I know I went over Energy (XLE) yesterday, but I wanted to revisit it. Today's decline took price further below the 20-EMA which is now causing both the 20/50-EMAs to creep lower. One thing that many may not realize, is that with an exponential moving average, when price moves above or below that EMA it will turn that average in that direction. XLE was hundredths of a point away from the 20/50-EMA "silver cross" but as soon as price closed beneath them, both EMAs reversed direction making it impossible to generate a silver cross. I had high hopes for Energy earlier in August. It looked like we were breaking out of bullish reverse head and shoulders. Unfortunately the breakout failed and here we are. The indicators suggest that we won't see that positive crossover for some time. You can also see the very short-term rising trend in the thumbnail failed to hold today. I'm watching this sector closely. When money does begin rotating here, there are plenty of bargains with huge upside potential. I'll keep my Diamonds readers on the cutting edge when I start to see strength in this sector again.

Don't forget Diamonds-subscribers! The DecisionPoint "Diamond Mine" will be open THIS Friday, August 21st exclusively for you! Bring your questions and symbol requests as we dive into the Diamonds of the week and search for what setups are out there for Monday! Registration links will be sent out on Wednesday and are always located within the Diamonds reports!

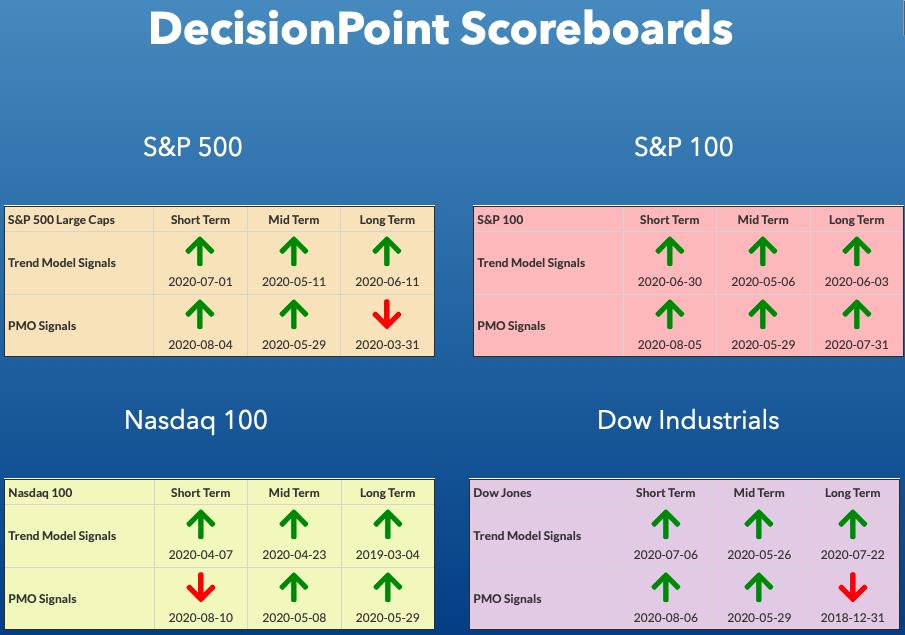

DP INDEX SCOREBOARDS:

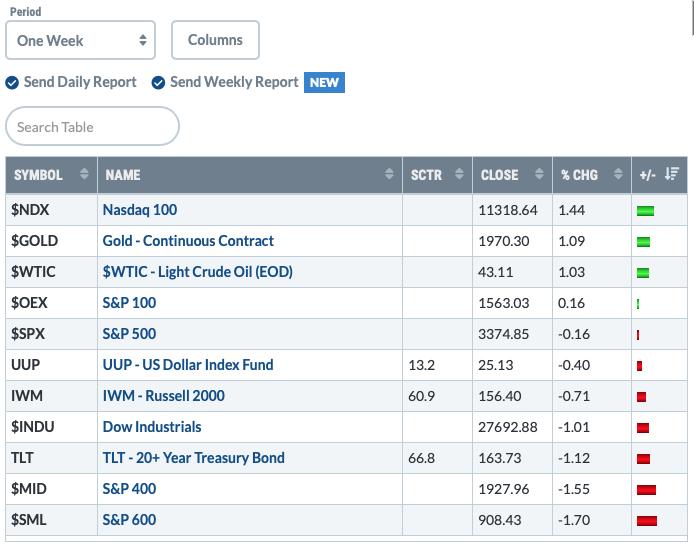

TODAY'S Broad Market Action:

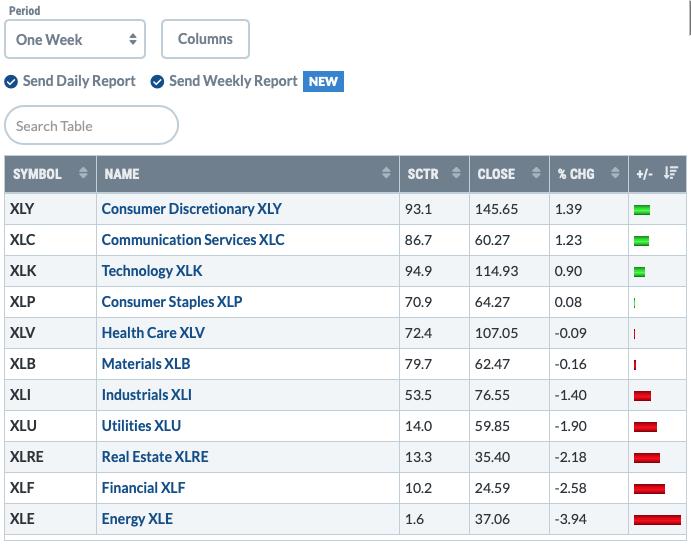

One WEEK Results:

Top 10 from ETF Tracker:

Bottom 10 from ETF Tracker:

On Friday, the DecisionPoint Alert Weekly Wrap presents an assessment of the trend and condition of the stock market (S&P 500), the U.S. Dollar, Gold, Crude Oil, and Bonds. Monday through Thursday the DecisionPoint Alert daily report is abbreviated and covers changes for the day.

Watch the latest episode of DecisionPoint on StockCharts TV's YouTube channel here!

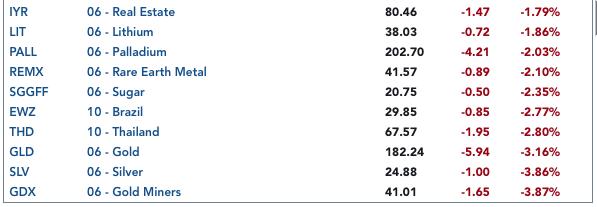

SECTORS

SIGNALS:

Each S&P 500 Index component stock is assigned to one, and only one, of 11 major sectors. This is a snapshot of the Intermediate-Term (Silver Cross) and Long-Term (Golden Cross) Trend Model signal status for those sectors.

TODAY'S RESULTS:

One WEEK Results:

STOCKS

IT Trend Model: BUY as of 5/8/2020

LT Trend Model: BUY as of 6/8/2020

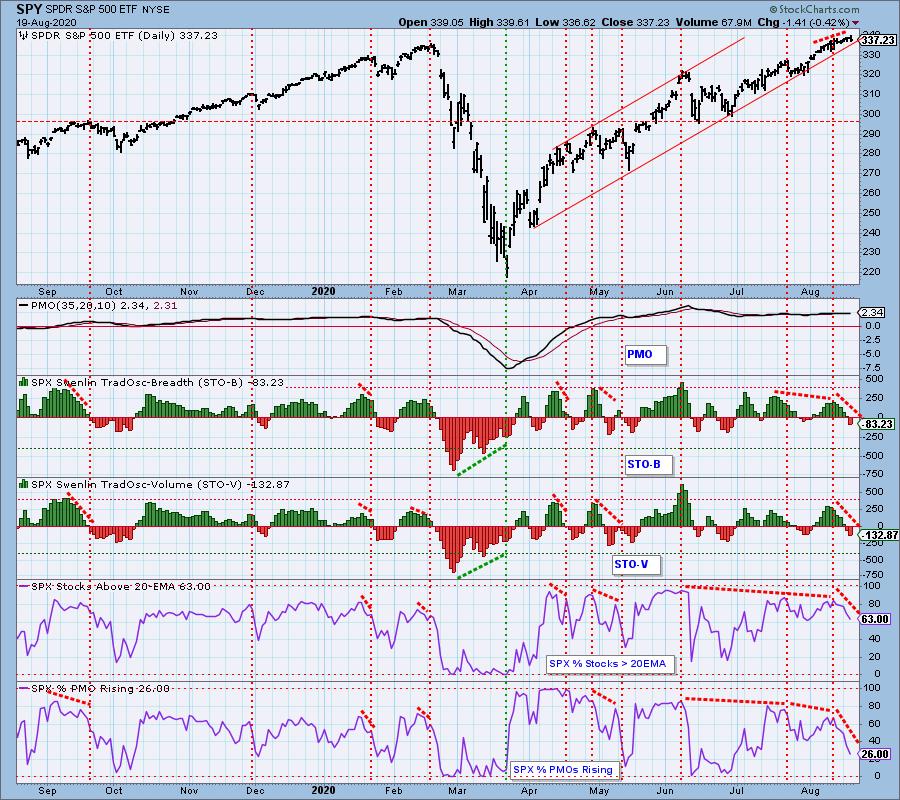

SPY Daily Chart: Another intraday all-time high was set today, but price closed lower at the bottom of the trading range. The PMO is now moving lower. Volume continues to be fairly low and definitely below the annual average. Look for high volume on Friday when we have options expiration. Typically on options expiration you'll see very high volume with very little price movement. Notice the pink "*" on the chart below. That denotes options expiration volume.

Climactic Market Indicators: More climactic negative readings, only today they accompanied by lower prices. I am looking at this as a selling initiation which would indicate a decline in the very near future. The VIX remains above its moving average on the inverted scale. I do note that it closed near the bottom of its range on the inverted scale. Nerves are beginning to show.

Short-Term Market Indicators: The short-term market trend is UP and the condition is OVERSOLD. Based upon the STO ranges, market bias is NEUTRAL. All of these indicators continue to show negative divergences and move even lower. One possible positive is that the STOs are now in near-term oversold territory. We generally see price rises out of these types of readings. However, the negative divergences make me less than optimistic about that.

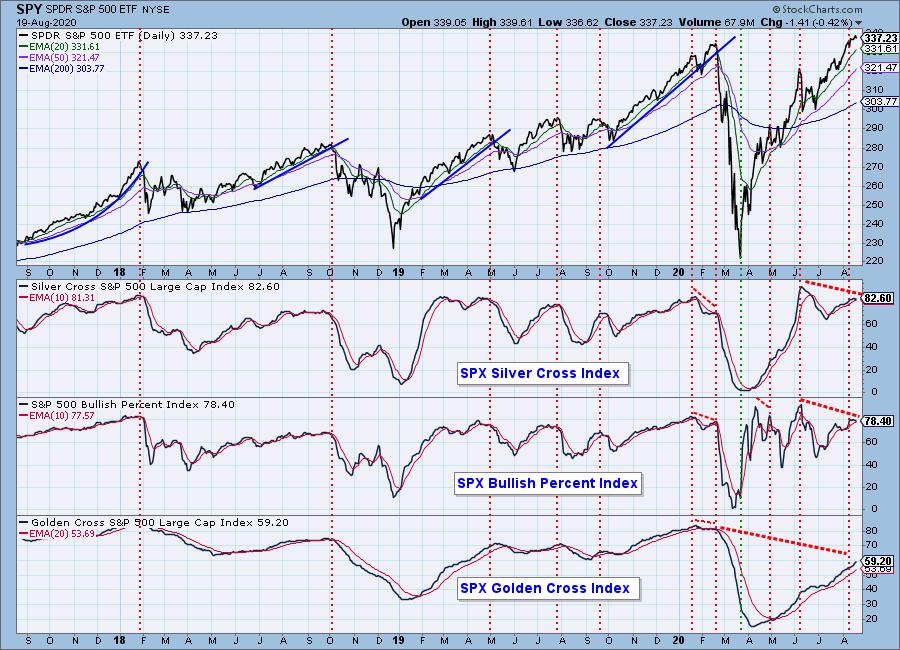

Intermediate-Term Market Indicators: The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA).

