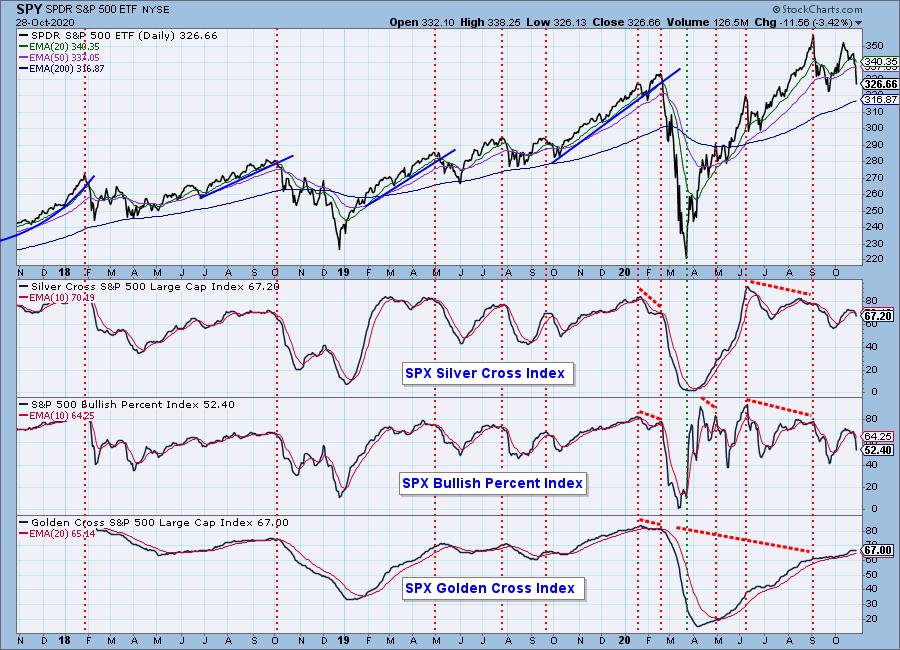

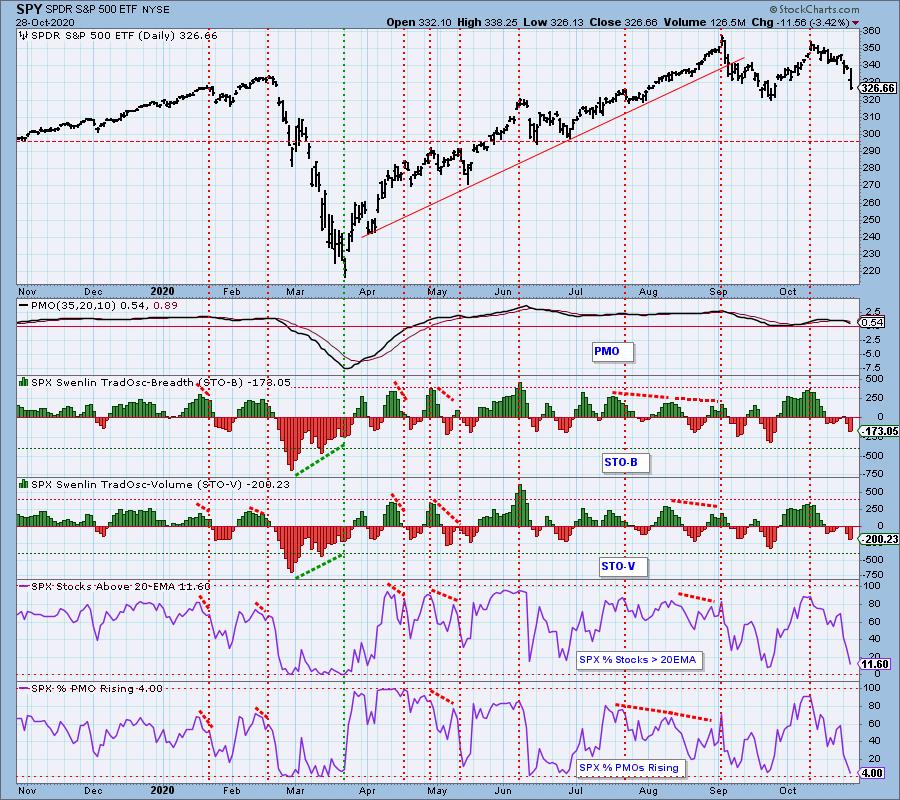

Well that was a drop today! The 5-month candlestick chart of the SPY really emphasizes the decline. The $335 level and 50-EMA was easily broken with today's -3.42% drop. The next level is $320 and the 200-EMA. I recorded "The Pitch" for StockChartsTV this morning with John Kosar, Mark Newton and host Grayson Roze. We were asked our thoughts on whether the $320 level (3200 for SPX) would hold through the end of the year or would price finish higher. I don't want to give away the ending, but all three of us agreed on lower. The double-top is a big problem and then pile the COVID, election, stimulus, etc on top of