It is clear that the market has a bullish trend and condition based on what happened to our spreadsheet this week. We had some losing positions last week that moved into the green and all but one of this week's "Diamonds in the Rough" finished higher. This is why we need to be intimately familiar with what the market is doing in general before expanding our portfolios. Unfortunately writing Diamonds, I don't get the luxury of not picking when the market gets mushy.

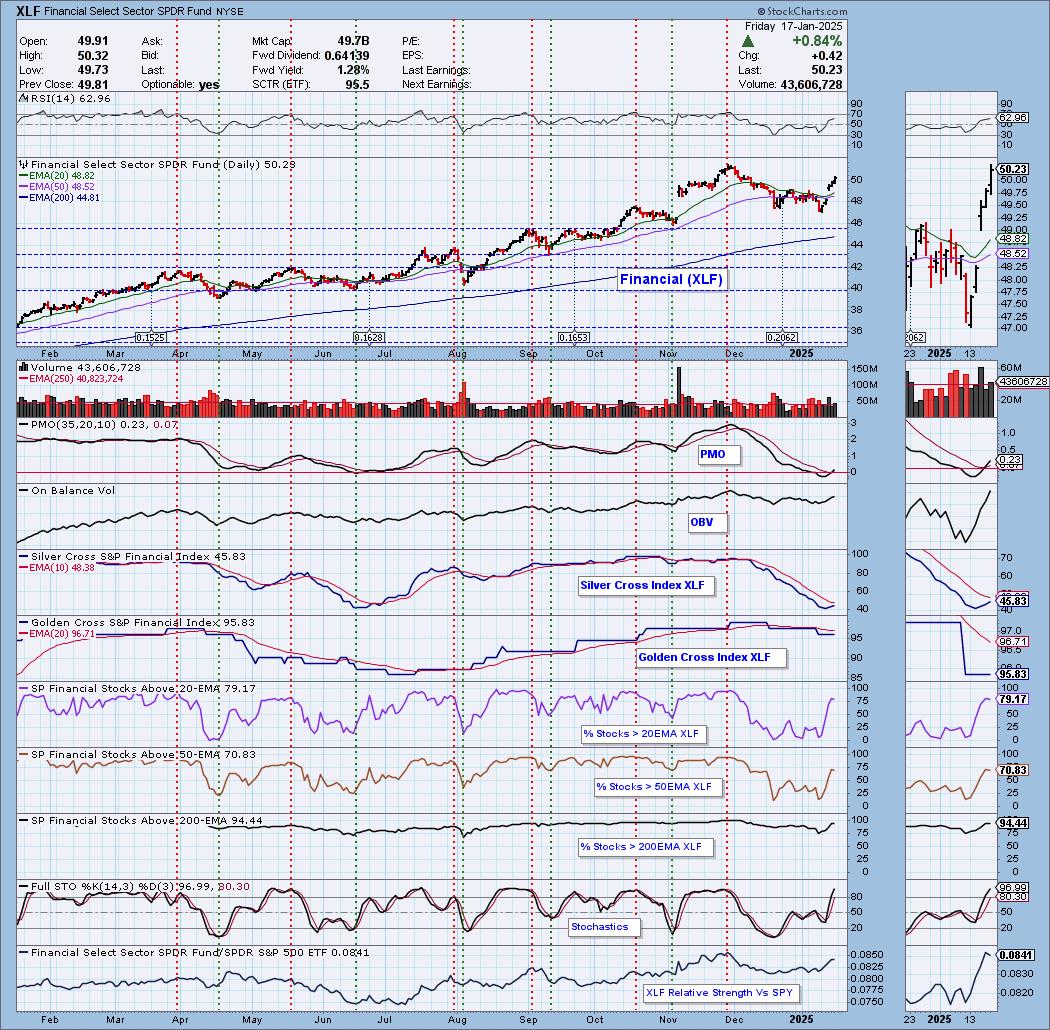

This week's Sector to Watch is Financials (XLF). With earnings coming out in this sector, I suspect we'll see more good results and that will lift it even higher. It is also the sector deemed the most likely to benefit most from the new Trump administration.

