It wasn't the best week for "Diamonds in the Rough" but they did average out in the green. The SPY surprised with a nice rally today that took care of its losses on the week. It finished the week up +0.26% whereas "Diamonds in the Rough" finished up +0.06%. Part of the reason for the positive finish were some excellent gains on the five stocks that did finish with advances this week. None of the stocks have bearish Sparkle Factors so I do see merit in all of them. Some are more holds than buys right now.

The Darling this week was Brandywine Realty (BDN) which finished up +2.32% since being picked on Tuesday. The Dud this week was the Wheat Fund (WEAT) from ETF Day. It really looked primed to breakout, but it is pulling back instead. I think it is still worth watching.

The Sector to Watch was Energy, but given the strong finish to trading today, the runner-up Technology is on the radar. We opted to go with Energy this morning as I was worried about internal weakness with current market conditions. I'm still not convinced this is a strong bottom today so I'm sticking with Energy which is likely to continue moving higher on the positive Crude Oil trade. I felt that it also would do well in spite of a possible market decline.

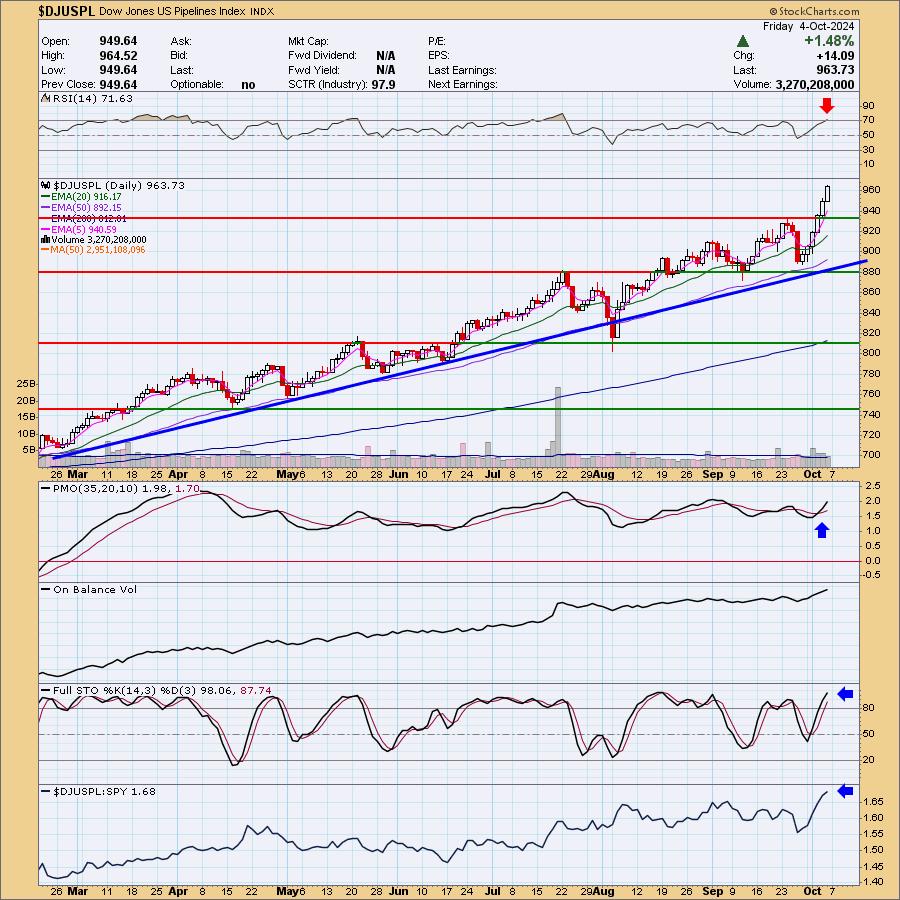

The Industry Group to Watch was Pipelines. They have been in a steady rising trend despite the volatile Crude Oil trade and given the positive outlook for the sector, this group will likely benefit and keep on running higher. We found the following symbols from this group for your watch lists: OKE, DKL, EPD, MMLP and ET.

