Market action today was very encouraging after the lukewarm finish to yesterday's trading. The overall market as I analyzed in today's DecisionPoint Alert has me ready to dive back in to some trades which I'll discuss in my conclusion. I decided to select Mastercard (MA) from the reader requests today. Remember to send them in during the week and I'll pick at least one to feature in Thursday's Diamonds report. I will be showing you one of the stocks that is in the queue of orders for me tomorrow. I say it often, but when I am ready to purchase, I do the same scans that I do for you and pick from the list of Diamonds I present to you. Said like the "most interesting man in the world"-- I don't always trade, but when I do it's from the DecisionPoint Diamonds Report!

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "diamonds in the rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

Current Market Outlook:

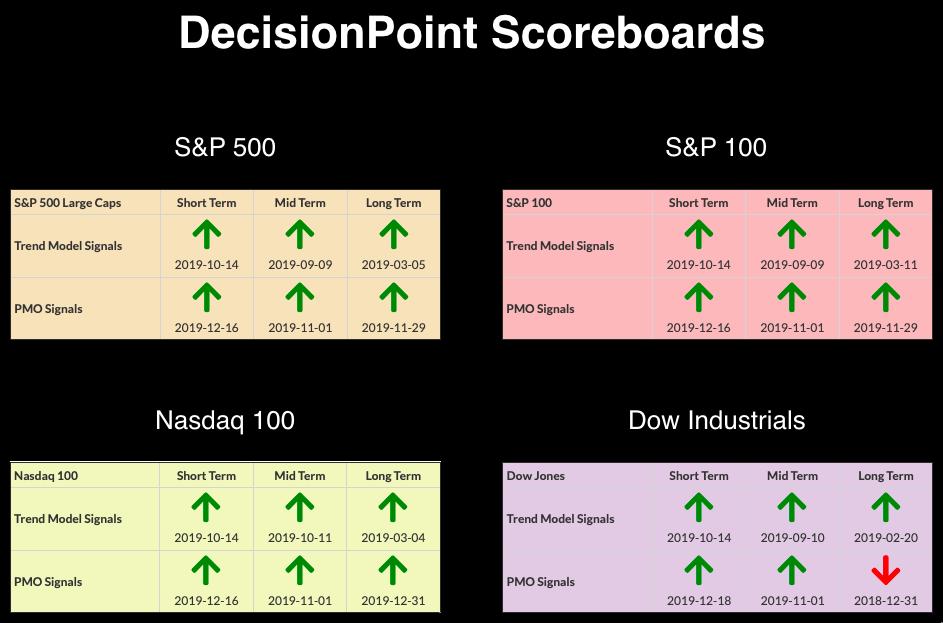

Market Trend: Currently, we have Trend Model BUY signals in all three timeframes on the DP Scoreboard Indexes.

