I recently received an email from a reader:

When you have an opportunity, can you explain what you mean by climatic moves? I am not clear on how that is defined on the charts.

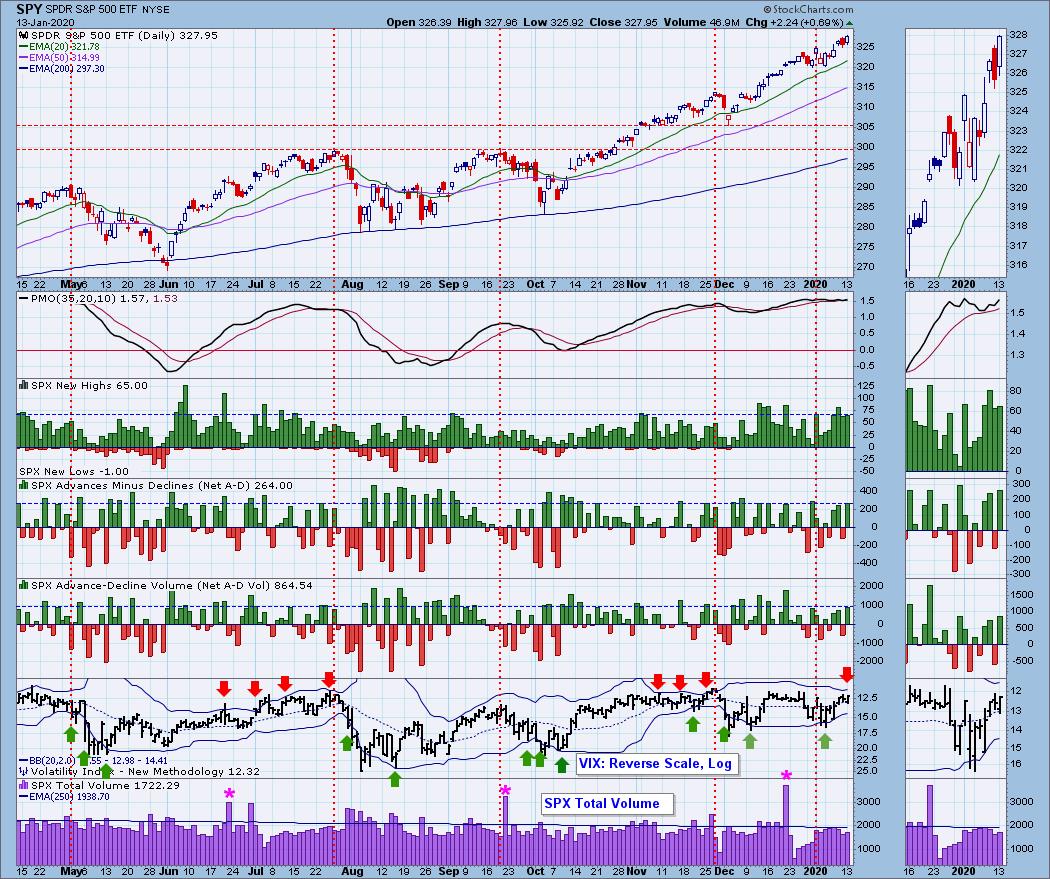

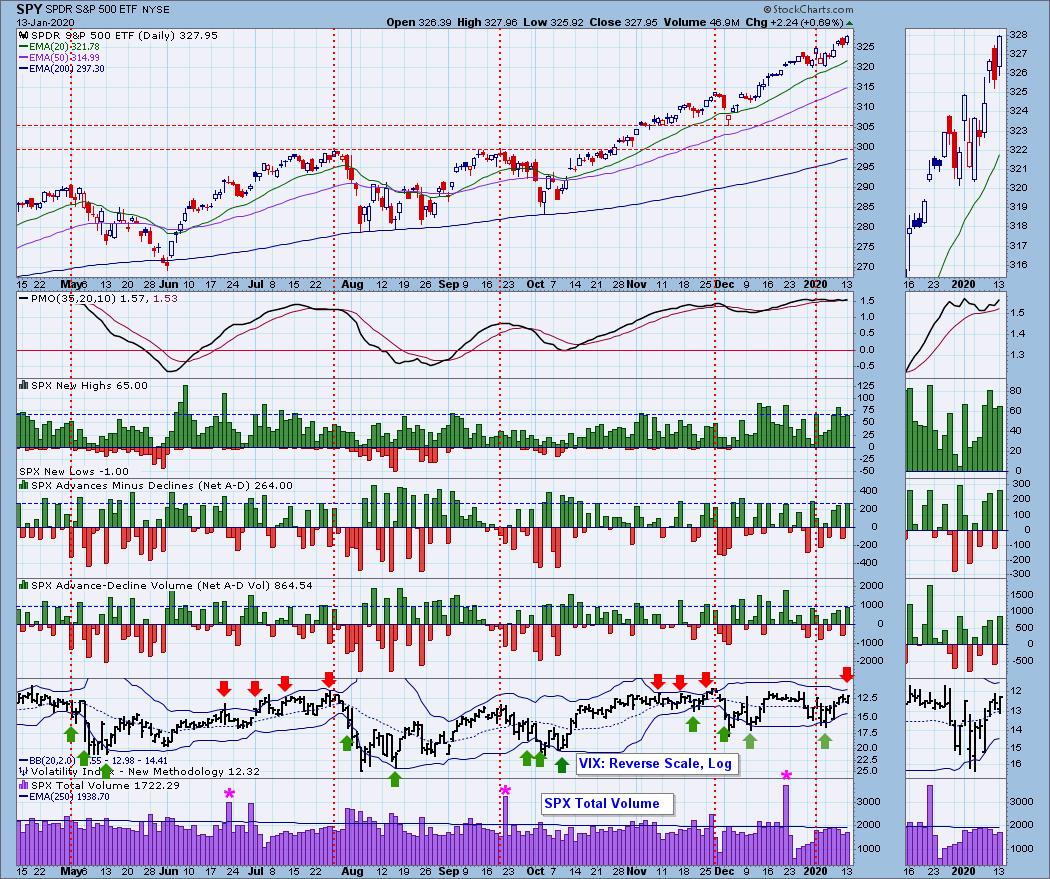

Excellent question! Since we have some climactic readings on today's Climactic Indicator chart, I thought it might be a good time to explain. Climactic readings are many times identified by a 'spike' in one direction or another that is comparable to or exceeds previous very high readings. A climax on the VIX I define as a puncture of the upper or lower Bollinger Bands.

The easiest way for me to identify climactic readings is to use a horizontal blue dashed line that I place on the top of today's readings. If you see only handful of previous readings that are at or exceeding that level, you have a climactic reading. In the chart below (I'll analyze the implications later), you can see that as far as New Highs, there aren't that many readings at or exceeding today's level so it is climactic. Net A-D is somewhat climactic. There are readings that exceed today, but today's reading is near the top of the range. Net A-D volume isn't climactic in my opinion.

Once we define a climactic reading, it is then time to determine whether it is an 'exhaustion' or an 'initiation' climax. That is really a judgement call. I generally base my decision on the current price trend. I'll let you know my thoughts in the indicators section further down in today's report.

TODAY'S Action:

The DecisionPoint Alert Weekly Wrap presents an end-of-week assessment of the trend and condition of the stock market (S&P 500), the U.S. Dollar, Gold, Crude Oil, and Bonds. Monday through Thursday the DecisionPoint Alert daily report is abbreviated and covers changes for the day.

Watch the latest episode of DecisionPoint on StockCharts TV's YouTube channel here!

