I received an email this morning about yesterday's DP Alert, "I am a little confused with this Alert as it says conflicting conclusions. First you talk about a bearish wedge, but then you talk about positive short-term indicators. Please clarify."

I opened with a discussion about the bearish rising wedge and its implications, but I also discussed the bullish short-term indicators. When we are in a rally, I want to give you any underlying problems that may be developing within the rally. I did point out some issues possibly developing with our climactic indicators yesterday, but overall they were bullish. With some problems developing on the climactic chart, I ended with the conclusion that we will likely see a pullback soon, not necessarily the next day. I hope that helps.

We ended up with a rally today instead of a breakdown from the rising wedge. The story is different today. Short-term indicators are now showing deterioration. I find that troubling in the context of this rising wedge which did NOT resolve upward. Price is still within that wedge.

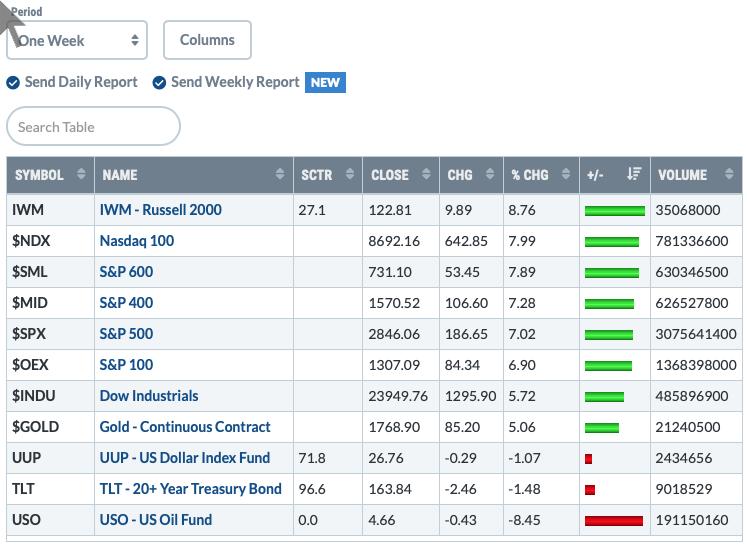

TODAY'S Broad Market Action:

Past WEEK Results:

Top 10 from ETF Tracker:

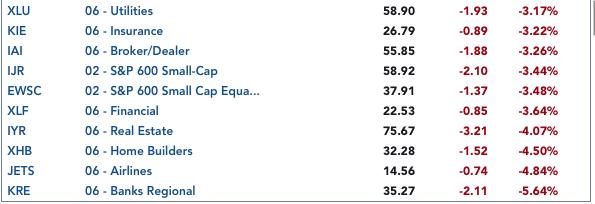

Bottom 10 from ETF Tracker:

On Friday, the DecisionPoint Alert Weekly Wrap presents an assessment of the trend and condition of the stock market (S&P 500), the U.S. Dollar, Gold, Crude Oil, and Bonds. Monday through Thursday the DecisionPoint Alert daily report is abbreviated and covers changes for the day.

Watch the latest episode of DecisionPoint on StockCharts TV's YouTube channel here!

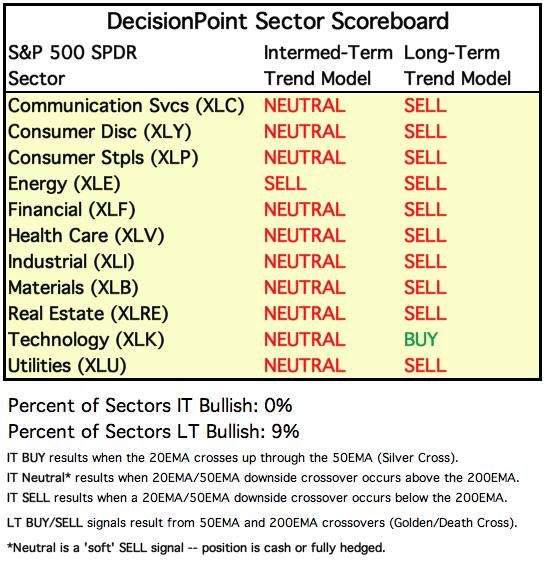

SECTORS

SIGNALS:

Each S&P 500 Index component stock is assigned to one, and only one, of 11 major sectors. This is a snapshot of the Intermediate-Term (Silver Cross) and Long-Term (Golden Cross) Trend Model signal status for those sectors.

