I was pleased to find a few charts with 'falling wedges'. These are bullish patterns that suggest a breakout. These wedges have just executed, so our expectation would be a continuation of the breakout rally. I also found that scan results were skewed toward Utilities. I opted to include three. You'll likely recognize the Software stock I've included and the Consumer Staples stock is definitely well-known! Pleasantly, I hadn't expected today to be a breakout day for the market but since it was, I wasn't stopped out and a few targets were hit. I'm now determining whether to tighten up the stops and continue to ride or sell a portion of my shares. The charts on a few are bullish still, so a tight stop to lock in profits will likely be how I proceed.

I will be traveling July 1 - July 15. I will be writing on the road, but broadcasting will be suspended during that time. It's going to be an adventurous road trip for me and my husband. We will be taking a train from Los Angeles to New Orleans, visiting family, checking out retirement areas and then renting a car and making our way back to California with various stops along the way. I'll be sure to post a picture or two and I'm sure I'll have funny stories to share along the way. It'll be interesting to see the various stages of the reopening of America.

A heads up to Bundle subscribers, after tomorrow the LIVE Trading Room will be going on hiatus as Mary Ellen will also be out of pocket in the upcoming month. We hope to reopen in late-July. If you recently upgraded to get the Trading Room, I do hope you'll continue the subscription while we are on hiatus. Please direct questions to erin@decisionpoint.com.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "diamonds in the rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

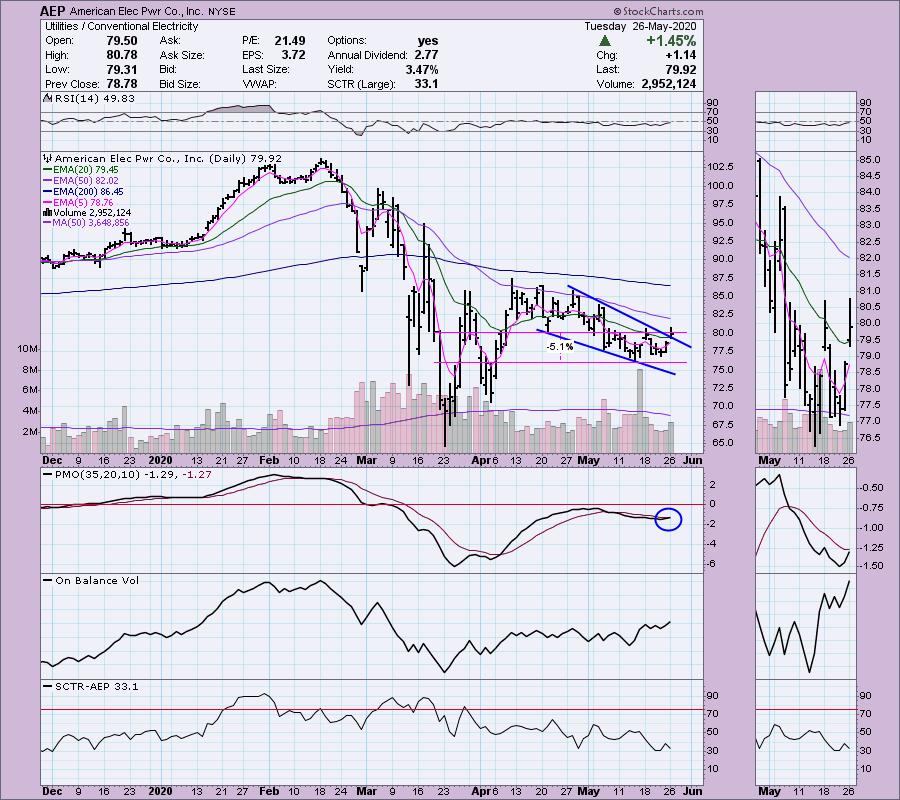

American Elec Power Co (AEP) - Earnings: 7/23/2020 (BMO)

