The benchmark SPY had a terrible week down -9.07% to be exact. "Diamonds in the Rough" did not fare well, but the average did beat the SPY by a mile. "Diamonds in the Rough" were down -2.35%. Not good, but at least better than our benchmark.

We should've stuck to shorts this week. Chemours (CC) was down over 18% since being picked and I suspect we could've done very well if we had stuck to shorts. I must say that until Thursday, the market looked pretty good so I don't completely fault myself for not going all in on the short side.

As noted above CC was our Darling of the week. Based on two stops hitting this week, we could actually point to both the Real Estate Bear 3x (DRV) and United Natural Foods (UNFI) as Duds, but technically based on stop levels, UNFI wins the moniker of "Dud".

The Sector to Watch wasn't that hard to pick given only defensive sectors have any promise at all. Utilities (XLU) and Consumer Staples (XLP) were the favorites in the trading room this morning. We all agreed on XLU for the Sector to Watch despite its falling PMO. All sector PMOs are falling so we had to go with the least likely to suffer.

The Industry Group to Watch is Water. Basically we are going with the same Sector to Watch and Industry Group to Watch as last week. I wanted to pick another industry group, but Water simply looked the most bullish of the bunch. Symbols to watch are: AWK, YORW, CWT and AWR.

I had time to run the Diamond Dog Scan at the end of the program and found five short candidates for your review: DFIN, TTD, TNDM, BILL and ILMN. All look terrible.

I want to let you know that the free DecisionPoint Trading Room will be going on hiatus soon. We will do two more and then go on break.

Have a wonderful weekend!

Good Luck & Good Trading,

Erin

Diamond Mine Trading Room:

RECORDING & DOWNLOAD LINK (4/4/2025):

Topic: DecisionPoint Diamond Mine (4/4/2025) LIVE Trading Room

Recording & Download Link

Passcode: April#4th

REGISTRATION for 4/11/2025:

When: April 11, 2025 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine LIVE Trading Room

Register in advance for this webinar HERE

After registering, you will receive a confirmation email containing information about joining the webinar.

Below is the latest free DecisionPoint Trading Room recording from 3/31. You'll find these recordings posted on Mondays to our DP YouTube Channel. Be sure and subscribe HERE.