that... it doesn't spell "bull market". The market doesn't like uncertainty. It usually likes gridlock, but the stymied stimulus talks seem to contradict that. This is why we have to tune out as much noise as possible and lean on our analysis.

The DecisionPoint Alert Weekly Wrap presents an end-of-week assessment of the trend and condition of the Stock Market, the U.S. Dollar, Gold, Crude Oil, and Bonds. The DecisionPoint Alert daily report (Monday through Thursday) is abbreviated and gives updates on the Weekly Wrap assessments.

Watch the latest episode of DecisionPoint on StockCharts TV's YouTube channel here!

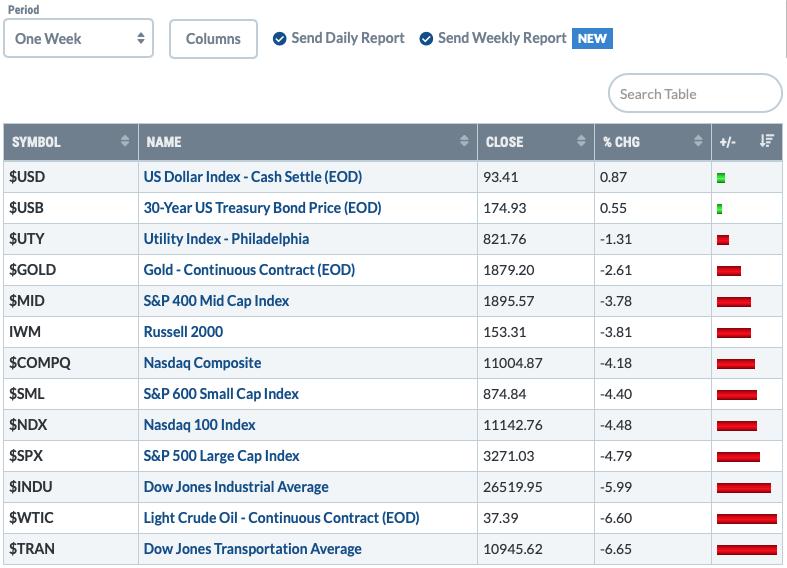

MAJOR MARKET INDEXES

One Week Results:

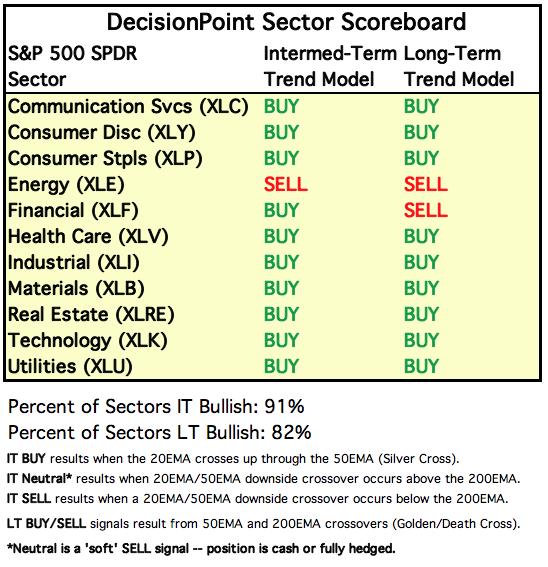

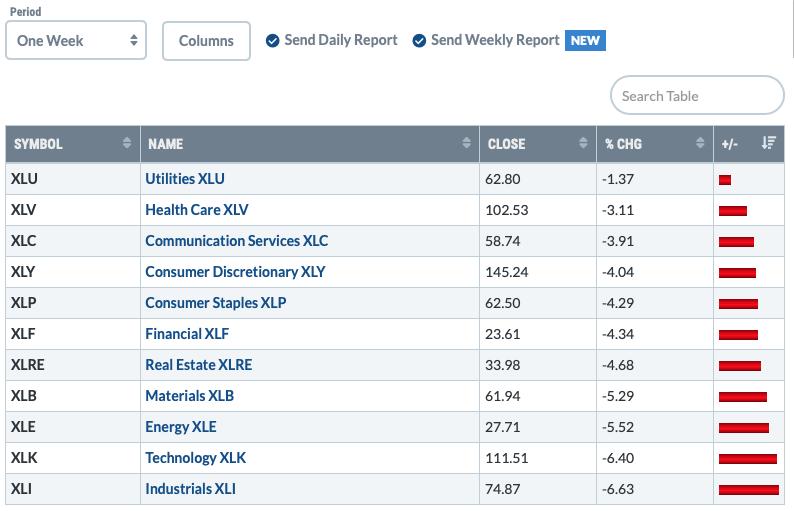

SECTORS

Each S&P 500 Index component stock is assigned to one, and only one, of 11 major sectors. This is a snapshot of the Intermediate-Term (Silver Cross) and Long-Term (Golden Cross) Trend Model signal status for those sectors.

One Week Results:

THE MARKET (S&P 500)

IT Trend Model: BUY as of 5/8/2020

LT Trend Model: BUY as of 6/8/2020

SPY Daily Chart: The February top has now been left behind. Now is the test at $320 which marks the "confirmation line" of the double-top. Should this pattern trigger on a drop below that level, the 'minimum' downside target would be $285. I would like to think that the $290 level will hold given the support, but a test of that level would mean a breach of the 200-EMA. The RSI is oversold, but March reminds us, it hasn't reached extremes.

It's Free!

***Click here to register for this recurring free DecisionPoint Trading Room on Mondays at Noon ET!***

Did you miss the 10/26 trading room? Here is a link to the recording (access code: X+2gJfpd).

For best results, copy and paste the access code to avoid typos.