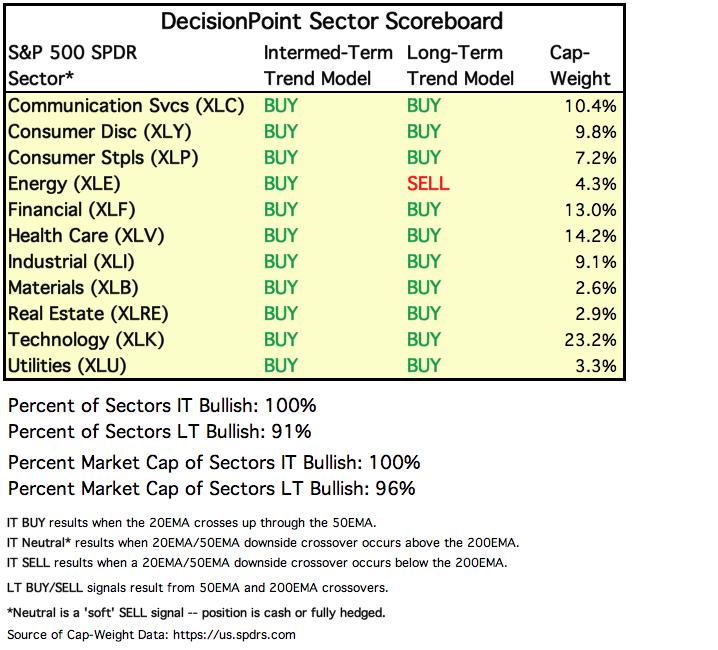

SECTORS

SIGNALS:

Each S&P 500 Index component stock is assigned to one, and only one, of 11 major sectors. This is a snapshot of the Intermediate-Term (Silver Cross) and Long-Term (Golden Cross) Trend Model signal status for those sectors.

TODAY'S RESULTS:

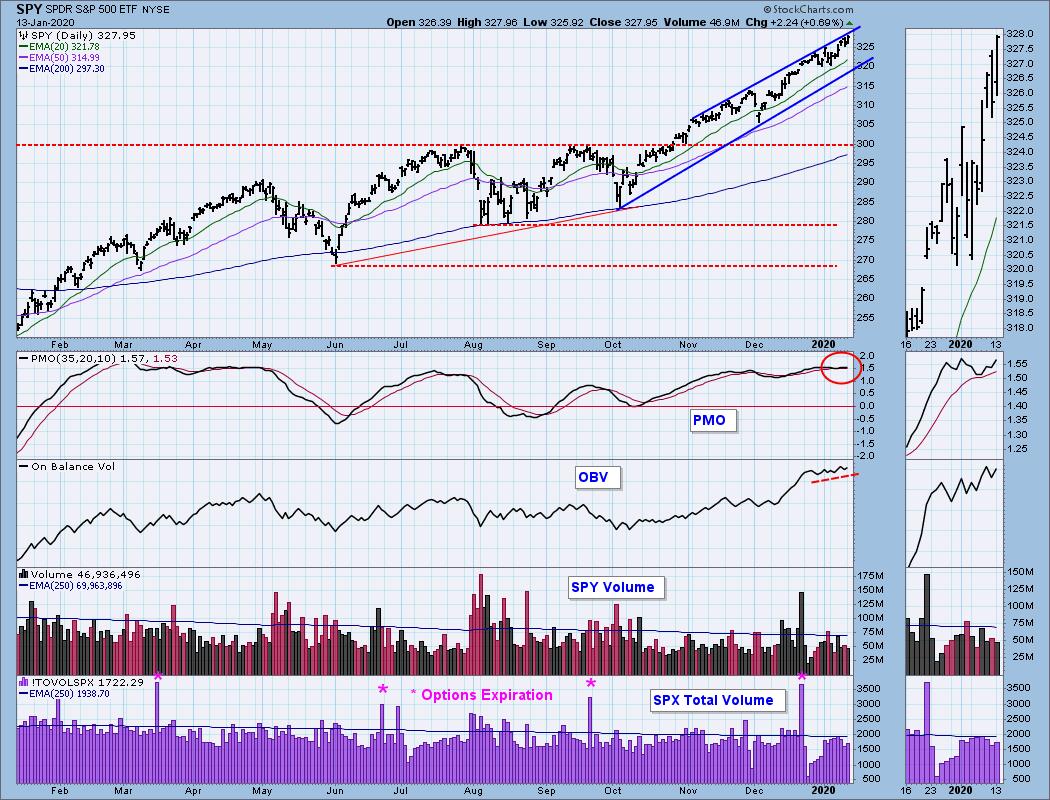

STOCKS

IT Trend Model: BUY as of 9/6/2019

LT Trend Model: BUY as of 2/26/2019

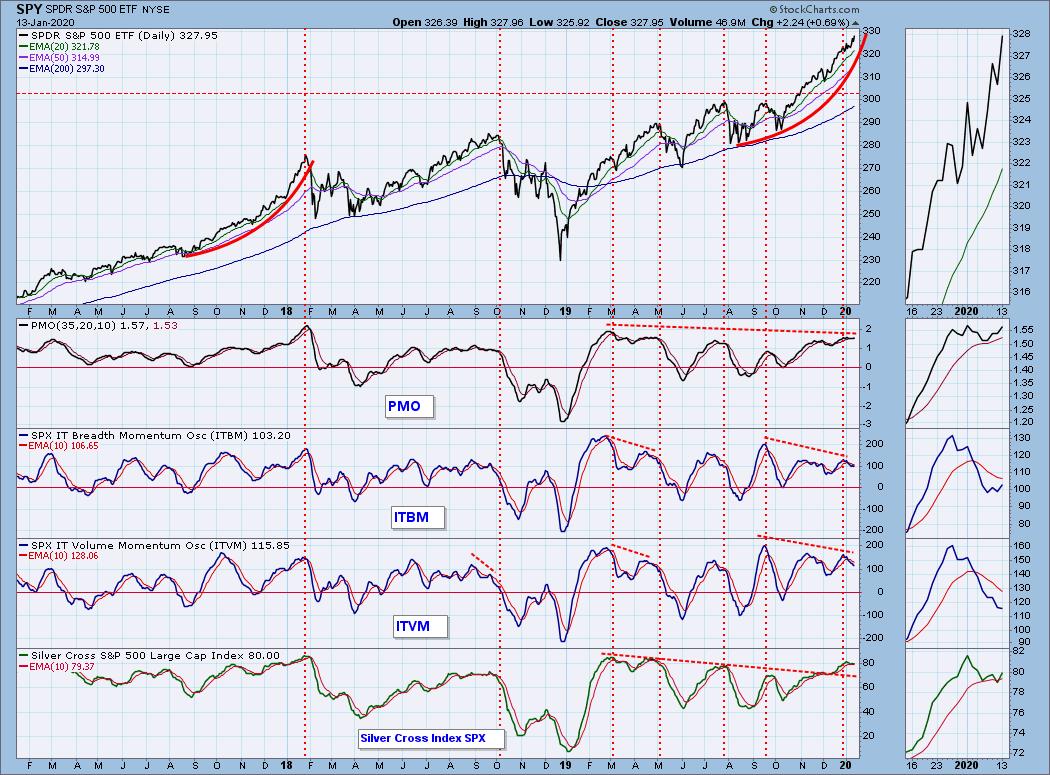

SPY Daily Chart: I noticed in today's market action summary above, that the NDX led, but small- and mid-caps were next in line. In order to sustain a bull market, or to add fuel to a rally fire, we want to see small- and mid-caps to outperform. I'll be watching this week to see if this is sustained. We are seeing price pushing up against the top of the rising wedge. The PMO has turned up above the signal line, but it is relatively flat. I'll be more impressed if the PMO can exceed its last top. I do like the OBV here. Rising bottoms are confirming the current move to the upside.

