I generally don't do exclusively short-term trades in the DP Diamonds reports as I'm more of an intermediate-term trader and I know many of you are the same, but I also know that many of you out there are day traders and short-term traders. Today's choices I'm listing as "short-term" mainly because the weekly charts do not look optimal for a longer-term trade. As with all Diamonds, I do have stop levels so you can always hold it longer if it behaves.

I really appreciate all of the upgrades and annual subscriptions that are coming in right now! Thanks so much to our DecisionPoint Faithful! I do want you to understand that you can ALWAYS upgrade your current subscription to an annual at your current rate; pay for 10 months and get 12! BUT, you can't add DP Alert without paying the higher rate after August 15th. More information is below.

** IMPORTANT NEWS for my current Diamonds-only subscribers, on August 15th the price of Diamonds Reports will be doubling to $50/mo. You do NOT need to concern yourself if you're happy with what you have. Your rate will stay at $25/month as long as your subscription continues in good standing. You can also switch to annual at the current rate of $250/yr at anytime.

However, you should consider our Bundle package if you aren't already a DP Alert subscriber. DPA will be going from $30/mo to $40/mo so adding DP Alert later will be more expensive by far.

If you add DP Alert after 8/15, it will cost you an additional $40/mo or $400/yr for a Bundle total of $65/mo or $650/yr. Bundles currently are $50/mo or $500/yr.

To summarize, if you don't already have the Bundle, you'll want to do that now before it becomes very expensive.

Other good news! I will be incorporating a 1-hour trading room, "The DecisionPoint Diamond Mine" once a week for Diamond subscribers only on Fridays! It will be an opportunity for us to talk live, review current and past Diamonds for possible entries/exits and take your questions and symbol requests in this intimate trading room. There will also be a once a week free trading room, "DecisionPoint Trading Room" for 1 hour on Tuesdays (we will keep our "diamonds" to ourselves though). But wait, there's more! I will be adding a Friday Diamonds Recap where I will look at the performance of that week's Diamonds and their prospects moving forward. Over the weekend we clean the slate and start over again. I hope you enjoy the new changes that will be underway soon! **

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "diamonds in the rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

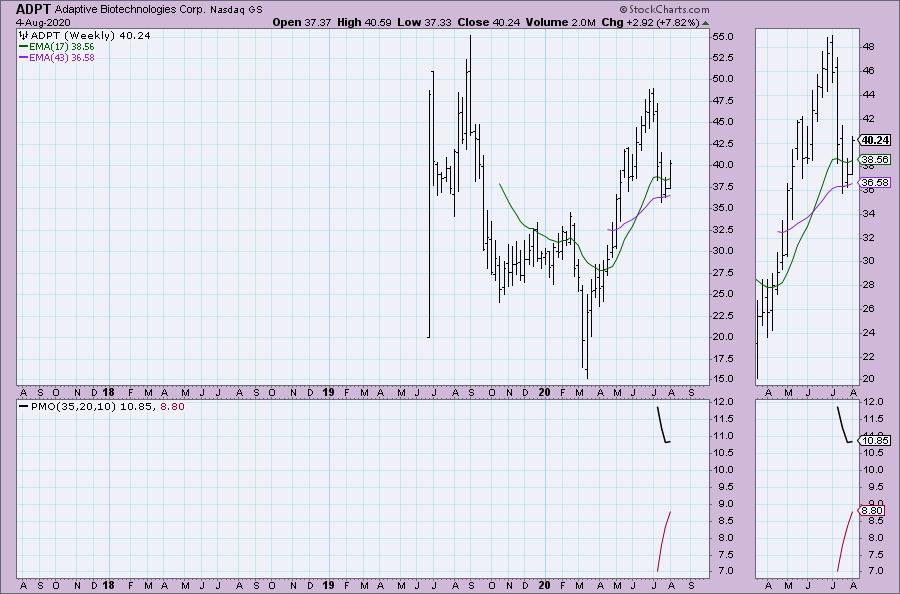

Adaptive Biotechnologies Corp (ADPT) - Earnings: 8/10/2020 (AMC)

Adaptive Biotechnologies Corp. engages in the development of an immune medicine platform. It harnesses the inherent biology of the adaptive immune system to transform the diagnosis and treatment of disease. Its products and services include immunoSEQ, clonoSEQ, cellular therapy, and vaccines.

