I decided to take a look at the 10-minute bar chart today to dissect what is happening on the SPX in the very short term. Price never really challenged overhead resistance at last week's high and now we have an island formation. Notice that price began to accelerate lower in the final minutes today which took the RSI into negative territory and caused the PMO to top below its signal line which is generally very bearish. With the rally pop on the open I had expected better than sideways consolidation.

Don't forget Diamonds-subscribers! The DecisionPoint "Diamond Mine" will be open THIS Friday, August 21st exclusively for you! Bring your questions and symbol requests as we dive into the Diamonds of the week and search for what setups are out there for Monday! Registration links will be sent out on Wednesday!

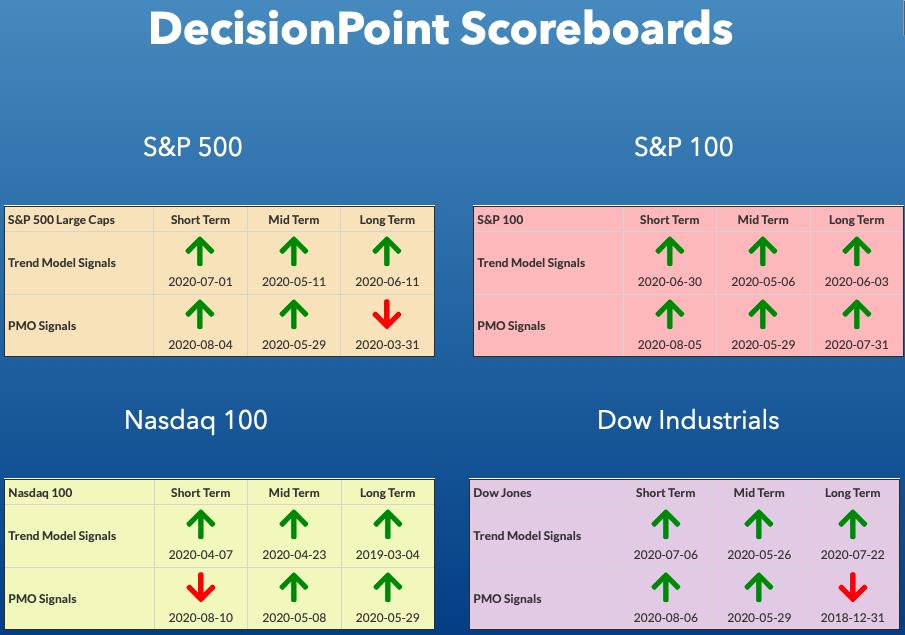

DP INDEX SCOREBOARDS:

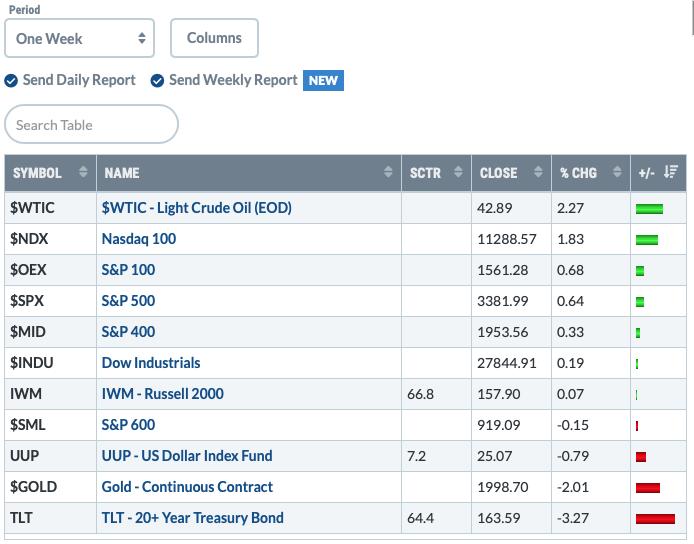

TODAY'S Broad Market Action:

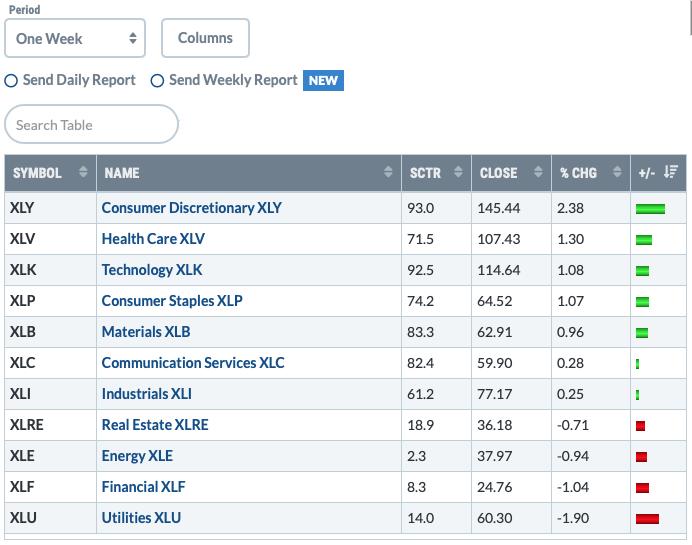

One WEEK Results:

