Last Friday I told my DP Diamonds subscribers that the Semiconductor industry group was the "one to watch" going into this week after it broke above its January top. Below is the SOXX ETF that covers this group. I'll tell you that my favorite Semiconductor right now is Micron (MU).

It isn't a "perfect" chart given the OBV negative divergence, but the rest looks pretty good. We have not only the price breakout, but a pullback to that breakout point. The RSI is positive and the PMO has just triggered a crossover BUY signal.

The DecisionPoint Alert Weekly Wrap presents an end-of-week assessment of the trend and condition of the Stock Market, the U.S. Dollar, Gold, Crude Oil, and Bonds. The DecisionPoint Alert daily report (Monday through Thursday) is abbreviated and gives updates on the Weekly Wrap assessments.

Watch the latest episode of DecisionPoint on StockCharts TV's YouTube channel here!

MAJOR MARKET INDEXES

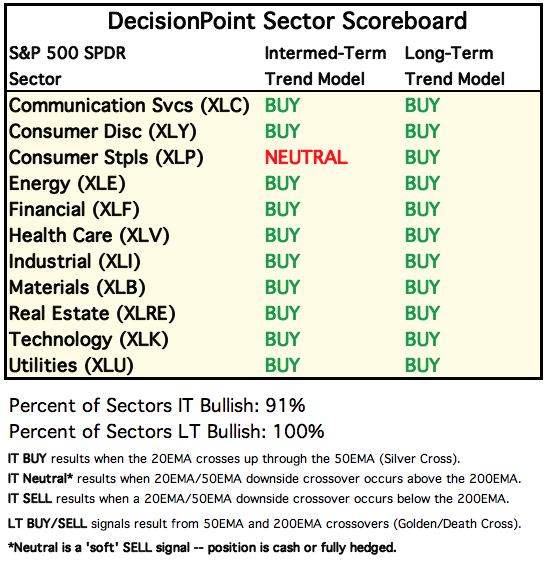

SECTORS

Each S&P 500 Index component stock is assigned to one, and only one, of 11 major sectors. This is a snapshot of the Intermediate-Term (Silver Cross) and Long-Term (Golden Cross) Trend Model signal status for those sectors.

CLICK HERE for Carl's annotated Sector charts.

THE MARKET (S&P 500)

