I ran my Momentum Sleepers Scan today. I previously found this one to be quite successful in the short-term on MarketWatchers LIVE. There appears to be momentum under the surface of some very rough diamonds. I'll tell you up front that the weekly charts for these stocks aren't particularly bullish, but this scan picks out beaten-down stocks. I would consider these more in the short-term timeframe, but, if they turn into phoenixes and rise from the ashes, those weekly charts will begin looking much more bullish.

I love to get your feedback on these reports, so shoot me an email at erinh@stockcharts.com. I read every one of them!

Welcome to "DecisionPoint Daily Diamonds," a newsletter in which I highlight five "diamonds in the rough" taken from the results of one of my DecisionPoint scans. Remember, these are not recommendations to buy or sell, but simply stocks that I found interesting. The objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

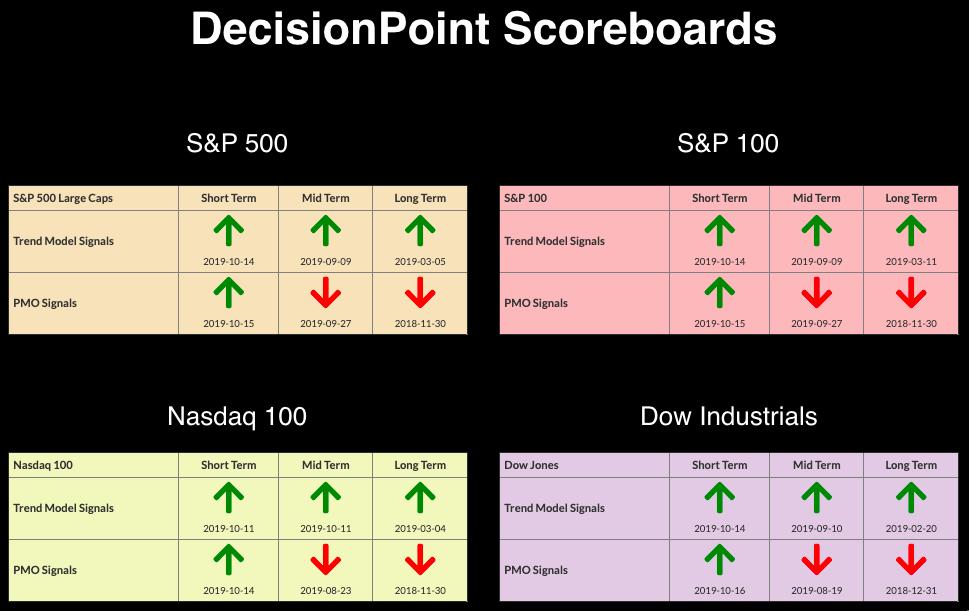

Current Market Outlook:

Market Trend: Currently, we have Trend Model BUY signals in all three timeframes on the DP Scoreboard Indexes.

Market Condition: The market is overbought and struggling to reach all-time highs, despite Price Momentum Oscillator (PMO) BUY signals on the DP Scoreboards. Caution is still warranted.

Market Environment: It is important to consider the odds for success. Here are the current percentages on the Silver and Golden Cross Indexes:

- Silver Cross: 60.8% SPX ITTM Buy Signals (20-EMA > 50-EMA)

- Golden Cross: 66.0% SPX LTTM Buy Signals (50-EMA > 200-EMA)

Diamond Index:

- Diamond Scan Results: 21

- Diamond Dog Scan Results: 18

- Diamond Bull/Bear Ratio: 1.17

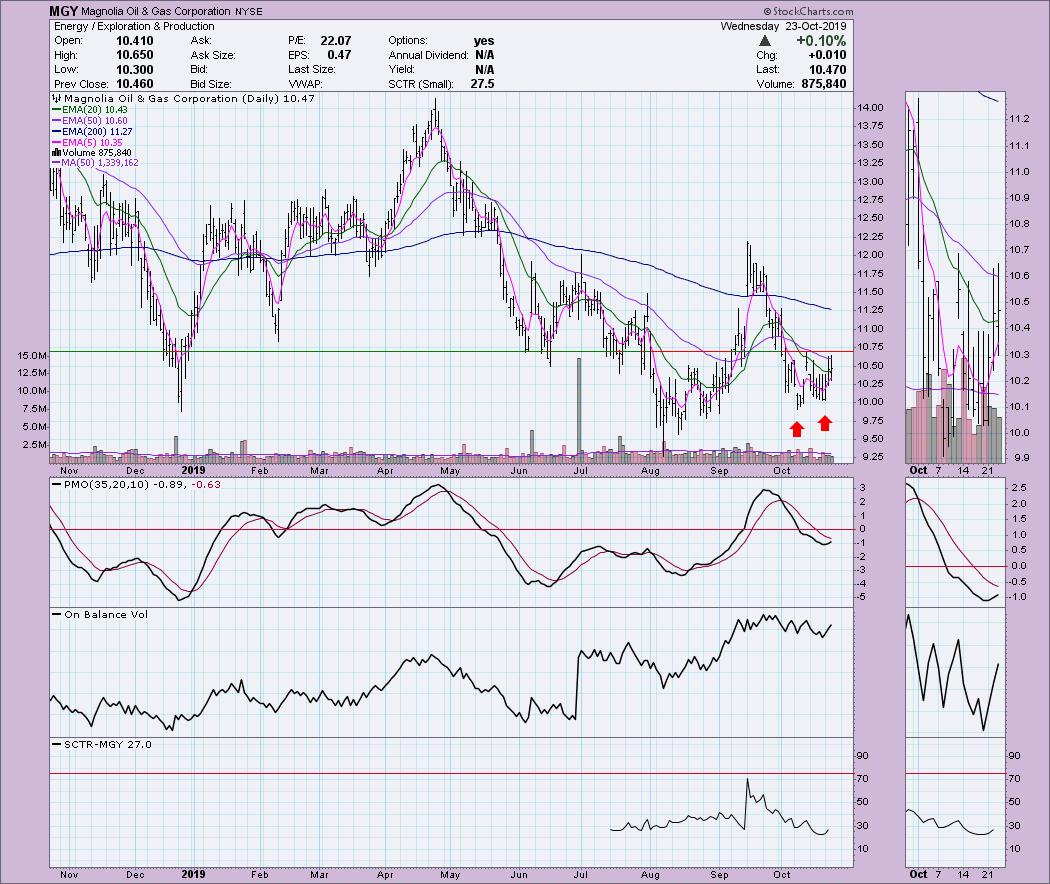

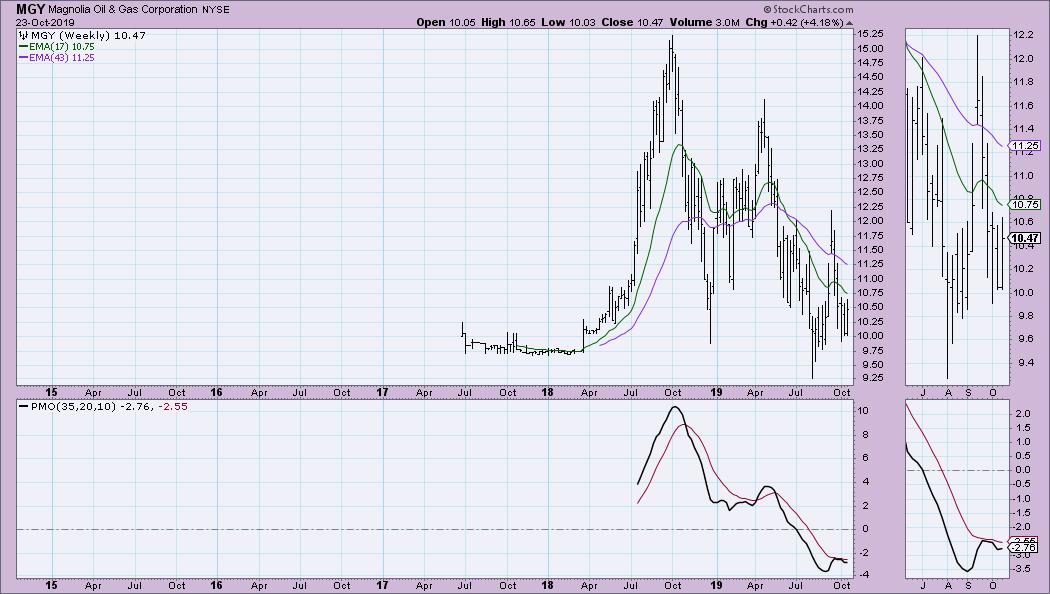

Magnolia Oil & Gas Corp (MGY) - Earnings: 11/5/2019

I saw a double-bottom on this one in the CandleGlance when I reviewed today's scan results. It hasn't broken above the confirmation line yet, though the PMO is rising nicely. Positive volume is coming in, but it has been decreasing, which could pose a problem. However, if we get the breakout above $10.75, the next area of overhead resistance is around $12.00-$12.25.

The weekly PMO has turned up and is trading near its lows.

MPLX LP (MPLX) - Earnings: 10/31/2019

Here we have another double-bottom that hasn't executed yet. We should look for a breakout above $27.50. One notable plus is the positive divergence between price bottoms and the OBV bottoms. If this executes, the height of the pattern is about $1.00. If we add that to the confirmation line, that gives us a minimum upside target at $28.50. I'm looking at $29.50 as solid resistance.

MPLX has been in a trading range and is currently at the bottom of it. If price rallies off the bottom of the range, that would form another double-bottom. Of course we want to see the PMO turning up.