Also to add to your watch lists are the results from the scans I ran this morning. There were a handful of stocks that looked good moving forward: TRGP, DBX, LUV, SVC, TTD and VNM.

Have a great weekend! I'll see you in Monday's trading room.

Good Luck & Good Trading,

Erin

Diamond Mine Trading Room:

RECORDING & DOWNLOAD LINK (10/4/2024):

Topic: DecisionPoint Diamond Mine (10/4/2024) LIVE Trading Room

Recording & Download Link

Passcode: October#4

REGISTRATION for 10/11/2024:

When: October 11, 2024 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine LIVE Trading Room

Register in advance for this webinar HERE

After registering, you will receive a confirmation email containing information about joining the webinar.

Below is the latest free DecisionPoint Trading Room recording from 9/30. You'll find these recordings posted on Mondays to our DP YouTube Channel. Be sure and subscribe HERE.

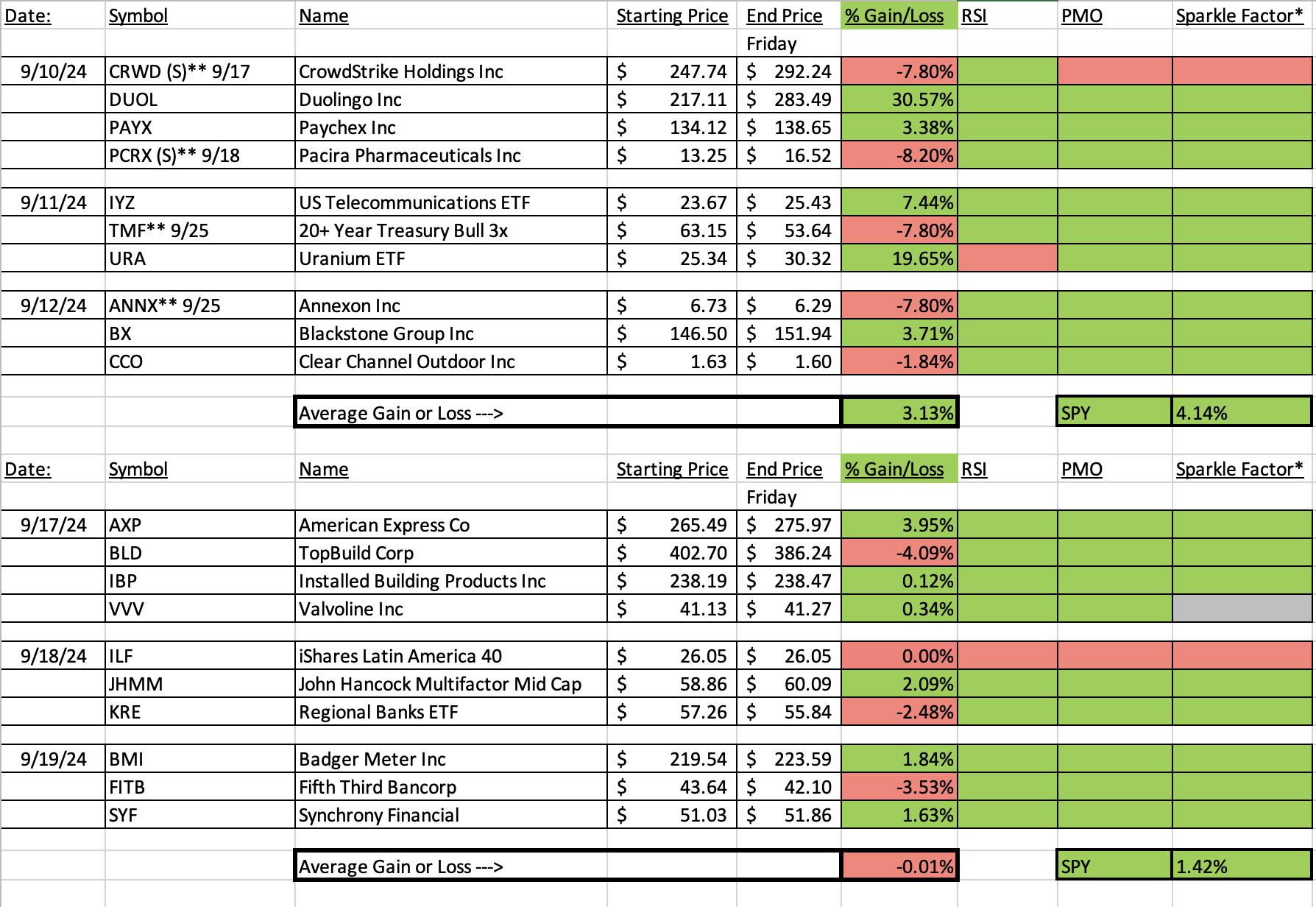

A few items about the spreadsheet: I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

Darling:

Brandywine Realty Trust (BDN)

EARNINGS: 2024-10-22 (AMC)

Brandywine Realty Trust engages in the acquisition, development, redevelopment, ownership, management, and operation of a portfolio of office, life science and lab, residential and mixed-use properties. It operates through the following segments: Philadelphia Central Business District (Philadelphia CBD), Pennsylvania Suburbs, Austin, Texas, and Other. The Philadelphia CBD segment includes properties in Philadelphia, Pennsylvania. The Pennsylvania Suburbs segment refers to the properties in Chester, Delaware, and Montgomery counties. The Austin, Texas segment focuses on properties in the City of Austin, Texas. The Other segment relates to properties located in Washington, D.C., Northern Virginia, Southern Maryland, Camden County, New Jersey and New Castle County, Delaware. The company was founded by Gerard H. Sweeney in 1986 and is headquartered in Philadelphia, PA.

Predefined Scans Triggered: New CCI Buy Signals, New 52-week Highs, Moved Above Upper Bollinger Band, Stocks in a New Uptrend (Aroon), Moved Above Upper Price Channel, P&F Ascending Triple Top Breakout and P&F Double Top Breakout.