TODAY'S RESULTS:

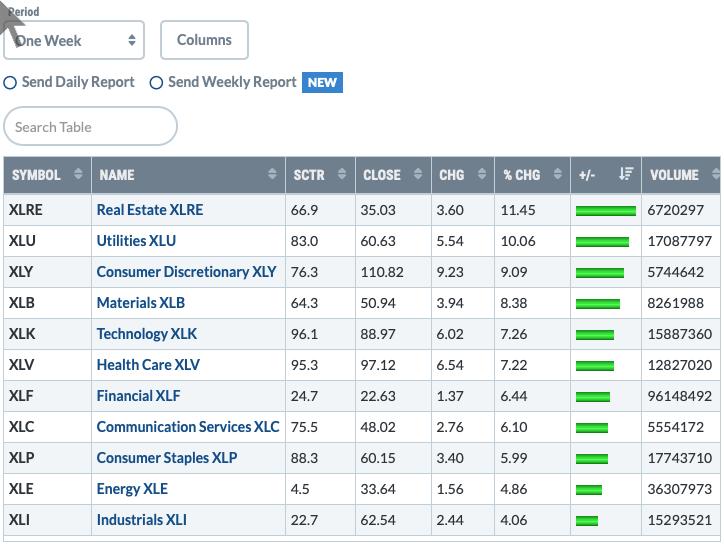

One WEEK Results:

STOCKS

IT Trend Model: NEUTRAL as of 2/28/2020

LT Trend Model: SELL as of 3/19/2020

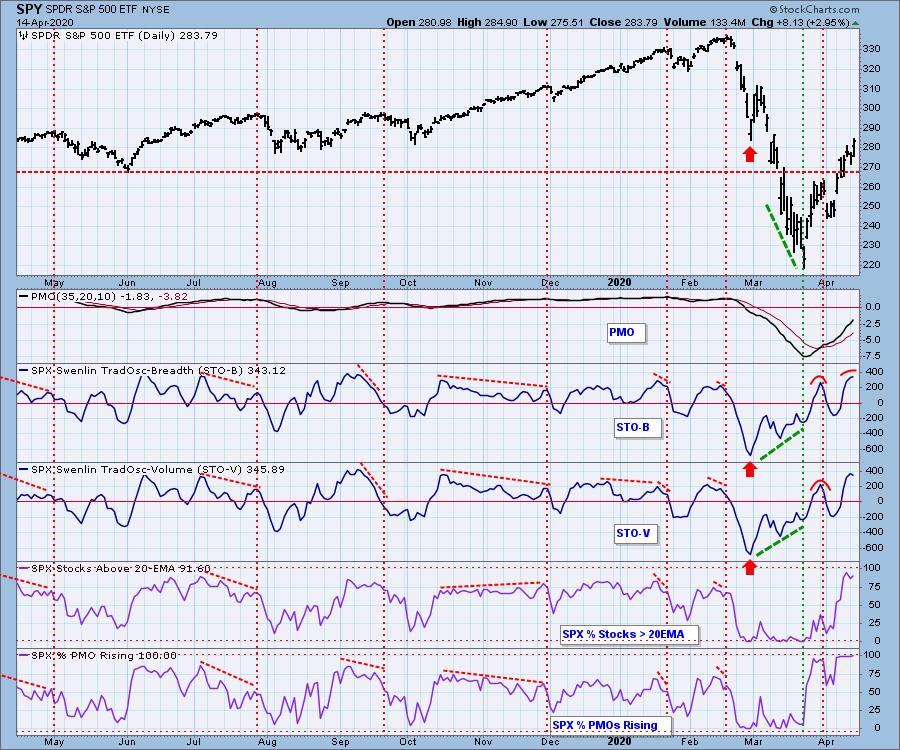

SPY Daily Chart: The PMO is still rising nicely and the OBV is confirming. Volume was slightly higher on the rally. The VIX continues to rise on the inverted scale, chasing the upper Bollinger Band. Until the VIX changes direction, the Band will continue to rise. I like to watch for penetrations of that Band which typically precede short-term declines.

Climactic Market Indicators: Positive readings on the Advances-Declines are contracting on a rally. That is generally a bad sign.

Short-Term Market Indicators: The ST trend is UP and the market condition is OVERBOUGHT based upon the Swenlin Trading Oscillator (STO) readings. Okay, we might be getting warning early, folks. Notice before the last short-term pullback, the STOs had turned lower. Today we saw the STO-V turn down and the STO-B is decelerating possibly in preparation for a top. The indicators are in overbought territory. Right now we have 100% of SPX members with rising PMOs. That's an overbought extreme. We didn't even see that during the bull market. For grins, I looked back in history and couldn't find a time when this was the case. If anyone finds it, let me know. This cannot be sustained in a bear market environment.

Intermediate-Term Market Indicators: The Silver Cross Index (% of SPX stocks 20EMA > 50EMA) and the Golden Cross Index (percent of SPX stocks 50EMA > 200EMA) are both rising. The more sensitive BPI has turned downward on a day when the SPY was up almost 3%. I don't like it. The SCI and GCI are bullish for intermediate and long term.

The IT trend is UP and the market condition is NEUTRAL based upon all of the readings on the indicators below. I can't complain about our intermediate-term indicators. All are rising and are in neutral territory. They can accommodate more upside. It does look very similar to the move out of the 2018 bear market low.

CONCLUSION: The ST is UP and IT trend is also UP. Market condition based on ST indicators is OVERBOUGHT and based on IT indicators is NEUTRAL. There is deterioration on breadth and the Swenlin Trading Oscillators (STOs). Add to that a rising wedge formation and you have a recipe for a short-term pullback.

(Not a Diamonds subscriber? Add it to your DP Alert subscription and get a discount! Contact support@decisionpoint.com for your limited time coupon code!)

