The scan I like best right now gives me results for Bullish EMA configurations with a SCTR > 70. It is producing lots of interesting selections and many big names. I picked two that are piquing my interest and have three reader requests. The requests are always great and I must say last Thursday's request to look at Zoom (ZM) for a short was brilliant. I appreciate seeing what you're eyeing and then picking the ones that have promise based on my analysis. I continue to include not only stop levels (in pink) on the daily charts, but also upside targets (in green) on the weekly charts if appropriate. It is important to consider targets right now. Volatility will continue and we need to take profits when possible even through partial position sales.

Mary Ellen and I have begun to hit our stride with the live Trading Room on Tuesdays/Thursdays. We start with an inventory of current market conditions, look at gapping stocks to find entries and during the 2nd half of the program, take viewer symbol requests. I look at the daily chart and if it is bullish, I drill down to the 5-minute chart and look for possible entry points. Give it a try!

Live Trading Room - Tuesdays/Thursdays

I'm teaming up with Mary Ellen McGonagle (MEMInvestmentResearch.com) to do regular "LIVE Trading Room" sessions for FREE at 11:00a EST. We've had excellent reviews on our new LIVE Trading Rooms so far and plan on continuing them Tuesdays/Thursdays 11:00a EST. The link will be sent out the day before the event, so watch your email and tell your colleagues to sign up for our free email list on DecisionPoint.com to be notified!

READER REQUEST: Evoqua Water Technologies Corp (AQUA) - Earnings: 5/12/2020 (BMO)

I like this particular industry group as 'up and coming'. It is just now starting to outperform the SPX. AQUA is outperforming both the industry group and the SPX so it is poised well. I believe we have some opportunity for entry on this one given its huge loss today. There are still some issues because it did fail resistance at the 200-EMA and it closed back in the declining trend. However, the indicators are quite favorable with a PMO BUY signal and rising bottoms on RSI, OBV and SCTR.

Not too much history on this one, but given what we know, its bear market low had a successful test of support at the 2018 low. What is good here is that our target is attainable without having to test all-time highs. Why is that good? I like to have the ability to close out all or part of a position when I have a target in mind. I like not having to wait for a test of all-time highs or a move past all-time highs to produce that profit.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "diamonds in the rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

Mine: Alteryx Inc (AYX) - Earnings: 5/6/2020 (AMC)

This has been a darling for me. I got in at the right time last year and even with the bear market killing, I still made a tidy profit. I'm considering picking this one up again. We have a very bullish double-bottom that executed today. The close was right on the confirmation line, so technically it hasn't really executed yet. The 50-EMA is still above the 200-EMA so AYX never got a LT SELL signal on a Death Cross. The RSI is just above 50 which I like, especially if it is rising from oversold territory. My one problem is that the OBV doesn't have rising bottoms to confirm this current rally. That PMO BUY signal coming out of oversold territory is quite bullish and the SCTR is back in the zone above 75. This was a giant upside move, there is a chance we will see a pullback. I hope so, I'll be watching the 5-minute bar chart for possible entry points on Monday. This one might be a runner.

Look at the upside target areas, quite nice. The parabolic broke down and we are now getting some very volatile chop as it works to find an area to base. The PMO is turning up. There is an ominous double-top, but it never executed on that bear market low. It still could technically execute, but if we see price hold above $111 for a week or two, I would consider the pattern dissolved.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Reader Request: Crown Castle Intl Corp (CCI) - Earnings: 4/29/2020 (AMC)

I'll be honest, I'm not a fan of REITs or the Real Estate sector in general right now. It has been seriously outperforming which is good, but the underlying fundamentals with the housing market worry me. Carl and I believe a bubble is forming. If we have 30% unemployment and more confinement, there will be defaults all over the place, so keep that in mind. Kudos to my reader for sussing this one out before this giant rally. Unfortunately right now it is pretty overbought. Good thing is you could still get in and set a reasonable stop. The RSI is on the rise and not overbought. The PMO looks great and it isn't overbought. The SCTR has been strong. It would be more enticing on a pullback, but higher prices aren't out of the question.

CCI is near all-time highs. The long-term rising trend is intact and we have a new PMO BUY signal that printed today. The PMO isn't really overbought, but price certainly is.

Mine: Clorox Co (CLX) - Earnings: 5/1/2020 (BMO)

This one came up on my scans yesterday and today. CLX is a coronavirus play in my mind. Typically, like many Consumer Staples members, they tend to move sideways in a wide trading range. It's the nature of the sector which is far less exciting and slower moving that say Technology. Right now, I can't find Clorox and haven't for over a month. I have to believe this is good for business. It saw an emotional spike mid-March as the stay-in-place orders materialized across the nation. I believe we could see price get back up there. The PMO just gave us a BUY signal. Volume has settled down and the OBV is steadily rising, along with RSI. Hard to beat a SCTR over 95.

The weekly PMO looks great and is only mildly overbought. If price can reach the all-time high, that will be a tidy 16% profit.