Below are the commentary and chart from Tuesday, 10/1:

"BDN is down -0.18% in after hours trading. We have a strong breakout today to new 52-week highs. The RSI is not yet overbought so it can accommodate more upside. The PMO is on a Crossover BUY Signal above the zero line. It is also flat above the zero line which signifies pure strength. Volume is coming in. Stochastics are above 80. Relative strength for the group is not good, but we are seeing some outperformance by BDN against the SPY and the group so it is acceptable. The stop is set beneath the last low and below the 20-day EMA at 7.1% or $5.21. It is low priced so position size wisely."

Here is today's chart:

The PMO remains flat above the zero line signaling pure strength. I would like to see the industry group improve its performance, but other than that the chart is looking good. The RSI is getting overbought so you may want to wait for a pullback before entering if you haven't already.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Dud:

Teucrium Wheat Fund (WEAT)

EARNINGS: N/A

WEAT tracks an index of wheat futures contracts. It reflects the performance of wheat by holding Chicago Board of Trade wheat futures contracts with three different expiration dates. Click HERE for more information.

Predefined Scans Triggered: P&F Double Bottom Breakdown, P&F Descending Triple Bottom Breakdown and Moved Above Upper Keltner Channel.

Below are the commentary and chart from Wednesday, 10/2:

"WEAT is up +0.18% in after hours trading. Today saw a powerful breakout above both horizontal resistance and the 200-day EMA. It hasn't seen territory above the 200-day EMA for some time so I believe this is an important breakout. Admittedly, the RSI is getting overbought, but on a good bull run like it could be in for, it can stay that way. The PMO is accelerating higher above the zero line on a Crossover BUY Signal. Stochastics are now above 80 and relative strength has been rising. I've set the stop as close to support as I could at 7.8% or $5.06. This is a low priced ETF so position size wisely."