American Electric Power Co., Inc. is a public utility holding company that engages in the business of generation, transmission and distribution of electricity. It operates through the following segments: Vertically Integrated Utilities, Transmission & Distribution Utilities, AEP Transmission Holdco and Generation & Marketing. The Vertically Integrated Utilities segment engages in the generation, transmission and distribution of electricity for sale to retail and wholesale customers through assets owned and operated by its subsidiaries. The Transmission & Distribution Utilities segment engages in the business of transmission and distribution of electricity for sale to retail and wholesale customers through assets owned and operated by its subsidiaries. The AEP Transmission Holdco segment engages in the development, construction and operation of transmission facilities through investments in its wholly-owned transmission subsidiaries and joint ventures. The Generation & Marketing segment engages in non-regulated generation and marketing, risk management, and retail activities.

Here is the first falling wedge of the bunch. The RSI isn't quite to 50, but it appears to be rising. The PMO is very close to a BUY signal. Price not only broke from the wedge, it closed above the 20-EMA on a gap up. I would likely set a tight stop near the May low. If it falls back within the wedge and falls beneath that stop area, the stock is likely in for more downside which I would want to avoid.

We see that weekly PMO is in oversold territory and does appear to be decelerating. Overhead resistance at the 2nd quarter 2019 high would be a good "relook" point if you get in. My upside target matches overhead resistance at the 2019 tops.

Akamai Tech Inc (AKAM) - Earnings: 7/28/2020 (AMC)

Akamai Technologies, Inc. engages in the provision of cloud services for delivering, optimizing, and securing content and business applications over the Internet. Its products include security, web performance, media delivery, and network operator.

I like the double-bottom that is forming. You could also set a reasonable stop around support at $92.50. The PMO is lackluster right now but the RSI is above 50 and we have rising bottoms on the OBV. I always like to see a SCTR above 75.

We have a BUY signal on the weekly PMO and it is currently rising. We are about 8.5% away from the all-time high. That would be a good relook target.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

American Water Works Co (AWK) - Earnings: 8/5/2020 (AMC)

American Water Works Co., Inc. engages in the provision of complementary water and wastewater services. It operates through the following segments: Regulated Businesses; Market-Based Businesses; and Other. The Regulated Businesses segment provides water and wastewater services to customers. The Market-Based Businesses segment is responsible for Military Services Group, Contract Operations Group, Homeowner Services Group, and Keystone Operations. The Other segment includes corporate costs that are not allocated to the Company's operating segments, eliminations of inter-segment transactions, fair value adjustments and associated income and deductions related to the acquisitions that have not been allocated to the operating segments for evaluation of performance and allocation of resource purposes.

I wanted this to be a falling wedge, but it lined up as a declining trend channel. Price broke out but then consolidated sideways. Today we saw a slight breakout above resistance that lines up with the 2019 tops on the left-hand side. Price closed above the 5/20-EMAs so we got a ST Trend Model BUY signal. The PMO is about to trigger a BUY signal.

I would do a relook target at about $128 and would set my price target to the all-time high. The weekly PMO isn't great so this might be a shorter-term investment.