Here we have a nice cup-shaped bottom. The PMO has turned back up and the OBV is confirming the move. You can see at the blue arrow that price is above the 20-EMA for the first time since its slide back in early July. The RSI is currently negative as it is below net neutral (50), but it is continuing to rise. The stop level is somewhat deep at about 10%, but watch the 200-EMA, that must hold up as support and it could end up moving your stop higher.

Not much data here, but technically the weekly PMO has ticked up today.

Applied Therapeutics Inc (APLT) - Earnings: 8/10/2020 (BMO)

Applied Therapeutics, Inc. is a clinical-stage biopharmaceutical company, which engages in developing a pipeline of novel product candidates against validated molecular targets in indications of high unmet medical need.

Here is another rounded bottom. The PMO has just about triggered a BUY signal. The RSI is very negative, but rising. I think the PMO and positive divergence on the OBV make this one a good bottom fish. Unfortunately the stop level would need to be deep on this one. I'd keep an eye on the PMO if you get in and be sure it keeps rising, if it tops it's time to bail.

Technically the weekly PMO is falling fast and you could easily make a case for an intermediate-term double-top forming. Keep this on a short leash or at least go in with eyes open on the possible downside risks.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

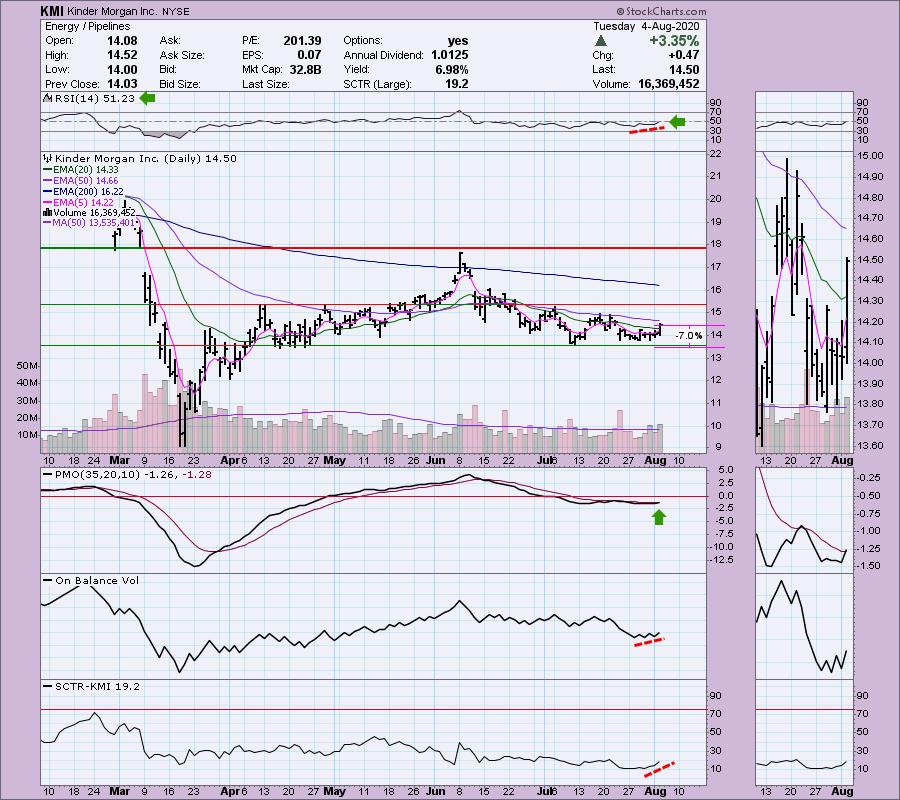

Kinder Morgan Inc (KMI) - Earnings: 10/21/2020 (AMC)