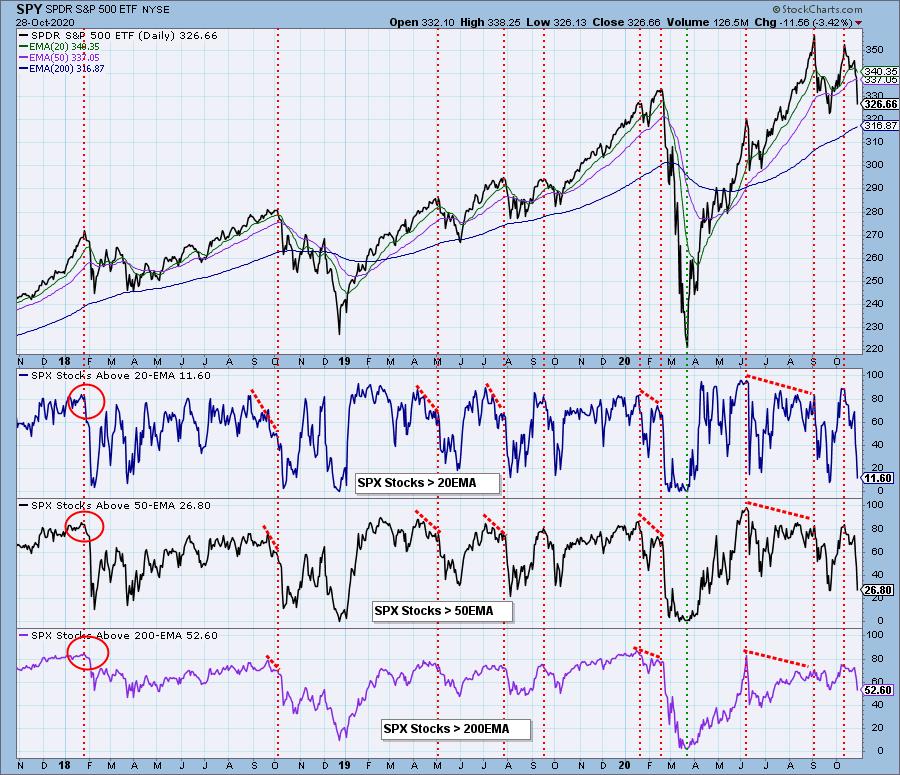

Participation: The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA).

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA).

- The Bullish Percent Index (BPI) shows the percentage of SPX stocks on Point & Figure BUY signals.

The GCI has now topped. The BPI and SCI are both tumbling lower now. The BPI is nearing oversold territory, but that is oversold during strong bull market runs. This appears more treacherous.

Now these indicators are definitely oversold. I hate to bring back bad memories but you can see during the bear market, those conditions persisted for over a month.

Climactic Market Indicators: Carl and I had a brief text conversation and we both agree that this looks like a selling exhaustion. It has all the earmarks: volatile price action, VIX dropping below its lower Bollinger Band on the inverted scale, exceedingly negative Net A-D numbers and a big pop in volume. Additionally, we have the addition of New Lows which are finally visible on the chart. This suggests a rebound rally over the next day or two. We do not think this is going to be the final low and we agree it likely won't lead to longer-term rally. Again with the bad memories, but you can see climactic readings in March didn't really lead to a reversal until they were contracting.

Short-Term Market Indicators: STOs moved lower and sadly they are not oversold. On the other hand, we do have oversold readings on the %stocks indicators.

Intermediate-Term Market Indicators: The intermediate-term market trend is UP and the condition is OVERBOUGHT. The market bias is BULLISH. Yesterday's comments still apply:

"These indicators are pulling back which could confirm the double-top that is forming."

CONCLUSION: I would look for higher prices in the next day or two in response to the climactic readings on our very short-term indicators. However, the rest of the picture isn't so bright. The PMO is nearing negative territory and the RSI is negative. We do have oversold readings appearing on some of our indicators, but many aren't at oversold extremes; and, regardless, oversold indicators can persist in a bearish environment. The double-top is a real problem.

Have you subscribed the DecisionPoint Diamonds yet? DP does the work for you by providing handpicked stocks/ETFs from exclusive DP scans! Add it with a discount! Contact support@decisionpoint.com for more information!