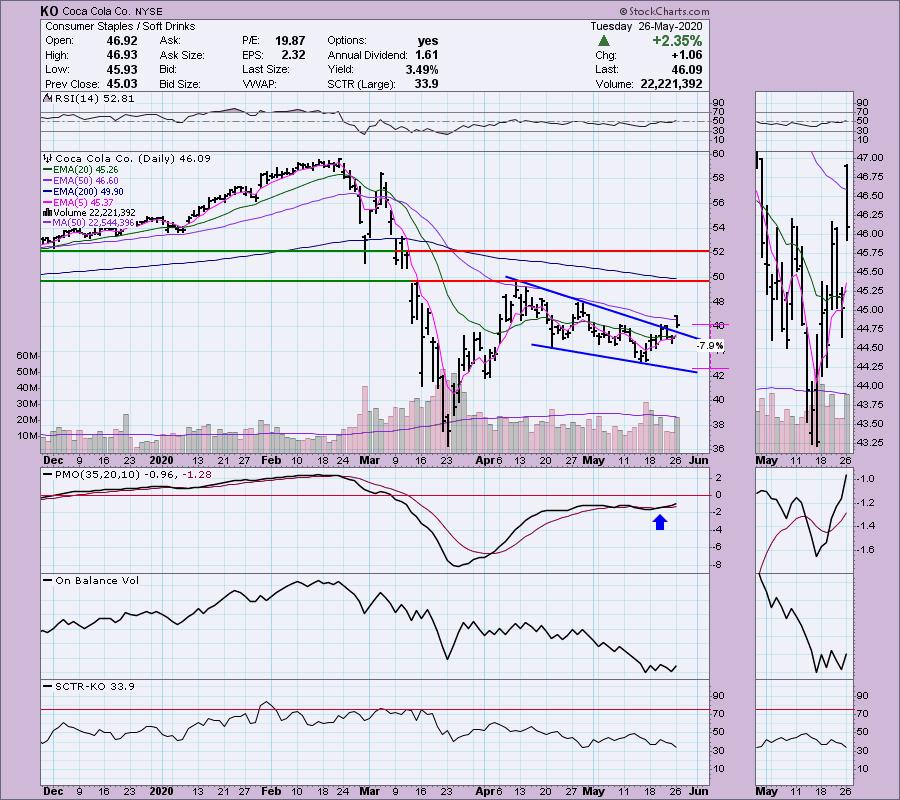

Coca Cola Co (KO) - Earnings: 7/21/2020 (BMO)

The Coca-Cola Co. is the nonalcoholic beverage company, which engages in the manufacture, market, and sale of non-alcoholic beverages which include sparkling soft drinks, water, enhanced water and sports drinks, juice, dairy and plant-based beverages, tea and coffee and energy drinks. Its brands include Coca-Cola, Diet Coke, Coca-Cola Zero, Fanta, Sprite, Minute Maid, Georgia, Powerade, Del Valle, Schweppes, Aquarius, Minute Maid Pulpy, Dasani, Simply, Glaceau Vitaminwater, Bonaqua, Gold Peak, Fuze Tea, Glaceau Smartwater, and Ice Dew. It operates through the following segments: Eurasia and Africa, Europe, Latin America, North America, Asia Pacific, Bottling Investments and Global Ventures.

Here is another rising wedge on a stock you'll recognize. CCEP, Coca Cola Europe, came up on the scan results, but I took a look at KO's chart and found it to be far more bullish. We have the execution of a falling wedge that is coming on the heels of a 5/20-EMA positive crossover. The RSI is rising above 50 and OBV bottoms are rising.

I am definitely a fan of Coke (the drink and this weekly chart!). The PMO is turning up and there's lots of potential on the upside target.

Southern Co (SO) - Earnings: 7/29/2020 (BMO)

The Southern Co. is a holding company. The firm engages in the sale of electricity. It operates through the following segments: Traditional Electric Operating Companies, Southern Power and Southern Company Gas. The Traditional Electric Operating Companies segment refers to vertically integrated utilities that own generation, transmission and distribution facilities, and supplies electric services in the states of Alabama, Georgia, Florida, and Mississippi. The Southern Power segment constructs, acquires, owns, and manages generation assets such as renewable energy projects and sells electricity in the wholesale market. The Southern Company Gas segment distributes natural gas through natural gas distribution facilities in the states of Illinois, Georgia, Virginia, New Jersey, Florida, Tennessee, and Maryland.

I used to own this stock and I'm considering reentering. There is a bullish falling wedge, but it hasn't executed yet. I might consider getting in before that breakout given price traded completely above the 20-EMA. This has a great dividend and yield as well. The SCTR is a bit of a problem given it is declining. The OBV has a lovely positive divergence that I don't think has completely played out on this rally.