DOLLAR (UUP)

IT Trend Model: BUY as of 3/12/2020

LT Trend Model: BUY as of 5/25/2018

UUP Daily Chart: Yesterday's comments still apply: "The Dollar is pulling back. The PMO suggests we will see a test of support along the October top."

GOLD

IT Trend Model: BUY as of 12/26/2019

LT Trend Model: BUY as of 1/8/2019

GOLD Daily Chart: I still like Gold. The only problem I see is a very overbought PMO. However, it is rising with little to no hesitation and could certainly move higher with price.

GOLD MINERS Golden and Silver Cross Indexes: Gold Miners were down slightly, but the EMAs are looking quite good. Very soon we should have both a Silver Cross and a Golden Cross on GDX. The Silver Cross Index is very bullish and rising. The Golden Cross Index is rising and nearing a positive crossover.

CRUDE OIL (USO)

IT Trend Model: Neutral as of 1/27/2020

LT Trend Model: SELL as of 2/3/2020

USO Daily Chart: I was sadly stopped out of this position. I got in too late in the short-term rally, but based on the PMO BUY signal I felt it was safe. If it begins to rise, that bullish reverse head and shoulders could come into play. If price continues to drop, it will reach support and be a possible BUY. Overall, this one requires some more patience.

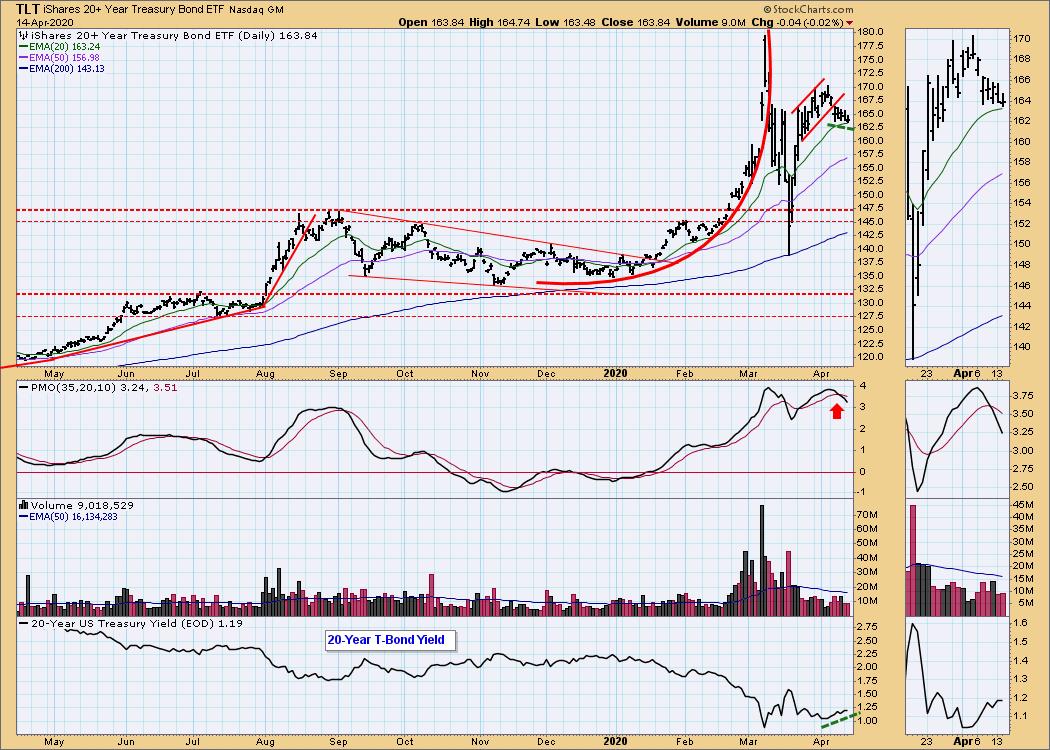

BONDS (TLT)

IT Trend Model: BUY as of 1/22/2020

LT Trend Model: BUY as of 1/2/2019

TLT Daily Chart: The PMO tells me to expect lower prices. I am seeing a very short-term positive divergence with the OBV and price happens to be sitting on the 20-EMA. We could see a last gasp upward before price breaks down.

Have you subscribed the DecisionPoint Diamonds yet? DP does the work for you by providing handpicked stocks/ETFs from exclusive DP scans! Add it with a discount! Contact support@decisionpoint.com for more information!

Technical Analysis is a windsock, not a crystal ball.

Happy Charting! - Erin

Email: erin@decisionpoint.com

Erin Swenlin will be presenting at the The MoneyShow Las Vegas August 16 - 20 at Bally's/Paris Resort! You'll have an opportunity to meet Erin and discuss the latest DecisionPoint news and Diamond Scans. Claim your FREE pass here! You can watch online with this pass too!! There will be online events held in May and when I have more information I'll let you know.

NOTE: The signal status reported herein is based upon mechanical trading model signals, specifically, the DecisionPoint Trend Model. They define the implied bias of the price index based upon moving average relationships, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links (Can Be Found on DecisionPoint.com Links Page):

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)