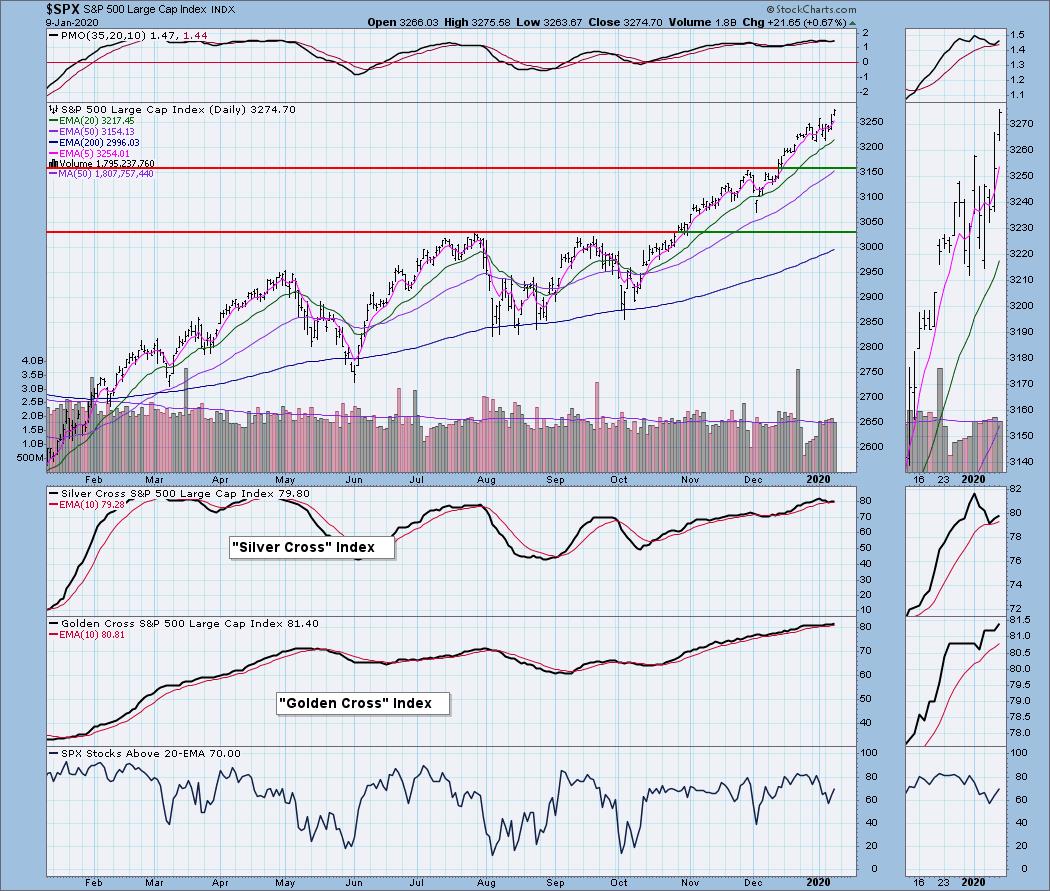

Market Condition: The market is beginning to show short-term strength, but remains overbought. Remember that in a bull market, overbought conditions can persist.

Market Environment: It is important to consider the odds for success. The Silver Cross Index measures the percentage of stocks on IT Trend Model BUY signals (20-EMA > 50-EMA), while the Golden Cross Index measures the percentage of stocks on LT Trend Model BUY signals (50-EMA > 200-EMA). Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side. Here are the current percentages on the Silver and Golden Cross Indexes:

Diamond Index:

- Diamond Scan Results: 16

- Diamond Dog Scan Results: 19

- Diamond Bull/Bear Ratio: .84

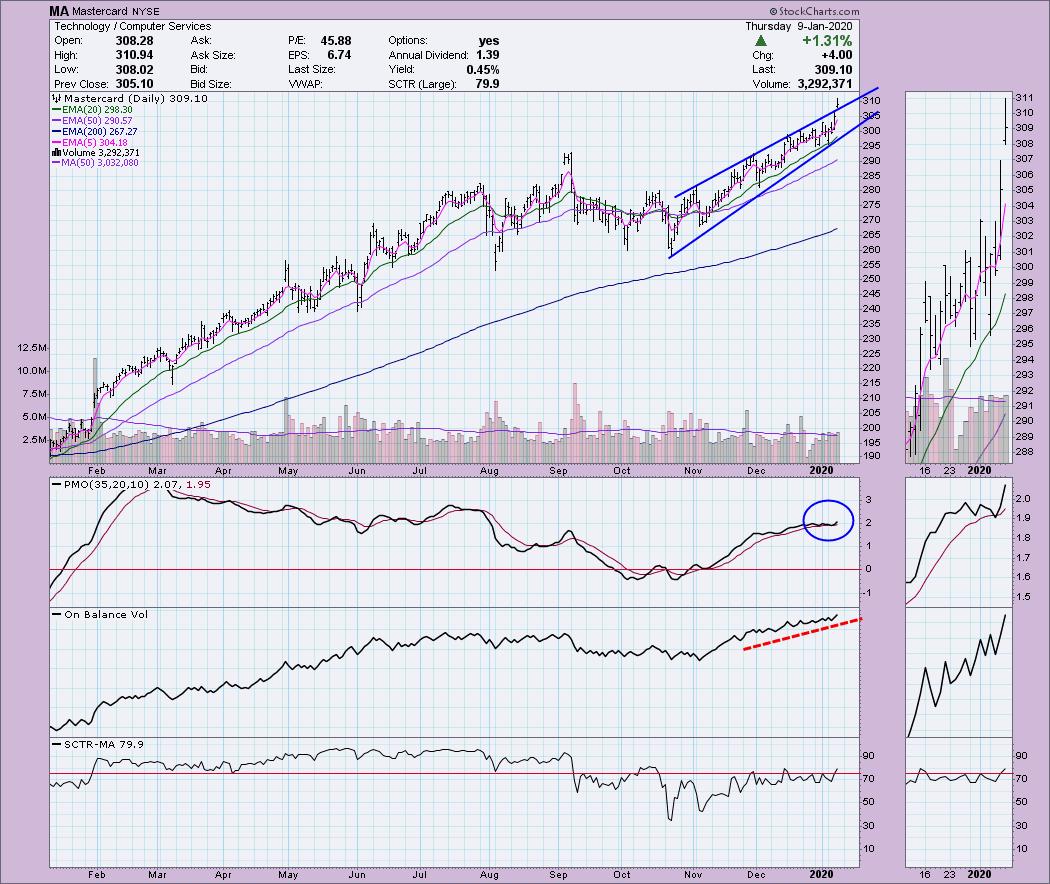

Mastercard (MA) - Earnings: 1/29/2020

I thought this request was a good choice. The request came in yesterday before the gap up rally today, so someone's analysis process is serving them well. When I looked at it yesterday, I wasn't completely convinced because of the bearish rising wedge. Today it gave us a bullish conclusion to a bearish pattern which is generally extra bullish. In this case, I think it helps to nullify the negative outlook that the pattern normally presents. The PMO is continuing higher and is not overbought. The OBV continues to confirm the rally and breakouts as they occur. The SCTR just entered into the "hot zone" above 75.

The weekly chart looks great minus the rising wedge. The weekly PMO has just triggered a BUY signal suggesting that the wedge isn't likely to resolve downward--at least not yet.

