The market took a turn for the worse today so some of our prior profits were limited. We did see four positions finish in the green this week despite the decline. The internals are still weak for the market. We were looking for churn, but the market is clearly vulnerable even during this period of favorable seasonality. There is likely a difficult road ahead for the market.

This week's Darling was VeriSign (VRSN) which was up +2.00% since being picked. The Dud this week was Xerox Holdings (XRX) which was down -3.17% this week since being picked.

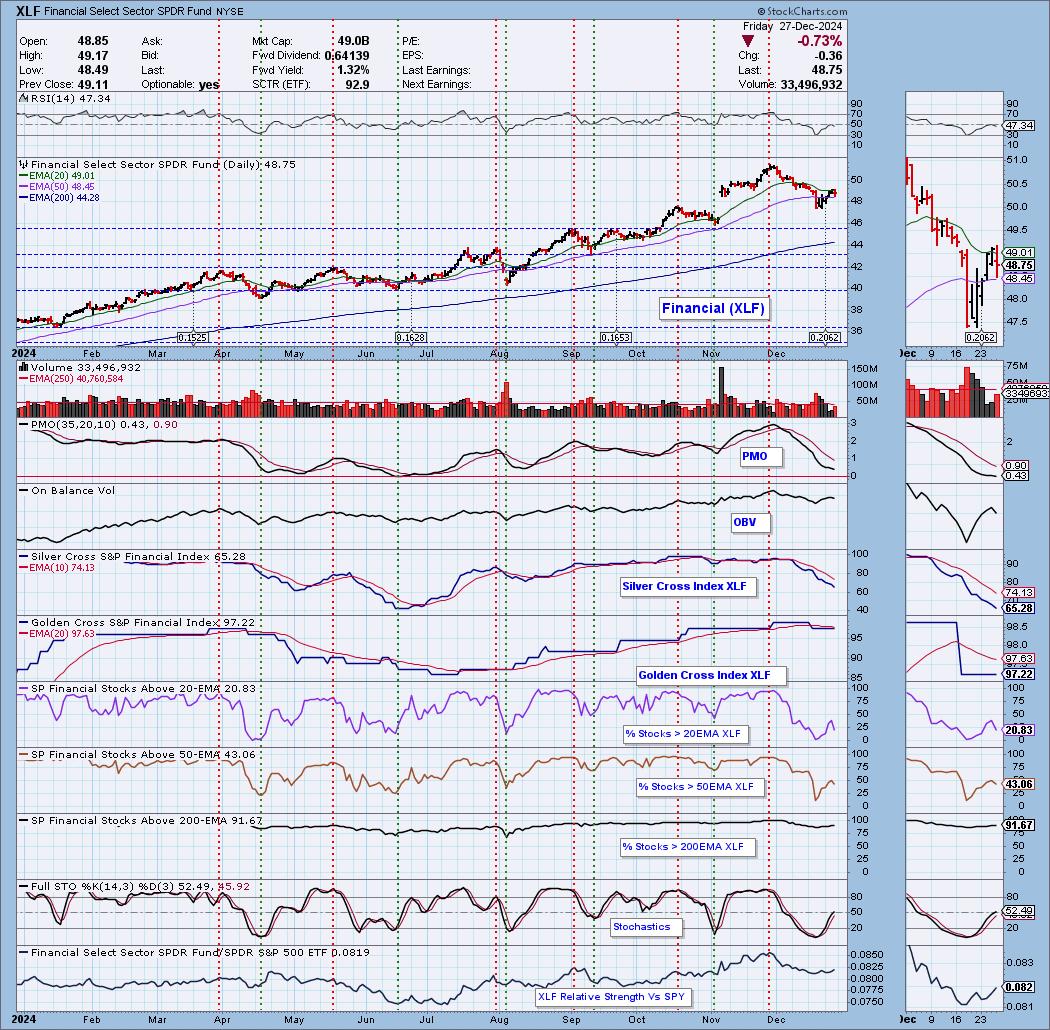

I decided the Sector to Watch this week would be Financials (XLF). The chart looks okay. It appeared to me to be the best choice, although Energy does look very interesting right now. The internals were still somewhat week on Energy so that's why I went with Financials.

The Industry Group to Watch will be Life Insurance. I found a few symbols of interest in the group that you may want to review: SLQT, CIA and AFL.

Due to the holiday, I didn't run an additional scan so I don't have any symbols for you there.

Have a wonderful weekend as you prepare for the new year! Below is the holiday schedule.

Good Luck & Good Trading,

Erin

--------------------

Schedule for next week:

Monday - 4 stocks

Tuesday - 3 ETFs

Thursday - 3 stocks (Reader Requests if possible)

There WILL be a trading room 1/3!

