Well last week looks very good, but this week was basically a bust. We had only two positions finish positive. One was up over 9% so that was good, but I'm not happy with how "Diamonds in the Rough" reacted to this week's decline.

The "Darling" this week was Darling Ingredients (DAR) which popped in today's trading pushing it up over 9% as noted above. The "Dud" was the Ethereum ETF which turned south as soon as it was picked. Crypto had looked very bullish and then it took a turn for the worse. Such is the lament of the momentum trader.

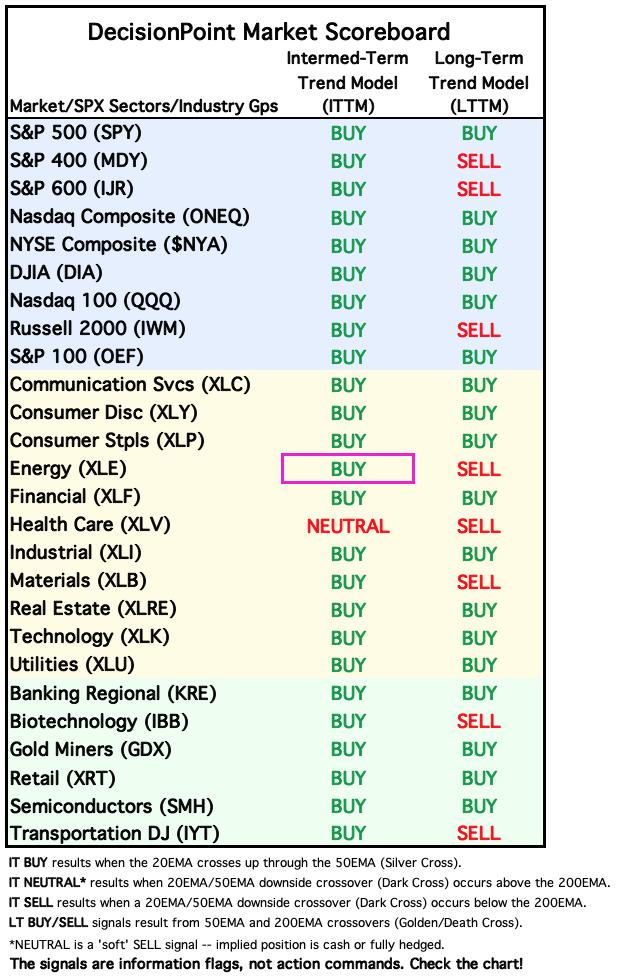

This week's Sector to Watch was Energy (XLE), but Healthcare (XLV) was a very close second. Technology is hanging in there too, but the market is looking vulnerable so I don't think I would want to be fishing in that sector at this time.

The Industry Group to Watch was Exploration and Production. It has an ETF, XOP so I will cover that at the end of today's report. I found several symbols that looked good, but admittedly many are overbought. Given tensions in the Middle East, we should see Crude continue to move higher from here so I believe they will maintain overbought conditions a little while longer: PARR, CVI, DK, EQT, WDS, VIST and PR.

I ran quite a few scans to finish today's trading room and definitely found some interesting stocks to keep an eye on next week: AGO, AIG, DDOG, PANW, RS and WTRG.

Have a great weekend! See you next week!

Good Luck & Good Trading,

Erin

Diamond Mine Trading Room:

RECORDING & DOWNLOAD LINK (6/13/2025):

Topic: DecisionPoint Diamond Mine (6/13/2025) LIVE Trading Room

Download & Recording LINK

Passcode: June#13th

REGISTRATION for 6/20/2025:

When: June 20, 2025 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine LIVE Trading Room

Register in advance for this webinar HERE

After registering, you will receive a confirmation email containing information about joining the webinar.