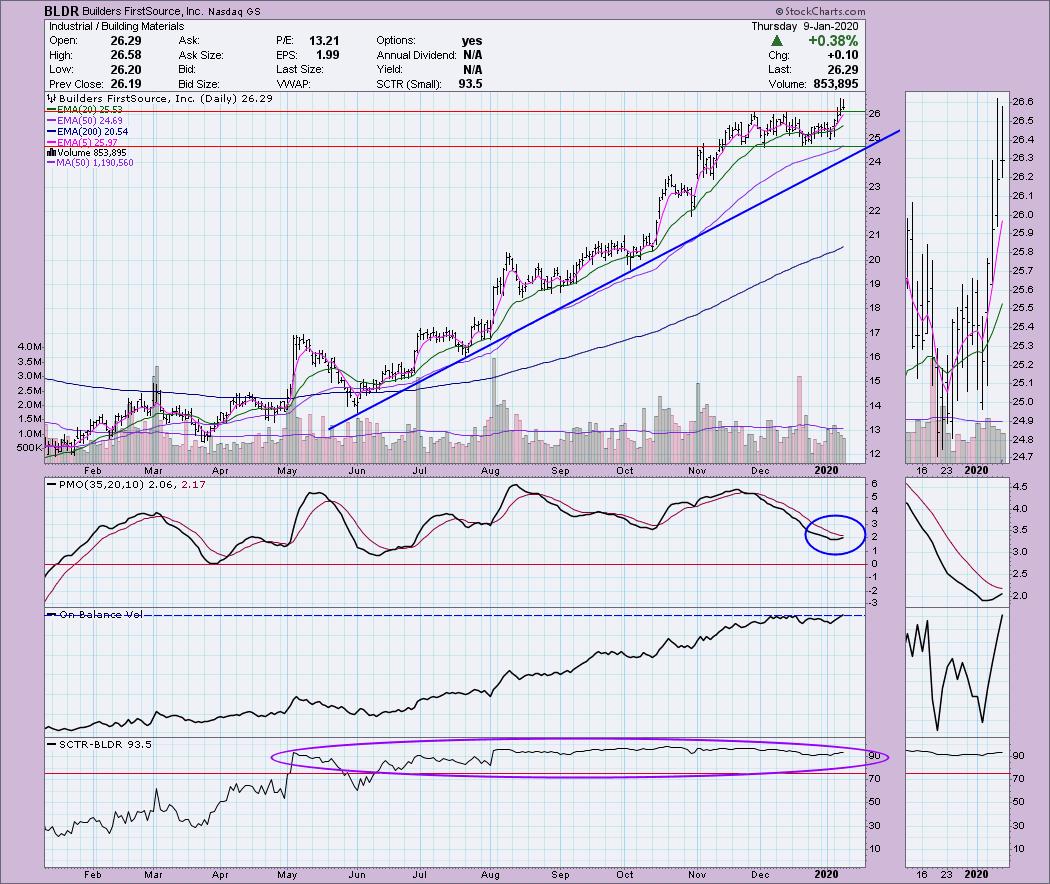

Builders FirstSource Inc (BLDR) - Earnings: 2/26 - 3/1/2020

BLDR broke out of a trading range yesterday but closed back within. Today trading was above that range all day. I think this gives us more confidence in that holding as a support line. The PMO is bottoming as we like and most importantly on this chart, the OBV confirmed the breakout by moving to a new high (it's visible best in the thumbnail). No denying relative and internal strength with a SCTR that has remained above 75 most of the year.

The breakout looks enticing on the weekly chart. The PMO had started to turn over, but has now put on the breaks and could be ready to turn higher. While it could be seen as overbought given the previous weekly PMO tops, but we certainly saw the range stretched in 2015.

Insmed Inc (INSM) - Earnings: 2/20 - 2/24/2020

Mary Ellen McGonagle and I hosted Wealthwise Women today on StockCharts TV and both us liked what we're seeing coming out the Health Care sector. Yesterday I spotlighted Inspire Medical (INSP) and have added it to my portfolio. INSM looks good as well. I think my only concern here would be that it is nearing resistance at the March 2019 low and the June 2019 top. $27 could be a make or break. The good thing is that after rallying intensely Tuesday and Wednesday, today it pulled back which makes for a better entry. The rising trend needs to stay in place, so setting a stop below the rising trend is a place to consider. The OBV is looking positive as it rises along with price.

I wasn't I was going to include INSM today, but when I looked at the weekly chart, I saw it as a possible intermediate-term investment. The weekly PMO is rising and is not overbought and we just got a 17/43-week EMA crossover. In the case of the weekly chart, overhead resistance is at the 2015 top followed by the previous two cardinal tops in 2018 and 2019.

