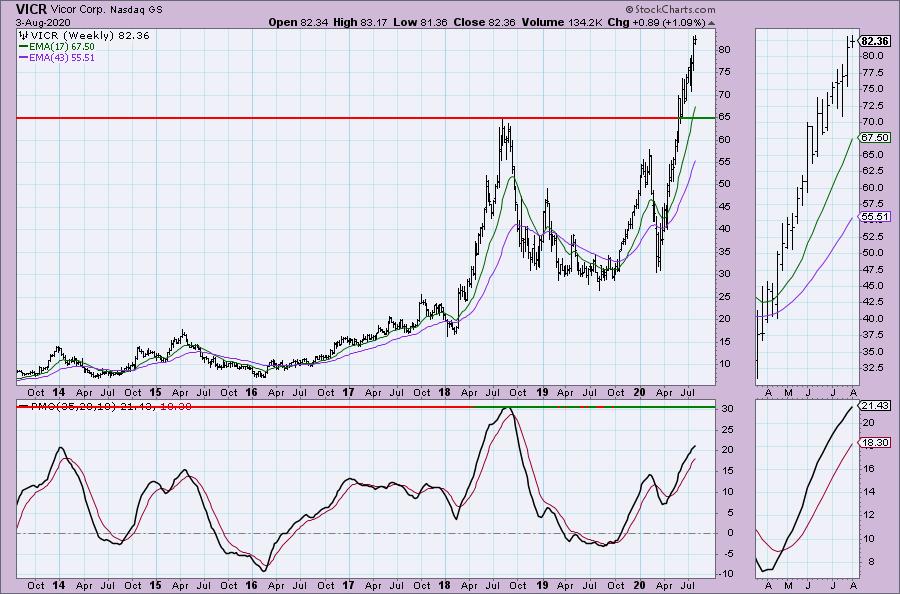

Vicor Corp (VICR) - Earnings: 10/15/2020 (AMC)

Vicor Corp. engages in the design, development, manufacture, and marketing of modular power components. The firm provides complete power systems based upon a portfolio of patented technologies. Its products include AC-DC converters, power systems, and accessories.

We should see a PMO BUY signal on this one tomorrow. I like the recent breakout and consolidation. The OBV is confirming the move with rising bottoms, the RSI is positive and not overbought and it has a first rate SCTR in the "hot zone" above 75 all year long.

This is another one with a vertical rising trend. The PMO isn't overbought though. This one is a lower volume stock, so just keep an eye on that.

Current Market Outlook:

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

- The Bullish Percent Index (BPI) shows the percentage of SPX stocks on Point & Figure BUY signals.

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Diamond Index:

- Diamond Scan Results: 17

- Diamond Dog Scan Results: 44

- Diamond Bull/Bear Ratio: 0.39

Full Disclosure: I'm about 70% invested right now as I've closed a few positions on trailing stop triggers. I did add RGEN and LXP to my portfolio this morning. 30% is in 'cash', meaning in money markets and readily available to trade with.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

ANNOUNCEMENT:

The MoneyShow Las Vegas has been canceled "in person", but I will still be presenting during their video production. As soon as I have information, I will forward it! In the meantime, if you haven't already, click to get your free access pass!

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Thursdays 8:00a EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!