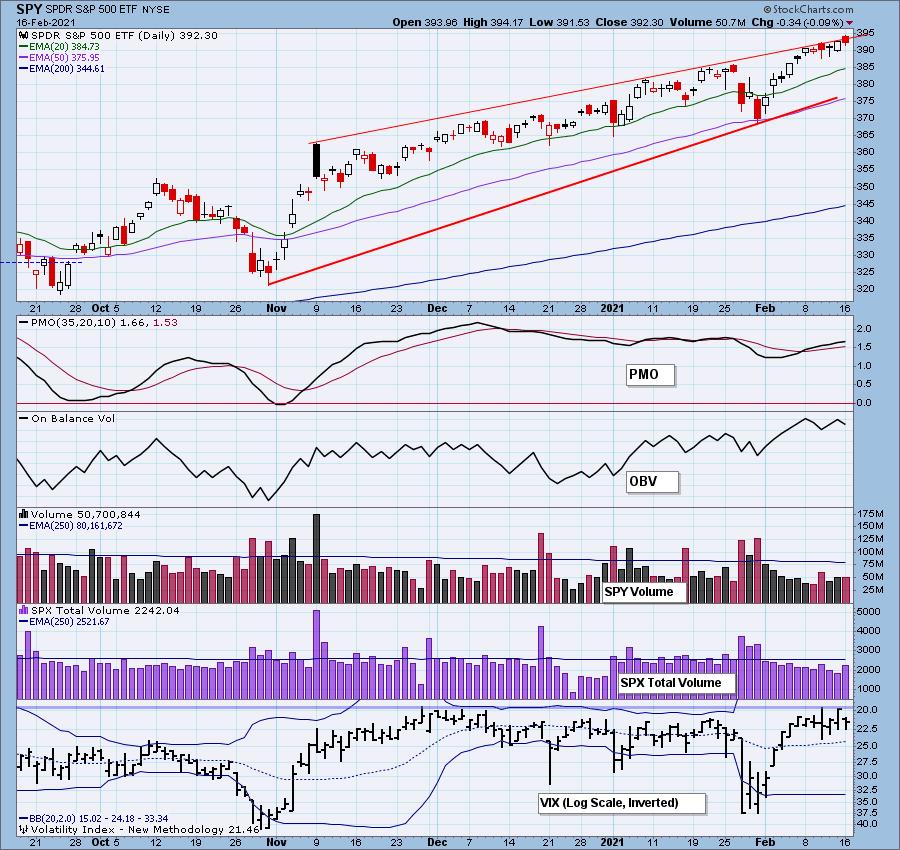

IT Trend Model: BUY as of 5/8/2020

LT Trend Model: BUY as of 6/8/2020

SPY Daily Chart: We did finish lower today, but the SPY set a new intraday all-time high. The PMO is still rising. We saw a jump in total volume today, but it is still below its annual average. My biggest concern is the VIX which hit overbought territory on Friday and is now pulling back.

The RSI is positive and not overbought.

Free DecisionPoint Trading Room on Mondays, Noon ET

David Keller, CMT, Chief Technical Analyst at StockCharts.com will be joining Erin in the free DP Trading Room on March 1st! Dave will give us his take on the market and share his trading methodologies as both of us discuss your symbol requests.

David Keller, CMT is Chief Market Strategist at StockCharts.com, where he helps investors minimize behavioral biases through technical analysis. He is a frequent host on StockCharts TV, and he relates mindfulness techniques to investor decision making in his blog, The Mindful Investor. David is also President and Chief Strategist at Sierra Alpha Research LLC, a boutique investment research firm focused on managing risk through market awareness. He combines the strengths of technical analysis, behavioral finance, and data visualization to identify investment opportunities and enrich relationships between advisors and clients.

*Click here to register for this recurring free DecisionPoint Trading Room on Mondays at Noon ET!*

=======================================

BELOW is a link to today's recording:

Topic: DecisionPoint Trading Room

Start Time : Feb 16, 2021

Meeting Recording:

https://zoom.us/rec/share/G4hnZKpDiDxpK3jFBaao-qVqCJWjEgJNyWn9lueufB-sO-iomygo7tot1vaFKbu7.6013TODA9_Zlb0Jc

Access Passcode: i^96E7mf

For best results, copy and paste the access code to avoid typos.