Top 10 from ETF Tracker:

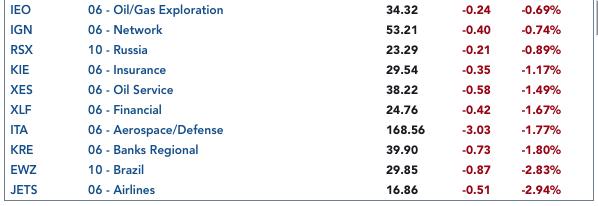

Bottom 10 from ETF Tracker:

On Friday, the DecisionPoint Alert Weekly Wrap presents an assessment of the trend and condition of the stock market (S&P 500), the U.S. Dollar, Gold, Crude Oil, and Bonds. Monday through Thursday the DecisionPoint Alert daily report is abbreviated and covers changes for the day.

Watch the latest episode of DecisionPoint on StockCharts TV's YouTube channel here!

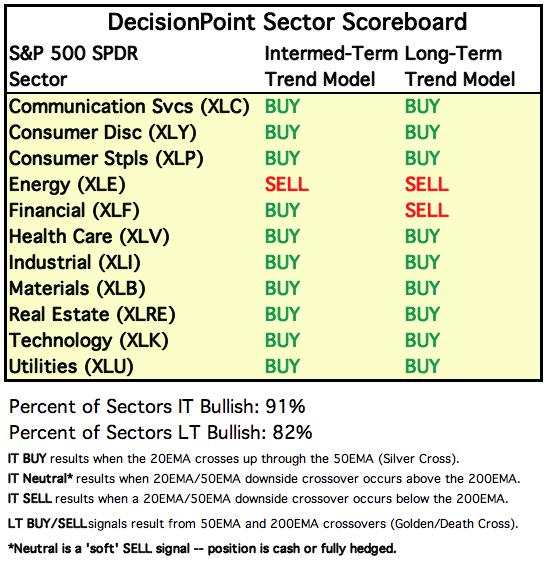

SECTORS

SIGNALS:

Each S&P 500 Index component stock is assigned to one, and only one, of 11 major sectors. This is a snapshot of the Intermediate-Term (Silver Cross) and Long-Term (Golden Cross) Trend Model signal status for those sectors.

TODAY'S RESULTS:

One WEEK Results:

