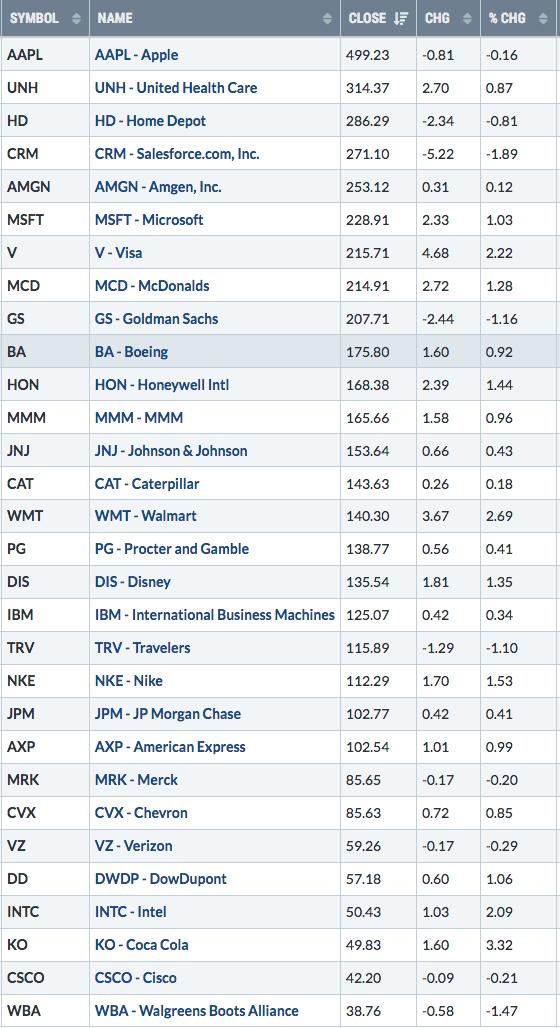

On Monday, August 31, AAPL will open after a 4 for 1 split. Not exactly news at this point, but there are some aspects of the event that some may not have considered. First, splits have been known to occur near (cause?) price tops -- not enough to make it a rule, but it happens. Other than AAPL being grossly overvalued (P/E = 39) and overbought, what else could be a factor? AAPL's membership in the Dow 30 Industrials, is going to create some selling pressure, because the Dow 30 is a price-weighted index. Pre-split, at $499.23, AAPL is ranked at the top, but after the split, at $124.81, it will be ranked 19th, and some index funds will have to sell AAPL shares to accommodate the new weighting. Here's a closing snapshot of the current ranking.

Here is a weekly chart of AAPL showing the parabolic advance I've been banging on about -- note that the weekly PMO is very overbought. While the parabolic will almost certainly collapse, it won't be the end of the world, because, hey, it's AAPL; however, a -25% pullback followed by a period of consolidation is possible and would be a healthy outcome. To be clear, I don't know when, or if, that will happen. We'll see.

The DecisionPoint Alert Weekly Wrap presents an end-of-week assessment of the trend and condition of the Stock Market, the U.S. Dollar, Gold, Crude Oil, and Bonds. The DecisionPoint Alert daily report (Monday through Thursday) is abbreviated and gives updates on the Weekly Wrap assessments.

Watch the latest episode of DecisionPoint on StockCharts TV's YouTube channel here!