Climactic Market Indicators: I am looking at today's climactic readings on New Highs and Net A-D as a possible buying exhaustion. The VIX hasn't penetrated the upper Bollinger Band, but it is very close and that typically leads to lower prices. My biggest concern is that the bands are beginning to squeeze together. Typically that can lead us into a correction or at least a pullback. The late November squeeze only resulted in a pullback, but you can see the results of the squeezes in April 2019 and late July 2019.

Short-Term Market Indicators: The STOs have broken out of their declining trends. Oscillation above the zero line is bullish and suggests internal strength. Carl pointed out in today's DecisionPoint show that the negative divergence on the %Stocks above their 20-EMA. It is beginning to perk up, but the negative divergence remains in play.

Intermediate-Term Market Indicators: Both the SCI turned up again and in the healthy > 75% zone.

The negative divergences are still very much in play on the ITBM/ITVM, but I do see the SCI and ITBM are beginning to rise again.

CONCLUSION: I'm still seeing our short-term indicators rising which is bullish. My problem is the possible buying exhaustion that could be lining up and the VIX 'squeeze'. The negative divergences are a concern on the intermediate-term charts but so far the market is holding up.

DOLLAR (UUP)

IT Trend Model: NEUTRAL as of 12/11/2019

LT Trend Model: BUY as of 5/25/2018

UUP Daily Chart: No change for the Dollar as it continues to pause after a strong rally into the year. I've been paying so much attention to the trading range of the last few months that I missed an important bullish falling wedge. The PMO has locked in a BUY signal and continues to rise. I would expect to see the upside breakout here, but seeing price fail before reaching the declining tops trendline tells me we may have to wait for another downside test of the wedge before a breakout.

GOLD

IT Trend Model: BUY as of 12/26/2019

LT Trend Model: BUY as of 1/8/2019

GOLD Daily Chart: Gold is pulling back. We are seeing the discounts contracting which suggests that despite the pullback, sentiment is moving bullish again. High discounts are bullish for Gold as it means sentiment is bearish. We have the opposite situation here. The PMO is starting to roll over. Price still remains above the 20-EMA which lines up with support at 1525. The rally was very steep, this pullback was needed to undo the near parabolic move Gold made on its way up to more multi-year highs.

GOLD MINERS Golden and Silver Cross Indexes: The drop in Gold hasn't helped Gold Miners. The SCI now has made a negative crossover and is headed lower out of overbought territory. $28 for GDX needed to hold and it didn't.

CRUDE OIL (USO)

IT Trend Model: BUY as of 11/6/2019

LT Trend Model: BUY as of 12/16/2019

USO Daily Chart: Oil prices took another dive lower today. At this point, the rising trend is now in jeopardy. Given the negative PMO, I suspect it will be broken.

BONDS (TLT)

IT Trend Model: NEUTRAL as of 12/12/2019

LT Trend Model: BUY as of 1/2/2019

TLT Daily Chart: The PMO is still headed higher and price remains in a bullish falling wedge. Although price declined today, volume contracted on the sell-off which I find encouraging. It could be a sign of a selling exhaustion.

**Don't miss any of the DecisionPoint commentaries! Go to the "Notify Me" box toward the end of this blog page to be notified as soon as they are published.**

Technical Analysis is a windsock, not a crystal ball.

Happy Charting! - Erin

Email: erin@decisionpoint.com

Erin Swenlin will be presenting at the The MoneyShow Las Vegas May 11-13, 2020! You'll have an opportunity to meet Erin and discuss the latest DecisionPoint news and Diamond Scans. The conference is free to attend or view online!

NOTE: The signal status reported herein is based upon mechanical trading model signals, specifically, the DecisionPoint Trend Model. They define the implied bias of the price index based upon moving average relationships, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links (Can Be Found on DecisionPoint.com Links Page):

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)