This week's Industry Group to Watch is Life Insurance, but I must say that Banks also look good and really every group within Financials holds promise. Here are a few symbols of interest from this group: CIA, CNO, PRI, MET, LNC and AEG.

The "Darling" was Century Aluminum (CENX) which was up +3.96% this week. The "Dud" was yesterday's Reader Request, SAIA Inc (SAIA) which was down -1.25% and was the only position down on the week.

We had time to run the Diamond PMO Scan at the end of the trading room. It was a very good list today and I was able to find the following symbols from the results: MSTR, LRN, TDS, CCL and SNA.

I wish you all an excellent three-day weekend. There will be no free DP Trading Room on Monday due to the holiday.

Good Luck & Good Trading,

Erin

Diamond Mine Trading Room:

RECORDING & DOWNLOAD LINK (1/17/2025):

Topic: DecisionPoint Diamond Mine (1/17/2025) LIVE Trading Room

Download & Recording Link

Passcode: January#17

REGISTRATION for 1/24/2025:

When: January 24, 2025 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine LIVE Trading Room

Register in advance for this webinar HERE

After registering, you will receive a confirmation email containing information about joining the webinar.

Below is the latest free DecisionPoint Trading Room recording from 1/6 (No recording 1/13 or 1/27). You'll find these recordings posted on Mondays to our DP YouTube Channel. Be sure and subscribe HERE.