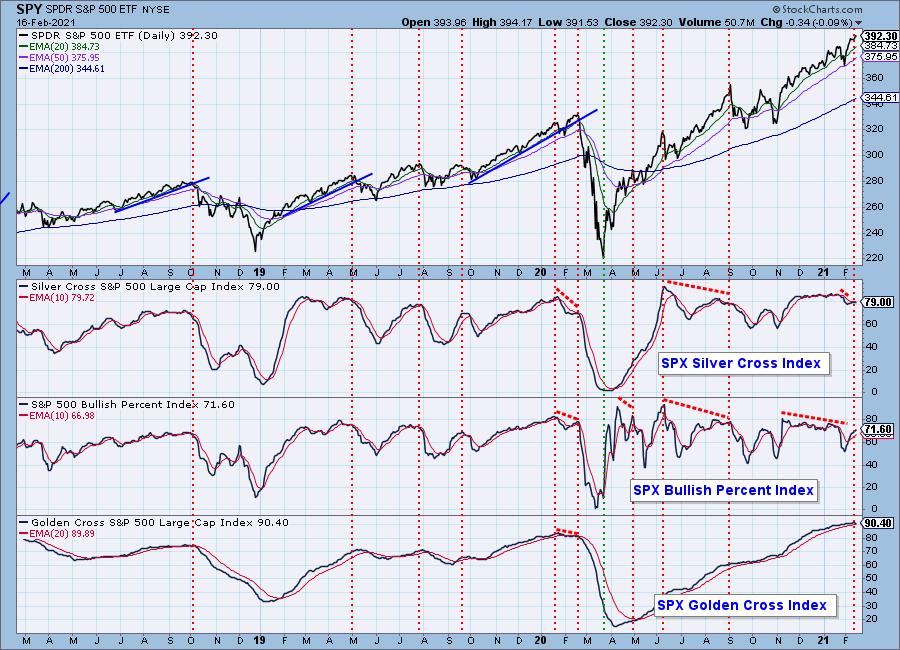

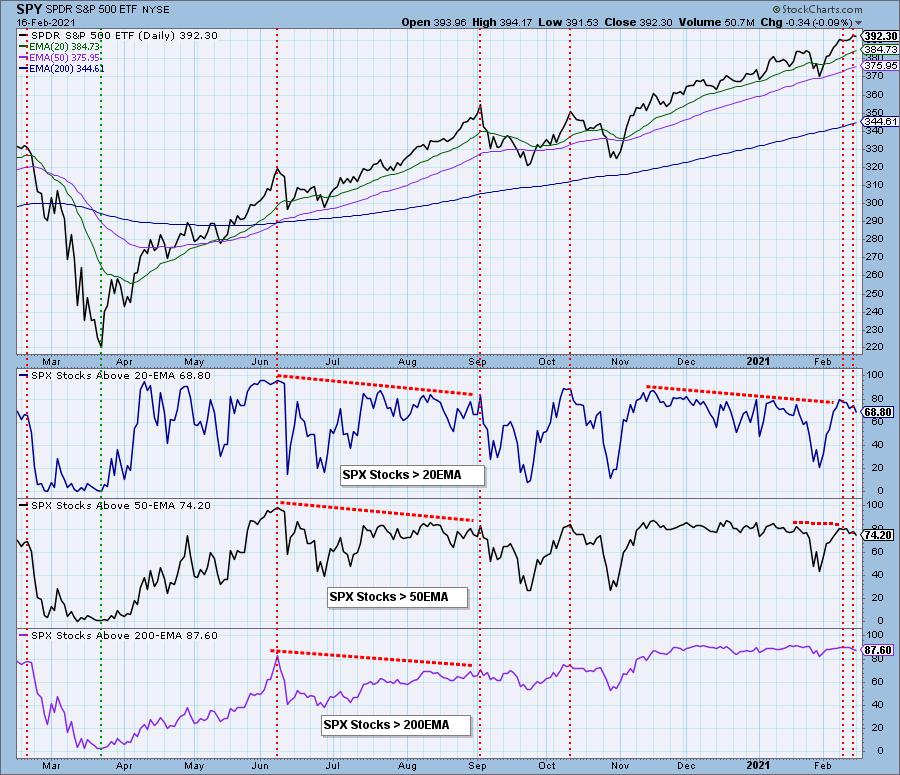

Participation: The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA).

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA).

- The Bullish Percent Index (BPI) shows the percentage of SPX stocks on Point & Figure BUY signals.

It's not quite visible, but both the SCI and GCI turned down. The BPI is still rising. The negative divergences are in play and suggest we are vulnerable to a pullback.

I marked the previous top as well as the current "cardinal top". It really displays the depth of the current negative divergence. Participation is beginning to drop off even as we set another intraday all-time high.

Climactic Market Indicators: No climaxes today, although we did see a healthy bump in New Highs which could indicate an exhaustion. I annotated the overbought conditions of the VIX earlier. The concern is that we are seeing it turn back down on the inverted scale. That typically leads to a decline.