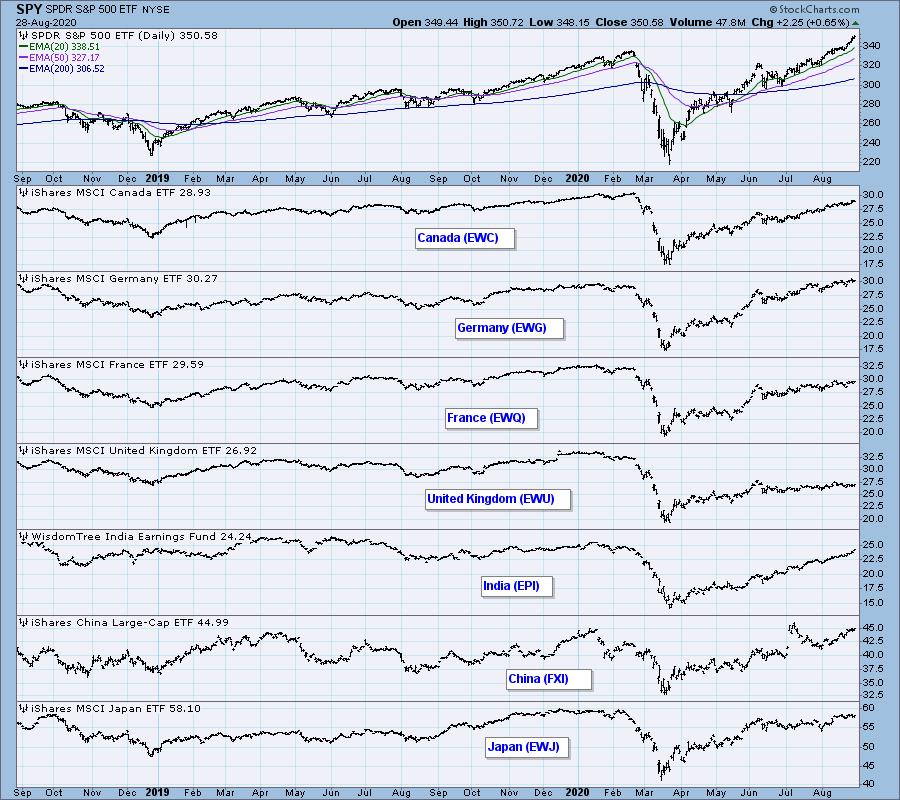

GLOBAL MARKETS

BROAD MARKET INDEXES

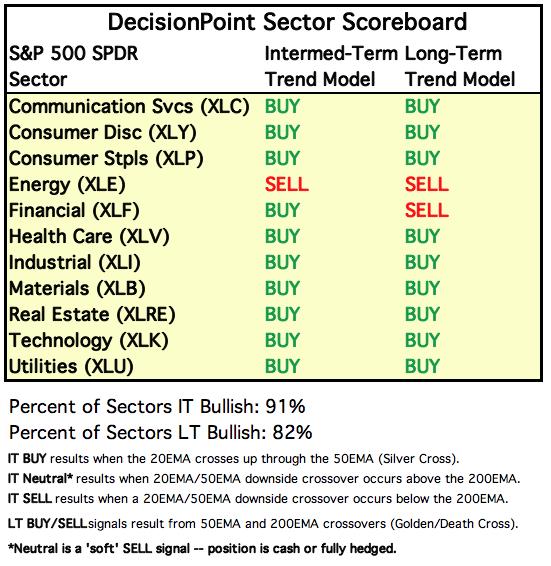

SECTORS

Each S&P 500 Index component stock is assigned to one, and only one, of 11 major sectors. This is a snapshot of the Intermediate-Term (Silver Cross) and Long-Term (Golden Cross) Trend Model signal status for those sectors.

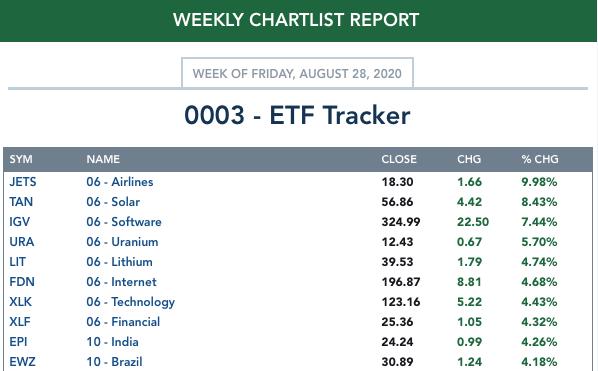

ETF TRACKER: This is a list of about 100 ETFs intended to track a wide range of U.S. market indexes, sectors, global indexes, interest rates, currencies, and commodities. StockCharts.com subscribers can acquire it in the DecisionPoint Trend and Condition ChartPack.

