At DecisionPoint.com I maintain daily charts of the eleven S&P 500 sectors for our subscribers, and I can't help noticing two of the charts have bearish rising wedge formations, which developed after the market's March low. Rising wedges are bearish because they resolve downward more often than not, the reason being simply that the rising trend line forming the bottom of the wedge is the steepest part of the structure, and is more likely to fail.

On Monday's StockCharts TV Erin and I discussed the rising wedge on the Technology Sector (XLK) chart. Since then, XLK moved higher within the wedge, once again testing the rising tops line, which forms the top of the wedge. In doing so, it created a smaller, even more confining wedge. The fact that two of the short-term indicators are quite overbought adds weight to the expectation of a breakdown.

The Utilities Sector (XLU) also has a rising wedge, along with two overbought short-term indicators.

As investors we want to accomplish two basic things: (1) Determine the trend and condition of the market, and (2) select stocks that will ride that tide. The DecisionPoint Alert helps with the first step, and DecisionPoint Diamonds helps with the second. Go to DecisionPoint.com and SUBSCRIBE TODAY!

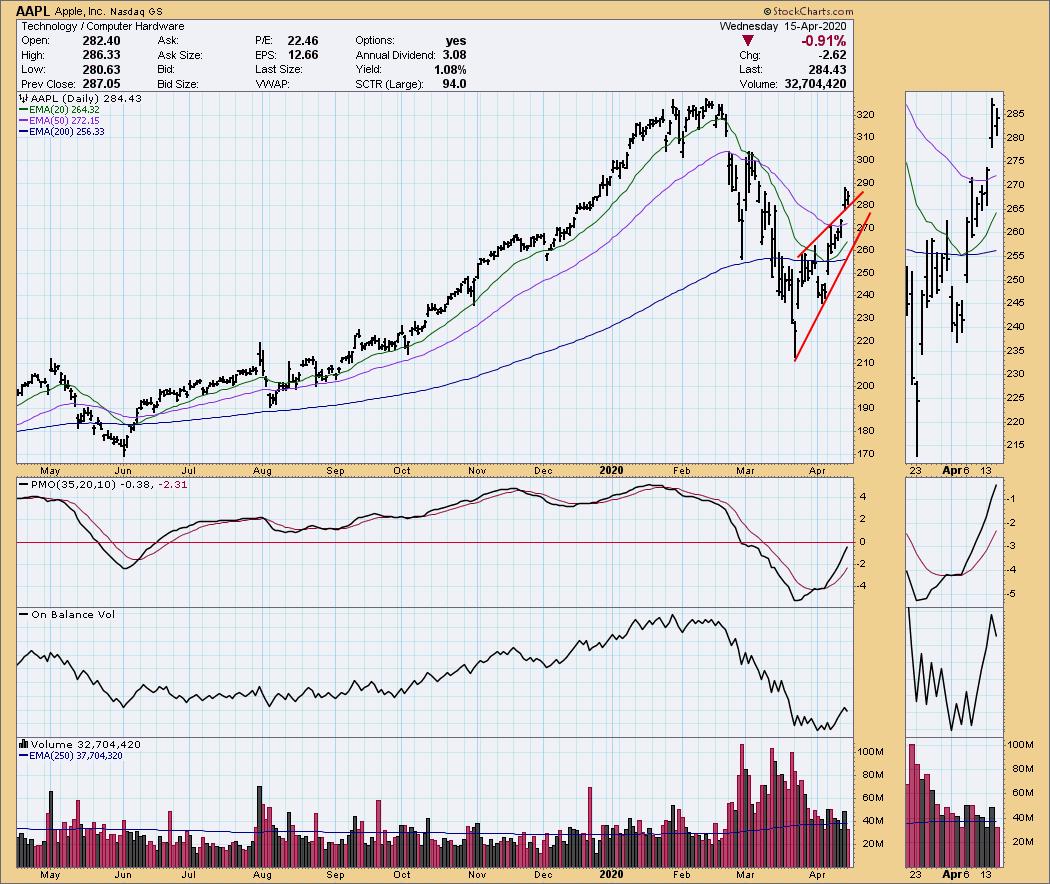

Yes, rising wedges are fairly reliable in resolving downward . . . except when they don't. Apple (AAPL) had a nice, tight rising wedge that . . oops! . . . resolved with a gap upward on Tuesday. At present, an island reversal may be setting up, but that's another story. Most interesting is the fact that AAPL is a component of the Technology Sector, which remains within the confines of its own wedge.

While we normally expect downside resolution of a rising wedge, that doesn't mean that, say, the March low will be retested. It could happen, but sometimes the result is that new bottom quickly forms and a less accelerated rising trend line is set.

There are a number of other sectors that have developed "wedge-like" formations could resolve similarly, but making the comparison might be a bit tortured, so I'll leave it at that.

Happy Charting! - Carl

Technical Analysis is a windsock, not a crystal ball.

Helpful DecisionPoint Links:

DecisionPoint Alert Chart List

DecisionPoint Golden Cross/Silver Cross Index Chart List

DecisionPoint Sector Chart List

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)