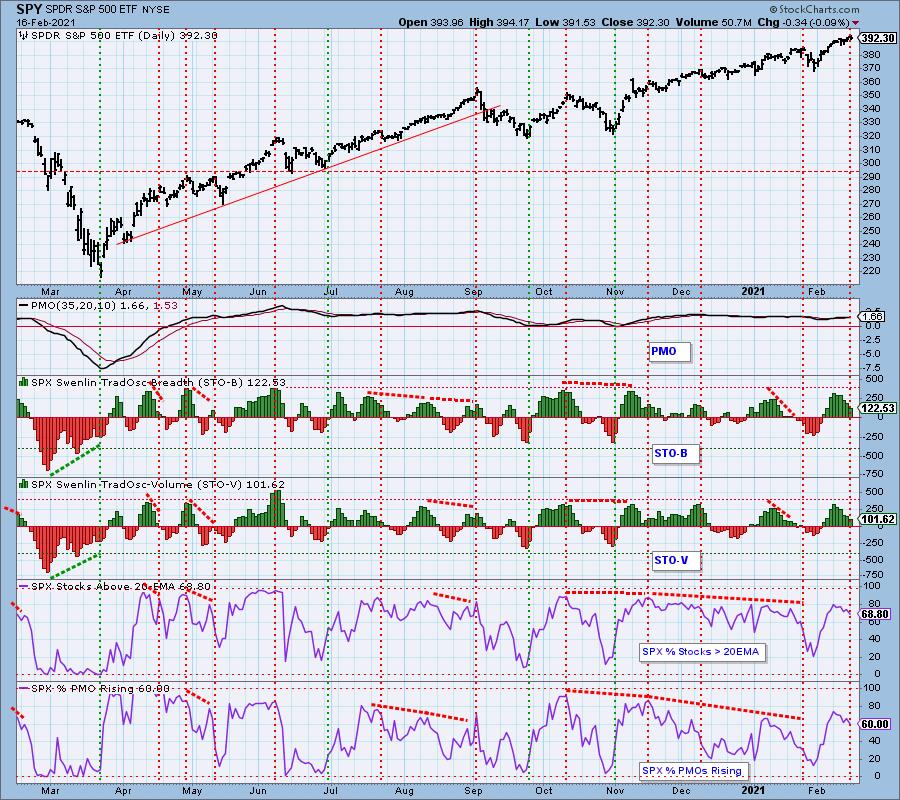

Short-Term Market Indicators: The short-term market trend is UP and the condition is OVERBOUGHT.

The STOs continue lower, as does participation and momentum. I still consider the STOs to be overbought.

Intermediate-Term Market Indicators: The intermediate-term market trend is UP and the condition is OVERBOUGHT. The intermediate-term market bias is BULLISH.

The IT indicators are still rising which tells me while we could see a market reversal, it won't likely be the beginning of a correction.

CONCLUSION: Most are in agreement that the market is overbought and will be declining very soon. Generally when "most are in agreement", the opposite occurs. Given the still positive IT indicators but very negative ST indicators, I would expect to see a decline very soon, but not necessarily a runaway train moving down a steep hill. A bubble is continuing to form in the market overall. My Dad forwarded me an article that listed a number of anecdotes on Twitter that describe the unbelievable speculation in the market. From doctors quitting their jobs to day trade and a youth who just bought a $2 million apartment in NY on proceeds from GME. It isn't this easy, folks. Again, keep your stops in force. You can always get back in if you get stopped out. Pretty soon you'll be quite thankful you have those safety nets in place.

Have you subscribed the DecisionPoint Diamonds yet? DP does the work for you by providing handpicked stocks/ETFs from exclusive DP scans! Add it with a discount! Contact support@decisionpoint.com for more information!

BITCOIN

As crazy as it may seem, Bitcoin has peaked above $50000. If you recall I noted that the minimum upside target (conservatively) based on the large bull flag is $64,500.