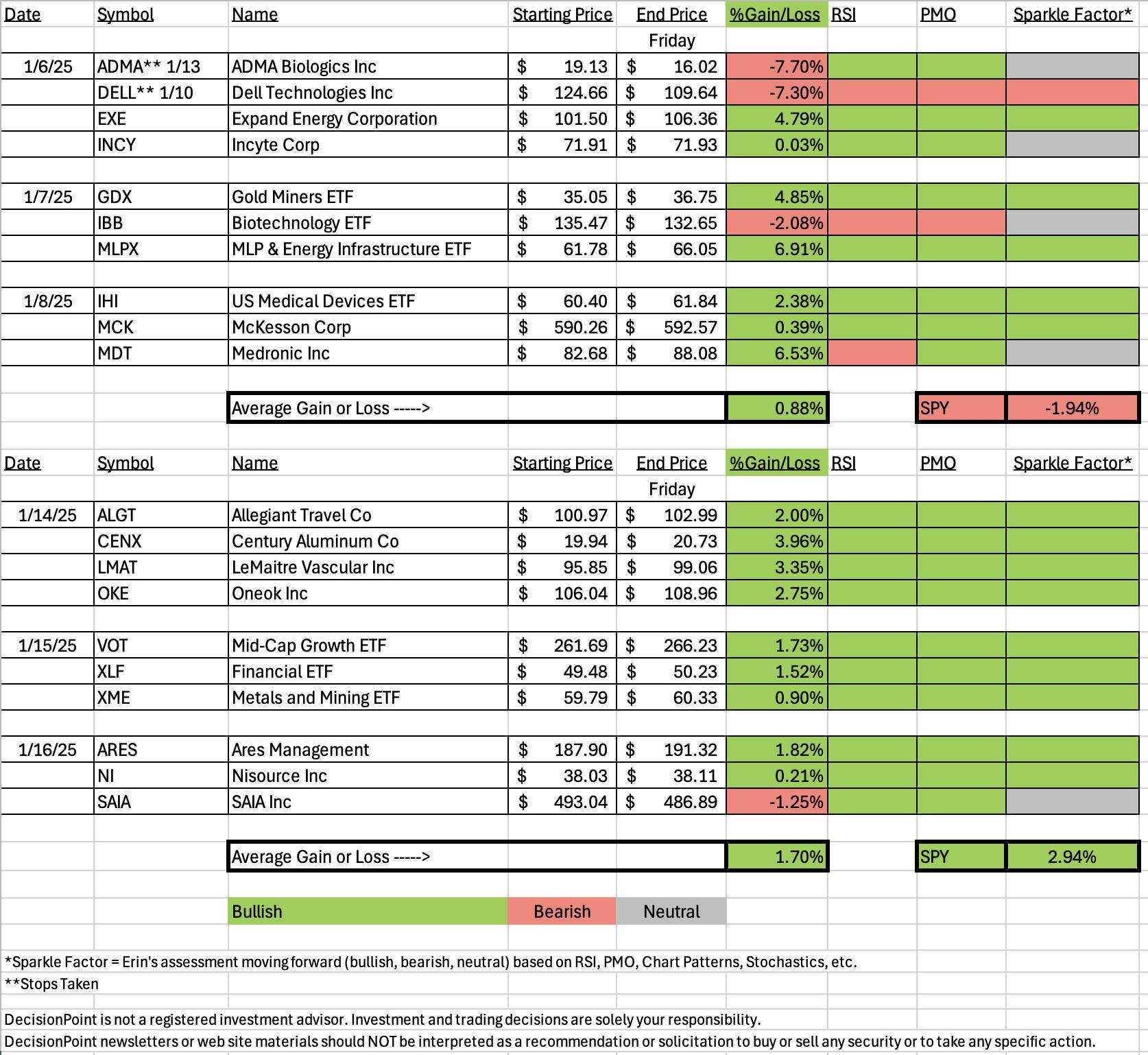

A few items about the spreadsheet: I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

Darling:

Century Aluminum Co. (CENX)

EARNINGS: 2025-02-19 (AMC)

Century Aluminum Co. is a producer of aluminum and operates aluminum reduction facilities, or smelters, in the United States and Iceland. Its products include standard ingots, T-ingot, extrusion billet, horizontal direct chill ingot, molten, slab, and sow. The company was founded in 1995 and is headquartered in Chicago, IL.

Predefined Scans Triggered: New CCI Buy Signals.

Below are the commentary and chart from Tuesday, 1/14:

"CENX is up +2.56% in after hours trading so we may be onto something here. The RSI is still in positive territory despite today's decline. The PMO has just had a PMO Crossover BUY Signal. I really liked the OBV positive divergence with price lows. It sets up for an extended rally. Stochastics are above 80. Relative strength is picking up for the group. Relative strength has been rising for CENX against the group and the SPY. The stop is set arbitrarily at 7.5% or $18.44."

Here is today's chart:

The rally continues for CENX. We have a new Silver Cross BUY Signal as the 20-day EMA crossed above the 50-day EMA. The PMO has just entered positive territory suggesting new strength. Stochastics are holding above 80. Materials (XLB) has really begun to rally and therefore I believe that Aluminum will rally too. There is tremendous upside potential (more than 20%) if it can recapture the December high.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Dud:

SAIA Inc. (SAIA)

EARNINGS: 2025-02-03 (BMO)

Saia, Inc. operates as a transportation holding company. The firm through its wholly-owned subsidiaries provides regional and interregional less-than-truckload (LTL) services through a single integrated organization. The firm also offers other value-added services, including non-asset truckload, expedited and logistics services across North America. The company was founded by Louis Saia, Sr. in 1924 and is headquartered in Johns Creek, GA.

Predefined Scans Triggered: P&F Triple Top Breakout and P&F Double Top Breakout.

Below are the commentary and chart from Thursday, 1/16:

"SAIA is down -0.55% in after hours trading. This was another double bottom formation that I spotted. We also have a breakout from a bullish falling wedge. There was a bullish engulfing candlestick today after a bearish candlestick yesterday. The RSI just moved into positive territory and the PMO is nearing a Crossover BUY Signal. Stochastics are above 80. We can see that all three relative strength lines are rising. The stop is set beneath the 200-day EMA at 7.6% or $455.56."