STOCKS

IT Trend Model: BUY as of 5/8/2020

LT Trend Model: BUY as of 6/8/2020

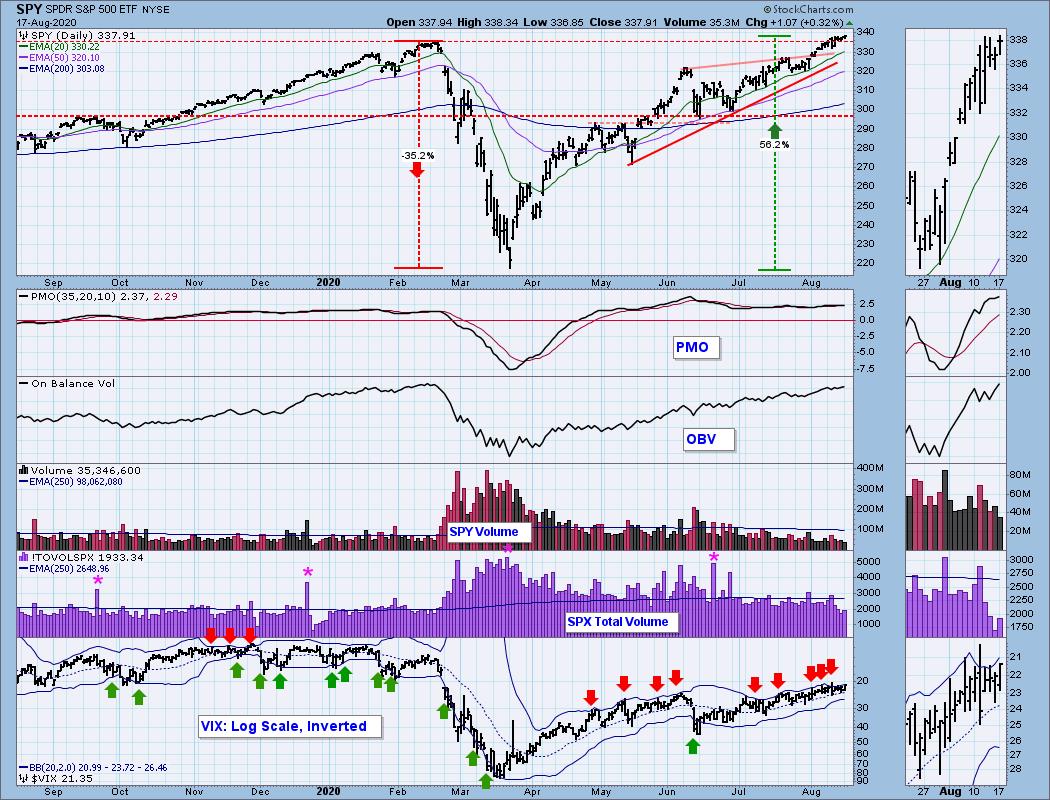

SPY Daily Chart: The SPY closed at an all-time high today (the SPX has yet to set an all-time high) and we saw volume increase slightly. Overall volume is below the annual average. The VIX closed near its lows today but remains below the upper Bollinger Band and above its average on the inverted scale. This is generally a sign of internal strength, but the bands have been squeezing together so the slightest changes could affect our analysis. One thing I will say, usually when the Bollinger Bands squeeze like this, the result is a decline.

Climactic Market Indicators: No climactic readings to report, but I do note the disparity between Net A-D and Net A-D Volume. A negative net result on the volume indicator suggests volume isn't supporting today's rally.

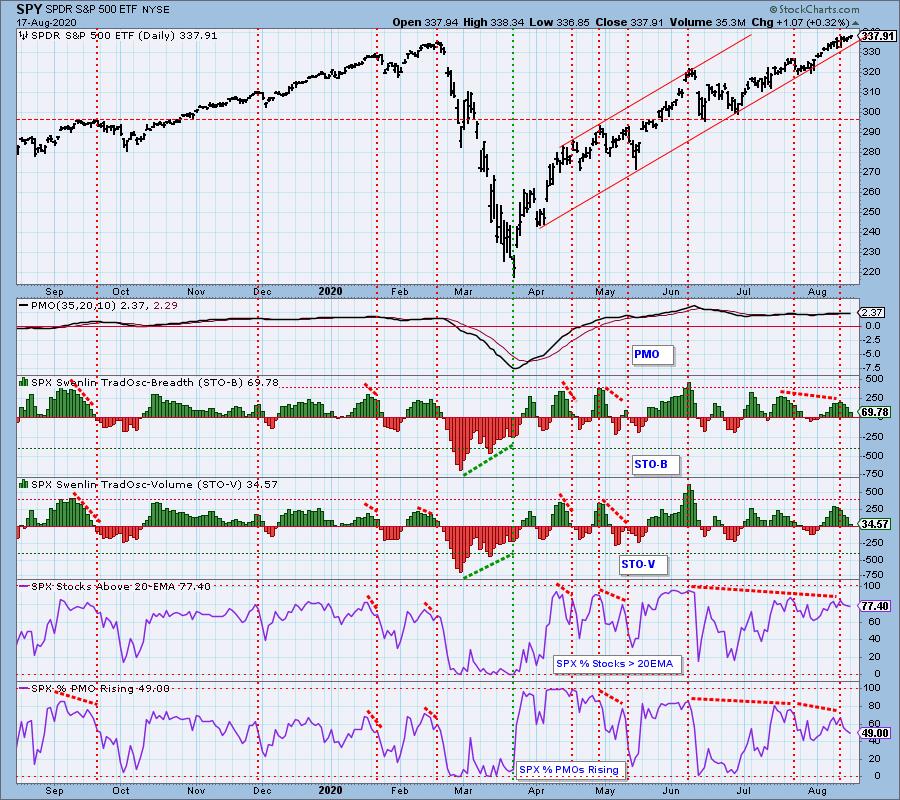

Short-Term Market Indicators: The short-term market trend is UP and the condition is NEUTRAL. Based upon the STO ranges, market bias is BULLISH. All of these indicators fell on a rally day. We should at least see %PMOs Rising moving higher with price, but we're not which tells us participation is drying up.