Here is today's chart:

What went wrong here? I was sold on that breakout above strong support, but it didn't hold. The rising trend is still intact which is why I haven't completely written this one off, but I do note that PMO is topping. I think this one is deserving of your watch list as there is a lot of upside potential if it can hold a breakout.

THIS WEEK's Performance:

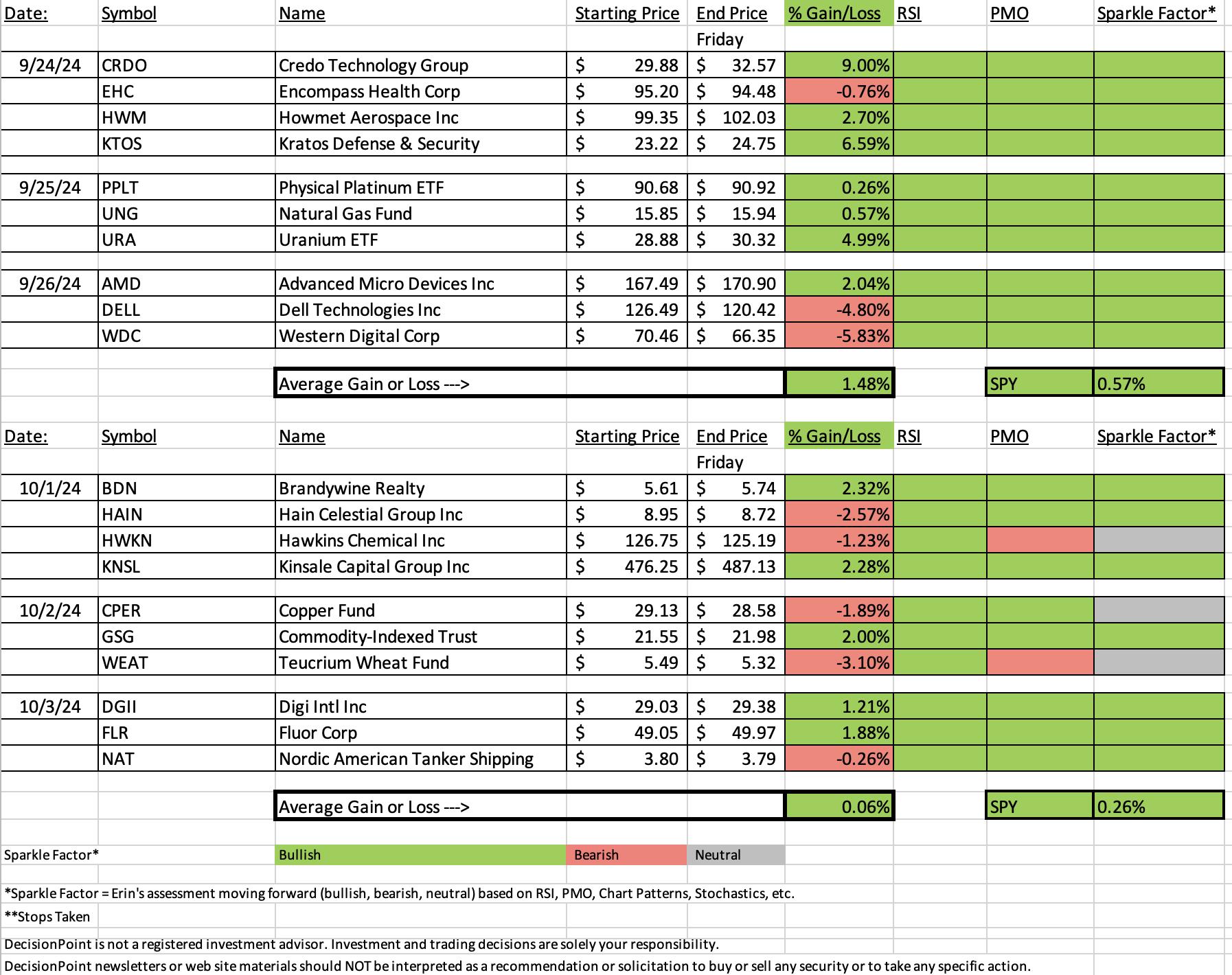

DecisionPoint Market Scoreboard (Mechanical Trend Model Signals):

Friday signal changes are outlined in purple.