Kinder Morgan, Inc. is an energy infrastructure company, which engages in the operation of pipelines and terminals that transport natural gas; gasoline; crude oil; carbon dioxide (CO2) and other products and stores petroleum products chemicals; and handles bulk materials like ethanol, coal, petroleum coke and steel. The firm operates through the following segments: Natural Gas Pipelines, CO2, Terminals, Product Pipelines, and Kinder Morgan Canada. The Natural Gas Pipelines segment engages in the ownership and operation of major interstate and intrastate natural gas pipeline and storage systems, natural gas and crude oil gathering systems, and natural gas processing and treating facilities. The CO2 segment focuses on the production, transportation, and marketing of CO2 to oil fields that use CO2 as a flooding medium for recovering crude oil from mature oil fields to increase production. The Terminals segment consists of the ownership and operation of liquids and bulk terminal facilities located throughout the U.S. and portions of Canada that transload and store refined petroleum products, crude oil, chemicals, ethanol and bulk products, including coal, petroleum coke, fertilizer, steel and ores. The Products Pipelines segment owns and operates refined petroleum products, NGL and crude oil and condensate pipelines that primarily deliver, among other products, gasoline, diesel and jet fuel, propane, crude oil, and condensate to various markets. The Kinder Morgan Canada segment operates the Trans Mountain pipeline system that transports crude oil and refined petroleum products from Edmonton, Alberta, Canada for marketing terminals and refineries in British Columbia, Canada and the state of Washington.

The Energy sector is still beat down and I've found many interesting candidates from this sector for bottom fishing. This one caught my eye with a new PMO BUY signal and confirming OBV. What's different this time in comparison to the last PMO BUY signal that was lost so quickly? Look at the behavior of the OBV when the BUY signal triggered. It had risen, but it hadn't reached the previous top. The RSI back then wasn't on a steady rise. This time around, the PMO BUY signal is accompanied by a higher high on the OBV and an improving RSI. We're even seeing a little improvement in the SCTR.

The weekly chart shows us some great upside potential. However it also shows risk with support down at under $13. I don't want to necessarily ride it all the way down there, so keep in mind that since the strongest support level is there, it may require a trip down there first. The weekly PMO makes me feel a bit better given it is currently on a BUY signal.

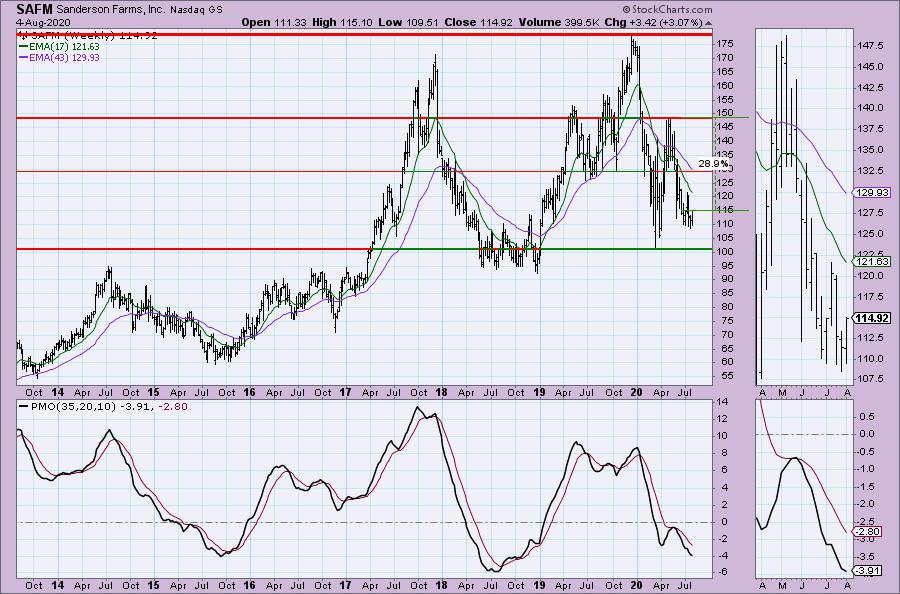

Sanderson Farms Inc (SAFM) - Earnings: 8/27/2020 (BMO)