Noble Energy Inc (NBL) - Earnings: 11/7/2019

I like the double-bottom on NBL that is forming. It isn't considered a pattern until it executes, with the breakout above the confirmation line. Interestingly, the height of the pattern added to the confirmation line would put price right at the next area of overhead resistance at about $23.00.

It's near the bottom of a trading range on the weekly chart, so it could be time for it to test the top of the range.

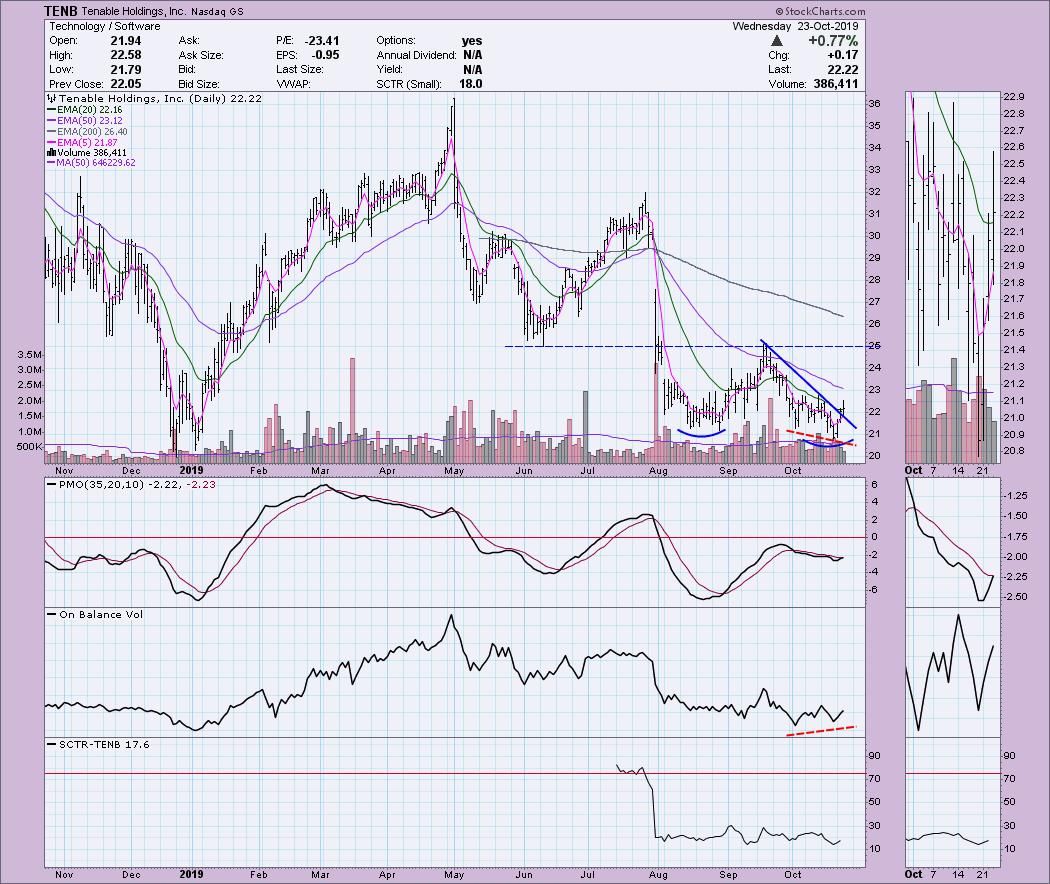

Tenable Holdings Inc (TENB) - Earnings: 10/29/2019

Today we saw a breakout above the 20-EMA at the same time as it broke a declining trend. It's very early, but a double-bottom could form if the rally continues. The OBV is showing a positive divergence between OBV bottoms and price lows. The PMO is about to trigger a BUY signal as well.

Price appears to be bouncing off the all-time lows. The $25.00 looks like it could be an area of strong resistance.

Cactus Inc (WHD) - Earnings: 10/30/2019

As expected, WHD broke from a descending wedge formation to the upside. The PMO is turning up just below the zero line and we can see another positive divergence on the OBV with price lows. I like that price also broke above both the 20-EMA and 50-EMA.

The PMO is trying to turn up on the weekly chart. Price is nearing the 17-week EMA and it could pose some resistance.

Full Disclosure: I do not own any of the stocks above and won't be adding them to my portfolio. I had something personal to deal with this morning and consequently missed the open of ZUMZ. It looks like it would have been a nice entry, but I didn't bite. I'm currently about 60% in cash.

SAVE THE DATE!!

Erin Swenlin will be presenting at the TradersExpo in New York City on March 15-17, 2020! You'll have an opportunity to meet Erin and discuss the latest DecisionPoint news and Diamond Scans. The conference is free to attend or view online!

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin LIVE on Mondays 5:00p EST or on the StockCharts TV YouTube channel here!

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erinh@stockcharts.com

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

**Don't miss DecisionPoint Commentary! Add your email below to be notified of new updates"**