The PMO seems to be decelerating. Of course, I did look and this was a Diamond on April 9th. The weekly PMO was rising at the time and it didn't do much at all. I prefer a better weekly chart, but for a short-term trade it could be good.

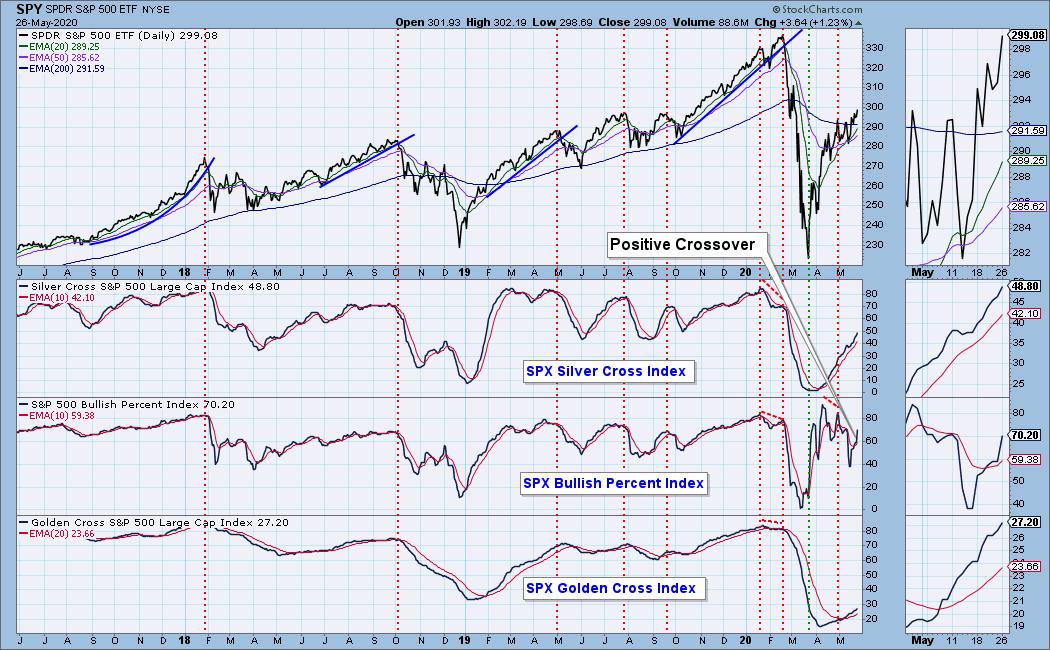

Current Market Outlook:

Market Environment: It is important to consider the odds for success. The Silver Cross Index measures the percentage of stocks on IT Trend Model BUY signals (20-EMA > 50-EMA), while the Golden Cross Index measures the percentage of stocks on LT Trend Model BUY signals (50-EMA > 200-EMA). Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page. Here are the current percentages on the Silver and Golden Cross Indexes:

Diamond Index:

- Diamond Scan Results: 4

- Diamond Dog Scan Results: 9

- Diamond Bull/Bear Ratio: 0.44

For a more comprehensive review of current market conditions as well as analysis of Dollar, Gold, Oil and Bonds, subscribe to the DecisionPoint Alert! For a LIMITED TIME you can get a coupon code that will give you a discount for bundling your Diamonds subscription with the DecisionPoint Alert! Contact support@decisionpoint.com for more details.

Full Disclosure: I do not currently own any of the above stocks. While today was a great breakout day, I am not planning on adding positions to my portfolio. The market is overdue for a pullback. I am currently 55% in cash.

Erin Swenlin will be presenting at the The MoneyShow Las Vegas August 16 - 20 at Bally's/Paris Resort! You'll have an opportunity to meet Erin and discuss the latest DecisionPoint news and Diamond Scans. Claim your FREE pass here! You can watch online with this pass too!! There will be online events held in May and when I have more information I'll let you know.

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Thursdays 8:00a EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!