Intermediate-Term Market Indicators: The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

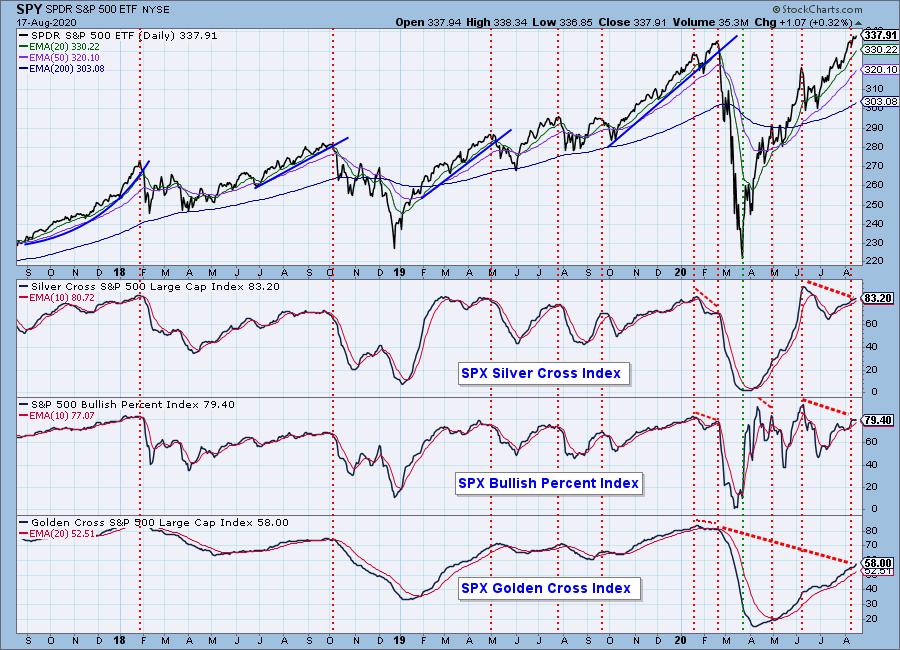

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA).

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA).

- The Bullish Percent Index (BPI shows the percentage of SPX stocks on Point & Figure BUY signals.

The BPI topped today. Again seeing a top on a rally day is bearish. The negative divergences persist. The SCI and GCI are rising which is good, but currently they are diverging negatively from price too.

The intermediate-term market trend is UP and the condition is OVERBOUGHT. With most of the ITBM/ITVM readings since the end of April being above the zero lines, the market bias is BULLISH.

All of these indicators have topped and are negatively diverging from price.

CONCLUSION: Today opened with a gap up, but trading fizzled and we ended up with consolidation that formed an island that could be a reversal point. Indicators are all declining with the exception of the longer-term Silver Cross and Golden Cross indexes and daily PMO. I am expecting lower prices this week.

DOLLAR (UUP)

IT Trend Model: NEUTRAL as of 5/28/2020

LT Trend Model: SELL as of 7/10/2020

UUP Daily Chart: I've been looking at the large island and expecting a reversal to the upside. However, the first attempt to rally in late July finished before closing the initial gap down. Last week, the second rally didn't even get price to that late July top before turning down. I will abort this as a bullish island formation if price fails at $25. Instead of a reverse island, we could be looking at a bearish reverse flag. The PMO is on a BUY signal though, so it may not be over just yet for the Dollar.

GOLD

IT Trend Model: BUY as of 3/24/2020

LT Trend Model: BUY as of 1/8/2019

GOLD Daily Chart: Carl and I talked at length about Gold in today's edition of the DecisionPoint Show. We had both been distressed to see Gold quickly lose support at the 2011 top. However, Gold instead went down and tested the rising bottoms trendline and 50-EMA. It bounced strongly and is heading back up toward 2100. The RSI turned up before reaching negative territory and we can see that discounts on PHYS are still high which suggests bearish sentiment (bullish for Gold). The PMO is on a SELL signal, but it is already attempting to turn back around.

Full Disclosure: I own GLD.