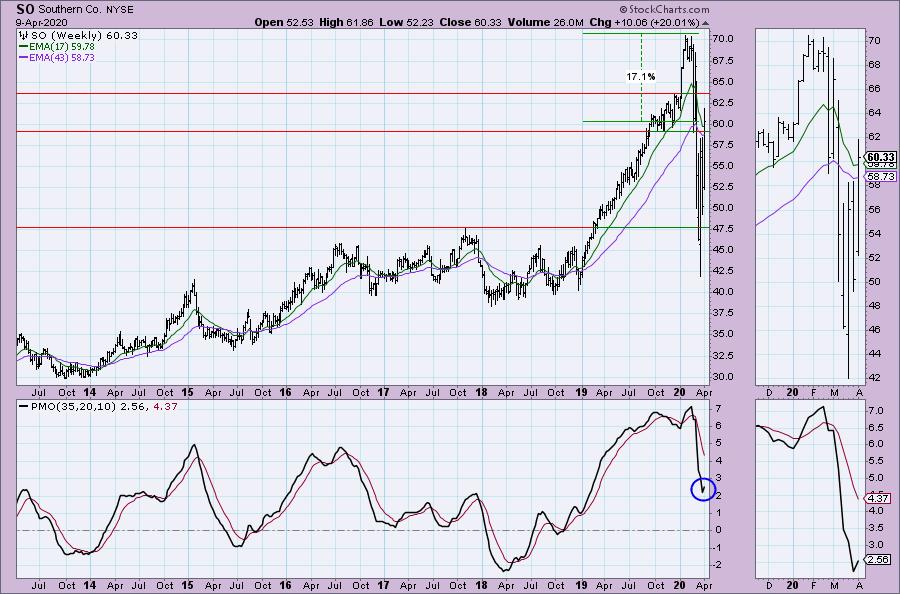

Reader Request: Southern Company (SO) - Earnings: 4/30/2020 (BMO)

Very interesting chart in an area I do like. Utilities are still performing nicely and I suspect they will continue to until the bear market is truly finished. I noticed an inverse head and shoulders pattern. I'm not generally a fan of upward sloping necklines, but even with that, SO executed the pattern. The 5-EMA crossed above the 20-EMA. The PMO BUY signal looks good and the OBV is confirming the rally. Note the yield on this one is over 4%.

The weekly PMO has ticked upward and we have a 17% profit target.

Current Market Outlook:

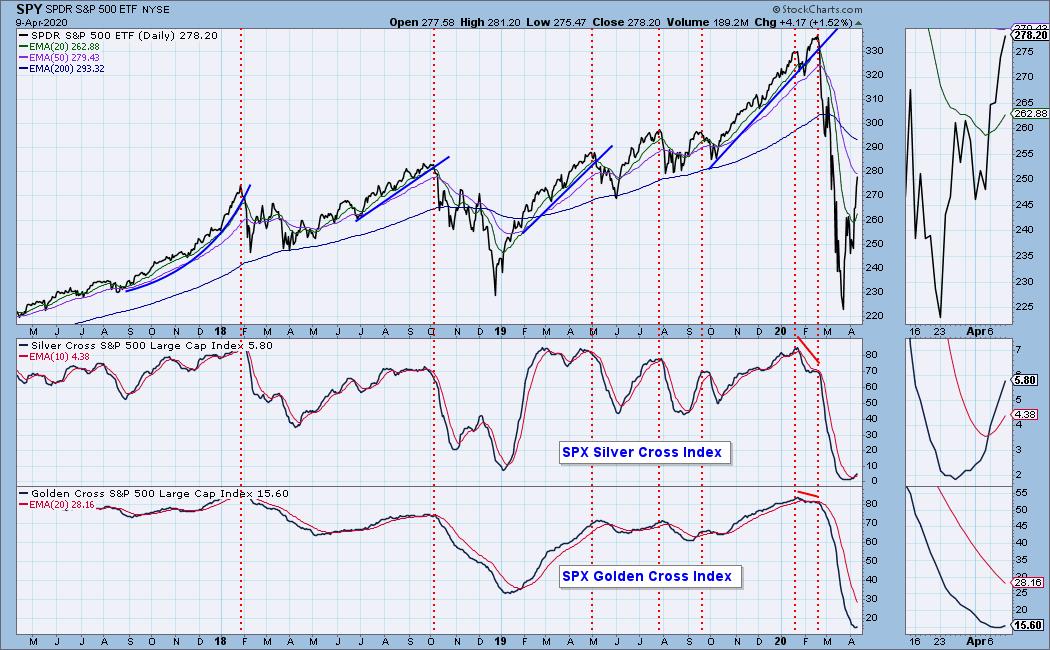

Market Environment: It is important to consider the odds for success. The Silver Cross Index measures the percentage of stocks on IT Trend Model BUY signals (20-EMA > 50-EMA), while the Golden Cross Index measures the percentage of stocks on LT Trend Model BUY signals (50-EMA > 200-EMA). Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page. Here are the current percentages on the Silver and Golden Cross Indexes:

Diamond Index:

- Diamond Scan Results: 0

- Diamond Dog Scan Results: 0

- Diamond Bull/Bear Ratio: 0.00

For a more comprehensive review of current market conditions as well as analysis of Dollar, Gold, Oil and Bonds, subscribe to the DecisionPoint Alert! For a LIMITED TIME you can get a coupon code that will give you a discount for bundling your Diamonds subscription with the DecisionPoint Alert! Contact support@decisionpoint.com for more details.

Full Disclosure: I do not own any of the stocks above. I'm currently 60% in cash.

Erin Swenlin will be presenting at the The MoneyShow Las Vegas August 16 - 20 at Bally's/Paris Resort! You'll have an opportunity to meet Erin and discuss the latest DecisionPoint news and Diamond Scans. Claim your FREE pass here! You can watch online with this pass too!! There will be online events held in May and when I have more information I'll let you know.

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin LIVE on Mondays 5:00p EST or on the StockCharts TV YouTube channel here!

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erinh@stockcharts.com

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!