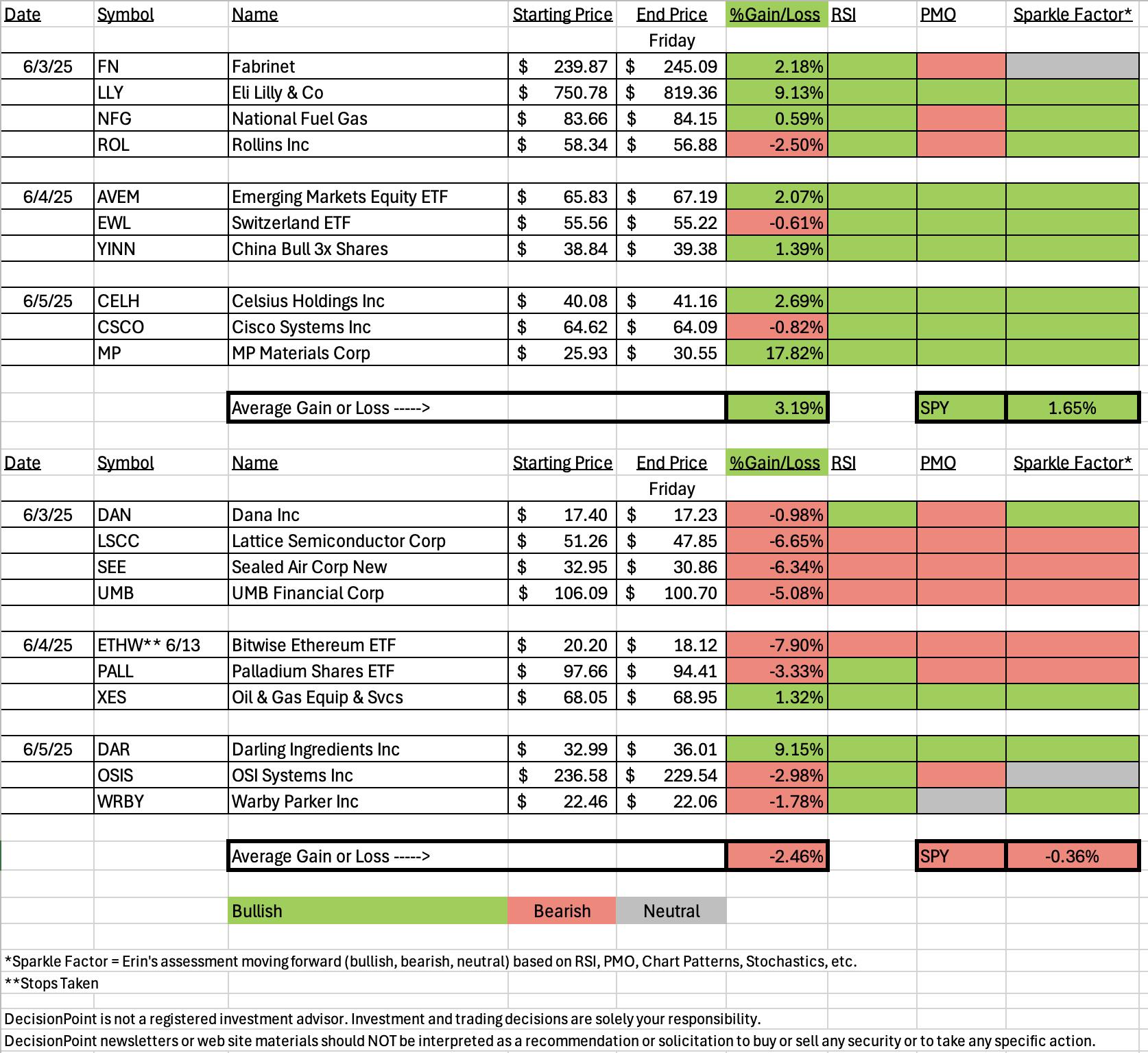

A few items about the spreadsheet: I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

Darling:

Darling Ingredients Inc. (DAR)

EARNINGS: 2025-07-24 (BMO)

Darling Ingredients, Inc. engages in the development and production of natural ingredients from edible and inedible bio-nutrients. It operates through the following segments: Feed Ingredients, Food Ingredients, and Fuel Ingredients. The Feed Ingredients segment includes ingredients such as fats and proteins used cooking oil, trap grease and food residuals collection, the Rothsay ingredients, and specialty products. The Food Ingredients segment consists of gelatin, natural casings and meat by-products, and specialty products activities. The Fuel Ingredients segment includes the bioenergy business. The company was founded in 1882 and is headquartered in Irving, TX.