Diamond Mine Trading Room:

RECORDING & DOWNLOAD LINK (12/20/2024):

Topic: DecisionPoint Diamond Mine (12/20/2024) LIVE Trading Room

Recording & Download Link

Passcode: December#20

REGISTRATION for 1/3/2025:

When: January 3, 2025 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine LIVE Trading Room

Register in advance for this webinar HERE

After registering, you will receive a confirmation email containing information about joining the webinar.

Below is the latest free DecisionPoint Trading Room recording from 12/23. You'll find these recordings posted on Mondays to our DP YouTube Channel. Be sure and subscribe HERE.

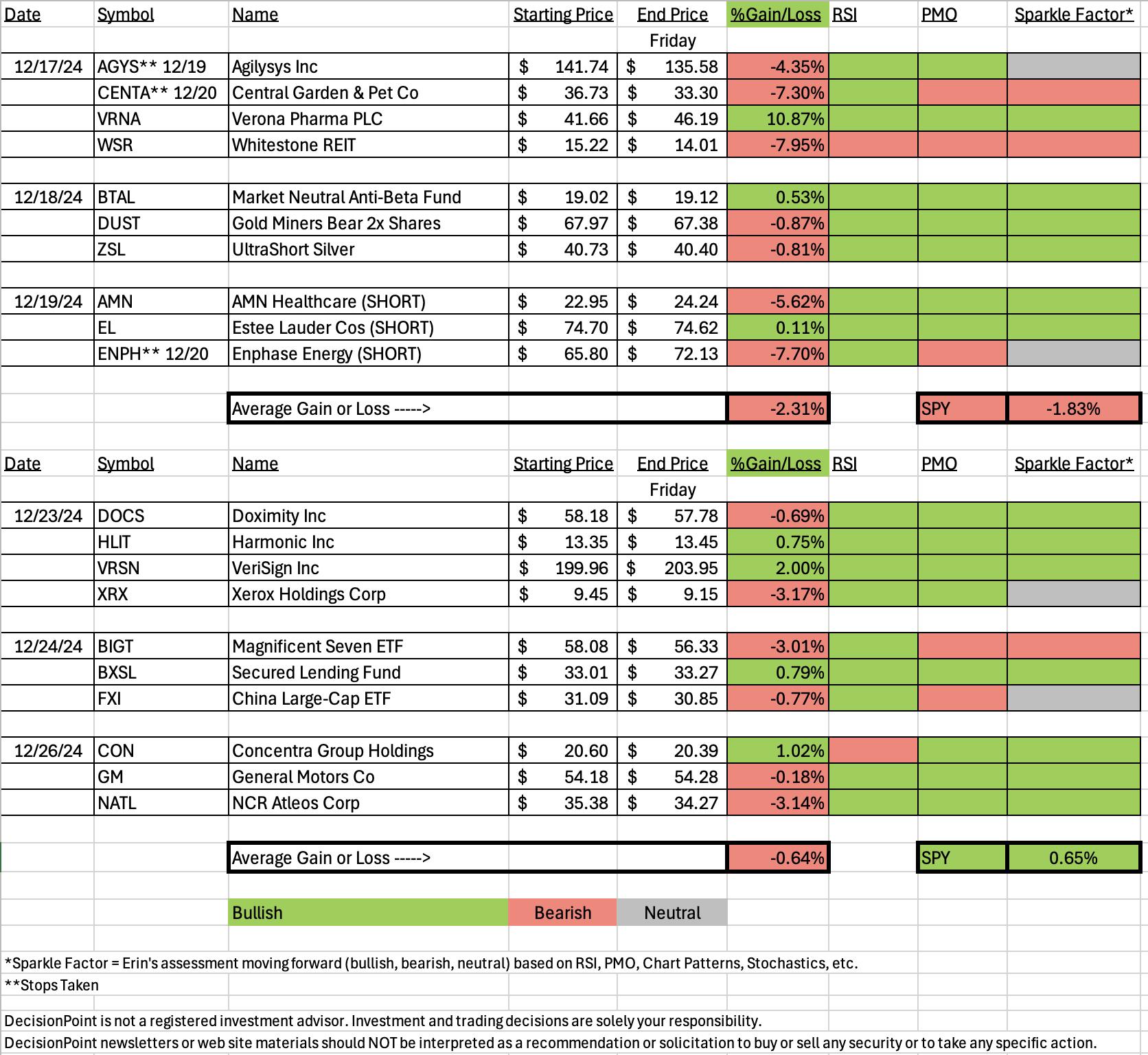

A few items about the spreadsheet: I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

Darling:

VeriSign, Inc. (VRSN)

EARNINGS: 2025-02-06 (AMC)

VeriSign, Inc. engages in the provision of critical Internet infrastructure and domain name registry services. It helps enable the security, stability, and resiliency of the Domain Name System and the Internet by providing Root Zone Maintainer services. The company was founded by D. James Bidzos on April 12, 1995 and is headquartered in Reston, VA.