Top 10 . . .

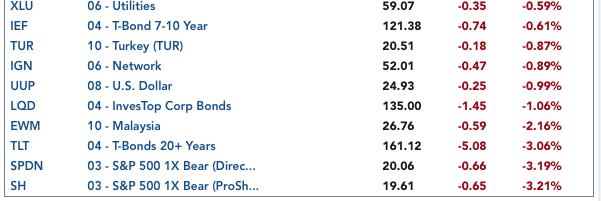

. . . and bottom 10:

INTEREST RATES

This chart is included so we can monitor rate inversions. In normal circumstances the longer money is borrowed the higher the interest rate that must be paid. When rates are inverted, the reverse is true.

STOCKS

IT Trend Model: BUY as of 5/8/2020

LT Trend Model: BUY as of 6/8/2020

SPY Daily Chart: I have added an RSI panel because it is a favorite of Erin's, and I have to admit it gives clear overbought/oversold readings. Speaking of which, it has been oversold all week. SPX Total Volume was thin all week, as well. The VIX Bollinger Bands are squeezing the VIX, an expression of low volatility, which will soon be followed by high volatility.

SPY has advanced +4.6% above the line drawn across the February top, which indicates it is unlikely to break down through it on a retest.

SPY Weekly Chart: The advance is becoming steeper, and the weekly PMO is very overbought.

S&P 500 Monthly Chart: The month doesn't end until Monday, but I'm going to include monthly charts this week on the exxpectation that Monday probably won't change the monthly charts significantly. What stands out the most on this chart is that price has made an extreme departure from the secular rising trend line. And it has done it in minumum time.

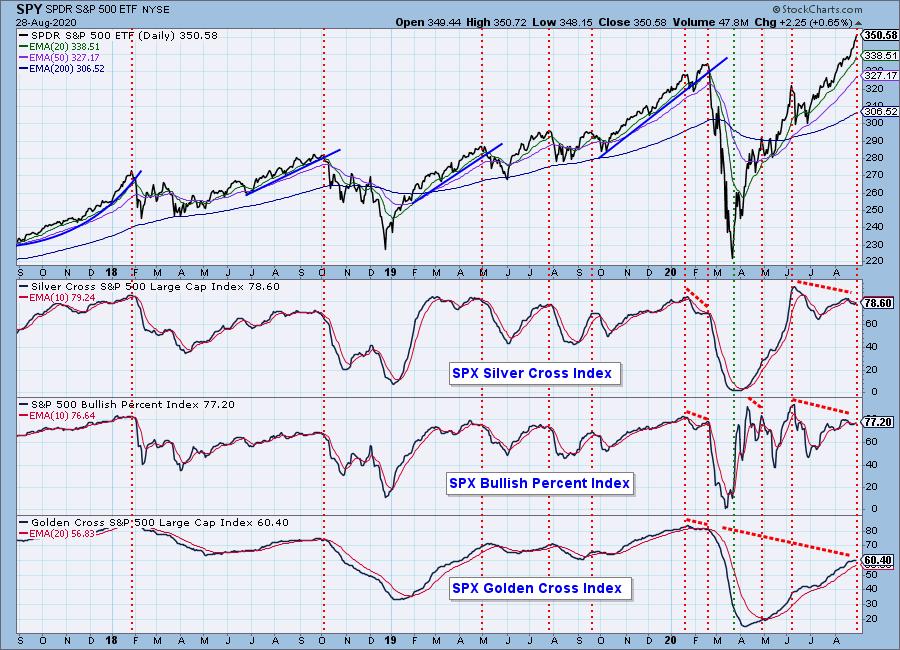

Participation: The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA).

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA).

- The Bullish Percent Index (BPI) shows the percentage of SPX stocks on Point & Figure BUY signals.

We still have clear negative divergences on all the indicators, and the Golden Cross Index shows only 60% of S&P 500 stocks are in a bull market configuration.