Sanderson Farms, Inc. is a poultry processing company, which engages in the production, processing, marketing, and distribution of fresh, frozen, further processed, and partially cooked chicken products. It operates through the following divisions: Production, Processing, and Foods. The Production division refers to the production of chickens to the broiler stage. The Processing division involves the processing, sale, and distribution of chickens. The Foods division comprises the processing, marketing, and distribution of prepared chicken items sold nationally and regionally. The firm offers its products under the brand Sanderson Farms.

I presented Sprouts (SFM) as a Diamond awhile back. If the market begins to turn, having a Consumer Staple stock isn't a bad idea and I like this one for a number of reasons. First, a new PMO BUY signal came in on today's breakout move. With that big move, it has made the stop level very manageable. Today price closed above the 20-EMA. Looks like a double-bottom is forming and the minimum upside target of that pattern would take price to at least $132.50. The RSI is about to turn positive and there is a beautiful positive divergence with the OBV. I don't think the rally is over on this one.

The weekly PMO is decelerating and upside potential looks pretty good!

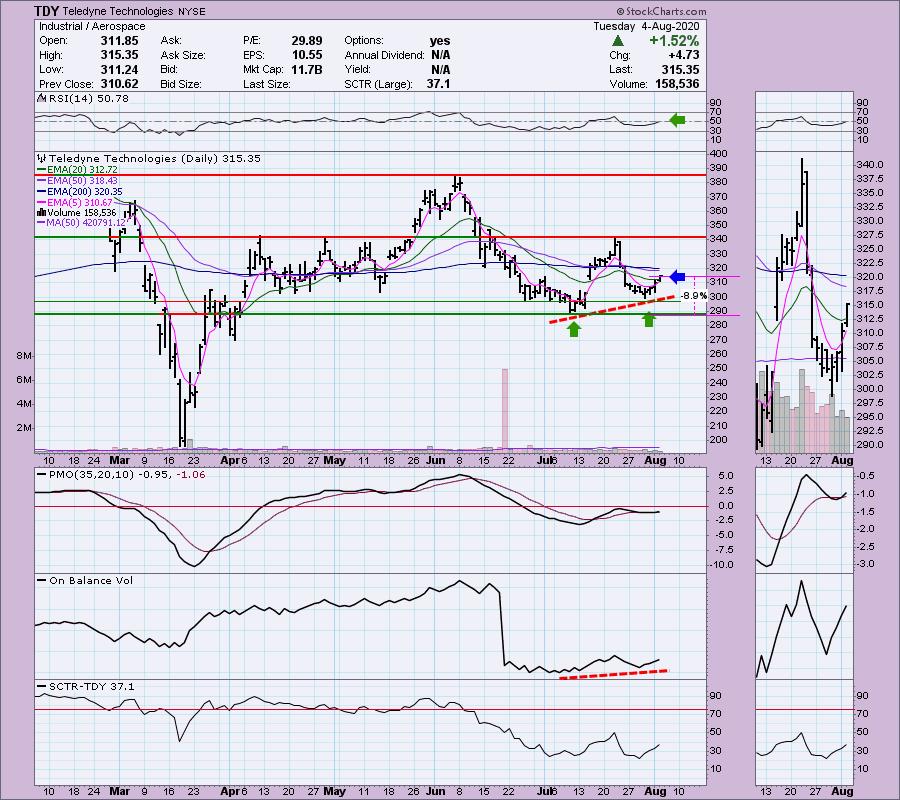

Teledyne Technologies (TDY) - Earnings: 10/21/2020 (BMO)