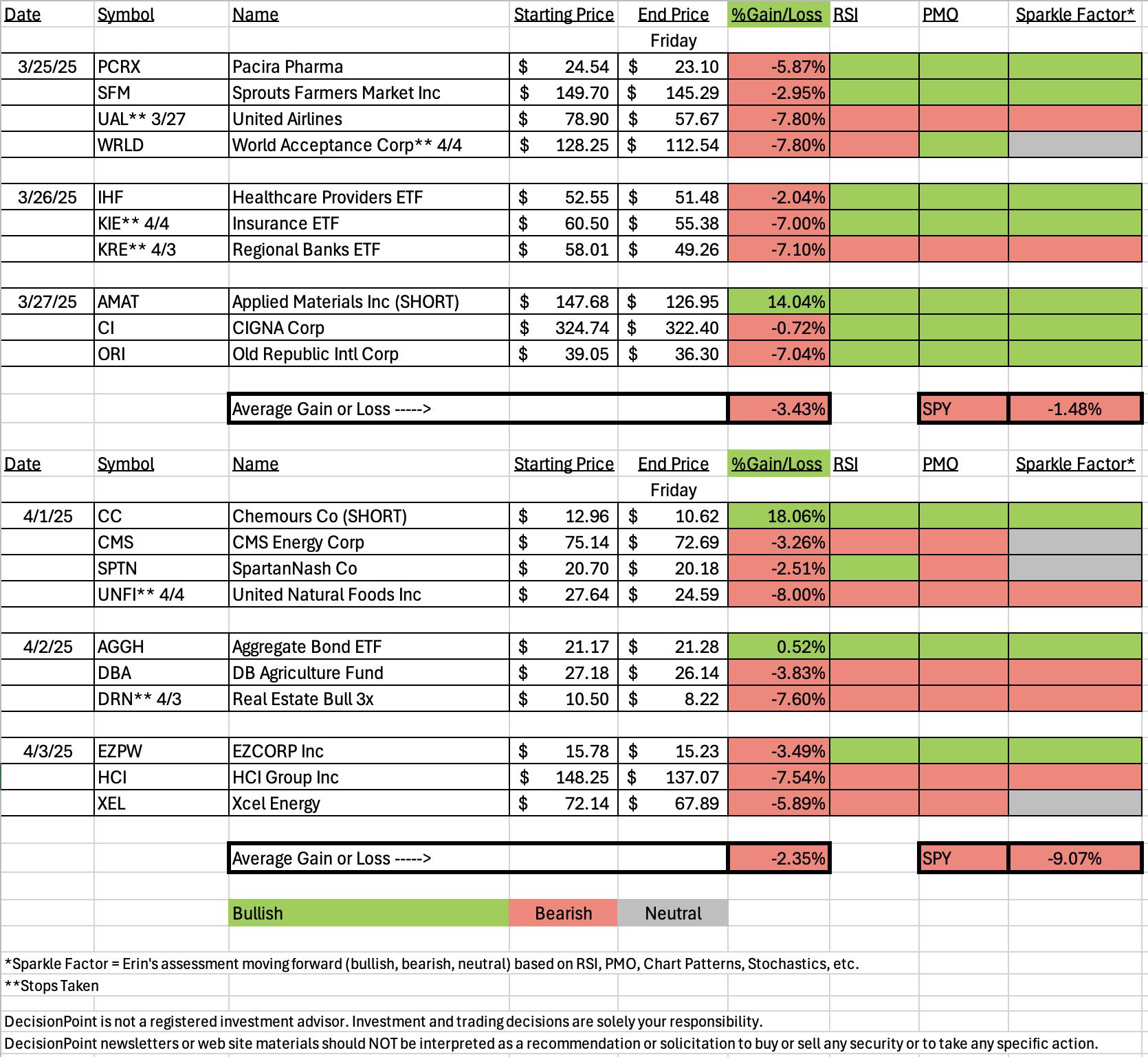

A few items about the spreadsheet: I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

Darling:

Chemours Co. (CC) - SHORT

EARNINGS: 2025-04-29 (BMO)

The Chemours Co. is a holding company, which engages in the provision of performance chemicals. The firm delivers solutions, which include a range of industrial and chemical products for markets including coatings, plastics, refrigeration and air conditioning, transportation, semiconductors and consumer electronics, and general industrial. It operates through the following segments: Titanium Technologies, Thermal and Specialized Solutions, Advanced Performance Materials, and Other. The Titanium Technologies segment is involved in the manufacture of titanium dioxide pigment. The Thermal and Specialized Solutions segment offers refrigerants, propellants, blowing agents, and specialty solvents. The Advanced Performance Materials segment produces polymers and advanced materials that deliver attributes, including chemical inertness, thermal stability, low friction, weather and corrosion resistance, extreme temperature stability, and di-electric properties. The Other segment consists of performance chemicals and intermediates business. The company was founded on February 18, 2014 and is headquartered in Wilmington, DE.

Predefined Scans Triggered: P&F Double Bottom Breakdown, P&F Descending Triple Bottom Breakdown, Stocks in a New Downtrend (Aroon), Moved Below Lower Bollinger Band, Moved Below Lower Price Channel and New 52-week Lows.

Below are the commentary and chart from Tuesday, 4/1:

"CC is up +1.85% in after hours trading so you should get a better entry on this short. It isn't surprising to see the after hours rebound given today's 4%+ decline. I chose this because it has lost near-term support on today's decline. The indicators are great for a short. The RSI is negative and falling. The PMO has topped well below the zero line and is headed toward a Crossover SELL Signal. Stochastics have now dropped below 20 indicating internal weakness. Relative strength for the group is rising which nearly prevented me from picking it, but ultimately the other indicators sold me. It is underperforming both the group and the SPY. The upside stop is set at 7.8% or $13.97."

Here is today's chart:

We had just gotten the breakdown from support. It was set up for failure. It did rally the next day, but the market's decline really took it down. This waterfall decline looks destined to continue. However, the RSI is now very oversold which would imply a possible rally, but looking at price action, I expect it to stay oversold for awhile. Notice the group is now underperforming as well.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Dud:

United Natural Foods, Inc. (UNFI)

EARNINGS: 2025-06-11 (BMO)

United Natural Foods, Inc. engages in the distribution of natural, organic, and specialty foods and non-food products. It offers food and non-food, frozen, perishables, bulk, body care products, and supplements. It operates through the following segments: Wholesale, Retail, and Other. The Wholesale segment refers to the national distribution of natural, organic, specialty, produce, and conventional grocery and non-food products, and providing retail services in the United States and Canada. The Retail segment derives revenues from the sale of groceries and other products at retail locations operated by company. The company was founded by Michael S. Funk and Norman A. Cloutier in July 1976 and is headquartered in Providence, RI.

Predefined Scans Triggered: Improving Chaikin Money Flow.

Below are the chart and commentary from Tuesday, 4/1:

"UNFI is unchanged in after hours trading. We have a small rally. This is an early pick as the rally hasn't really gotten going yet. I'd like to see price get over the 50-day EMA soon. The RSI is still negative, but is very close to positive territory so I'll take it. The PMO is on a new Crossover BUY Signal. It is running flat beneath the zero line so it is currently only indicating weakness, but the BUY Signal is promising. Stochastics are above 80 and as noted above the industry group is on fire. UNFI is slowly outperforming the group and the SPY. It's early on this one, but it does hold some promise as far as upside targets as you'll see on the monthly chart. The stop is set below the prior low and as close as possible to support at 8% or $25.42."