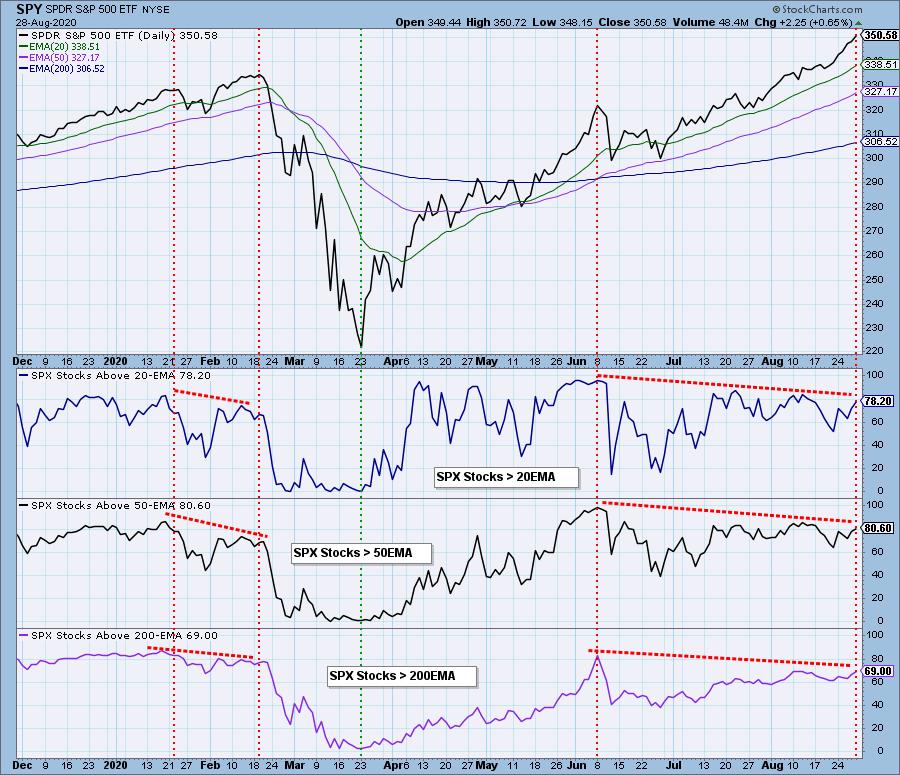

Another objective measure of participation is the chart showing the percentage of stocks above the 20EMA, 50EMA, and 200EMA. It has been showing weakness for a few months.

Climactic Market Indicators: The upside initiation climax on Monday was certainly prescient regarding the rally that followed the rest of the week. There were climactic A-D and A-D Volume readings on Friday. Possibly an exhaustion climax?

Short-Term Market Indicators: The short-term market trend is UP and the condition is OVERBOUGHT. The market bias is NEUTRAL in this time frame.

Intermediate-Term Market Indicators: The intermediate-term market trend is UP and the condition is NEUTRAL. Market bias has been bullish for several months, but recent indicator readings have been closer to NEUTRAL. This means that there is no internal pressure favoring any outcome. Now look at the price index moving straight up, then look at the indicators drifting toward zero. Persistent negative divergences.

CONCLUSION: The market was up persistently this week, and I'm guessing that the coming split for AAPL stock on Monday had a lot to do with it; however, I think the "Apple Effect" is likely dissapate in conjunction with the split. Whether or not the Apple Effect is a figment of my imagination, the abundance of negative divergences we have been tracking are still a major demonstration of internal weakness, and they need to be resolved. If the rally continues, they could be reversed, but it seems more likely to me that we'll see the market pull back. How much of a pullback? I don't know, but the divergences we have now are worse than what we saw at the February top, so it could be severe.

Have you subscribed the DecisionPoint Diamonds yet? DP does the work for you by providing handpicked stocks/ETFs from exclusive DP scans! Add it with a discount! Contact support@decisionpoint.com for more information!

DOLLAR (UUP)

IT Trend Model: NEUTRAL as of 5/28/2020

LT Trend Model: SELL as of 7/10/2020

UUP Daily Chart: The daily PMO is above the signal line and trending up, but this is because price is moving sideways. So, while the PMO might look positive, price is not there yet.