Predefined Scans Triggered: None.

Below are the commentary and chart from Monday, 12/23:

"VRSN is up +0.27% in after hours trading. We have an excellent bounce off support and a strong rally that would encourage followthrough. The RSI is positive and not overbought. The PMO has surged above the signal line and Stochastics are rising toward 80 in positive territory. The group isn't performing that well right now, but overall it is still in a rising trend for relative strength. VRSN is showing excellent strength against the group and the SPY. The stop is set beneath the 200-day EMA at 7.1% or $185.76."

Here is today's chart:

As was expected, we did get the upside breakout. The indicators look great. The RSI is not overbought and the PMO is still headed higher. Stochastics are holding above 80. This one behaved as it should have!

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Dud:

Xerox Holdings Corp. (XRX)

EARNINGS: 2025-01-30 (BMO)

Xerox Holdings Corp. is a workplace technology company, which builds and integrates software and hardware for enterprises. It operates through the Print and Other, and Financing (FITTLE) segments. The company was founded on March 11, 2019, and is headquartered in Norwalk, CT.

Predefined Scans Triggered: P&F Double Bottom Breakdown, Elder Bar Turned Green, New CCI Buy Signals, Bullish MACD Crossovers, Moved Above Upper Bollinger Band, Stocks in a New Uptrend (Aroon), Parabolic SAR Buy Signals, P&F Triple Bottom Breakdown and Entered Ichimoku Cloud.

Below are the commentary and chart from Monday, 12/23:

"XRX is down -0.51% in after hours trading. It was a spectacular rally today, one that may require some pullback so you may want to stalk this one before taking a plunge. We also haven't left the current trading range. This is an encouraging rally, but there is more work to do. It is also a reversal candidate and I am not excited about trying for reversals when the market is weak internally. We'll see how this one shapes up because the indicators are good. The RSI is now in positive territory and is not overbought. The PMO was yanked upward today and gave us a Crossover BUY Signal. Stochastics are rising strongly now. The group is struggling a bit now, but in general it still has a rising trend on relative strength. XRX is performing inline with the group and the SPY which is acceptable, but not optimum. The stop is set at the 20-day EMA at 7.8% or $8.71."

Here is today's chart:

This one really hasn't gone anywhere. It is pulling back right now, but the indicators look healthy enough to get the upside reversal so I'm leaving this one with a "neutral" Sparkle Factor. It ended up hitting overhead resistance and pulled back. It could be ready to head to the bottom of the range, so if you aren't in it, it would be a good watch list addition. What went wrong here is likely due to it being a reversal candidate.

THIS WEEK's Performance:

DecisionPoint Market Scoreboard (Mechanical Trend Model Signals):

Friday signal changes are outlined in purple.

Click Here to view Carl's annotated "Under the Hood" ChartList!

Sector to Watch: Financials (XLF)

This is not a very strong sector. There really are no sectors that I see having strength and good internals. Energy is making a move right now, but has stalled right now. Crude Oil is not going anywhere so I suspect upside may be limited. XLF is rallying right now, but the PMO is headed lower so I am not wholeheartedly behind investing in this sector. The Silver Cross Index is headed lower but is at least higher than our 50% bullish threshold. Participation isn't bullish as it is below 50% for stocks greater than their 20/50-day EMAs. Stochastics did move into positive territory and we can see it is outperforming the SPY on its recent rally. Keep an eye on this sector, but I don't expect too much out of it.

Industry Group to Watch: Life Insurance ($DJUSIL)

Again, not the best chart but certainly an area to watch. We saw a nice reversal off the 200-day EMA. Price reversed before having to test prior support. The RSI is not positive yet, but I like this little rally. The PMO is trying to turn up. Stochastics are rising again. We also see that relative strength is showing a bit of improvement. I am not thrilled with the large double top, but it looks like it has moved down as far as it needed to, but it is still vulnerable. The stocks that looked interesting to me in this area were: SLQT, CIA and AFL.

Go to our Under the Hood ChartList on DecisionPoint.com to get an in-depth view of all the sectors. On StockCharts.com you can find the Industry Summary.

Good Luck & Good Trading!

- Erin

erin@decisionpoint.com

Full Disclosure: I'm 35% long, 0% short.

Watch the latest episode of the DecisionPoint Trading Room with Carl & Erin Swenlin HERE!

Technical Analysis is a windsock, not a crystal ball. --Carl Swenlin

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

(c) Copyright 2024 DecisionPoint.com