Here is today's chart:

This one was doing alright until the market tsunami hit. This has caused another price top that could be considered a right shoulder on a large bearish head and shoulders pattern on the chart. This one could be considered a shorting candidate based on that formation and the topping PMO below the zero line. The group is doing very well and it had been seeing some outperformance, but that has changed quickly. We are at support, but given today's deep decline, I would be looking for lower prices still.

THIS WEEK's Performance:

DecisionPoint Market Scoreboard (Mechanical Trend Model Signals):

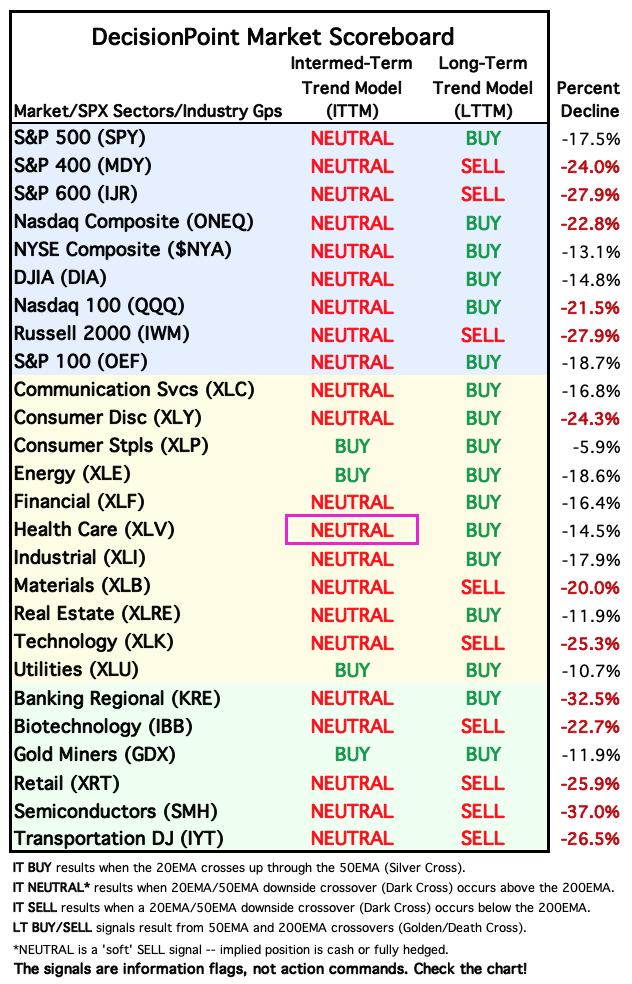

Today Carl checked to see how far these indexes have fallen from their one-year high to a recent low. Note that many have fallen into bear markets (down -20% or more), and of the remaining indexes all but one are in correction mode (down -10% or more).

Friday signal changes are outlined in purple.

Click Here to view Carl's annotated "Under the Hood" ChartList!

Sector to Watch: Utilities (XLU)

This is not a pretty chart, but at least price appears to have hit strong support at the December/January lows. It did lose the 200-day EMA as support though. It has a chance of seeing a rebound. Participation crashed today which is also a problem, but Consumer Staples didn't fare much better today. I have to say if we get a market rebound next week, it will likely come in on aggressive sectors more than defensive ones, but any rally across the board will be temporary. The market environment is just too bearish. I wouldn't be a buyer of XLU, but it has one of the best chances of turning around given its defensive nature.

Industry Group to Watch: Water ($DJUSWU)

This turned out to be a good one to watch last week. Notice even on yesterday's market crash, Water was actually up. It didn't go unscathed today and it did form a bearish engulfing candlestick, but unlike the other groups, the PMO is actually rising here and it is well above the zero line. This area has some potential, but as I noted earlier, I'm avoiding expanding my portfolio given overall market conditions. There were some symbols of interest here: AWK, YORW, CWT and AWR. Stochastics have topped as well so upside is likely going to be somewhat limited regardless.

Go to our Under the Hood ChartList on DecisionPoint.com to get an in-depth view of all the sectors. On StockCharts.com you can find the Industry Summary.

Good Luck & Good Trading!

- Erin

erin@decisionpoint.com

Full Disclosure: I'm 10% long, 0% short.

Watch the latest episode of the DecisionPoint Trading Room with Carl & Erin Swenlin HERE!

Technical Analysis is a windsock, not a crystal ball. --Carl Swenlin

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

(c) Copyright 2025 DecisionPoint.com