UUP Weekly Chart: Price is below major support, and I don't see any obvious support before the 2018 low. Okay, there is the 2020 low, but it hit during a time of panic. It could hold, but I don't give it much weight. The weekly PMO is getting very overbought, but there is no hint of a bottom yet.

UUP Monthly Chart: Bearish. The monthly PMO is below the signal line and falling.

GOLD

IT Trend Model: BUY as of 3/24/2020

LT Trend Model: BUY as of 1/8/2019

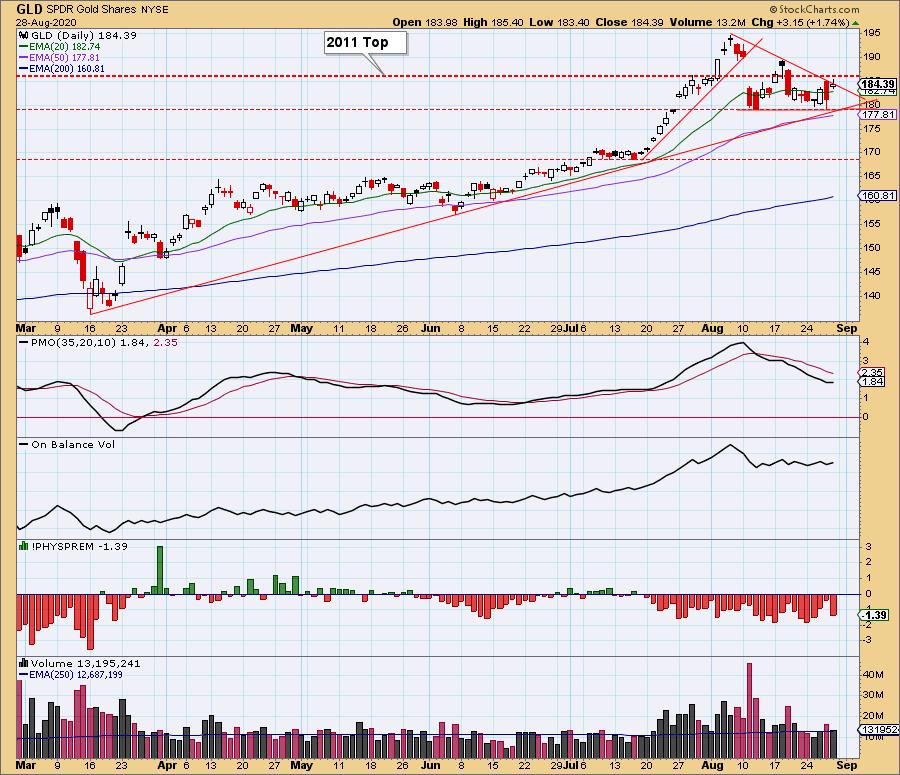

GOLD Daily Chart: Gold continues to correct, working into a symmetrical triangle, while remaining above the long-term support set by the 2011 top. This is considered to be a continuation pattern, which in this case if bullish The daily PMO is still overbought, but has backed well off its August top.

Looking at GLD, a trading vehicle for gold, we see that it is below the long-term support line. Another problem is that the triangle here is a bearish descending triangle, which conflicts with the symmetrical triagle above. Which to believe? If you are trading GLD, you need to heed the message on the GLD chart. Personally, I don't think any action is indicated at this point. As of today, price was trying to break out of the triangle, so we may have a case where the bull market in gold will result in a bullish outcome.

GOLD Weekly Chart: The weekly PMO is quite overbought, approaching the level it was at the 2011 top. After price's recent vertical move, gold has corrected back to a less accelerated rising trend line, but it is still steeper than earlier lines -- a much needed correction, but still pretty steep.