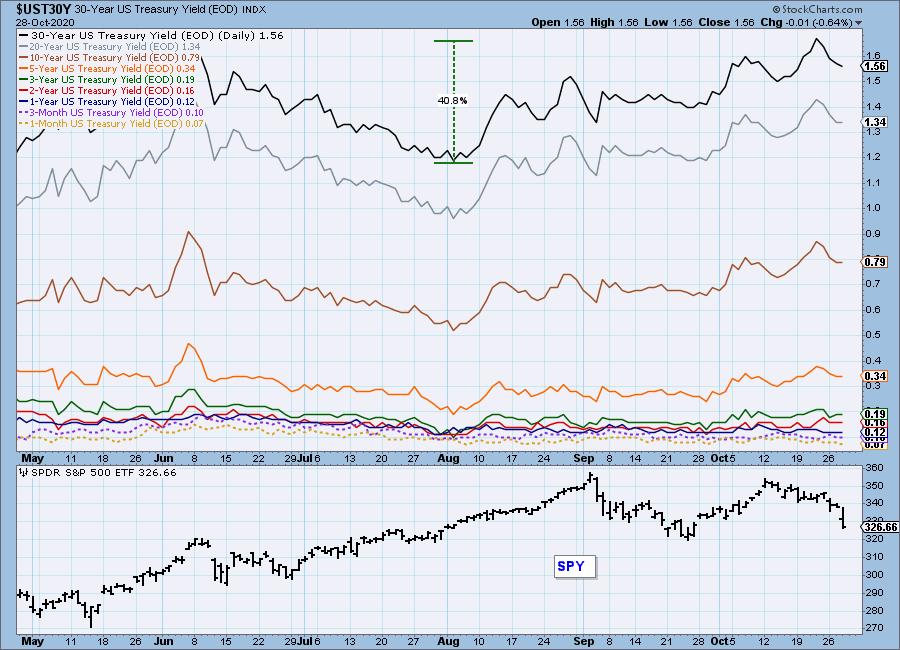

INTEREST RATES

This chart is included so we can monitor rate inversions. In normal circumstances the longer money is borrowed the higher the interest rate that must be paid. When rates are inverted, the reverse is true.

DOLLAR (UUP)

IT Trend Model: NEUTRAL as of 5/28/2020

LT Trend Model: SELL as of 7/10/2020

UUP Daily Chart: UUP rallied today. It took price out of its declining trend, but it was held up at the 50-EMA. The PMO is trying to bottom and the RSI is now in positive territory. This bodes well for the Dollar. Price never tested the $24.75 level before rallying. That level certainly could be revisited. Price hasn't managed a breakout above the 50-EMA.

GOLD

IT Trend Model: NEUTRAL as of 10/14/2020

LT Trend Model: BUY as of 1/8/2019

GOLD Daily Chart: Gold fell heavily today on the rising Dollar but also due to an increase in sellers. Price couldn't manage to breakout and execute the bullish falling wedge pattern. The RSI is negative and we have a PMO SELL signal. It appears Gold needs to test the bottom of the wedge in this rising Dollar environment given the negative correlation is still there.

Full disclosure: I own GLD.

GOLD MINERS Golden and Silver Cross Indexes: This was the last thing we wanted to see on GDX. This was an important support level and it has been broken. The 200-EMA now must hold. The good news is that indicator readings are very very oversold, particularly the %Stocks > 20/50-EMAs. Fortunately there is underlying strength based on the GCI and %Stocks > 200-EMA.

CRUDE OIL (USO)

IT Trend Model: SELL as of 9/8/2020

LT Trend Model: SELL as of 2/3/2020

USO Daily Chart: Oil took back all of yesterday's gains and then some. It is now testing support. The negative RSI and negative/declining PMO suggest we could see a breakdown here, but support at $24 still remains.

BONDS (TLT)

IT Trend Model: NEUTRAL as of 8/27/2020

LT Trend Model: BUY as of 1/2/2019

TLT Daily Chart: Yesterday's Comments Still Apply:

"TLT did what it had to...bounce at the 200-EMA. Now it is coming up against dual resistance of the 20-EMA and horizontal resistance just above $160. That line has many "touches" which tells you it will require some energy to overcome. Note that it hasn't been able to break cleanly above the 20/50-EMAs since mid-August. The PMO and RSI are improving, but the RSI is still in negative territory and the PMO is well-below the zero line."

Full Disclosure: I own TLT.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting! - Erin

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

NOTE: The signal status reported herein is based upon mechanical trading model signals, specifically, the DecisionPoint Trend Model. They define the implied bias of the price index based upon moving average relationships, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links:

DecisionPoint Alert Chart List

DecisionPoint Golden Cross/Silver Cross Index Chart List

DecisionPoint Sector Chart List

Price Momentum Oscillator (PMO)