Teledyne Technologies, Inc. engages in the provision of electronic and communication products for wireless and satellite systems. It operates through the following business segments: Instrumentation; Digital Imaging; Aerospace & Defense Electronics; and Engineered Systems. The Instrumentation segment includes monitoring and control instruments for marine, environmental, and industrial applications. The Digital Imaging segment offers sensors, cameras, and infrared systems. The Aerospace & Defense Electronics segment provides electronic components, data acquisition, subsystems, and communications equipment. The Engineered Systems segment develops and produces electrochemical energy systems and small turbine engines.

We could be seeing a double-bottom forming on TDY. Price closed above the 20-EMA and the RSI just moved into positive territory. The OBV is confirming the move and the PMO just triggered a BUY signal. The SCTR is beginning to improve.

The weekly PMO is trying to decelerate in oversold territory and upside potential is great.

Current Market Outlook:

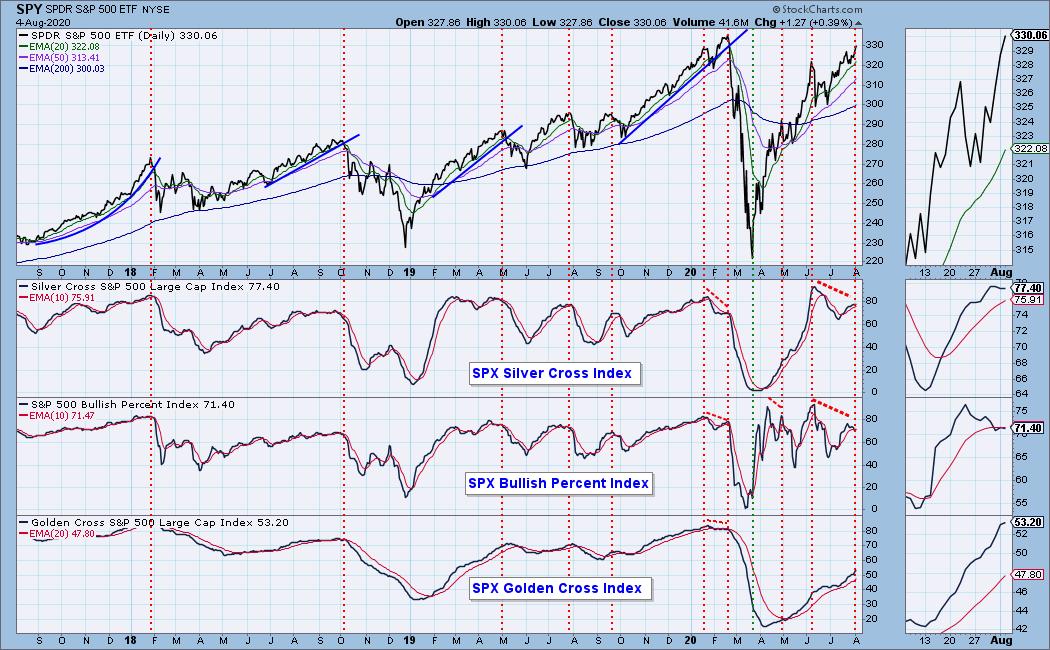

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

- The Bullish Percent Index (BPI) shows the percentage of SPX stocks on Point & Figure BUY signals.

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Diamond Index:

- Diamond Scan Results: 32

- Diamond Dog Scan Results: 34

- Diamond Bull/Bear Ratio: 0.94

Full Disclosure: I'm about 70% invested right now and 30% is in 'cash', meaning in money markets and readily available to trade with.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

ANNOUNCEMENT:

I have the information for my VIRTUALpresentation at The Money Show! My presentation will on August 19th at 1:20p EST! Click here for information on how to register to see me!

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Thursdays 8:00a EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!d