GOLD Monthly Chart: [[comments]]

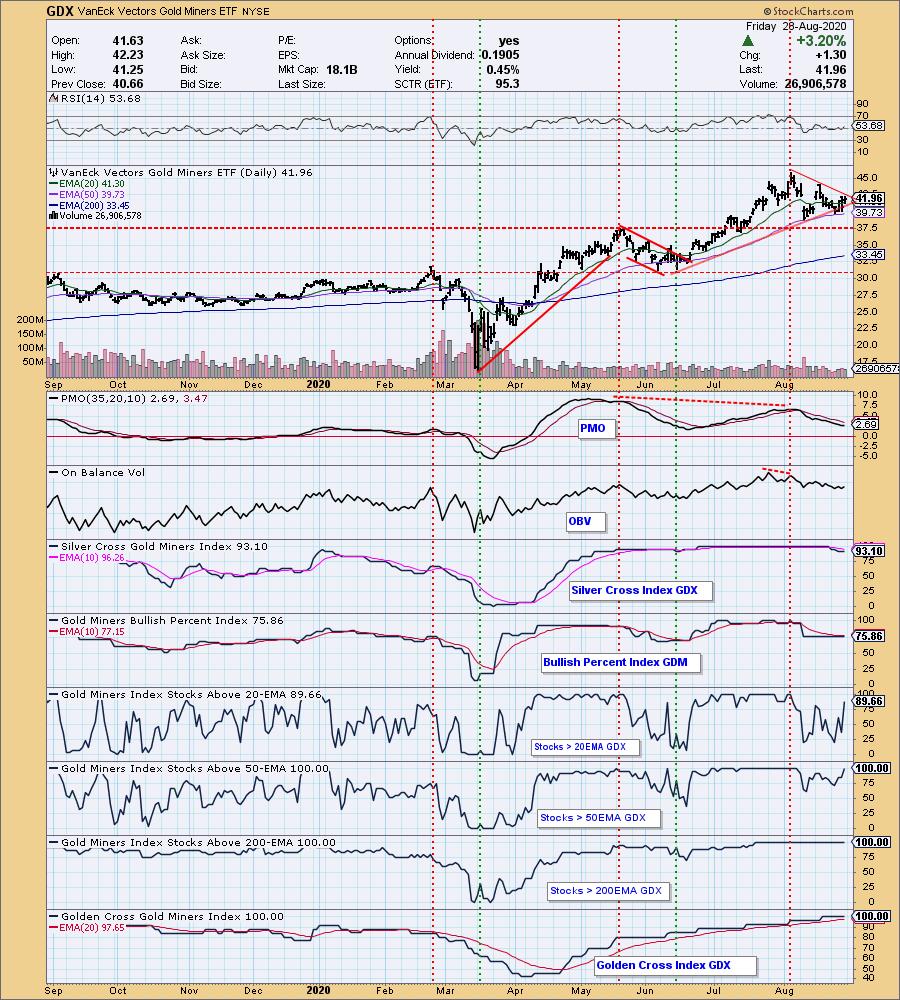

GOLD MINERS Golden and Silver Cross Indexes: A symmetrical triangle at the end of an advance suggests that it is a bullish continuation pattern.

CRUDE OIL (USO)

IT Trend Model: BUY as of 8/13/2020

LT Trend Model: SELL as of 2/3/2020

USO Daily Chart: Price is gradually becoming flat, and notice how flat the daily PMO has become.

USO/$WTIC Weekly Chart: Which way will it break? I'm thinking down.

$WTIC Monthly Chart: Price has broken decisively above the longer-term support line at 40, but it is decelerating.

BONDS (TLT)

IT Trend Model: NEUTRAL as of 8/27/2020

LT Trend Model: BUY as of 1/2/2019

TLT Daily Chart: The support line was tested this week, and so far it has held. As you can see, the line is somewhat fanciful, and not clearly defined. The most definite line is at about 161.

TLT Weekly Chart: The rising trend line has been broken, and the weekly PMO is bearish.

TLT Monthly Chart: The monthly PMO is very overbought and is about to top.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting! - Carl

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

NOTE: The signal status reported herein is based upon mechanical trading model signals, specifically, the DecisionPoint Trend Model. They define the implied bias of the price index based upon moving average relationships, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links:

DecisionPoint Alert Chart List

DecisionPoint Golden Cross/Silver Cross Index Chart List

DecisionPoint Sector Chart List

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)