Click Here to view Carl's annotated "Under the Hood" ChartList!

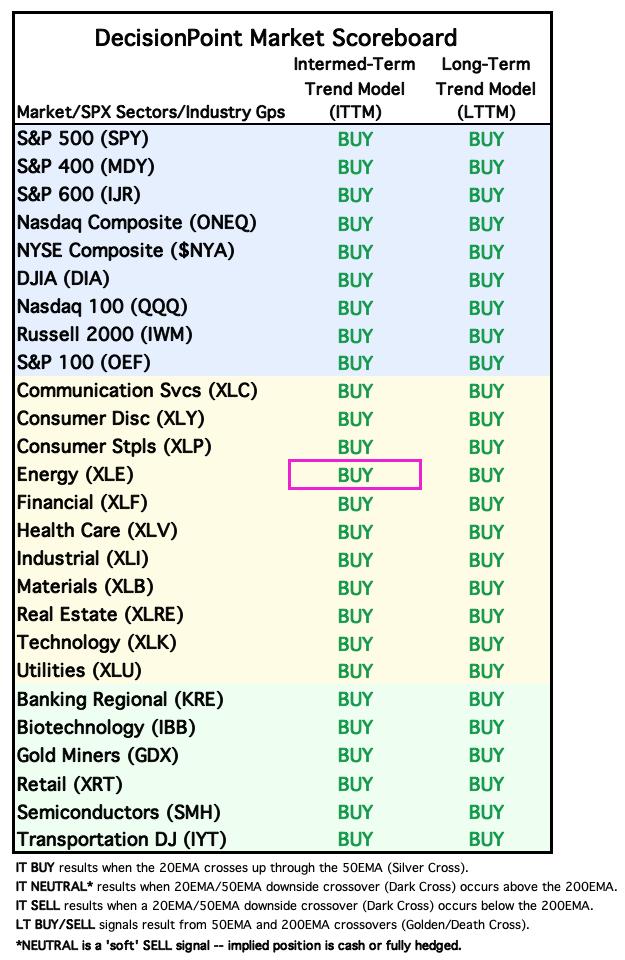

Sector to Watch: Energy (XLE)

One problem with this sector is that as one subscriber put it this morning, it is acting speculative on the Middle East Crude Oil trade. When that trade goes south so might the sector follow. For now it has the best PMO of all of the sectors and it is strong under the hood.

Participation is at 100% for stocks above their 20/50-day EMAs. The Silver Cross Index is on the rise and picking up speed. The RSI is not overbought yet so there should be some more upside before a pullback. Stochastics look great and of course it is showing relative strength against the SPY. Should the market get going again next week, Technology will likely be the star, but if we see weakness, Energy should hold up.

Industry Group to Watch: Pipelines ($DJUSPL)

All of the industry groups were showing overbought conditions on very strong vertical rallies. As noted in the opening I picked Pipeline because of the strong rising trend that has held up despite a not so great Crude Oil trade over the past month or two. So if the Crude trade goes south, this group could still see rising prices or at least we should see the rising trend hold up. The PMO is on a Crossover BUY Signal and is holding well above the zero line. Volume is coming in and Stochastics are well above 80. Relative strength has of course been excellent. Some stocks in this area to look at: OKE, DKL, EPD, MMLP and ET.

Go to our Under the Hood ChartList on DecisionPoint.com to get an in-depth view of all the sectors. On StockCharts.com you can find the Industry Summary.

Good Luck & Good Trading!

- Erin

erin@decisionpoint.com

Full Disclosure: I'm 60% long, 0% short.

Watch the latest episode of the DecisionPoint Trading Room with Carl & Erin Swenlin HERE!

Technical Analysis is a windsock, not a crystal ball. --Carl Swenlin

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

(c) Copyright 2024 DecisionPoint.com