Here is today's chart:

It is struggling to hold the breakout from the bullish falling wedge so this is why I gave it a Neutral Sparkle Factor, but overall it still looks like it could rally. Today we have a bullish hollow red candle. The indicators are still positive. The RSI is holding above net neutral (50) despite today's decline. I think the position is still viable.

THIS WEEK's Performance:

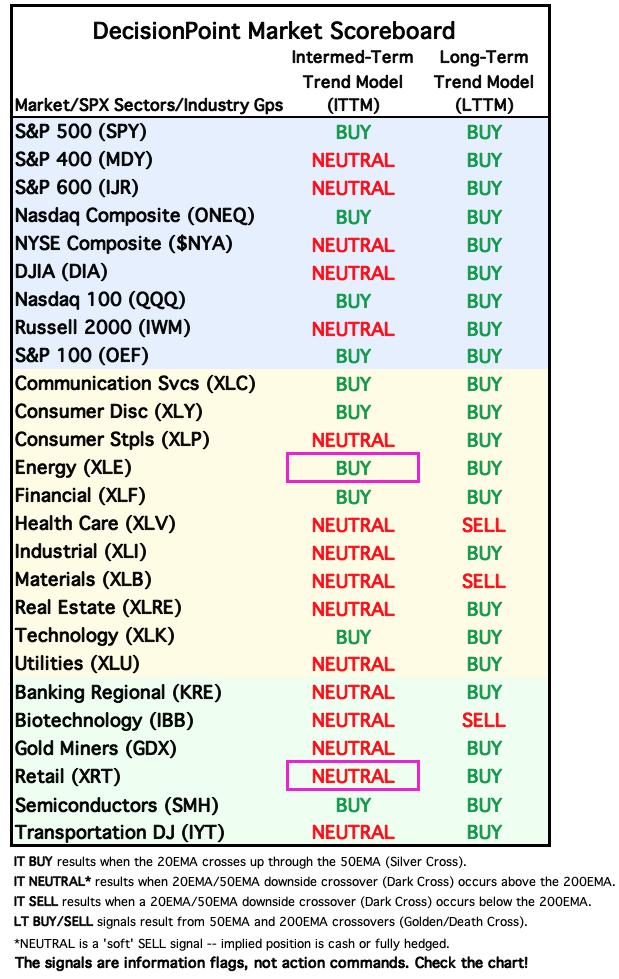

DecisionPoint Market Scoreboard (Mechanical Trend Model Signals):

Friday signal changes are outlined in purple.

Click Here to view Carl's annotated "Under the Hood" ChartList!

Sector to Watch: Financials (XLF)

XLF is off to the races. Today saw a followthrough rally day and it looks very bullish under the hood. The RSI is positive and not overbought. The PMO is rising on a new Crossover BUY Signal. There is a slight positive divergence between OBV bottoms and price bottoms. The Silver Cross Index is on the rise toward a Bull Shift across the signal line. The Golden Cross Index is still floundering, but it is at an incredibly high 96% so it's forgivable. Participation did see a small tick down today, but overall it is very robust and suggests more are getting on board this rally. Stochastics are above 80 and we can the sector is outperforming the SPY.

Industry Group to Watch: Life Insurance ($DJUSIL)

There is a bullish double bottom that has been confirmed with the recent breakout rally. The RSI is positive and not at all overbought. The PMO is rising strongly toward the zero line. This looks like new strength not diminishing weakness. OBV bottoms are on the rise and Stochastics are above 80. Relative strength looks particularly good. The symbols I found of interest in this area: CIA, CNO, PRI, MET, LNC and AEG.

Go to our Under the Hood ChartList on DecisionPoint.com to get an in-depth view of all the sectors. On StockCharts.com you can find the Industry Summary.

Good Luck & Good Trading!

- Erin

erin@decisionpoint.com

Full Disclosure: I'm 42% long, 0% short.

Watch the latest episode of the DecisionPoint Trading Room with Carl & Erin Swenlin HERE!

Technical Analysis is a windsock, not a crystal ball. --Carl Swenlin

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

(c) Copyright 2025 DecisionPoint.com