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA).

- The Bullish Percent Index (BPI shows the percentage of SPX stocks on Point & Figure BUY signals.

Yesterday's comments still apply:

"Negative divergences persist on the intermediate-term indicators as well with both the SCI and BPI topping. Technically the GCI is still rising and could erase the negative divergence, but given the activity of the other two, I don't see that as a possibility."

The intermediate-term market trend is UP and the condition is OVERBOUGHT. With most of the ITBM/ITVM readings since the end of April being above the zero lines, the market bias is BULLISH.

Yesterday's comments still apply:

"These indicators continue to fall and are just more in a long line of negative divergences."

CONCLUSION: I continue to scratch my head as prices continue higher despite falling momentum, negative divergences and falling indicators, but the bulls have a very firm grip as the market bias continues to be bullish. As I continue to note, I've put trailing stops on most of my positions. I've only had two trigger and beautifully on big intraday pops to the upside and then a decline that triggers it. As my positions close and cash becomes available, I'm watching for pockets of strength to take advantage of.

DOLLAR (UUP)

IT Trend Model: NEUTRAL as of 5/28/2020

LT Trend Model: SELL as of 7/10/2020

UUP Daily Chart: Ok, I give up on patterns on UUP. Between the reverse islands, reverse head and shoulders and lastly a reverse flag, it's been futile to nail this one. So, I'm going to stick to trend analysis. I realize we saw a big upside move today and that brought the PMO back above its signal line, but the declining trend hasn't been broken. Neither have we seen price even test the 20-EMA. If this rally breaks the declining trend and the 20-EMA, I'll get bullish then. This seems like a head fake.

GOLD

IT Trend Model: BUY as of 3/24/2020

LT Trend Model: BUY as of 1/8/2019

GOLD Daily Chart: Big pullback on Gold today partly due to the rally in the Dollar. It held onto the 20-EMA which is positive, but it may decide to test the rising trend before heading back up. The RSI remains positive and we are still seeing discounts on PHYS which is positive. The PMO is ugly, but it needed to unwind. Overall I remain bullish on Gold as long as the rising trend holds.

Full Disclosure: I own GLD.

GOLD MINERS Golden and Silver Cross Indexes: Ha! Kiss of death was my mentioning a purchase of AUY yesterday. I did buy it today near the lows so I don't feel especially terrible about the decline. I don't like that GDX failed to hold the 20-EMA and closed the previous gap. However, like with Gold, we may see a bit more pullback here. Yesterday the indicators looked very positive, today it seems that many of the Miners fell out of bed, losing their 20-EMAs just like GDX.

CRUDE OIL (USO)

IT Trend Model: BUY as of 8/13/2020

LT Trend Model: SELL as of 2/3/2020

USO Daily Chart: Yesterday's comments still apply:

"It's rather hard to see much on this USO chart. Mainly I want to note the possible bull flag in the thumbnail and the squeeze between the 20/50-EMAs and the March low. I don't see it breakout just yet, but I have to say the RSI and PMO look pretty good."

BONDS (TLT)

IT Trend Model: BUY as of 6/26/2020

LT Trend Model: BUY as of 1/2/2019

TLT Daily Chart: Bonds broke down but held short-term support. The RSI is negative and the PMO is nearing the zero line on its way down. My stop will be hit just below $160. I'd like to say we'll see a rebound off that $160 area, but the chart isn't encouraging.

Full disclosure: I own TLT.

Have you subscribed the DecisionPoint Diamonds yet? DP does the work for you by providing handpicked stocks/ETFs from exclusive DP scans! Get in on the new "DecisionPoint Diamond Mine" trading room as part of that subscription! Contact support@decisionpoint.com for more information!

Technical Analysis is a windsock, not a crystal ball.

Happy Charting! - Erin

Email: erin@decisionpoint.com

NOTE: The signal status reported herein is based upon mechanical trading model signals, specifically, the DecisionPoint Trend Model. They define the implied bias of the price index based upon moving average relationships, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links (Can Be Found on DecisionPoint.com Links Page):

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)