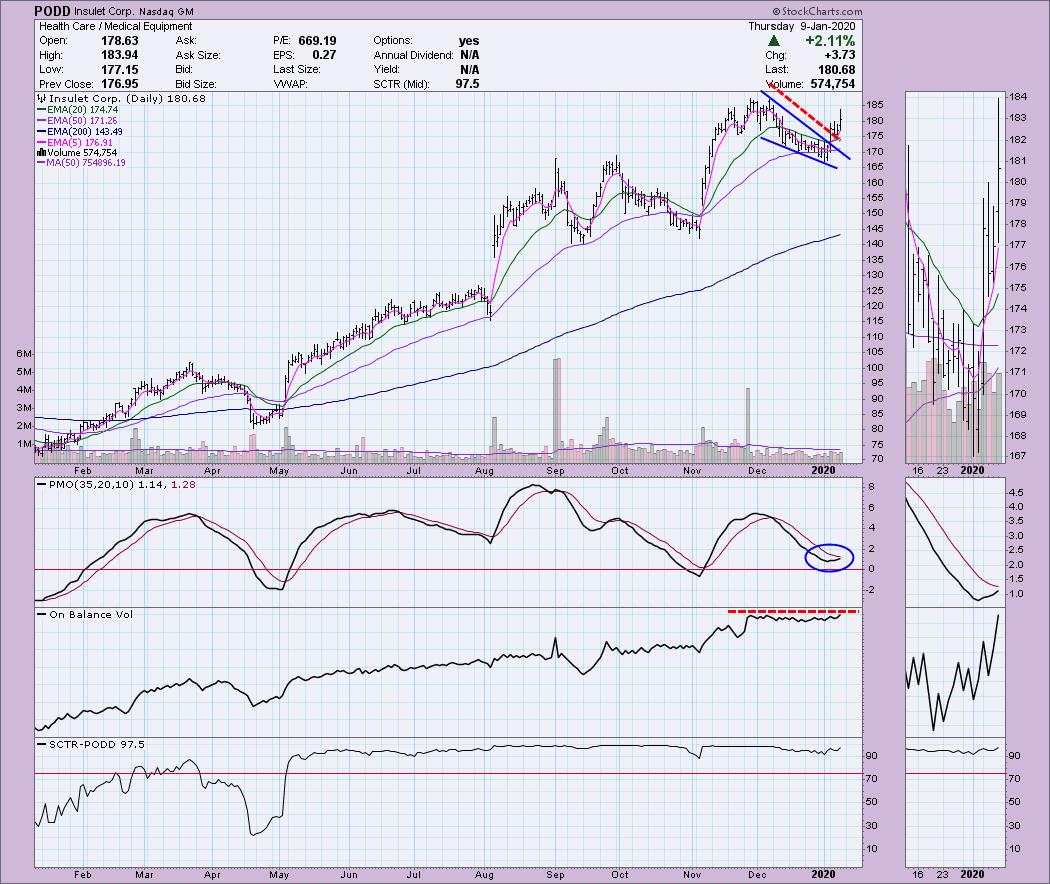

Insulet Corp (PODD) - Earnings: 2/25/2020

This one has a few under the surface positives that everyone might not catch when they first look at this chart. The rally out of the bullish falling wedge was strong. When it moved out of the wedge, it also pierced the 20-EMA. Since then price has held above the 20-EMA (and the 5-EMA). The PMO is rising and nearing a BUY signal. The OBV was actually suggesting this breakout for quite some time. Notice that OBV tops were not falling despite the steady price decline. The SCTR speaks for itself.

The weekly chart is little less likable. However, I'm not going to dismiss this one yet. Remember that overbought conditions can continue on in a rally. PODD had a similar PMO pattern back in 2017/2018. So while the weekly PMO is flattening and moving sideways, I wouldn't completely count this one out as far as a continuation of this week's rally.

PTC Therapeutics Inc (PTCT) - Earnings: 2/26 - 3/2/2020

I'm purchasing this one tomorrow. Normally I would have an issue with the PMO being overbought, but it isn't extremely overbought yet and it is triggering a BUY signal right now. The flag formation is exciting and it does appear price might be pausing a bit before a continuation of the rally. The positive divergence on the OBV is exactly what I want to see and of course the SCTR is just moving back into the "hot zone" above 75.

I think you can make a case for a bullish ascending triangle. The breakout is happening on a PMO BUY signal. I am setting my first target to $62. Once hit, I'll reevaluate. I'll likely set a stop somewhere around $40-$45.

Full Disclosure: I will own PTCT tomorrow if it doesn't act suspect during trading. I purchased CIGNA from yesterday's Diamonds, as well as PAYC and INSP. I will be about 35% cash probably by the end of tomorrow. I'll update in Monday's Diamonds Report.

Erin Swenlin will be presenting at the The MoneyShow Las Vegas on May 11-13, 2020! You'll have an opportunity to meet Erin and discuss the latest DecisionPoint news and Diamond Scans. The conference is free to attend or view online!

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin LIVE on Mondays 5:00p EST or on the StockCharts TV YouTube channel here!

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erinh@stockcharts.com

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

**Don't miss DecisionPoint Commentary! Add your email below to be notified of new updates"**f