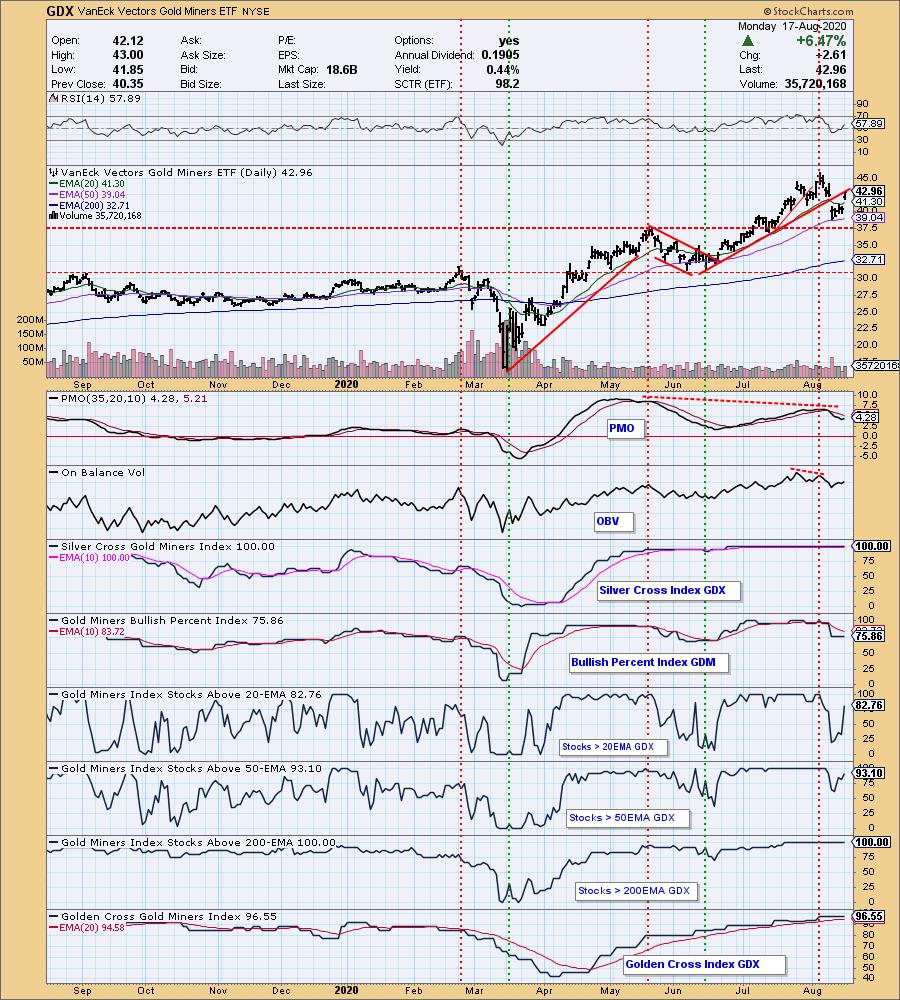

GOLD MINERS Golden and Silver Cross Indexes: I am back on board the Miners train. Price didn't even need to test support at the May top before reversing, the 50-EMA provided what it needed. Today's gap up didn't get price back into the previous short-term rising trend, but it did trade completely over the 20-EMA and closed the initial gap down. We're seeing excellent improvement in the indicators.

CRUDE OIL (USO)

IT Trend Model: BUY as of 8/13/2020

LT Trend Model: SELL as of 2/3/2020

USO Daily Chart: Not much change on the Oil chart except that we did get a new PMO BUY crossover BUY signal on Friday. I like Oil but it has been in a holding pattern for quite some time. The "silver cross" of the 20/50-EMAs last week set the stage for this new PMO BUY signal. The RSI is positive. Looking in the thumbnail, I think you could make a case for a bull flag forming out of the late July low.

BONDS (TLT)

IT Trend Model: BUY as of 6/26/2020

LT Trend Model: BUY as of 1/2/2019

TLT Daily Chart: Bonds finished on the positive side today and the PMO is already attempting to decelerate and possibly bottom above the zero line. The RSI is negative, but turning back up. I like this area as an upside reversal point for TLT, but I'm also keeping watch for a possible reverse flag formation here.

Full disclosure: I own TLT.

Have you subscribed the DecisionPoint Diamonds yet? DP does the work for you by providing handpicked stocks/ETFs from exclusive DP scans! Get in on the new "DecisionPoint Diamond Mine" trading room as part of that subscription! Contact support@decisionpoint.com for more information!

Technical Analysis is a windsock, not a crystal ball.

Happy Charting! - Erin

Email: erin@decisionpoint.com

The MoneyShow is THIS week!

I have the information for my VIRTUALpresentation at The Money Show!

I present on August 19th at 1:20p EST!

Click here for information on how to register to see me!

NOTE: The signal status reported herein is based upon mechanical trading model signals, specifically, the DecisionPoint Trend Model. They define the implied bias of the price index based upon moving average relationships, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links (Can Be Found on DecisionPoint.com Links Page):

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)