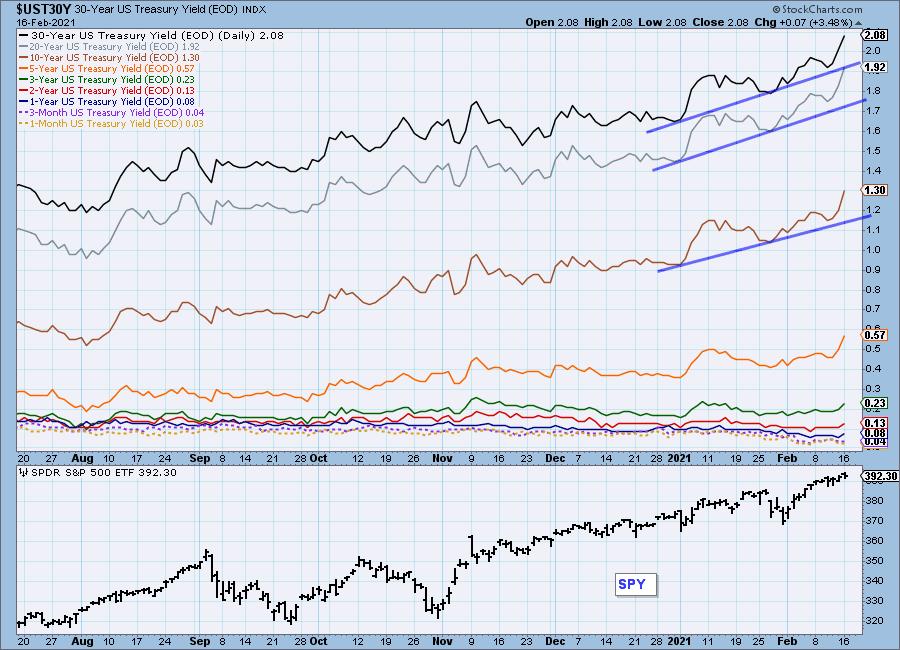

INTEREST RATES

This chart is included so we can monitor rate inversions. In normal circumstances the longer money is borrowed the higher the interest rate that must be paid. When rates are inverted, the reverse is true.

Carl wrote an excellent article on yields and bonds, here is a link.

DOLLAR (UUP)

IT Trend Model: NEUTRAL as of 5/28/2020

LT Trend Model: SELL as of 7/10/2020

UUP Daily Chart: I see a cup and handle on the Dollar. While it technically broke out from the handle, it really "drifted" out. The pattern is bullish, but price hasn't been able to get above the 20-EMA. The PMO is negative, but does appear to be decelerating. The RSI is negative. I suspect we will see price rally here, but a PMO top below the zero line is quite bearish. It will be difficult.

Even if we get a rally, strong overhead resistance will arrive at $24.75.

GOLD

IT Trend Model: NEUTRAL as of 1/14/2021

LT Trend Model: BUY as of 1/8/2019

GLD Daily Chart: The Dollar finished lower and so did Gold. Gold broke further below its 200-EMA. The RSI is negative and the PMO has topped below the zero line. I note that we had a premium rather than a discount today on PHYS. This tells us that participants are getting more bullish so Gold could be ready for a reversal as it goes down to test support around $166 on GLD.

Full disclosure: I own GLD.

Gold is about to reach strong support at the November low. While the PMO and RSI are quite negative, this has been a reversal point and with premiums starting to arrive, we could be getting very close to an upside reversal.

GOLD MINERS Golden and Silver Cross Indexes: I'm a fan of the Materials sector and today the Metals and Mining ETF (XME) found its way in my PMO scan results today. I like XME, but not GDX. Diamonds readers can see the XME chart annotated with stop and target levels in today's report. The SCI did have a positive crossover but the rest of the indicators are very negative. The PMO had just given us a BUY signal and it has already reversed into a SELL signal. Support is arriving soon and I suspect by then the indicators will be even more oversold than they are already. This will be a good investment, but it isn't time yet as there is likely more downside ahead.

CRUDE OIL (USO)

IT Trend Model: BUY as of 10/20/2020

LT Trend Model: SELL as of 2/3/2020

USO Daily Chart: Crude oil continues to rise as do many of the stocks in the Energy sector. Price has now accelerated enough that it is breaking out of the rising trend channel. Clearly USO is very overbought given this price action and the PMO and RSI, but the internal strength cannot be denied. With more news of pressure being put on fossil fuels by the new administration, this area should continue to prosper.

BONDS (TLT)

IT Trend Model: NEUTRAL as of 8/27/2020

LT Trend Model: SELL as of 1/8/2021

TLT Daily Chart: And you thought the Gold chart looked ugly... Carl wrote an excellent article about yields and interest rates. You can find it here. I would add that despite the RSI being oversold, I don't see this as a reversal point. The PMO has turned down below the signal line and yields are increasing quickly which will only add more downside pressure to TLT.

The next areas of support would be around $142.50 and $137.50. Yields will need to cool or we will likely see a test of both of these support levels.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting! - Erin

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

NOTE: The signal status reported herein is based upon mechanical trading model signals, specifically, the DecisionPoint Trend Model. They define the implied bias of the price index based upon moving average relationships, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links:

DecisionPoint Alert Chart List

DecisionPoint Golden Cross/Silver Cross Index Chart List

DecisionPoint Sector Chart List

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

DecisionPoint is not a registered investment advisor. Investment and trading decisions are solely your responsibility. DecisionPoint newsletters, blogs, trading rooms or website materials should NOT be interpreted as a recommendation or solicitation to buy or sell any security or to take any specific action.