Predefined Scans Triggered: Elder Bar Turned Green and Bullish MACD Crossovers.

Below are the commentary and chart from Thursday, 6/12:

"DAR is up +0.03% in after-hours trading. It hasn't gotten above resistance yet, but this rounded bottom looks very interesting. We can see a prior double bottom pattern that hasn't really fulfilled yet. The pattern is still viable. We also had a bullish engulfing candlestick today. The RSI is just now getting positive. The PMO is very near a Crossover BUY Signal. Stochastics are rising very strongly. Relative strength for the group is unimpressive, but we do see DAR beginning to outperform both the SPY and the group. The stop is set as close to support as possible at 8% or $30.35."

Here is today's chart:

I'm not sure what happened here. Trading was intense today with a giant gain. We did have a bullish engulfing candlestick yesterday, but wow, quite a move. Surprisingly, the RSI is not overbought yet. It may be too late for entry, but something good is going on under the surface so an entry on a pullback would be interesting. The PMO is now rising above the zero line and price punched right through the 200-day EMA. It looks good for more upside.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Dud:

Bitwise Ethereum ETF (ETHW)

EARNINGS: N/A

ETHW is a low-cost Ethereum fund built by crypto specialists. The Fund holds ether (ETH), the second-largest crypto asset in the world and the force behind some of the most popular projects in crypto. Click HERE for more information.

Predefined Scans Triggered: P&F Double Top Breakout.

Below are the commentary and chart from Wednesday, 6/11:

"ETHW is down -0.10% in after hours trading. I'm not usually one to present crypto, but this breakout from the consolidation zone looks very bullish. There are other Ethereum ETFs so pick the one you want, they all look like this. The RSI is not overbought and is positive. The PMO has whipsawed back into a Crossover BUY Signal. Stochastics are rising strongly toward 80 and we can see that there is some outperformance being logged with the relative strength line rising again. The stop is set beneath the 200-day EMA at 7.9% or $18.60."

Here is today's chart:

Crypto looked really good when I picked this ETF on Wednesday, but I picked it just in time for a pullback. The Israel/Iraq conflict did not help matters as investors were definitely risk off in trading today. It could still bounce from here but with uncertainty likely to continue globally, this is not where you want to be right now. The RSI is almost in negative territory and the PMO is now falling on a Crossover BUY Signal.

THIS WEEK's Performance:

DecisionPoint Market Scoreboard (Mechanical Trend Model Signals):

Friday signal changes are outlined in purple.

Click Here to view Carl's annotated "Under the Hood" ChartList!

Sector to Watch: Energy (XLE)

XLE soared today pushing past overhead resistance at the May top and the 200-day EMA. The RSI is not yet overbought so we definitely could see price move higher from here. The PMO is rising strongly above the zero line. The OBV shows lots of volume coming in to confirm the rally. The Silver Cross Index is rising vertically and is above our bullish 50% threshold. The Golden Cross Index isn't that great so there is work to do in the long term. Participation is very strong, but is overbought. We suspect the rally will continue from here, but is likely to run into some trouble when it hits overhead resistance at the March top.

Industry Group to Watch: Exploration & Production (XOP)

Since we have an industry group that is tradable, I have included a stop level. The group broke out strongly today pushing price well past resistance. The RSI has just gotten overbought, but given the Middle East conflict, we should see Crude prices continue to rise and that will definitely help this group move higher despite overbought conditions. The PMO is rising strongly and Stochastics are rising above 80. It's a very healthy chart. We're even seeing outperformance against the SPY. Here are a few stock symbols to review from this group: PARR, CVI, DK, EQT, WDS, VIST and PR.

Go to our Under the Hood ChartList on DecisionPoint.com to get an in-depth view of all the sectors. On StockCharts.com you can find the Industry Summary.

Good Luck & Good Trading!

- Erin

erin@decisionpoint.com

Full Disclosure: I'm 60% long, 0% short.

Watch the latest episode of the DecisionPoint Trading Room with Carl & Erin Swenlin HERE!

Technical Analysis is a windsock, not a crystal ball. --Carl Swenlin

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

(c) Copyright 2025 DecisionPoint.com